On 19 July 2013, the OECD issued its much-anticipated Action Plan on Base Erosion and Profit Shifting ("BEPS"), with a view to bringing international economic integration and national taxing rights more closely into line. The 40-page BEPS Action Plan contains 15 separate action points, some of which are further split into specific actions or outputs. The BEPS Action Plan aims to address these issues in a coordinated, comprehensive manner, and was endorsed by the leaders of the "G20" economic grouping in September 2013.

While it may take considerably longer for the impact of these changes to be applied fully in practice, there are indications that the BEPS project and related developments are already leading to material shifts in the behaviour of many tax authorities.

Status

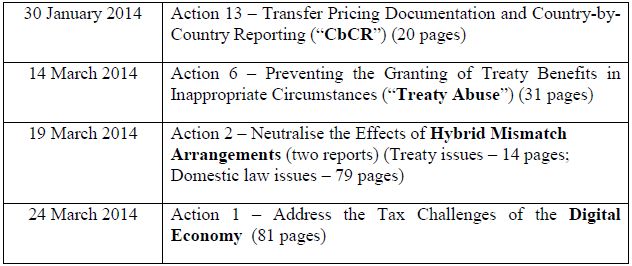

At the date of this summary, 28 May 2014, the OECD has so far successfully followed the timetable running through to the end of 2015 as set out in the BEPS Action Plan, and has published four initial Discussion Drafts of various Reports, each as proposed in the BEPS Action Plan. The Discussion Drafts are as follows.

These Discussion Drafts have each since been the subject of public consultation by way of both written submissions and public meetings, as outlined further below. Input from this consultation process, and from further consultation with the tax authorities of all OECD member states (including Luxembourg), will be taken into consideration by the OECD before it publishes the final versions of its work in these areas. In each case, this is anticipated as occurring before the end of September 2014.

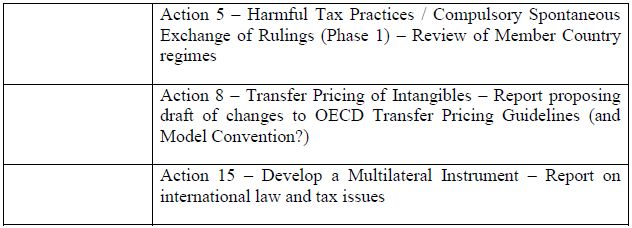

Other output noted in the BEPS Action Plan timeline as "to be produced by September 2014" is tabulated on the next page. The OECD also publishes regularly a "Calendar for planned stakeholders input" (see www.oecd.org/ctp/discussiondrafts.htm) - the most recent (13 May 2014) version does not give any more precise guidance on the likely issue dates of draft output for these yet-to-be-produced deliverables. Nothing else is now expected to be published until after the summer.

On 26 May 2014 the OECD ran a BEPS webcast, at which OECD senior BEPS project officials gave an update on progress on each of the currently-active workstreams. They remained optimistic that all output due to be finalised in September 2014 would be completed on schedule. Also, work to date had indicated that the "multilateral instrument" approach to amending a large number of bilateral tax treaties at once was feasible, with work on a framework set to start in early 2015.

Transfer Pricing Documentation and CbCR

The Discussion Draft of the report essentially comprises the draft for a complete rewrite of Chapter V ("Documentation") of the OECD Transfer Pricing Guidelines, annotated with questions for further consideration. The revised Guidelines would require all MNE groups to prepare and maintain contemporaneous TP documentation in the form of a group "master file" and "local files", with OECD-specified detailed content set out in Annexes 1 and 2 to the rewritten Chapter. The "master file" was to contain information on and note the base location of (but not the names of) the 25 most highly-paid employees of the MNE group.

The Discussion Draft also requires MNEs, as one component of the "master file", to collate financial data in a standard format, referred to as the "CbCR template". (Many MNEs would have to adapt their financial systems significantly in order to be able to generate this data efficiently.) This CbCR template (a pro-forma, together with instructions for completion, comprises Annex 3 to the rewritten Chapter) would have to show – line by line, on a per group company basis – sales, profits, intra-group flows, as well as "economic indicators" including fixed assets, employee numbers, and total salary bills.

The Discussion Draft suggested alternative approaches for achieving a high level of transparency to tax authorities, this being seen as a core objective of the BEPS Action Plan. One proposal was that the "master file", including all the CbCR template data covering all countries, would be filed automatically with the tax authorities in every country where the MNE has a presence. An alternative was for the "master file" to be filed with the tax authorities in the country where the MNE group parent company was based, with it being available to other tax authorities under "exchange of information" mechanisms.

