The European Supervisory Authorities (ESAs), comprising of the European Banking Authority (EBA), the European Insurance and Occupational Pensions Authority (EIOPA), and the European Securities and Markets Authority (ESMA), recently released a consultation paper regarding guidelines under Regulation (EU) 2023/114 on Markets in Crypto-Assets (MiCAR). The aim of the consultation paper is to standardize the classification of crypto-assets through templates and importantly a standardized test in order to harmonize regulatory approaches across the EU.

MiCAR regulates the offering to the public and admission to trading of asset-referenced tokens (ARTs), e-money tokens (EMTs) and other types of crypto-assets to include the provision of crypto-asset services in the EU. Inter alia, MiCAR establishes different regimes with separate regulatory requirements as well as authorizations, prudential requirements and conduct of business for issuers and crypto-asset service providers (CASPs). To this end, a consistent application of MiCAR depends on the regulatory classifications of the different crypto-assets subject to MiCAR.

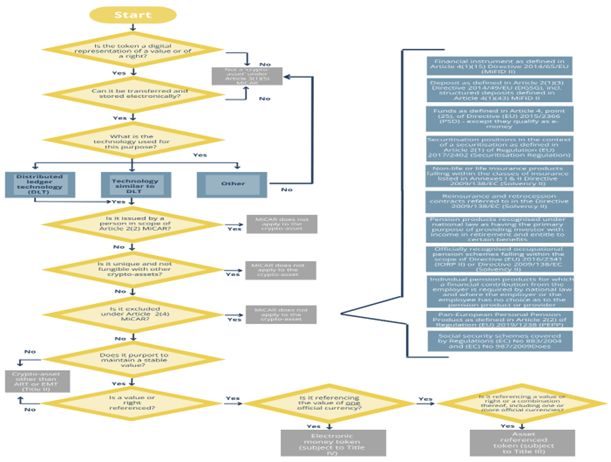

The ESAs to help ensure uniform application have therefore provided a draft standardized test, as published in Annex C of the consultation paper, to help determine the classification of crypto-assets under MiCAR, which can be visualized as the below flow chart. This test serves as a comprehensive tool for market participants to evaluate if a crypto-asset both falls under MiCAR as well as how it should be further classified.

Key questions raised include whether there is a digital representation of a value or right as interpreted in accordance with recital (2) of MiCAR and whether the digital representation of the value or right can be transferred and stored via distributed ledger technology or similar technologies.

In addition, a key part of the assessment is determining whether a crypto-asset under review is within scope by referring to the exclusions identified in Article 2 (4) of MiCAR.

Whilst MiCAR seeks to fill existing regulatory gaps for crypto-assets, it makes clear that the regulation of crypto-assets that fall within the ambit of existing regulatory frameworks are not affected. MiCAR therefore does not apply to financial instruments defined within the Markets in Financial Instruments Directive (2014/65/EU) (MiFID II), deposits, insurance, securitization positions and pension products, among other financial products as referred to in Article 2(4) of MiCAR. Certain types of NFTs will also fall outside the scope of MiCAR being unique and non-fungible as outlined in Article 2(3) nor will crypto-assets issued by excluded persons pursuant to Article 2(2) be subject to MiCAR.

The standardized test also includes specific questions to distinguish between ARTs and EMTs by asking whether a crypto-asset is referencing a value or right and if the reference is relating to the value of an official currency or if the value and/or right is referenced otherwise such as via multiple currencies. Moreover, it distinguishes ARTs and EMTs from other crypto-assets by asking if a crypto-asset purports to maintain a stable value and if any value is referenced.

As part of the consultation paper, the ESAs have also acknowledged three key points in relation to the standardized test:

- the standardized test is purely from a regulatory classification standpoint of the crypto-asset and does not comment on the person(s) that are carrying out any activity involving such an asset (i.e., service provision, issuance, offering or any other activity);

- all crypto-assets require an assessment based on case specifics and their individual attributes; and

- applicable notions established in EU and national law (i.e., 'financial instrument' under MiFID II and 'deposit' under the Deposit Guarantee Schemes Directive (DGSD)) as well as any guidance issued by national authorities need to be taken into account when applying the standardized test and interpreting regulatory concepts.

As MiCAR comes into effect starting from the 30th of December 2024 (except for Titles III & IV), referring to the standardized test at hand, asking the right questions and recognizing the nuances of crypto-asset classification will be crucial.

Our firm can assist in navigating this new regulatory landscape by providing advisory services, regulatory interpretation, legal opinions and compliance strategies ensuring proper conformity with all MiCAR requirements and market standards.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.