JAPAN

OVERVIEW |

|

JURISDICTION |

LANGUAGE |

| Civil law | Japanese |

BUSINESS ENVIRONMENT |

||

|

||

| POPULATION | INCOME | GNI PER CAPITA (PPP TERMS) |

| 127.8 million | High | $34,670 |

PROFILE

Following the Second World War, a western parliamentary system of governance was introduced in Japan. Throughout the second half of the 20th century Japan experienced tremendous economic growth which saw the country emerge as the leading economy of Asia. Despite an economic slowdown in the 1990s, Japan is currently the third largest economy in the world behind the US and China. The disasters of 2011 triggered by Japan's largest-ever earthquake, tested the country's institutions whilst thrusting energy issues into the national and global spotlight. Sporadic territorial disputes with China and Russia have led political leaders to question the country's pacifist constitution.

ELECTRICITY INDUSTRY OVERVIEW

- Total installed capacity in 2012 was 225GW, making Japan the third largest generator of electricity in the world.

- Japan is just 16% energy self-sufficient, but it has a 100% electrification rate.

- Prior to the Fukushima nuclear disaster in March 2011, Japan relied on nuclear power for roughly 30% of its energy needs, with 60% coming from conventional sources such as coal, oil and natural gas.

- Japan is aiming to reduce electricity demand by at least 10% by 2030.

- Japan has the second highest electricity rates in Asia, after the Philippines. In 2011, the retail rate of electricity was US$0.179 per kWh.

- Currently, all but two of Japan's 54 operating nuclear reactors have been permanently shut down or are temporarily closed for inspection. This is in spite of the election of the largely pro-nuclear, Shinzo Abe-led Liberal Democratic Party (LDP) in 2012.

Electricity laws

- The Basic Act on Energy Policy was passed by the Japanese Diet in June 2002. The Act focuses on energy security, adaptability to the environment and promotes the use of market mechanisms.

- The Electricity Utilities Industry Law (which was amended significantly in 1995) sets out the procedures for an electricity utility to obtain a licence from the Minister of Economy, Trade and Industry.

Generation, transmission and distribution

- The electricity market is dominated by regional monopolies, with 85% of the country's total installed generating capacity produced by 10 privately owned companies.

- The electricity producers are strictly regulated by the Ministry of Economy, Trade and Industry (METI).

- Companies engaged in the electric power business in Japan are classified either as General Electric Utilities, Wholesale Electric Utilities, Independent Power Producers (IPPs), Power Producers and Suppliers (PPSs), or Specified Electric Utilities.

- The General Electric Utilities are full-service electric power companies providing users (customers)with electric power generation, transmission, and distribution. Japan has 10 power companies in this category, namely, Hokkaido Electric Power Company, Tohoku Electric Power Company, TEPCO, Chubu Electric Power Company, Hokuriku Electric Power Company, Kansai Electric Power Company, Chugoku Electric Power Company, Shikoku Electric Power Company, Kyushu Electric Power Company and Okinawa Electric Power Company.

- In the past, the electric power business in Japan was dominated by the General Electric Utilities, which had monopoly control in their respective service areas. After a revised Electric Utilities Industry Law came into effect in 1995 (along with two later revisions), the situation has been changing significantly, starting with the liberalisation of power generation and partial liberalisation of retail sales.

- Wholesale Electric Utilities are businesses having supply capacity of 2GW or above and supplying electricity to General Electric Utilities. Examples are J-Power and the Japan Atomic Power Company.

- Wholesale Suppliers (including IPPs) are businesses other than Wholesale Electric Utilities supplying electricity to General Electric Utilities, contracting with them for supply of 1MW or more for at least 10 years, or for 100MW or more for at least five years.

- PPSs are businesses supplying electricity to customers contracted for 0.05MW or more, using the power line networks of General Electric Utilities. PPSs are new entrants in the liberalised retail electricity sector.