Public responses to the Discussion Draft had to reach the OECD by 23 February 2014, and there was a public consultation meeting at the OECD on 19 May 2014. There has already been much opposition to the proposals, including indications that US IRS has concerns that "global formulary apportionment" could in practice arise. The OECD are hence now considering moderating the stance initially taken, notably through

- Excluding the CbCR template from the "master file" contents, and recognising that it is a "high-level" document intended mainly for risk assessment.

- Removing a number of columns from the CbCR template that detail specific intra-group flows such as royalties.

- Allowing the CbCR template to be prepared on an aggregate territory basis, rather than entity by entity.

- No longer requiring the "master file" to give any "25 highest paid" details.

- Reflecting further on how increased transparency to tax authorities is to occur (this having been the subject of heated debate at the public consultation meeting).

Treaty Abuse

The Discussion Draft focuses heavily on the OECD's concerns over "treaty shopping", taking a far-reaching approach that in effect sees ANY inclusion of any intermediate country in an income flow as "treaty shopping". The proposed text of a new Model Treaty clause is set out, with this containing:

- A very restrictive, US-style "limitation of benefits" ("LoB") regime set out over more than two pages of text – with no "derivative benefits" rules, and only limited let-outs for "active trade or business" flows; and

- A much shorter "main purposes" test for denial of benefits (i.e. no treaty benefits granted if one of the main purposes of an arrangement was getting treaty benefits).

The Discussion Draft also addresses other areas where a taxpayer might "seek to circumvent treaty limitations". Notably, a blunt, overall "effective rate of tax" rule is proposed, to deny treaty benefits to flows to "low-taxed" branches. Also, the treaty status of any "dual resident" company would be decided solely via "competent authority" deliberations.

The public consultation period ended on 9 April 2014, and a public consultation meeting was held at the OECD on 13/14 April 2014. The proposals have received a strongly negative response. Many bodies pointed out that the proposals would deny treaty benefits to most non-publicly traded groups with foreign shareholders, and almost all private equity and similar fund structures. One body felt that the proposals would be "turning the clock back more than 50 years", and many felt that the proposals would serve to hinder rather than encourage international trade and investment. The proposals are also regarded by many as being in conflict with EU treaties, and there were some indications at the public consultation meeting that the OECD accepts that it needs to work further on this aspect.

The consensus in the business community appears to be that the OECD needs to get back to a situation where holding companies with "genuine economic activity" unequivocally still get treaty benefits.

It is understood that the US Treasury feel that the "main purposes" test proposed is a blunt instrument that could result in tax authority overreach, and would resist its inclusion in further OECD discussions as this Report moves towards being finalised. Conversely, the OECD working party remains convinced that a "main purposes" test, as well as LoB provisions, is required to deal with issues such as "conduit" financing. In any event the OECD still needs to draft a section to go into the Model Commentary that would seek to clarify how any "main purposes" test would operate. The OECD has noted a need for flexibility, to deal with the interaction of domestic and Model Convention treaty anti-abuse measures.

The OECD's progress update webcast on 26 May 2014 suggested that the Report is being redrafted in some areas. Within the LoB text, "derivative benefits" rules, which would allow treaty entitlement in situations where a group has a "third country" parent but does not secure a treaty-shopping advantage via the insertion of an intermediate entity in a treaty partner territory, may well become part of the new Model text rather than a Commentary option, although this is still felt to give rise to difficult issues.

Also, importantly, the "design" of the LoB provisions is understood to be being moderated, to address some of the issues raised in public consultation regarding treaty access for "collective investment vehicles" ("CIVs"), pension funds and "dual-listed" companies.

Lastly, the OECD sees a need for the text of the report to retain flexibility while other interacting BEPS workstreams, such as that on interest deductibility, develop their measures.

Hybrid mismatches

The OECD has issued two Discussion Drafts on this topic. The longer one is complex, recommending very detailed changes to domestic laws. The shorter one covers possible Model treaty changes, having less impact and referring primarily to other BEPS Action Plan deliverables.

The "domestic law changes" Discussion Draft identifies specific situations that it believes should be caught, distinguishing between "D/NI" (deduction/no inclusion) and "DD" (double deduction) situations. The text covers individual financial instruments with hybrid characteristics, hybrid entity payments, and "imported mismatches" and "reverse hybrids". The overall approach recommended is for the "paying country" to deny a deduction if the recipient country does not tax the flow as ordinary income. If this treatment is not applied a "secondary rule" should come into play, and the "recipient country" must either tax income (if D/NI) or deny the deduction (if DD). On this basis, only one of the two (or three) countries involved in a potential hybrid mismatch arrangement would need to change its legislation in order to render the arrangement no longer tax-advantageous.

