Waiver and remission of tax penalty

The Malaysian Inland Revenue Board ("IRB") has recently announced that there will be a waiver and remission of tax penalty to encourage voluntary disclosures and early settlement of tax arrears.

How can this benefit you?

- Opportunity to resolve tax disputes

- Waiver of tax increase (late payment penalty) for tax arrears: Income tax, withholding tax and RPGT*

- Remission of penalty for voluntary disclosure of non-submission or late filing of income tax return forms

- Remission of penalty for voluntary disclosure of incorrect returns filed

- Remission is for a limited time frame: 1 May 2015 to 30 November 2015

Source:

" IRB's media release on "Reduction of Penalty And

Waiver of Tax Increase for Voluntary Disclosure And Early

Settlement of Tax Arrears" dated 24 April 2015

Note:

*RPGT denotes Real Property Gains Tax

Taxpayers deriving income from Malaysia and looking for opportunities to regularise their tax positions may apply for the reduction of penalties and/or waiver of increase of tax.

Who can apply?

| Multinational companies ("MNCs")* | Local companies* (including small and medium enterprises) |

| Individuals | Others (including body of persons, limited liability partnership, corporation sole, trust companies) |

Note:

*Excludes companies whose tax files are handled by the

Multinational Tax Branch or the Petroleum Branch of the

IRB

Recommended for:

| MNCs and local companies |

|

| Individuals |

|

Current tax penalty regime

The tables below set out the current penalty regime under the tax law and the concessionary rates applied by the IRB in practice:

1) Concessionary rate of penalty

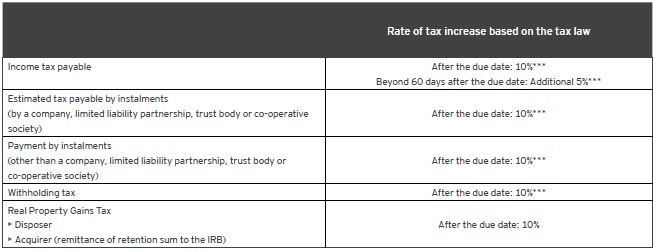

2) Rate of tax increase

Notes:

*Rates of penalty for the late submission of tax returns are

extracted from the "Garis Panduan Operasi Bil. 1 Tahun

2015" issued by the IRB on 5 March 2015.

**Based on the Tax Audit and Tax Investigation Frameworks

***Based on the Income Tax Act 1967

Amnesty regime

The recent IRB announcement aims to reduce the current concessionary penalty rates and waiver of tax increase. However, the amnesty* does not indicate the rate of reduced penalty.

Key areas to note:

- Merit based

Depending on IRB's discretion based on the merits of the case - Tax review

Possibility of a tax audit by the IRB - Open years

Not clear on the years of assessment to be audited by the IRB - State of

documentation

Ability to retrieve relevant documentation - Short time frame: 30 November

2015

Short period of time for applicants to perform a tax health check

Notes:

*The IRB's conditions for amnesty are outlined as

follows:

> The eligibility of the offer depends on the merits of the

taxpayer's case

> It is subject to relevant regulations issued by the IRB

> It is not applicable to taxpayers whose tax files are handled

by the Multinational Tax Branch or the Petroleum Branch of the

IRB

You can consider...

Before approaching IRB:

- Ascertain your tax status (payable / refund) for each year of assessment

- Undertake a health check on the tax returns for the past 3 to 5 years of assessment

- Undertake a withholding tax review on payments made to non-residents

- Undertake a means test or capital statement review in the last 5 years of assessment (for individuals)

- Formulate a submission strategy

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.