This article looks at the range of indirect taxes in Cyprus.

The importance of indirect taxes in the Cyprus economy is made clear in the 2013 edition of Taxation trends in the European Union issued by Eurostat, the EU's statistical office, and the Commission's Directorate-General for Taxation and Customs Union. This annual publication compiles tax indicators in a harmonised framework based on the European System of Accounts, allowing accurate comparison of tax systems and tax policies between EU Member States. According to the latest edition, in 2011 Cyprus had the sixth highest share of indirect taxes in the EU-27, deriving 41.9 percent of its tax revenues from indirect taxes, compared with an EU average of 34.5 percent.

As in most EU countries, the most important indirect tax is VAT, but in addition there are numerous other indirect taxes. They are predominantly levied at the national level, but some are levied at the local government level.

In the following paragraphs we give an outline of the most commonly-encountered indirect taxes in Cyprus. Definitions of direct and indirect taxes vary – for completeness we have adopted the wide definition of an indirect tax as any tax apart from taxes on income and capital gains or social insurance levies.

I. VAT

VAT is far and away the most important source of revenue in Cyprus, accounting for almost 60 percent of indirect tax revenue and 24 percent of total tax revenue. This is due to the high share of consumption in the economy, since VAT rates are among the lowest in the EU. The standard VAT rate is 18 percent (only Luxembourg has a lower rate, at 15 percent) and the registration threshold is EUa15,600.

A reduced rate of 5 percent applies to certain formerly exempt foods, pharmaceutical products and construction or purchase of a first residence and an 8 percent rate applies to hotel accommodation and restaurant services. Certain goods and services are exempt from VAT, including letting of immovable property, cultural, sport, banking, insurance, medical and hospital services. International transportation, supplies of goods and services to sea-going vessels, medicines and food (apart from the supply of food in catering), exports and intra-Community supplies of goods and services are all zero-rated. On January 13, 2014 the standard rate of VAT is due to increase to 19 percent and the 8 percent rate will increase to 9 percent.

II. Excise duties and consumption taxes

Excise duties and consumption taxes are the next most important source of indirect tax revenue, accounting for almost 25 percent of indirect tax revenue and 10 percent of total tax revenue. The excise duties on energy, particularly unleaded petrol and diesel, were aligned with the EU minima in 2010. Excise duties are also levied on cigarettes, tobacco, alcoholic drinks and motor vehicles.

III. Stamp duty

Stamp duty is payable on contracts relating to property or business in Cyprus. With effect from March 1, 2013 the rates of stamp duty are as follows:

- no stamp duty is payable on the first EUa5,000 of consideration

- on the tranche of consideration between EUa5,000 and EUa170,000, stamp duty is payable at the rate of EUa1.50 for every EUa1,000 or part thereof

- on any consideration above EUa170,000 stamp duty of EUa2.00 is payable for every EUa1,000 or part thereof.

The wording of the law indicates that the rate of stamp duty is determined by the aggregate value of the contract and applies to the entire consideration, whereas previously the appropriate rate was applied to each tranche of the consideration. Our discussions with the relevant authorities indicate that they intend to continue to apply the old method of calculation in practice. In any event, the difference is less than EUa300.

The maximum stamp duty payable on a contract is capped at EUa20,000. Where no amount of consideration is specified in the contract the stamp duty is EUa34. For a transaction which is evidenced by several documents stamp duty is payable on the main contract and ancillary documents are charged at a flat rate of EUa2. A number of categories of documents are exempt from stamp duty, including documents relating to corporate re-organisations (which are exempt from all forms of taxation) and ship mortgage deeds or other security documents.

Stamp duty must be paid within 30 days from the date of execution of the relevant documents, or, if they are executed abroad, within 30 days after they are received in Cyprus. If stamp duty is paid late, a surcharge of approximately 10 percent of the unpaid amount is payable if payment is made within six months after the due date; otherwise the surcharge is twice the unpaid amount.