It is noted that the EU Commission-proposed Parent/Subsidiary Directive "anti-hybrid" amendment (described further at C.3 below) only proposes a D/NI "secondary rule" to tax income (given that all EU Member States ought to adopt the Directive change into their domestic legislation, and on a consistent basis), and in any event would only be of application where a hybrid financing instrument is in place between two entities that are both types of EU entities listed in the Directive.)

The Discussion Draft text represented a highly complex set of proposals. The initial reaction has been that the rules are similar, but by no means identical, to those already adopted or proposed in the UK, the Netherlands, France, Germany, Australia, Mexico and some other jurisdictions, and (for hybrid entities) to the US "dual consolidated loss" rules. Concerns that have been raised focus on the risk of inconsistency in adoption, complexity, and the impact on internal financing harming economic growth.

Developments to date in Luxembourg, and potential implications

Transparency, and reporting requirements (including transfer pricing documentation and CbCR)

As regards the countering of harmful tax competition, the OECD work in this area will primarily involve information gathering until September 2014. The BEPS Action Plan calls for "compulsory spontaneous exchange on rulings related to preferential regimes", and "requiring substantial activity for any preferential regimes".

Given that Luxembourg has been under close EU Code of Conduct Group on Business Taxation surveillance since the original EU initiative on harmful tax competition in the late 1990's and ongoing since, it can be observed with reasonable comfort that Luxembourg already has few if any preferential tax regimes, and hence should not be affected radically by the OECD work.

That said, Luxembourg does have a specific "IP Box" regime that in effect excludes 80% of net income derived from certain types of intellectual property. Shortly after the regime was introduced in 2008, the EU's Code of Conduct Group on Business Taxation confirmed that the Luxembourg regime did not need to be assessed under the criteria set out in the Code of Conduct for identifying whether measures give rise to harmful tax competition. Confirmation in identical terms was given at the same time regarding the Belgian patents regime and Spain's intangible assets regime.

However, in recognition that regimes of this nature have in recent years proliferated across the EU, since September 2013 the EU Commission has been conducting a new informal review of these regimes from a State aid perspective. A local difficulty arose in March 2014, when the EU Commission announced that the level of information provision to date by Luxembourg to support the review was in its view insufficient, and sought an injunction to force Luxembourg to provide documentation on a taxpayer by taxpayer basis for the 100 largest users of the regime. Luxembourg has refused to comply, on the grounds that the EU Commission is exceeding its powers, given that there is no prima facie evidence of State aid being granted to any individual taxpayer and thus that taxpayer secrecy remains paramount, and has hence referred the matter to the CJEU to seek cancellation of the injunction.

Unconnected with this EU Commission issue, the Luxembourg tax authorities have informally made it clear that, since January 2014, they would not give advance confirmations that the IP regime would apply, unless the Luxembourg entity seeking the confirmation could show substantial activity being conducted in connection with the IP. This is clearly aimed at being "BEPS compliant".

There are no indications that the Luxembourg government intends to introduce any legislation or filing requirements concerning the disclosure of aggressive tax planning arrangements.

In its Coalition programme, the Luxembourg government has committed to modernising its transfer pricing regime. At present the regime does not impose any documentation requirements except in the context of unilateral APA requests. There are currently no indications that there is any intention to re-examine transfer pricing documentation obligations under domestic rules. While Luxembourg considers that its transfer pricing regime is consistent with the practices and methods outlined in the OECD Transfer Pricing Guidelines (which the CbCR Discussion Draft proposes modifying significantly in the area of documentation requirements), until the Luxembourg government issues any wider proposals for a new transfer pricing regime, no indications are available of the extent to which Luxembourg would begin to require taxpayers to prepare "master files", "local files" and CbCR templates as transfer pricing documentation.

Treaty abuse, and the use of permanent establishments

EU Commission proposals to add a general anti-abuse ("GAAR") provision to the Parent/Subsidiary Directive were announced in November 2013, and were justified on the grounds that this would be best practice, equivalent to preventing treaty abuse under the BEPS Action Plan. The EU Commission "GAAR" would withdraw the benefits of the P/S Directive in the event of "artificial arrangements", which "do not reflect economic reality". More specifically, the draft Directive text targets arrangements "being carried out in a manner which would not ordinarily be used in reasonable business conduct" or "resulting in a significant tax benefit which is not reflected in the business risks undertaken by the taxpayer or its cash flows".

On this basis, there would be potential for exposure under a P/S Directive GAAR (and any subsequent extension of it under EU law or jurisprudence) for any intra-EU intermediate holding company structure, unless it could be asserted with confidence that the structure was NOT in place "for the essential purpose of obtaining an improper tax advantage". The EU GAAR would be likely to have a "blunderbuss" effect, at least until new CJEU cases clarified its scope of application.

