Background – We analyzed the terms of venture financings for 112 companies headquartered in Silicon Valley that reported raising money in the fourth quarter of 2009.

Overview of Fenwick & West Results

- Up rounds exceeded down rounds in 4Q09 47% to 30%, with 23% of rounds flat. This was an improvement over 3Q09 when up rounds exceeded down rounds 41% to 36%, with 23% flat. This was also the second quarter in a row in which up rounds exceeded down rounds. The improvement in 4Q09 was driven primarily by financings of internet/digital media companies, and software companies (which includes SaaS companies), which had 60% and 65% up rounds, respectively.

- The Fenwick & West Venture Capital Barometer" showed an average price increase of 19% in 4Q09, compared to 11% in 3Q09. This was the second quarter in a row in which the Barometer was positive. We note that the Barometer would have been up only 12% in 4Q09 except for one financing that sold stock at a very significant increase to its prior round.

Overview of Other Industry Data

Third party reports on the venture industry generally reported a mildly improving venture investment and liquidity environment in 4Q09, but a poor 2009 overall. Detailed results are as follows:

- Dow Jones VentureSource ("VentureSource") reported that the amount invested by venture capitalists in the U.S. in 4Q09 was approximately $6.3 billion in 743 deals, a 17% increase in dollars from the $5.4 billion invested in 629 deals in 3Q09. For all of 2009, a total of $21.4 billion was invested in 2,489 deals, a 31% decrease in dollars from 2008, when $31 billion was invested in 2,817 deals. VentureSource financing press release.

- VentureSource reported 86 acquisitions of venture backed companies in the U.S. in 4Q09, for a total of $7.3 billion, a close to three-fold increase in dollars from the $2.6 billion paid in 84 acquisitions in 3Q09. For all of 2009 VentureSource reported 326 acquisitions for a total of $16.2 billion, a 37% drop in dollar terms from the $25.6 billion paid in 380 acquisitions in 2008. VentureSource liquidity press release.

- VentureSource reported 3 venture backed IPOs in 4Q09 raising a total of $220 million, compared to 2 IPOs raising $450 million in 3Q09. For all of 2009 VentureSource reported 8 IPOs raising $904 million, a 64% increase in dollars from the 7 IPOs raising $551 million in 2008. VentureSource noted that there were 25 venture backed companies in registration at year end 2009. VentureSource liquidity press release.

- The MoneyTree" Report by PricewaterhouseCoopers and the National Venture Capital Association based on data from Thomson Reuters (the "MoneyTree Report") noted that 2008- 2009 were the slowest consecutive years for venture-backed IPOs since 1974-75. MoneyTree liquidity press release.

- The MoneyTree Report also reported that venture capital funds raised approximately $3.8 billion in 4Q09, an 80% increase from $2.1 billion raised in 3Q09. For all of 2009 venture capital funds raised $15.2 billion, a 47% decline from $28.6 billion raised in 2008.

- The Silicon Valley Venture Capitalists Confidence Index" produced by Professor Mark Cannice at the University of San Francisco reported the confidence level of Silicon Valley venture capitalists at 3.48 on a 5 point scale, which is a slight increase from the 3Q09 results of 3.37.

- The National Venture Capital Association's annual survey of venture capitalists concluded that "the venture industry will begin to see gradual increases in investment levels and exit transactions in 2010, but the asset class will continue to shrink in size over the next five years. Specific areas of optimism include clean technology investing, growth equity and later stage companies, and ongoing opportunities overseas." NVCA venture capitalist survey.

- Nasdaq was up 7.5% in 4Q09, but is down 7% in 1Q10 through February 9, 2010.

