Summary and implications

On 6 April 2016, changes made to the Companies Act 2006 will introduce a new requirement for unlisted companies, societates europaeae (SEs) and limited liability partnerships (LLPs) to keep a register of individuals that have significant influence or control over them (PSC Register).

From 30 June 2016 onwards, companies, SEs and LLPs will also have to deliver the information contained in their PSC Register annually to Companies House as part of their confirmation statement (which replaces the existing annual return).

This briefing sets out some of the key corporate governance aspects of the PSC Register together with a summary of the new disclosure and compliance requirements it will introduce.

Introduction

The requirement to keep a PSC Register forms part of wider changes being implemented under the new Small Business, Enterprise and Employment Act 2015. It aims to improve transparency in the ownership and control of UK companies with the agenda of reducing financial crime and the wider misuse of companies by criminals.

Who is required to keep a PSC Register?

All unlisted UK companies (whether limited by shares or guarantee), SEs and LLPs will be required to have a PSC Register. For convenience, this briefing refers to the obligation on companies to keep a PSC Register.

The requirement to keep a PSC Register will not apply to UK companies that are:

- subject to Chapter 5 of the Disclosure and Transparency Rules (DTRs) – this includes companies that have shares listed on the main market of the London Stock Exchange, AIM and the ISDX Growth Market; and

- other companies that have voting shares listed on other "regulated markets" in a different EEA state or certain non-EEA markets (including, but not limited to, the New York Stock Exchange and NASDAQ).

Who is a person with "significant" control?

| Criteria |

|

A person with significant control over a company is an individual that (alone, or as a joint holder):

|

What about corporate shareholders?

Although generally the PSC Register is aimed to capture details of living individuals who control a company, the details of a legal entity must also be registered when that entity (known as a Relevant Registrable Entity (RLE) is "relevant" and "registrable".

| What does "relevant" and "registrable" mean? |

|

The requirement for an RLE to be

"registrable" (i.e. the first in a

company's chain of ownership) means that where group structures

are concerned, it will not normally be necessary for the ultimate

controlling individuals to be placed on the PSC Register of every

subsidiary in that group (see Example 1). Instead, someone wishing

to identify the ultimate controlling individuals in a group will

have to follow the chain of ownership in that group by looking at

the PSC Register of each subsidiary.

Example 1

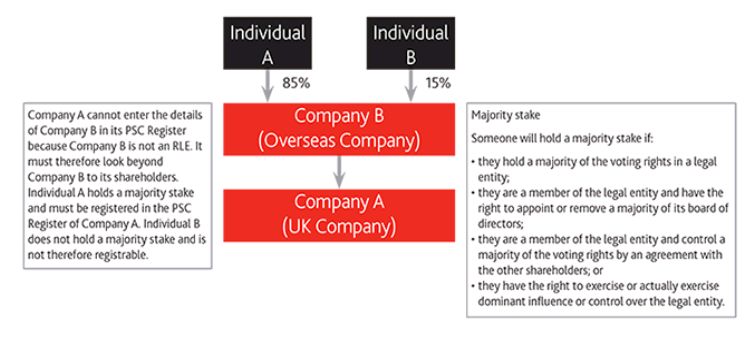

Overseas companies

An overseas company that does not fall into the definition of a RLE (i.e. because it is not required to maintain its own PSC Register and its shares are not listed on a qualifying exchange), cannot be registered in a PSC Register. Where an overseas company exists in a corporate group a company may, depending on that overseas company's level of control, be required to investigate who controls that overseas company and identify any individuals or RLEs who have an indirect "majority stake" that requires registration. Example 2 provides further information:

Example 2

Taking "reasonable steps" and recording information in the PSC Register

Reasonable steps

A company must take "reasonable steps" to identify all individuals and RLEs who are required to be recorded in its PSC Register. Non-statutory guidance (the Guidance) has been produced by the government (available here) on what will amount to reasonable steps but at this stage there is no conclusive list of the actions that it will be necessary to take in a particular set of circumstances. What is clear is that a company must proactively investigate, and will be required to serve formal notices on, individuals or RLEs who fail to supply PSC Register information to them. Similarly, a company must monitor its PSC Register to ensure it is up to date and may also be required to impose restrictions on those individuals or RLEs who fail to supply information (including the disenfranchisement of share voting rights, suspension of dividends and other benefits and prohibiting the sale or transfer of shares).

An individual or RLE will also have a corresponding duty to disclose certain information requested by a company or, where that individual/RLE has reason to believe they do have significant influence or control over a company and have not been contacted by that company, or their details have changed since they last supplied them to that company, to notify the company of these facts.

Recording information in a PSC Register

From 6 April 2016 onwards a PSC Register should never be empty. Certain required particulars of each registrable individual or RLE must be collected and recorded in the PSC Register, along with the status of any investigatory work being undertaken by a company. The Guidance sets out certain prescribed statements that must be recorded in the PSC Register in particular circumstances. Where an individual is required to be registered in a PSC Register their information must also be confirmed (or, in certain circumstances, deemed confirmed) as an additional step.

Public right to inspect PSC Register

A PSC Register must be made available for inspection at a company's registered office to any member of the public who has a proper purpose. A fee subject to the statutory maximum of £12 may be charged by a company for the making of copies of PSC Registers.

From 30 June 2016, PSC Register information will also be required to be filed at Companies House (either through an annual confirmation statement or via the incorporation documents of a newly incorporated company). The PSC Register information available from Companies House will not include an individual's residential address (unless they have used this as their service address) or their date of birth. Residential addresses should not be supplied to members of the public who inspect a hard copy PSC Register either.

There will be an option to keep a PSC Register at Companies House rather than at a company's registered office and we expect further details on this to follow in due course from Companies House.

Failure to comply

The consequences of failing to comply are serious and could lead to companies, their officers and any individuals or RLEs (and their corresponding officers) committing a criminal offence punishable with up to two years' imprisonment and/or a fine.

Next steps

Companies should start PSC Register investigations now in readiness for the regime commencement on 6 April 2016.

If you require further information on the PSC Register or would like to discuss how we can assist you via our specialist PSC service offering please contact Ben Hendry, Caroline Newsholme or your usual Nabarro contact.

Please note that the contents of this briefing provide only a general overview, and are not intended to be, and should not be used as, a substitute for the taking of legal advice in the circumstances.

Footnotes

1. By reference to nominal share value or (if the company does not have share capital) the right to share in more than 25% of the entity's capital or profits.

2. The Government has published draft guidance on the meaning of "significant influence or control" available here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.