Indeed, were these GAAR proposals to be implemented as drafted in November 2013, this might mean in practice that only Luxembourg "regional HQ-type" structures, with management from Luxembourg of the businesses of companies owned by a Luxembourg holding company, would be GAAR-safe.

However, the GAAR would require unanimity of the 28 EU Member States before it could be adopted into the Directive. This is highly unlikely in the short term, and hence it would be alarmist to assume that intermediate holding company structures within the EU will no longer be tax effective. Nevertheless, our view is that, irrespective of where in the EU an intermediate holding company is located, it is increasingly important that such entities have real economic substance (although recognising that, on a case by case basis this is hard to define without legislative or court-given guidance), as otherwise eventually the structure will fall foul of either individual territory domestic rules or practices that have the same effect of denying Directive benefits, or of future GAAR-style Directive amendments.

Particularly given the current OECD backing for action, the EU Commission is equally unlikely to give up entirely in its efforts to introduce a GAAR into the direct tax Directives. Specifically, Italy has indicated that, during its Presidency of the EU over the second half of 2014, it intends that there should be further in-depth discussion of the matter.

The March 2014 OECD Discussion Draft proposals regarding treaty shopping, involving both very tightly drawn LoB clauses and a "main purposes" test, would, if implemented as planned, deny treaty benefits on flows from lower in the ownership chain to the great majority of intermediate holding company structures currently in place, in Luxembourg and equally in any other jurisdiction that is regarded as favourable for holding company structures. The absence of any form of "derivative benefits" provisions in the proposals would mean that even groups with US publicly quoted parents would probably not be able to sustain intermediate holding structures in Europe. The only available "let out" would be the relief for income flows linked to the "active trade or business" of the recipient. This would go far beyond any current needs for "substance" in order to support a structure. As noted at 16. Above, there are now some indications that the final version of the Report may introduce some "derivative benefits" provisions, thereby lessening concerns in this area.

This Discussion Draft also does little to recognise the specific position of investment funds, despite the OECD having done significant work in the past in this area – see notably its April 2010 Report "The Granting of Treaty Benefits with Respect to the Income of Collective Investment Vehicles", recognising the need to achieve neutrality between a direct investment and an investment via a collective investment vehicle. The Discussion Draft proposals ignore this objective, and would leave both investment fund vehicles themselves, and any holding and financing platforms that they might have set up (as is commonplace in the alternative funds environment), having all treaty benefits denied on investments they make, again because the LoB clause is so restrictively written.

At this stage, it is impossible to foresee how the final version of these "treaty-shopping" proposals will affect Luxembourg. However, as things stand the proposals could well cause there to be a possible material reduction in the level of all intermediate holding and financing activity, particularly given that so much of this activity in Luxembourg is owned by investment fund vehicles. Furthermore it is unclear how rapidly countries will move (or be pressed to move) to renegotiate their treaties to introduce the Model Treaty text that the proposals promulgate.

However it is felt by many commentators that the current text of the OECD Discussion Draft represents a politically-driven initial negotiating position, which in the period leading up to the finalisation of the Report (scheduled for September 2014) tax authorities themselves are likely to seek to moderate to protect inward investment. It must also be remembered that the OECD requires consensus among its members before it can conclude on a position, and there are already indications that divergent views of member countries may not readily be reconciled. The current text is thus probably a "worst-possible" outcome for business. Certainly, a move towards a situation where holding company structures that have genuine and significant economic activity are not denied treaty benefits would be very important for the MNE and alternative investment funds business communities internationally.

Whether, in finalising its proposals, the OECD will do more to help investment funds also remains to be seen. Both at the public consultation meeting last month and in the text of the OECD 26 May 2014 webcast there appeared to be some willingness to grant "qualified person" status under the LoB provisions to certain types of fully-regulated investment funds, meaning that such entities would not automatically be denied treaty access. Movement in this area would be welcome for the Luxembourg funds industry. However there still seems to be a perception that private equity-type funds should not be able to access treaties.

The March 2014 OECD Discussion Draft proposals regarding treaty abuse using "low-taxed" branches could also have material implications for Luxembourg if implemented into tax treaties between Luxembourg and territories that are funded out of such branches. A blunt rule (based on US treaty practice) is proposed, that would deny treaty benefits if the effective tax burden on the income flow, combining the tax due in Luxembourg and in the branch location, was below 60% of the general corporate income tax rate in Luxembourg (i.e. 29.22%).

Luxembourg is not generally affected by entities seeking to artificially avoid PE status in Luxembourg, and there are no indications that the Luxembourg government is going to introduce new measures in this area.

Hybrid mismatches, and base erosion via interest deductions and other financial payments

As regards hybrid mismatch arrangements, there are no suggestions at present that the Luxembourg government is anxious to introduce any of the measures proposed as recommendations for changes to domestic laws in order to adopt any of the proposals in the 19 March 2014 Discussion Draft report following Action 2 in the BEPS Action Plan.

