The latest Deloitte Consumer Tracker shows a fall in consumer confidence in the first quarter of 2016, a sign of a degree of caution returning to the consumer sector. Our index is now one point down from Q4 2015 and three points lower than this time last year. Confidence was down across five of our six measures, with consumers' confidence in their level of debt the only element of the index to see a rise.

The primary driver behind the fall in overall confidence is a strong seasonal downturn in sentiment around health and wellbeing. This year the trend has been particularly pronounced, with the confidence reading for health and wellbeing falling by six points year-on-year to its lowest level since our survey began. The recent introduction of the sugar tax, the flu season arriving later than usual and wider media coverage around health and health care have focused consumers' attention on their wellbeing. In addition, we believe that the growing use of health and fitness wearables and apps may also be increasing awareness of health and wellbeing as an issue.

Homeowners remain more confident than non-homeowners, who report a four point fall in overall confidence from the previous quarter. Homeowners' overall confidence remains flat at minus six. The difference in confidence between these two groups is now at its widest ever point, and comes as the Office for National Statistics (ONS) reported a rise in UK private rental prices of 2.6% in the 12 months to February 2016. In London, rental prices increased by 3.8% over the same period. The increases are above the 2.2% growth in average weekly earnings from regular pay in January 2016.

Consumers in London were significantly less confident than consumers in other regions, with overall confidence falling ten points from this time last year. The capital also experienced a sharper fall in sentiment around disposable incomes with a drop of nine points compared to last quarter and a six-point decline in confidence in job security. London, with its particular exposure to developments in emerging and financial markets, has seen consumer confidence disproportionately affected.

Most consumers continue to spend more on essentials while the majority have reduced spending on small and big ticket discretionary items in the seasonal downturn following Christmas. There are now more consumers adopting expansionary behaviours and fewer being defensive in their spending compared to this time last year. However, the gap between expansionary and defensive behaviours has flattened since the start of this year, suggesting consumers have been more measured in their spending.

Despite consumer-focused economic fundamentals remaining strong – for instance low unemployment, low cost of borrowing, low inflation and gradually improving earnings – consumers are clearly influenced by lower UK economic growth projections. Our survey is showing that consumers are still relatively upbeat about their own finances, despite growing concerns in the corporate sector about the global slowdown and the potential for Brexit, as highlighted by the first quarter Deloitte CFO Survey. The question is how long this will remain the case, as consumers show signs of being aware of these headwinds.

Consumer confidence

Health and wellbeing drives fall in confidence

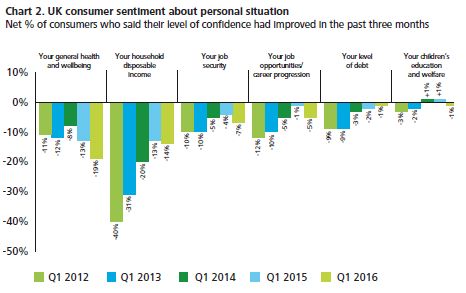

Five of the six confidence measures fell compared to the same time last year. The only area where consumers felt more confident was in their level of debt, which rose by one point from Q1 2015 and is up three points from last quarter.

The fall in overall confidence was driven by a sharp decline in sentiment around general health and wellbeing which fell two points compared to the previous quarter and six points compared to Q1 2015. At minus 19 in Q1 2016, the confidence rating is the lowest it has ever been. This fall comes at a time of growing awareness around health and healthcare related issues and growing sales of wearable fitness devices and apps.

Consumers reported feeling less confident about their job security and job opportunities. These measures fell by three and five points respectively compared to Q1 2015. This decline in job related confidence must be viewed in the context of increasing awareness of global economic uncertainty.

Consumer confidence

Confidence among Londoners and non-homeowners falls

The gap between the confidence of homeowners and non-homeowners is now at its widest point since our survey began. While confidence among those who own their homes remained flat, non-homeowners reported a four point fall from the previous quarter. The findings emerged shortly before the ONS reported a rise in UK private rental prices of 2.6% in the 12 months to February 2016. The increase in London was 3.8% during the same period. Both rates are significantly above the 2.2% growth in average weekly earnings from regular pay reported in January 2016.

Consumers in London were significantly less confident than in other regions, with Londoners' confidence in job security falling by six points and in disposable income by nine points, compared to the previous quarter.

To continue reading this article, please click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.