To facilitate Chinese enterprises investing overseas, the National Development and Reform Commission (NDRC) issued a draft rule to relax the approval regime for outbound investments for consultation – the Draft NDRC Decision on Revising the Administrative Measures on Approval and Recordfiling of Outbound Investment Projects/国家发展改 革委关于修订《境外投资项目核准和备案管理办 法》的决定(公开征求意见稿)(the "Consultation Draft"). The consultation period will end on 13 May 2016.

The current NDRC approval framework for outbound investments is based on the Administration Measures on Approval and Record-filing of Outbound Investment Projects/《境外投资项目核准 和备案管理办法》(the "Measures") promulgated in 2014. The Measures apply to all outbound investment projects of Chinese enterprises. Compared with the regulatory guidelines prior to 2014, the Measures already marked a significant move by the Chinese government to simplify the approval and filing requirement for outbound investments, making record-filing the default rule and mandating government approval only for sensitive projects. The issuance of the Consultation Draft demonstrates the government's determination and willingness to further relax the restrictions on outbound investments.

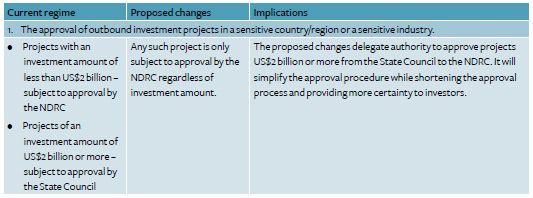

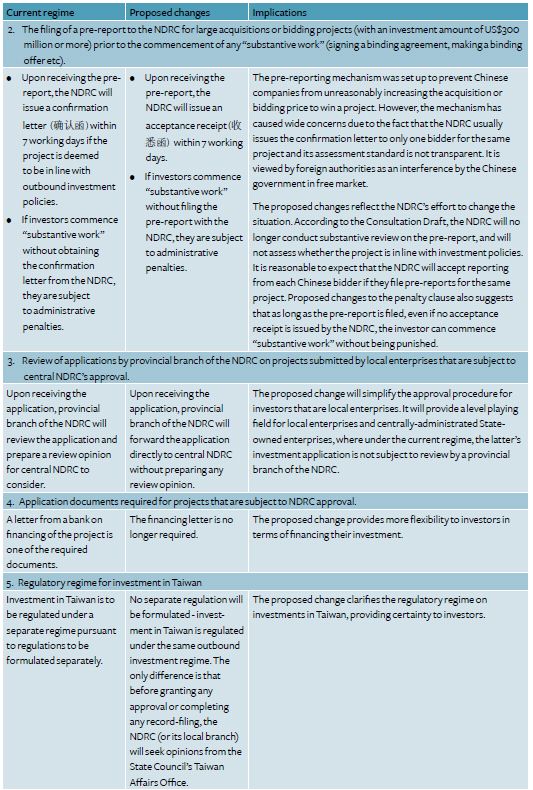

Highlights

Key changes proposed by the Consultation Draft are summarised in the table below:

Comments

In recent years, outbound investments by Chinese investors have increased by double digits annually. The Chinese government has continued to relax the regulatory regime on outbound investments. Both the NDRC and the Ministry of Commerce, as the major approval authorities, have gone through several rounds of legislative amendments to simplify the approval procedures for Chinese investors. Issuance of the Consultation Draft is the latest development in this trend. It is a welcomed move by the Chinese government. In particular, the proposed changes to the pre-reporting mechanism show the government's willingness to lower the level of interference that it may have over the market. This will not only benefit Chinese investors who have been disadvantaged by the uncertainty and delay caused by the government approval process compared to their foreign competitors, but also provide more certainty to foreign sellers. Once finalised, the revised regime will offer greater flexibility to investors in structuring and financing their overseas transactions.

Visit us at www.mayerbrown.com

Mayer Brown is a global legal services organization comprising legal practices that are separate entities (the Mayer Brown Practices). The Mayer Brown Practices are: Mayer Brown LLP, a limited liability partnership established in the United States; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales; Mayer Brown JSM, a Hong Kong partnership, and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2016. The Mayer Brown Practices. All rights reserved.

This article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein. Please also read the JSM legal publications Disclaimer.