Inevitably, if other jurisdictions implement proposals along the lines set out in the 19 March 2014 Discussion Draft, hybrid structures involving Luxembourg may nevertheless be rendered ineffective, if the "secondary rule" measures are applied by the other jurisdiction because Luxembourg has not changed its legislation and introduced "primary rule" measures that restrict deductions.

Conversely, "quasi-hybrid"-type arrangements that do not result in any mismatch in tax characterisation should not fall within the scope of the 19 March 2014 Discussion Draft recommendations. An example might be a Luxembourg entity financed by a PPL or similar instrument, which has "interest" characterisation for the purposes of withholding tax application (or non-application) and deductibility in Luxembourg, but which is not taxed in a counterparty territory (because the finance-providing entity is simply not taxable there on the income flow) despite retaining "interest" characterisation in that other territory.

The EU Commission proposal to add an "anti-hybrid" provision to the Parent/Subsidiary Directive noted at B.3 above was justified on the grounds that this would be best practice under the BEPS Action Plan. This proposal would apply only to hybrid financing instruments (i.e. not to hybrid entities), and only when the EU Parent/Subsidiary Directive would otherwise have applied (i.e. where both payer and recipient of the flow are fully taxable EU corporates). The approach taken is that "source country" characterisation would be applicable, but with a "secondary" rule applying, requiring the recipient territory to tax the flow (and deny the application of the P/S Directive "participation exemption") if the source territory gave a deduction.

EU legislators decided on 6 May 2014 to "delink" this proposal from other, more contentious proposals to amend the Parent/Subsidiary Directive, meaning that this "anti-hybrid" proposal is now likely to be adopted into EU law as early as June 2014. There is still some likelihood that the measure could secure unanimous support at the next ECOFIN Council meeting on 20 June 2014, despite currently outstanding concerns raised by Malta. If this all occurs as now foreseen, Luxembourg, as with all other EU Member States, would then be required to transpose the "anti-hybrid" provision into its domestic law, possibly before 31 December 2015.

It should be understood that this new EU-level "anti-hybrid" provision would not apply to a Luxembourg entity making payments under a PPL-type instrument unless the counterparty was another EU corporate entity that is fully taxable in an EÙ Member State, which is usually not the case. (Indeed, Luxembourg/intra-EU structures involving D/NI hybrid mismatches are in any case not thought to have been common.) Furthermore, the new EU-mandated provision would not in any circumstances cause a flow out from Luxembourg to lose its "interest" characterisation and hence its deductibility or withholding tax exemption.

As regards the BEPS Action Plan initiative to limit base erosion via interest deductions and other financial payments, there is no indication yet at OECD level how this work will proceed. Furthermore there are no indications that the Luxembourg government plan to introduce any form of "interest capping" or other thin capitalisation or "debt/equity" legislation. That said, there does currently appear to be some degree of tightening by the Luxembourg tax authorities of the way in which they apply their long-held (but unwritten) practice regarding the need for an 85:15 upper limit to the debt:equity ratio for the related party financing of equity participations.

The most significant impact that is currently foreseen for Luxembourg is that there might be an overall reduction in the volume of intra-group financing provided from Luxembourg. This will occur as other countries tighten rules further, or introduce new rules, that restrict the deductibility of interest expenses, either by bringing in German-type interest capping rules or otherwise by taking a stricter line on thin capitalisation situations.

Transfer pricing

As regards the transfer pricing consequences of OECD proposals to limit base erosion via interest deductions, again the most significant effect is also likely to be on intra-group financing provided from Luxembourg. As BEPS-driven sensitivity to the interest rate and terms applied to such loans increases, the need for thorough and well-grounded loan price benchmarking study work will also increase. Although primarily driven by tax authority pressure in the borrower jurisdiction, co-ordination of such work will often best be done from Luxembourg, given the need for consistency in cases where a single financing structure is used to fund several territories.

Financing structures that not only provide loans from Luxembourg, but also involve borrowing by the same Luxembourg entity on similar terms, may also be curtailed as a result of implementation of BEPS "treaty abuse" Action 6 measures. Notably, to the extent that such structures currently evidence a low level of economic risk in Luxembourg (and hence leave only a low margin in Luxembourg), these structures might increasingly be denied treaty benefits on the interest flow out from the territory ultimately using the finance. This would be on the grounds that the Luxembourg entity had been inserted primarily for "treaty shopping" purposes, with the low margin being left serving as per se evidence of this. Hence, in order to survive, a higher margin, commensurate with a the higher level of functional activity undertaken and risk borne in Luxembourg that would be necessary, would need to be retained – and the benchmarking for transfer pricing purposes of such a margin would become a more complex exercise.