- Specified Electric Utilities are businesses supplying electricity to certain defined areas using their own power generation and distribution facilities, such as power lines.

- West Japan and East Japan have electricity running at different frequencies. In West Japan it runs at 60Hz and in East Japan it runs at 50Hz. There are very few conversion stations, resulting in difficulty transmitting power from one region to the other.

RENEWABLES INDUSTRY OVERVIEW

- Japan currently sources approximately 9% of its energy from renewable sources, with hydropower the largest source of renewable energy.

- In 2010, a target of 20% renewable energy contribution was announced, however this target is not a central driver of renewable energy investment like in other jurisdictions.

- There was a significant push to develop renewable energy in Japan in order to boost energy selfsufficiency and to move away from nuclear power in the wake of the 2011 disasters.

- Although there was initial uncertainty in the renewables industry following the election of the pro-nuclear LDP in 2012, Japan has re-emerged as one of the most promising renewables markets in the Asia Pacific, particularly for solar energy.

- Japan does not have a national emissions trading scheme, but does have regional schemes in Tokyo and Saitama. Under the Cool Earth 50 initiative launched in 2007, the Government has committed to reduce emissions by 50% on current levels by 2050. Later policies, like the Fukuda Vision, set even more ambitious carbon reduction targets.

- Perhaps the most notable feature of Japan's renewables industry is its feed-in tariff regime (see below).

Hydropower

- 65% of Japan's 34GW of hydropower reserves have already been tapped into.

- It is easily the largest source of renewable energy in Japan at present.

Wind energy

- The topographical features of Japan present challenges in wind development. Hokkaido and Tohoku are two of the regions where large-scale wind farms continue to be constructed. Within these two prefectures, the Japanese Government has committed to the construction of a high voltage transmission network to help wind producers gain grid access.

- In 2010, the total installed wind capacity was 2.3GW.

- Offshore wind is emerging as one of the most promising renewables sources in the country.

Solar energy

- Japan is expected to become the world's largest solar market by year's end with solar installation projects going beyond expectations to produce an anticipated 6.9GW to 9.4GW of energy in 2013.

- Japan is the third largest producer of PV panels. It is regarded as a global pioneer in the residential solar market.

Geothermal energy

- Japan's geothermal capacity is 2.47GW, however the resource is largely undeveloped.

Biomass energy

- By July 2009, 218 towns were established as biomass towns as part of the Biomass Nippon Strategy

Biofuels energy

- The Japanese Government predicts that Japan has the capacity to produce 6Gl per year of biofuels by 2030.

- Use of abandoned arable land (386,000ha) could produce resource crops equivalent to 6.2Gl of oil.

CURRENT ISSUES IN THE RENEWABLES INDUSTRY

- The political instability of successive Japanese Governments is seen by some commentators as a deterrent to renewables investment. Indeed, the industry is in minor state of regulatory flux with the new LDP Government yet to make significant announcements on the country's energy future. Nonetheless, this has not deterred domestic and international developers investing in major projects in recent months.

- Nuclear energy remains unpopular with the Japanese public, with support for renewable energy options continuing despite the likelihood of electricity price rises if renewable energy options were developed more aggressively.

- Regional utilities have retained the right of refusal for renewable energy generators. This has been a particular problem for wind producers with utilities often refusing to accept wind power on the grounds that it might destabilise the grid. Recently, Softbank Corp's plans for three solar farms in Hokkaido were also turned down by a regional grid provider. Hokkaido Electric Power Co emphasised that there was a limit to how many large solar farms that could be incorporated into the grid.

- Complex environmental impact assessments and zoning restrictions are also seen as significant barriers to guaranteeing power markets for investors.