Detailed Fenwick & West Results

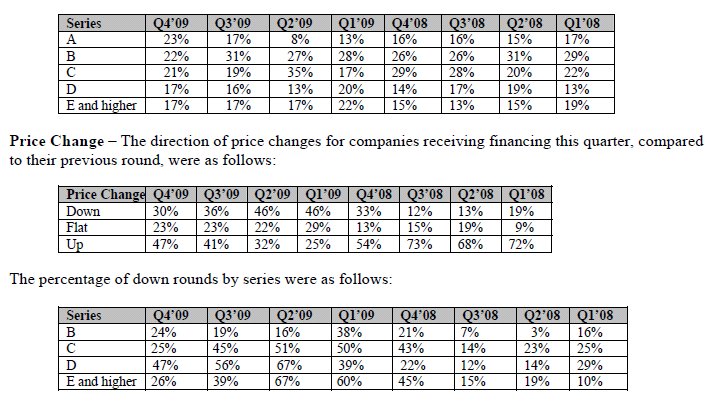

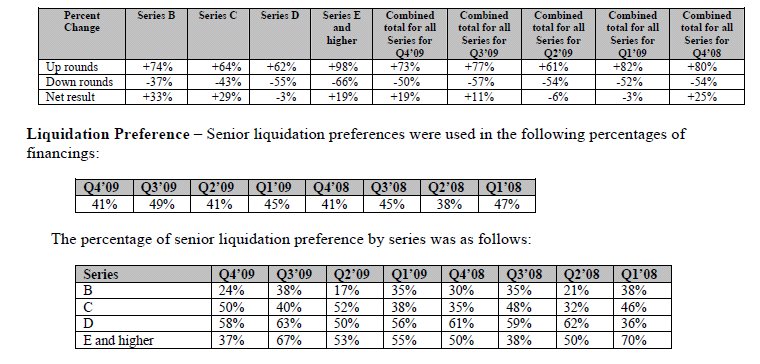

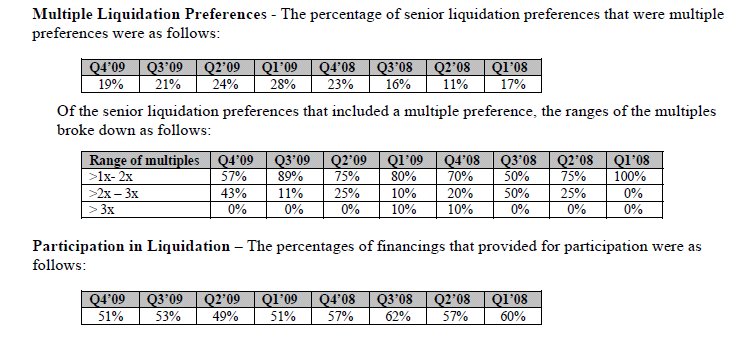

Financing Round – The financings broke down according to the following rounds:

The Fenwick & West Venture Capital Barometer" (Magnitude of Price Change) –Set forth below is (i) for up rounds, the average per share percentage increase over the previous round, (ii) for down rounds, the average per share percentage decrease over the previous round, and (iii) the overall average per share percentage change from the previous round for all rounds taken together. Such information is broken down by series for Q4'09 and is provided on an aggregate basis for comparison purposes for the prior four quarters. In calculating the "net result" for all rounds, "flat rounds" are included. For purposes of these calculations, all financings are considered equal, and accordingly the results are not weighted for the amount raised in a financing.

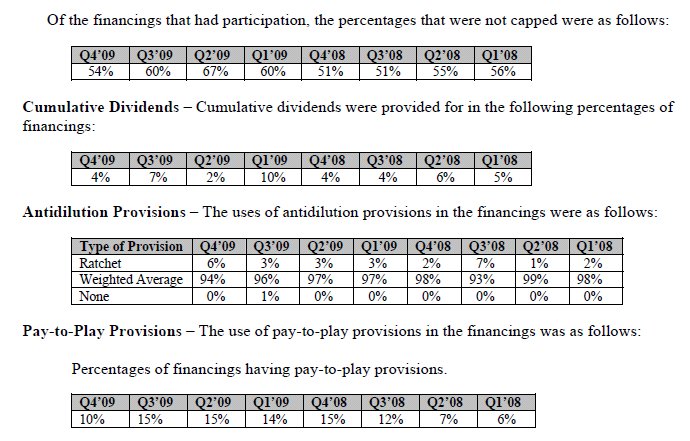

Note that anecdotal evidence indicates that companies are increasingly using contractual "pull up" provisions instead of charter based "pay to play" provisions. These two types of provisions have similar economic effect but are implemented differently. The above information includes some, but likely not all, pull up provisions, and accordingly may understate the use of these provisions.

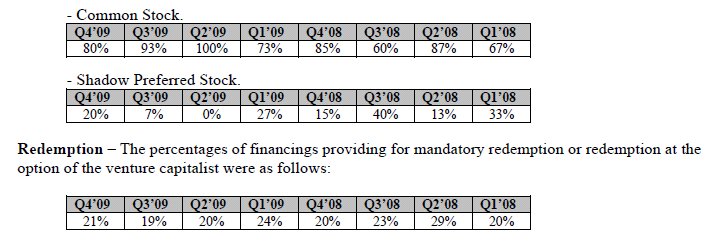

The pay-to-play provisions provided for conversion of non-participating investors' preferred stock into common stock or shadow preferred stock, in the percentages set forth below:

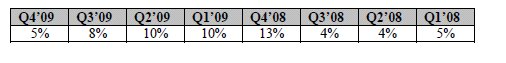

Corporate Reorganizations – The percentages of post-Series A financings involving a corporate reorganization were as follows:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.