While Australian businesses have been navigating sanctions laws for many years, often as part of broader compliance programs to address anti-money laundering (AML) and counter-terrorism financing (CTF) provisions. However, the recent escalation of global conflicts and matters of international peace and security have prompted a heightened focus on sanctions compliance.

Sanctions pose restrictions on a range of business activities and can be confusing, time-consuming and costly to navigate. But in this rapidly evolving area, businesses need to take steps to ensure their compliance programs are sufficient to respond to both current and new measures under Australia's sanctions legislation.

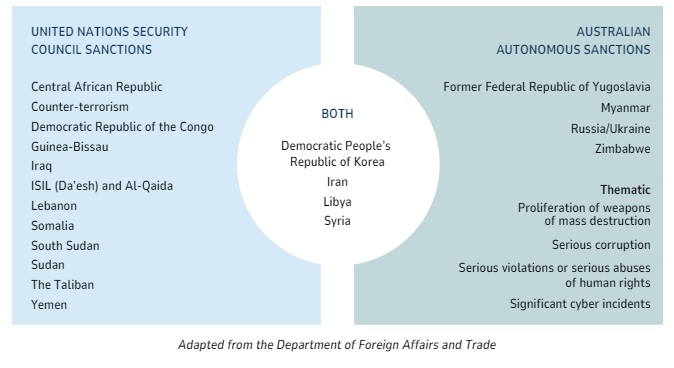

Australia operates two sanctions regimes:

- United Nations Security Council sanctions. These are sanctions adopted by the United Nations (UN) Security Council which Australia, as a UN Member State, is required to implement under domestic law under the Charter of the United Nations Act 1945 (Cth) (UN Charter Act) and associated regulations. These sanctions are generally implemented on a geographic basis but also include global counter-terrorism sanctions.

- Autonomous sanctions. These are sanctions that Australia independently adopts and implements as a matter of policy under the Autonomous Sanctions Act 2011 (Cth) (ASA) and its associated regulations. This includes Australia's Magnitsky-style thematic sanctions which are not geographically defined or limited.

With limited exceptions, all Australian individuals, bodies corporate and any legal person conducting business in Australia must comply with Australia's sanctions regimes.

The escalation of the Israel-Palestine and Russia-Ukraine conflicts, as well as increasing geopolitical tensions, human rights violations and cyber security incidents have resulted in significant expansion of Australian sanctions. As at 29 August 2024, almost 8,000 individuals and entities are subject to sanctions under Australian law.

The nature of sanctions being imposed by the Australian Government is also expanding. While Australia's autonomous sanctions have traditionally been country-based, late 2021 saw the introduction of the Magnitsky-style sanctions regime. The Magnitsky-style sanctions are thematic and facilitate targeted sanctions against individuals responsible for, or complicit in, serious violations or serious abuses of human rights, significant cyber incidents, serious corruption and the proliferation of weapons of mass destruction. Since its introduction, the Magnitsky-style sanctions regime has been used to sanction individuals complicit in corruption, political and military figures involved in human rights violations and cybercriminals.

This expansion in the number and nature of sanctions poses real risks to business. Organisations must understand the ambit of proscribed activity and keep their screening lists up to date to ensure new designations are covered by existing sanctions screening processes. The introduction of thematic sanctions requires compliance teams to look beyond red-flag countries and regions when assessing possible risks. This is particularly important for high-risk businesses, including those in export services, defence, industrial agriculture, energy and natural resources, and with foreign ownership or entities within their operational structure.

Recent Federal Court cases

Recent cases before the Federal Court have shed light on the complex and challenging area of regulation and compliance that is Australia's sanctions regimes.

All offences under the UN Charter Act and ASA are strict liability, meaning that contravention does not require a state of mind (such as intent, knowledge or recklessness) to satisfy the commission of an offence. An individual or body corporate commits an offence if it engages in conduct that contravenes a sanctions law, or a condition of an authorisation made under a sanctions law.

Contravening conduct broadly includes:

- Sanctioned supply. Supplying, selling or transferring sanctioned goods which (as a direct or indirect result) end up in the relevant sanctioned country, or for the use or benefit of that country or a sanctioned individual.

- Sanctioned import. Importing, purchasing or transporting sanctioned goods.

- Sanctioned service. Providing technical, financial or other services if the service assists with the above conduct, or other specified service.

- Sanctioned commercial activity. Engaging in sanctioned commercial activities, which can include acquisitions of interests, establishing joint ventures or granting loans to sanctioned individuals or entities, as well as engaging in particular commercial activities in respect of sanctioned countries.

