In June of this year, the Hungarian government decided to allow Hungarian companies to prepare stand-alone financial statements in accordance with IFRS. The relevant laws were then amended and passed on 17 November.

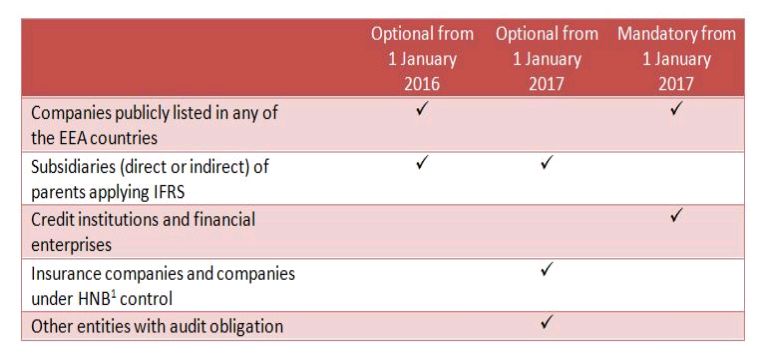

According to Act CLXXVIII, the adoption of IFRS will take place in several phases. The changes open the door to the application of IFRS instead of Hungarian GAAP for statutory reporting purposes as follows:

Companies who would like to take advantage of the rule are already faced with a very busy 2015 year-end, as the change is conditional on having a positive opinion from an IFRS-licensed auditor stating that the company is ready for the preparation of IFRS financial statements. The auditor should review whether the company:

- employs a professional who is authorised to produce financial statements in accordance with IFRS (accountant or auditor)

- is in possession of signed-off IFRS Accounting Policies; and

- has already established the opening balances for the comparative period (the first day of the year preceding the transition) that comply with IFRS.

The auditor's opinion has to be attached to the notification about IFRS adoption that is to be sent to the Tax Authority 90 days before the intended change, at the latest. Since the regulation was first accepted in November 2015, companies opting for a 2016 adoption are supposed to report the conversion within 15 days following the transition (i.e. in case of financial year starting 1 January 2016, the notification should be submitted by 15 January 2016).

Once a company has adopted IFRS for statutory reporting purposes they may only reverse this decision after five financial years or, in an instance where there is a change in the direct or indirect parent company. Naturally, applying Hungarian GAAP is mandatory from the point when the company is no longer eligible for the transition for any reason.

The Government's objective was to keep the transition neutral from a taxation point of view. However, because of the unpredictable impact the change may have on the liquidity of the state budget, the rules regarding taxation (mainly Corporate Income Tax and Local Business Tax) needed to be created with special care. On one hand, the tax liability calculations will be based on IFRS pre-tax profit, and a series of tax base modifying items will ensure that companies – basically – re-establish their Hungarian GAAP tax base. On the other hand, there will be a minimum tax and tax advance payment liability in the first two years after the transition: this means that the paid tax advances and final tax liability cannot be lower than the tax paid in the year preceding the transition.

It appears the stability of the state budget overrode the objective of neutrality, as both the minimum tax requirements and the application of the extensive tax base modifying items try to conserve taxation in the old model.

Also, companies' well expressed wish to keep administration as simple as possible – meaning that they would not have to carry out parallel accounting (Hungarian GAAP and IFRS) after the transition – most likely remains a wish. This is very well reflected by the fact that in order for companies to be able to define and quantify tax base modifying items, they will still need to categorise revenues / expenses and assets / liabilities in accordance with Hungarian GAAP as well.

Nevertheless, considering the whole package, the possibility for the transition is a very significant achievement. There will certainly be further modifications when the first adoptions happen and 'bugs' come to the surface, and with that the system can be fine-tuned to the actual demands of the parties involved and may become a bit better balanced, so that it can really be an advantage for the users.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.