The post-2011 transfer pricing regime applying when groups wish to seek a unilateral APA concerning the margin to be left in Luxembourg on arrangements that involve a Luxembourg company in borrowing and on-lending is (per se) already BEPS-compliant, and hence ought not to change radically.

The three Actions aimed at assuring that transfer pricing outcomes are in line with value creation are each less likely to have a direct effect in Luxembourg, given that the value-creating transaction (e.g. creation and development of a high-value intangible) is in practice (outside the financial services sector) seldom likely to be one where Luxembourg is the territory warranting the commensurately high arm's length reward. However, Luxembourg may well often be the counterparty territory to related party income flows that will need to generate such rewards, and, assuming that Luxembourg in due course either domestically or indirectly as a result of EU actions imposes documentation requirements, transfer pricing documentation supporting such arrangements would then also need to satisfy Luxembourg considerations. However, while (as noted above) the Luxembourg government intends to modernise its transfer pricing regime, there are no indications at present that any formal penalty-based documentation requirements would be introduced.

A Some suggestions for Luxembourg's tax policy makers

D.1 Forthcoming OECD discussions on the "treaty abuse" Discussion Draft

1. Luxembourg (linking together with other sympathetic jurisdictions on an issue-by-issue basis) needs to react energetically at OECD level in the coming weeks. Specific areas where change to the Discussion Draft should be sought, and pushed hard for, are listed below.

2. Complete removal of the sweeping "main purposes" provision from the proposed new Model treaty draft text should be pressed for, given its subjective nature and consequent lack of certainty that taxpayers would face. Public comment by senior government officials suggests that the US will also be likely to take this line, and resist the use of a "blunt instrument" of this nature – notably, the US Senate has in the past rejected clauses of this type when proposed for inclusion in US treaties. Conversely the UK is on record as being likely to continue to press for such a clause, as it has such an approach in its domestic legislation and believes that it works satisfactorily.

3. Another essential amendment is the removal of the "active trade or business" let-out from the LoB clause, and its replacement by a much broader LoB let-out, which allows any intermediate entity in a structure to not have its benefits limited, so long as it conducts "genuine economic activity". This would be a term which should be clearly defined in the OECD Model Commentary, using a broad approach and building on existing jurisprudence (e.g. the CJEU Cadbury Schweppes case). Unless there is relaxation in this area, even many "regional headquarters" operations that also act as holding companies would be denied treaty benefits.

4. Inclusion of a broad "derivative benefits" clause in the proposed new Model treaty draft text for an LoB clause should be insisted upon, although here it may now turn out that this would be "pushing at an open door". Without this, genuinely multinational, as opposed to purely "bi-national", operations and structures cannot access treaty benefits – a highly regressive situation. ("Derivative benefits" was described as an option in the Discussion Draft, and is already a recognised part of the bilateral treaty landscape, appearing notably in the US-Luxembourg treaty.) Luxembourg (and all other small, open economies) should not even contemplate support for these OECD proposals, unless "derivative benefits" measures are included actually within the Model treaty text (and not just suggested as an option in the Commentary).

5. Also, all private equity and real estate funds that operate holding and financing platforms beneath their fund vehicles could well lose ALL treaty benefits under the current proposals, unless they moved their main fund manager activity into the structures they manage - which would be a radical innovation. Even then, there would be no certainty that the "active trade or business" let-out as drafted would be available. A move towards a "genuine economic activity" treaty entitlement is thus particularly vital to the alternative funds sector. It is hence of particular importance to Luxembourg, given the contribution to the local economy that these holding and financing platforms currently make.

6. Extension to the "qualified persons" rules in the Model LoB clause is needed, to include as "qualified persons" any fund vehicle (irrespective of whether it has legal persona) so long as it is "regulated" in an effective manner in its territory of establishment. "Regulation" should properly and reasonably include AIFMD regulation; whilst this is strictly of the fund manager involved, the regulations control and constrain the funds managed, too, in many cases at least as strictly as the EU's UCITS Directives. This extension in scope is needed in order to recognise that fund vehicles, as with pension funds and major corporate conglomerates (both of which the LoB clause does help), are not set up with treaty shopping as a motive, and hence should not be denied treaty benefits, particularly given that most of their investors would be able to access treaty benefits were they not investing via collective vehicles. This is notably the case for many alternative funds, which have a primarily "big ticket" institutional investor base. The guiding principle (endorsed by the OECD in 2010) of tax neutrality between investment via a fund or collective investment vehicle into an asset, and direct investment into an asset, would be entirely set aside were the Discussion Draft proposals as currently made to be finally endorsed by the OECD.