IV. Property taxes

Immovable property tax

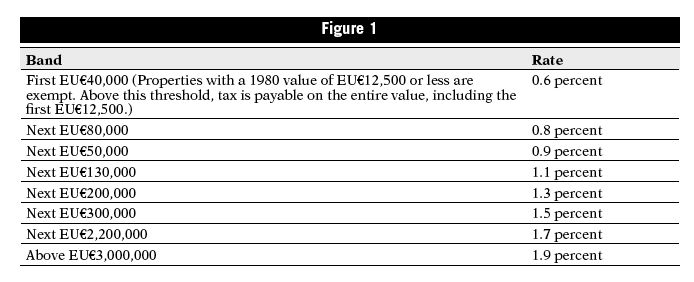

Immovable property tax is payable by 30 September each year. It is based on the market value of a property on January 1, 1980 and is levied on all immovable property in Cyprus registered in the name of the taxpayer at the start of the year. For 2013 the rates applied to each successive tranche of the 1980 value were as follows.

For 2013 the payment date has been extended to November 15, 2013. A penalty of 10 percent of the tax due will be imposed in the event of late payment and a discount of 10 percent will be allowed if the tax is paid 30 days or more before the due date.

With effect from January 1, 2014 it is intended to base immovable property tax on current values instead of 1980 values and a revaluation exercise is in progress. The Government has announced that the revaluation should not lead to a general increase in immovable property tax.

Property transfer fees

Under the Immovable Property (Transfer and Mortgage) Law of 1965, purchasers of immovable property are required to pay a fee to the Department of Lands and Surveys for registration of the transfer. The fee is based on the purchase price or, under certain circumstances, on the current market value. The first EUa85,000 is charged at 3 percent, the next EUa85,000 is charged at 5 percent and any excess above EUa170,000 is charged at 8 percent.

V. Bank deposit levy

Credit institutions operating in Cyprus are required to pay a levy of 0.15 percent on their customer deposits. Each year's levy will be calculated on the basis of customer deposits held at December 31 of the preceding year. No levy is payable on inter-bank deposits.

The levy is not deductible for the purpose of calculating taxable profits. The declaration of taxable deposits on the preceding December 31 must be made by March 31 each year, and the levy will be collected in four equal instalments at the end of each quarter, starting March 31. The declaration of taxable deposits may be revised up to December 31. The Commissioner of Income Taxes has the power to raise assessments for the levy and to collect it from banks.

VI. Company incorporation and maintenance duties

On incorporation of a Cyprus registered company, capital duty of EUa103 plus 0.6 percent of the authorised capital is payable to the Registrar of Companies. Any subsequent increase in authorised share capital is liable to capital duty at 0.6 percent. No capital duty is payable on share premium and capital duty can be minimised by issuing a reduced nominal value of shares at a premium.

An annual levy of EUa350 is payable to the Registrar of Companies by all companies incorporated in Cyprus. The levy is payable before June 30 each year. If it is paid no later than two months after the due date a penalty of 10 percent will be charged. If the levy is paid between two and five months after the due date, a penalty of 30 percent will be charged. Companies which have not paid after five months from the due date may be struck off the register. They can be restored to the register by paying a fee of EUa500 within two years of removal or EUa750 after two years.

VII. Inheritance tax

Cyprus has no wealth or succession taxes or taxes on gifts.

VIII. Municipal taxes

In addition to the above taxes, municipalities in Cyprus may charge municipal taxes, fees and duties, including professional tax on companies, hotel accommodation tax, and fees for issuing permits and licences and for refuse collection and other services. These charges are generally modest by international standards.

IX. Conclusion

Cyprus's patchwork of indirect taxes reflects the island's history. Several taxes, such as stamp duty, excise duties and local taxes have their origins in colonial times and are based on the British model. VAT was introduced in 1992 in preparation for entry into the EU.

The slightly odd amounts of some indirect taxes (for example the capital duty of EUa103 on forming a company) are the result of the conversion from Cyprus Pounds to Euro when Cyprus changed its currency. The most recent introductions such as the levy on companies and on bank deposits have exploited the revenue potential of the business and financial services industry.

As noted earlier, indirect taxes provide an above average proportion of total tax revenues. Given the continued importance of tourism in the economy, much of the indirect tax burden, particularly VAT and excise duties, is borne by visitors from overseas, lessening the tax burden on residents. Looking forward, the nascent offshore gas industry is also expected to be a large contributor to state revenues in the medium term.

Originally published in Tax Planning International: Indirect Taxes - 29.10.2013

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.