RENEWABLES LAWS

- The 2003 Renewable Portfolio Standard targeted solar power, wind power generation, biomass energy, hydropower and geothermal power:

-

- the law requires electricity utilities to meet certain annual renewable energy targets set by the Minister, determined as a percentage of electricity sales; and

- an electricity utility may choose to meet its obligation in the following ways: (i) by generation of electricity itself; (ii) by purchasing the electricity generated from renewable resources from another party; or (iii) by purchasing tradable "Renewable Energy Certificates" from another party. Such Renewable Energy Certificates are granted to utilities that generate electricity from renewable sources.

GOVERNMENT INCENTIVE PROGRAMS

- The 2011 Tax Reforms introduced tax exemptions between 30 June 2011 and 31 March 2014 for the acquisition of machinery and equipment to promote environmental protection.

Japan's feed in tariff regime

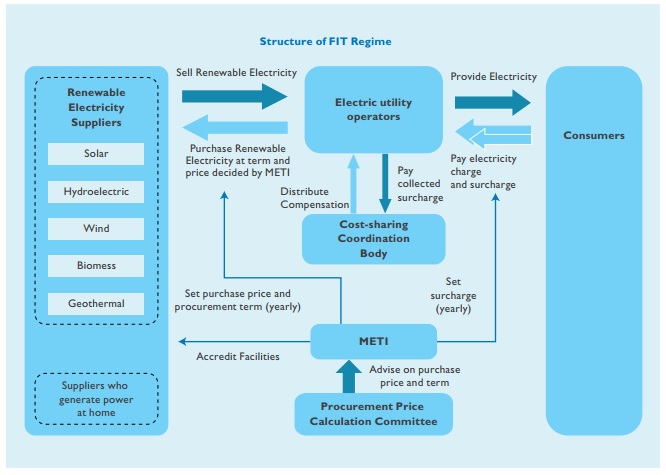

- The Act on Purchase of Renewable Energy Sourced Electricity by Electric Utilities, which became effective on 1 July 2012, establishes a feed-in tariff regime for renewable energy. The tariffs are the Government's chief incentive for renewables investment. The law:

-

- introduces a feed-in tariff regime for renewable energy whereby energy operators are generally obligated to purchase set amounts of solar, wind, geothermal, hydropower and biomass energy at set rates;

- shortens the amount of time required to assess the environmental impact of building and running wind farms;

- deregulates the process of setting up small hydropower plants;

- exempts solar power stations from regulations under the Factory Location Act;

- allows for geothermal power development in national parks for firms that drill wells outside the parks; and

- gives power generation companies control over the substance of Power Purchase Agreements. Electric utilities cannot refuse requests by power generation companies to enter into agreements to supply power from renewable energy sources unless there is a risk of unjust harm to the interests of the electric utility.

- In order to receive the benefit of the feed-in tariff, a supplier must first obtain accreditation from METI for the facility generating renewable electricity. While there are particular requirements for each kind of renewable resource, the following criteria apply to all:

-

- the facility must have a system in place that enables it to maintain its expected capacity during the anticipated term of the agreement with the electric utility operator that will purchase the electricity;

- the facility must have a proper mechanism to accurately measure the amount of the renewable electricity supplied;

- the functions and operations of the facility must be specifically identified and reported to METI; and

- the installation and operating costs of the facility must be recorded accurately and filed with METI.

- After a supplier has received accreditation, it may then apply to enter into an agreement with an electric utility operator. The terms of the agreement are determined by METI.

- Despite a 10% drop in solar rates, the 2013 revision of feed-in tariff rates by METI still provide some of the most generous feed-in tariff rates in the world.

- In 2012, the tariffs resulted in US$16.3 billion of renewable energy investment, which was an increase of 75% on the year prior.

MAJOR PROJECTS/COMPANIES

- The Fukushima prefecture is now set to become a renewable energy hub. Aided by generous national government subsidies, construction is about to commence on a number of projects that are a part of the prefecture's goal to become 100% energy self-sufficient by 2040. The projects include:

-

- the world's largest offshore wind farm to be built by a joint venture (including Toshiba, Hitaci, Zosen Corp and JFE Steel) off the Fukushima coast and comprising of up to 143 floating turbines;

- a proposal to build Japan's largest solar park;

- construction of a biomass energy experiment facility;

- mass distribution of solar PV panels to offices and residential buildings; and

- instigating 'smart city' plans.