To have funds treated as "qualified persons" is important in any event, but would become critical, as a "back-stop" way of securing treaty access for the holding and financing platform subsidiaries of alternative funds, were the OECD not to move to accepting a much broader "genuine economic activity" treaty entitlement.

8. Resistance should be maintained to the overly strict proposals on dual resident companies, and the "blunt instrument" low-taxed branch proposals.

D.2 Broader BEPS- related actions recommended

9. As well as a full tax authority involvement in OECD-level debate in the coming weeks, Luxembourg needs to engage in wider diplomatic activity, in particular seeking to make "common cause" with other countries, such as the Netherlands, Switzerland and Ireland, and also on some issues the US, that stand to lose most from, or have the strongest dislike of, the more radical components of the OECD proposals.

10. The November 2013 EU Commission proposals regarding the changes to the Parent/Subsidiary Directive feature a BEPS-driven "anti-Directive shopping" measures, also in the form of a subjective "general anti-avoidance rule" or "GAAR". As with the "main purposes" clause in the OECD's "treaty abuse" proposals, this GAAR targets structures that lack economic substance, but it also creates wide uncertainty. It now appears that these proposals are to be delayed extensively or re-written, as it has already been made clear that Member State unanimity for acceptance is far from likely. Leaving aside other current EU Commission issues, during the further in-depth discussion on the topic proposed during the period of the Italian Presidency of the EU, Luxembourg should emphatically resist any EU Directive GAAR, on the simple grounds of subjectivity and uncertainty, and again make "common cause" with other EU Member States likely to be sympathetic to this position.

11. Should, conversely, any EU-mandated GAAR become part of Luxembourg law, then it would become especially important for Luxembourg to have, as a route back to certainty for taxpayers, a system for rulings that can confirm in a relatively short timeframe whether or not the GAAR provisions would apply to specific planned arrangements.

12. A strategy for clear communication by the Government to the business community of its specific actions, priorities and stances is essential. Particularly on the specific OECD "treaty abuse" Discussion Draft, the manner in which Luxembourg is perceived to be supporting the interests of the many multinationals and fund managers already present in Luxembourg (with whatever level of substance) will be of pre-eminent importance in determining their future feelings towards either augmenting activity in Luxembourg or withdrawing altogether from Luxembourg. Apparent passive acceptance of the OECD proposals (irrespective of the underlying reality) is likely to create highly negative perceptions in this business sector. Conversely, "being seen to fight" will be viewed very positively.

13. Lastly, going beyond the need for specific recognition of the situation of funds and their holding and financing platforms as noted above, Luxembourg should press the OECD to make further substantial progress on its wider work on integrating "collective investment vehicles" into the tax treaty framework, building on the 2010 OECD report on this topic. Arguably, Luxembourg could at least use receiving a commitment for progress here as a quid pro quo in consensus building on some of the other OECD proposals.

D.3 Consequences for domestic tax reforms

14. At this stage, the final outcome of the OECD work as it might affect holding and financing activities cannot be predicted with precision. What is however clear is that the era of the "brass plate" structure is emphatically over (if indeed it ever truly existed), and any multinational group or fund manager that wishes to continue with holding and financing activities in Luxembourg will need to imbue its corporate structure with genuine economic substance. Certainly, the Luxembourg tax regime should evolve towards both encouraging and, in some areas, enforcing minimum levels of such substance.

15. Luxembourg will remain in intense and growing competition with other jurisdictions to secure and retain such activities. It thus needs a tax regime that is enticing to groups and funds thinking of augmenting substance in Luxembourg. Key considerations are noted below.

16. An almost immediate move is needed towards reducing the standard "headline" overall corporate tax rate from 29.22%, to a level that is competitive with the current UK rate of 21%. Ideally, a reduction, ultimately to perhaps 16% or 17%, should be targeted - the "market leader" should be seen as Ireland, with its 12.5% rate. To achieve this without serious adverse impact on overall tax revenues would probably entail having to accept a material broadening of the tax base. Although this would inevitably give rise to winners and losers, new business will not be as concerned by such changes.

17. Arguably, to reach this goal, there would also need to be a "de-linking" of the municipal business tax from a "corporate profits" basis. It should be noted that several countries, such as the UK, have a "headline" rate of tax that does not include any component that finances local government – such countries instead generally have "business premises-linked" impositions that give rise to very significant operating costs which are not often mentioned in the debate on tax rates.

18. Continuing efforts should be made towards removal of small but irritating existing features of the corporate tax ecosystem and its overall modernisation. Some good progress is already occurring, with some measures, such as facilitating the choice of functional currency, or the use of IFRS-based accounts, understood now to be coming to fruition in the short term. The commitment to revise the transfer pricing regime so that it is more closely harmonised with OECD-recommended practices is also welcomed.