- Controlled assets. Using or dealing with a controlled asset (owned by a sanctioned entity or individual) or allowing or facilitating this use or dealing.

It is also an offence to give false or misleading information in connection with the administration of a sanctions law.

The goods, services, commercial activities and entities or individuals the subject of sanctions is constantly evolving. The ASA was amended as recently as April 2024 to provide that persons or entities can be validly designated as being subject to sanctions based on past conduct or with respect to past circumstances. Businesses in high-risk industries must be alert to changes to Australia's sanction regimes.

The cases of Alumina and Bauxite Company Ltd v Queensland Alumina Ltd [2024] FCA 43 (Alumina Case) and Tigers Realm Coal Limited v Commonwealth of Australia [2024] FCA 340 (Tigers Realm Case) clarified the scope of the contravening conduct, suggesting an expanding application of Australia's sanctions regimes. In particular, O'Bryan J in the Alumina Case held that:

- The meaning of ‘sanctioned supply' of ‘export sanctioned goods' is to be broadly construed to include sale transactions, the transfer of title to goods, the physical delivery of goods and simply furnishing or providing the goods.

- The terms ‘direct or indirect', used in the context of regulating sanctioned supply and determining whether an asset has been made available for the benefit of a designated person, are to be broadly construed – ‘indirect' is taken to mean making an asset available, including through an intermediary, agent, interposed corporate entities or via an indirect financial interest, and to encompass ‘any number of degrees of remoteness of causation'.

In the Tigers Realm Case, Kennett J similarly applied a broad interpretation, noting that sanctioned exports are designed to encompass the transfer of goods ‘for the benefit of' the identified country, which ‘reflects a deliberate decision to extend the concept of a “sanctioned supply” beyond the physical transfer of goods into the designated country'.

The interpretation of indirectly engaging in sanctioned conduct raises the possibility of capturing entities further down an organisation's supply chain than perhaps previously considered. This interpretation, coupled with the attribution of responsibility to body corporates for the conduct of entities within their effective control under the ASA, means that Australian businesses with extraterritorial exposure within their operations, structure or business relationships should err on the side of caution and consider that any conduct which may fall under the scope of Australia's sanctions regimes will create material risks to their operations.

Key components of an effective sanctions compliance regime

The Australian sanctions regimes provide for limited defences. Most relevantly, bodies corporate may avail themselves of a defence if they can prove that they took reasonable precautions and exercised due diligence to avoid the contravention.

Australian businesses should ensure that their compliance systems are sufficient to support a robust defence that the company implemented ‘reasonable precautions and exercised due diligence' to avoid any contravening conduct. This defence may be necessary to avoid significant monetary penalties of the greater of three times the value of the contravening transaction (if able to be determined) or 10,000 penalty units (A$3,130,000 as at 1 July 2023).1

While any sanctions compliance regime will be proportionate to the organisation's operational circumstances, including its sanctions risks and the nature of its activities, key components of a reasonable and effective compliance regime include:

- Risk assessments. A sanctions risk assessment should form part of a broader risk assessment of your business relationships. A sanctions risk assessment will need to consider sanctions risks (e.g. high-risk jurisdictions and high-risk sectors) and common sanctions red flags (e.g. prior sanctions breaches or government ownership).

- Due diligence. Thorough due diligence and screening process should be conducted before entering into a business relationship and continue throughout the relationship. The level of due diligence should be proportionate to the risks connected to the particular relationship or circumstances of that relationship (e,g, business relationships that are assessed at a higher risk should undergo more intense due diligence processes throughout the relationship).

- Controls. Businesses should implement a range of controls (proportionate to the risk) which could include training, adoption of screening tools, alerts for new or additional sanctions and external audits.

- Review. Sanctions compliance regimes should be regularly reviewed to assess their effectiveness and undertake updates as required.

- Culture and governance. As with other compliance issues, sanctions compliance should be backed up by a robust compliance culture and tone from the top.

***

Recent sanctions law developments provide an opportunity for organisations to assess whether their sanctions compliance systems are fit for purpose and whether advice should be sought to minimise the risk of contravention of what are increasingly complex regimes.

The Australian (and international) sanctions landscape will not simplify anytime soon, and as a result, Australian businesses need to consider how they can leverage their internal and external resources to safeguard business opportunities while also positioning themselves for future-proof sanctions compliance.

Footnote

1 The Crimes and Other Legislation Amendment (Omnibus No. 1) Bill 2024, which proposes to amend the value of a penalty unit from $313 to $330, is currently before Parliament.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

|

|

| Lawyers Weekly

Law firm of the year

2021 |

Employer of Choice for Gender Equality

(WGEA) |