- In addition to 'smart city' plans in Chiba and Fukushima, companies including Fujitsu, PanaHome Corp and Daiwa House are investing JPY50 billion (approx. US$528 million) for the construction of high-tech urban communities.

- In May 2013, Goldman Sachs announced plans to invest as much as JPY50 billion (approx. US$487 million) in renewable energy projects over the next five years. The firm also formed the Japan Renewable Energy Company to develop projects across a range of renewables sources.

- Tokyo's metropolitan government awarded Sparx a contract to establish a renewable energy fund for the region. METI have also announced plans for a nationwide renewable energy fund, while in November 2012 Mizuho Corp Bank launched a JPY5 billion (approx. US$53 million) solar energy fund.

- In February 2013, Hitachi announced an investment of JPY1 billion (approx. US$10.5 million) in an 8MW solar plant in Kumamoto prefecture, which is scheduled to be operational by the end of 2013.

- SB Energy Corp will be constructing and managing Japan's largest solar project, a 200MW project in Tomakomai, Hokkaido.

- A 13MW plant at Kawasaki is currently the largest installed solar PV plant in Japan. Tokyo Electric Power Co along with Kawasaki City plan to build more solar plants in the region.

- Other major solar players include Zen-Noh (plans for 200MW of capacity by 2015) and Toshiba (plans for 100MW of solar along the Fukushima coast). Kyocera, IHI Corp, Mitsui Fudosan, Maeda Corp, Solar Frontier, Orix Corp, West Holdings Corp, Mitsui & Co and Tokyo Marine Asset Management Co have also announced solar project plans.

- Mitsui Ocean Development & Engineering Company is constructing the world's first hybrid wind-current generation facility in 2013.

- SB Energy is planning a 111MW wind project (among other larger proposals), while Marubeni Corp and Wind Power Energy have announced a 250MW wind farm north of Tokyo.

- Daiwa House Industry Co completed a wind farm on the Sadamisaki Peninsula in 2007. It operates nine generators and provides enough energy for 6,500 homes.

- Eurus Energy Holdings Corp has numerous wind farm projects in Japan. It developed Japan's first major wind farm in Tomamae-cho, Hokkaido in 1999.

- J-Power operates 16GW of hydropower and thermal power plants.

- A 2.35GW Kannagawa hydropower plant is due online in 2017.

FOREIGN INVESTMENT/OWNERSHIP

- Japan External Trade Organisation (Jetro) is a body that encourages foreign direct investment in Japan.

- Jetro assists foreign investors through tours of regions and introductions to Japanese business persons.

- There are no restrictions on foreign investment for participation in the feed-in tariff regime. In fact, foreign investment is welcomed by the Government to help increase the country's renewable electricity base.

- There are four ways in which corporations can establish a business presence in Japan:

-

- representative office (cannot engage in business operations, can only carry out supplementary and preparatory tasks);

- branch office;

- subsidiary company; and

- limited liability partnership.

- To lawfully operate, at least one director or representative of the foreign company must be present in Japan.

RELEVANT INTERNATIONAL TREATIES

- Japan is a signatory to the United Nations Framework Convention on Climate Change and the Kyoto Protocol. Citing the United States' and China's reluctance to enter into binding emissions targets, Japan has indicated that it will not agree to a renewal of the Kyoto Protocol.

© DLA Piper

This publication is intended as a general overview and discussion of the subjects dealt with. It is not intended to be, and should not used as, a substitute for taking legal advice in any specific situation. DLA Piper Australia will accept no responsibility for any actions taken or not taken on the basis of this publication.

DLA Piper Australia is part of DLA Piper, a global law firm, operating through various separate and distinct legal entities. For further information, please refer to www.dlapiper.com