Companies are always innovating to stay ahead of the competition in today's fast-moving business world. One important way to innovate is by implementing and customizing enterprise resource planning (ERP) systems and other tailor-made software solutions. However, many organizations don't know that these software development efforts could qualify them for valuable research and development (R&D) tax credits under IRC Section 41. This article shows how companies can optimize their federal and state R&D tax credits by claiming ERP customization and software development activities.

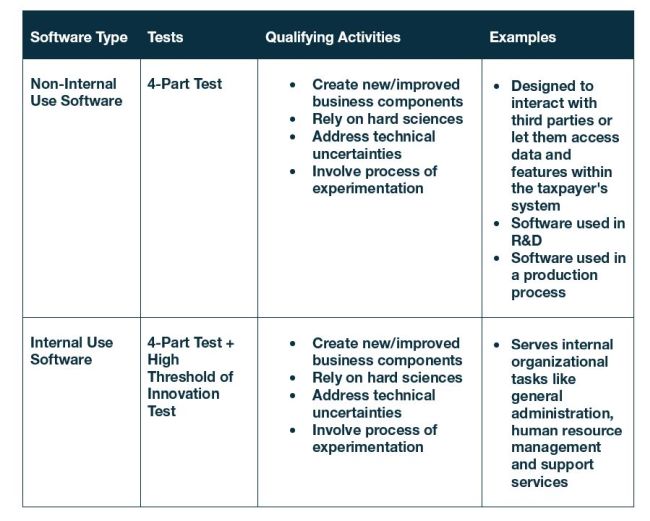

Implementing an ERP system involves many tasks. Activities such as designing new functions, developing add-ons, finding new ways to process large amounts of data, and integrating systems may qualify provided they meet either the four-part or seven-part test described below.

Examples of qualifying ERP customization activities include:

- Developing ERP software embedded in devices like machinery or industrial equipment.

- Creating utility programs specific to ERP systems, such as data migration tools or performance analyzers.

- Transitioning ERP systems to newer technologies, like moving from on-premises to cloud-based solutions.

- Introducing new features in ERP software, such as improved reporting capabilities or workflow automation.

- Developing ERP system components like modules or plugins, addressing uncertainties in areas like scalability or integration.

- Specializing in ERP technologies like supply chain management or financial forecasting, involving experimentation to refine functionalities.

- Integrating ERP software with hardware components to optimize system performance and functionality.

The customization and development of enterprise software solutions encompass a broad spectrum of activities spanning multiple domains. These tasks range from designing innovative features to seamlessly integrating diverse systems and refining operational workflows. Examples of qualifying activities may include:

ERP and S/4HANA: Designing new custom functions, developing add-ons, integrating old systems and improving data processing and analysis.

Customer Relationship Management: Customizing customer interaction workflows, developing AI-driven recommendation engines and integrating CRM with other systems.

Business Process Improvements: Enhancing business processes, streamlining workflows, and automating repetitive tasks to improve efficiency and productivity.

Supply Chain Management: Optimizing supply chain processes, improving inventory management, and enhancing logistics coordination for greater efficiency and cost savings.

Inventory Management: Developing solutions for inventory tracking, optimizing stock levels, and improving inventory forecasting accuracy.

Artificial Intelligence: Developing machine learning models, natural language processing algorithms and computer vision applications.

Business Intelligence: Designing advanced analytics algorithms, developing predictive modeling capabilities and improving data visualization techniques.

Gartner forecasts global IT spending to surge to $5 trillion by 2024, with continued growth anticipated, particularly in IT.1 As businesses focus on enhancing efficiency and streamlining operations, there emerges a significant opportunity to leverage ERP customization and software development initiatives to maximize R&D tax credits. The IT services sector is poised to become the dominant segment of IT expenditure in 2024,2 fueled by enterprises' pursuit of operational excellence and innovation. Organizations can capitalize on this trajectory by strategically allocating resources to ERP customization and software development ventures that qualify for R&D tax credits.

Through ERP customization and software development activities, companies can qualify for substantial R&D tax credits. Organizations can enhance their technological capabilities and achieve valuable tax savings by carefully documenting and organizing these activities to meet the IRS criteria for qualified research. As IT spending continues to increase, there has never been a better time for companies to explore the potential for R&D tax credits in their ERP and software development initiatives. In today's dynamic business environment, understanding the wide applicability of the R&D tax credit is essential for driving innovation and maintaining competitiveness.

Footnotes

2. ibid

Originally published by 23 April, 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.