19. One notable further step, which would have the added advantage of freeing up significant resources within Tax Offices, would be the abolition of the net wealth tax for companies. Luxembourg is currently the only EU Member State to impose such a tax. There should be recognition that the 2012 minimum corporate income tax regime, which in many cases levies tax based on the gross assets of a company, is seen by some parties as being an at least partial double imposition of "wealth-based" taxation. A partial step of less significance, although still in the right direction, would be to extend the "fiscal integration" measures available under the corporate income tax regime to the net wealth tax regime as well. Capping the annual maximum net wealth tax liability, for both individual companies and fiscally-integrated groups, would be another palliative measure.

20. As well as generally assisting international investment via Luxembourg, broadening the scope of exemptions from dividend withholding tax (article 147 LIR) would allow fund vehicles to finance Luxembourg holding and financing "platforms" with orthodox equity and still maintain the low level of withholding tax leakage that has attracted this type of activity to Luxembourg. Dividend withholding tax exemptions should be granted to recipients that are companies subject to a comparable tax regime (even if resident not in a tax treaty partner country), pension funds, charitable bodies, sovereign wealth funds, regulated UCIs, and even fund vehicles such as English LPs (that are widely used in the private equity and real estate funds sectors) so long as their activities are in effect regulated under the EU Alternative Investment Fund Management Directive or similar regulatory regimes.

21. Luxembourg's participation exemption regime is already a major draw for businesses investing internationally. Extensions to the scope of the exemption (in addition to those noted above in the context of dividend withholding tax) would further increase the attractiveness of the regime. Broadening of the exemptions, to include any foreign company that is resident in a tax treaty partner country irrespective of whether it is subject to a comparable tax, or that is engaged in an active trade or business but is not resident in a tax treaty partner country, should be considered, in the context of both the exemption of dividend and disposal gain receipts, and the exemption from withholding tax on dividend payments. Further relaxation of the rules regarding levels of holding, and their duration, would also be helpful.

22. Another "attractant" would be the introduction of an incentive that benefits companies that operate with a strong equity capital base. This would not take the form of a "notional interest deduction" (as seen in Belgium), but might instead take the form of a relief for enhanced equity funding, by being based on the component of a company's capital that exceeds the minimum needed for prudency purposes. Active consideration of such a measure, intended to equalise the tax treatment of debt financing and equity financing, as well as rewarding sound solvency and substantial business activity, should be pursued. In practice it would be likely to stimulate locally-based treasury management activity by large MNCs, as well as encouraging well-capitalised local businesses.

23. Other more technical measures, in some cases aimed at simplification, should be considered, including notably

- The introduction of consolidated VAT reporting for groups of companies.

- The introduction of a REIT (real estate investment trust) regime.

- Moving towards a more strictly "territorial" regime for businesses operating internationally, by extending the tax treaty policy of exempting foreign branch income to all foreign branches, wherever located.

- Re-examining the framework for taxation of Luxembourg funds, with the aim of making it easier for investment funds to secure tax treaty benefits.

- Giving further clarification that foreign investors in Luxembourg limited partnerships (particularly being used for private equity investment) do not generally cause their partners to have exposures to Luxembourg corporate or business taxes.

24. Ensuring that the personal tax burden for key senior (and thus highly-paid) individuals is, and remains, competitive with locations such as London, Dublin, Amsterdam and Geneva is a sine qua non. Expansion of the "carried interest" regime for fund management executives with an interest in the funds they manage would be widely welcomed, and a notable attractant.

25. The tax system needs to be underpinned by advance confirmations of the consequences of their planned operations. It is clearly recognised by all parties that this may need to be done in greater transparency. Whatever is done, it should be remembered that it is hard to overstate the importance of such a facility to corporates and funds that operate internationally, especially in a time of more, rather than less, uncertainty in the tax environment generally.

26. The Government's December 2013 Coalition programme indicated a commitment to invest in resources for the tax administration, notably to respond to developments in the international tax environment. As well as ensuring that ample resources are dedicated to the advance confirmations process noted above, this strengthening of resources should in particular be focussed in the following areas.

- Growing the number of specialists in transfer pricing, especially given the likely increased need for interaction with other authorities to protect the interests of Luxembourg taxpayers involved in "competent authority" procedures under tax treaties.

- Ensuring that specialists in other areas working at the Direction do not become overloaded, and can focus sharply on specific issues.

- Increasing mid-level and senior-level staffing at individual tax Bureaux, in order to maintain the generally good level of "service" international business has historically experienced, as well as to sustain the increased level of control activity foreseen in the Coalition programme.

While a tax reform to take effect on 1 January 2017 has been promised by the Government, it is clear that tax competition between various countries is has already become a major trend. Therefore, 2017 is none too soon.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.