ABOUT THIS SURVEY REPORT

119 individuals from a range of businesses in the financial services sector, including investment management, broking, banking, insurance and corporate finance firms participated in our 16th annual survey.

The majority of firms surveyed employ up to 250 people, with 40% employing up to 20.

Respondents according to annual turnover

10% - above £500m

18% - between £51m and £500m

17% - between £11m and £50m

16% - between £5m and £10m

39% - less than £5m

EXECUTIVE SUMMARY

Sector optimism reaches a new high

- 59% of respondents say their annual turnover increased last year, with nearly two thirds expecting it to grow this year, far higher figures than a year ago. Only 8% believe their turnover will decrease, compared to nearly 20% last year.

- 45% expect to increase headcount over the next 12 months, while only 6% plan to reduce it, compared to over 20% last year.

How do you expect your business' turnover to change in the next 12 months?

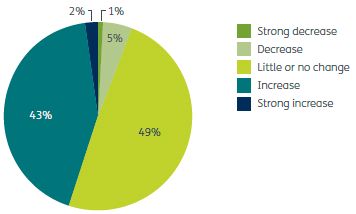

How do you expect your business' headcount to change over the next 12 months?

Our viewRespondents appear far more buoyant than in previous years, with many expecting to increase turnover and headcount over the coming year. However, many firms continue to feel the pressure on both costs and fees. In addition, with firms facing severe competition for high-quality employees, attracting and recruiting suitably qualified people could prove a challenge. |

Challenges remain

- Maintaining profitability, pressure on fees, winning new work and managing costs are among the greatest concerns currently facing the sector, outside of compliance issues.

- Retaining and recruiting suitably qualified staff is also a key concern for 43% of firms surveyed, demonstrating the intense competition for high-calibre employees in the sector.

- Salary increases (38%) are the main incentives being used to attract and retain key employees, ahead of bonuses (27%) and share options (24%).

Looking ahead

- 59% of respondents are focused on cost control, demonstrating that despite the improving economy, they have not forgotten the lessons of a deep recession.

- Increasing salary levels appear to be creating a squeeze on other costs, which still need to be carefully managed.

- 55% of respondents are aiming to grow their range of services or products, while 49% are expecting to develop their business through enhanced technology. These indications of investment in the sector bode well for the future.

Our viewBranching outMany firms seem more willing to extend their service or product offering or to enter new markets. They appear less concerned about international competition, except from New York. Other financial centres, for example, in the Far East, are perceived as facing difficulties in attracting the best talent, with London and New York seen as the pre-eminent centres. Having deferred investment in new technology over the last couple of years, many firms say they are now more likely to commit greater resources in this area, often critical in delivering the response times and global market intelligence required in a highly competitive sector. Cautious optimismThis optimism is tempered by continuing economic challenges in the EU, the potential impact of global hikes in interest rates and, more recently, the threat of instability in Eastern Europe. Closer to home, respondents call on the UK Government to play its part in alleviating uncertainty and fuelling growth by making regulatory and tax requirements less onerous where possible. |

ECONOMIC OUTLOOK

Economic recovery remains fragile

- Beyond regulatory requirements, the UK economy (58%) is the key factor expected to have the greatest impact on businesses over the coming year.

Which of the following do you expect to have the most impact on your business over the next 12 months?

(respondents could tick as many answers as applied)

Our viewBy the end of 2013 the UK was showing some of the fastest growth among the G7 economies. However, despite this, UK GDP remains 2% below its prior peak level in early 2008, with the absence of productivity growth perhaps being the biggest issue for the economy. Since 2009, the Bank of England has kept the base rate at 0.5% and injected £375bn of quantitative easing into the system. It is unlikely to raise interest rates unless a wage cost spiral follows, which seems some way off. Pressure to tighten monetary policy has diminished now that headline inflation has fallen below the 2% target level. The Bank of England recently increased its 2014 growth rate forecast to a respectable 3.4%. It is aware that a premature tightening of rates could damage the household balance sheet and consumption growth, so is likely to err on the side of caution when it comes to reversing policy, with rates remaining lower for longer. An improvement in the economy should bolster tax receipts, which could provide some scope for the Government to offer limited tax sweeteners in this year's autumn statement. |

- Competition ranks as a major concern, with 47% of respondents mindful of competition within the UK and internationally – particularly from New York and Frankfurt.

- The up-and-coming but less well-developed Far Eastern markets, e.g. Shanghai, Hong Kong and Singapore, are believed to pose less of a threat to London as a financial centre, compared to previous years.

In your opinion, which financial centre represents the biggest threat to London?

(respondents could tick as many answers as applied)

Our viewThe latest Global Financial Centres Index (GFCI) saw London lose the top spot to New York. The index showed that London's reputation had been affected by a combination of regulatory uncertainty, the Libor and FX 'insider' trading claims and uncertainty over taxation. London remains the global market leader in foreign exchange trading, cross-border bank lending, interest rate derivatives and marine insurance. The GFCI also showed that the leading Asian centres (Singapore, Tokyo, Seoul and Shenzen) are pulling away from the weaker Asian centres such as Mumbai and Kuala Lumpur. The Middle East centres continue to rise in the index. All offshore centres with the exception of Gibraltar and the British Virgin Islands saw a decline in their rankings reflecting concern over regulation. |

To read this survey in full, please click here.

* We would like to thank Resolve Marketing for their help in compiling this survey and conducting this research in line with the professional code of conduct from the Market Research Society.

We have taken great care to ensure the accuracy of this information. However, the document is written in general terms and you are strongly recommended to seek specific advice before taking any action based on the information it contains. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication.