Originally Published 1st July 2008

Full Federal Court decision in Brady King case favours taxpayers

The Full Federal Court in Brady King Pty Ltd v FCT has overturned the initial contentious judgement made by the single judge of the federal court earlier this year. The initial judgement provided a detrimental result for developers as it stipulated that there had to be a strict identity between the property acquired and the property sold in order for the margin scheme to apply. The full federal court supported a wider application of the margin scheme provisions stating that it was not essential that the property acquired should be identical to the stratum units supplied. This is a positive result for developers and is consistent with the common application of the margin scheme.

Draft GST Ruling 2008/D3

Margin scheme can be applied to partitioning agreements

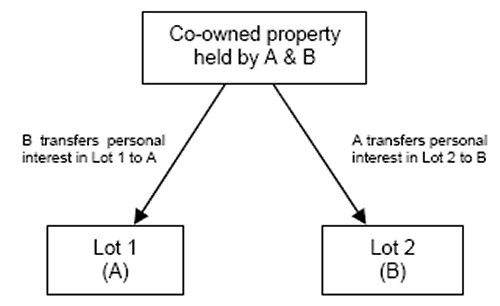

The Commissioner of Taxation has recently released a draft ruling GSTR 2008/D3 which discusses the GST consequences of the partitioning of real property by joint tenants or tenants in common (co-owners). Among other things, the ruling discusses whether the margin scheme provisions can be applied to a transfer or conveyance of an interest in land under a partition.

A partitioning agreement involves the division of co-owned property through a contemporaneous transfer or conveyance by each co-owner of their respective share in a part of the property.

The Commissioner is of the view that a supply as defined in the GST Act arises under a partition by agreement or a court ordered partition, but not under a mere subdivision of land. Furthermore, the supply will be a taxable supply if it is made in the course or furtherance of an enterprise of the co-owner. The value of the consideration is the sum of the GST inclusive market value of other co-owner's interests in the part of the land acquired by a co-owner plus any equality money received in respect of the partition. For example, in the diagram above, the consideration A pays for Lot 1 is the GST inclusive market value of Lot 2 plus any additional money paid to B.

Furthermore, the ruling accepts that the margin scheme provisions set out in section 75 of the GST Act can be applied to a transfer or conveyance of an interest in land under a partition. The margin scheme can only apply if there is a 'selling' of a freehold interest in land, a stratum unit, or (granting) a long term lease. The Commissioner takes a broad view of the term 'selling' and states that for the purposes of Division 75, under a partition, each co-owner is 'selling' their freehold interests in land to be retained by the other co-owners.

Calculating the margin

The margin used to calculate GST liability for the supply of property under a partition will vary depending on the acquisition date of the property.

- On or after 1 July 2000: the margin will be calculated under section 75-10(2) (the amount by which the consideration for supply of each co-owners interest exceeds the consideration for the acquisition).

- Before 1 July 2000: the margin will be calculated under section 75-10(3) (the amount by which the consideration for the supply for each co-owners interest exceeds the proportion of the valuation of each co-owners interest at the prescribed valuation date).

Phillips Fox has changed its name to DLA Phillips Fox because the firm entered into an exclusive alliance with DLA Piper, one of the largest legal services organisations in the world. We will retain our offices in every major commercial centre in Australia and New Zealand, with no operational change to your relationship with the firm. DLA Phillips Fox can now take your business one step further − by connecting you to a global network of legal experience, talent and knowledge.

This publication is intended as a first point of reference and should not be relied on as a substitute for professional advice. Specialist legal advice should always be sought in relation to any particular circumstances and no liability will be accepted for any losses incurred by those relying solely on this publication.