INTRODUCTION

Fleet choices are among the most significant decisions an airline has to make. Large scale changes to the aircraft fleet, including potentially determining new principal aircraft and engine platforms, will touch nearly every aspect of the business, from day to day flight operations and customer satisfaction through to financial performance and shareholder return.

Growth in forecast demand coupled with the introduction of a wider range of new aircraft frame and engine choices makes the decision highly complex. At the same time, margin compression and competitive pressures increases the risk as well as the value at stake.

Comprehensive analysis of the key issues, complexities and uncertainties as well as the risk-return trade-off of alternative options should be considered so as to assess the impact on the company's financial performance as well as operational effectiveness.

CONTEXT

Industry characteristics

Recent industry performance as well as economic uncertainty provides a complex backdrop for fleeting decisions which demands greater focus. Our discussions with airline executives have identified ten critical issues:

- Demand growth:

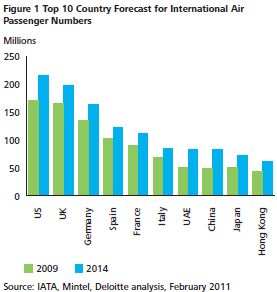

- Total international passenger traffic is expected to grow at an average compound rate of almost 6% from 952 million in 2009 to an estimated 1,265 million in 2014.

- The overall trend holds for both international and domestic

travel, with the highest rates of growth in the Middle East and

Asia (Figures 1 & 2).

- International freight growth has been even higher at just over

8% globally with the strongest growth in Asia-Pacific and the

Middle East (Figure 3).

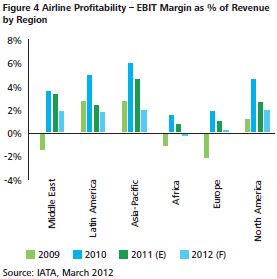

- Margin compression: Profits have historically

been tight across the sector and the increase in total operating

costs threatens to suppress margins further. Having recovered in

2010 from the lows of 2009, average regional EBIT margins declined

again in 2011 and are forecast to fall back further in 2012 (Figure

4).

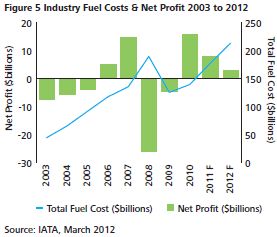

- Rising fuel costs: Fuel remains the most

significant and volatile component of operating costs and managing

this exposure is an increasing challenge for senior management

(Figure 5).

- Emissions taxes: The extension of the European and other emissions trading schemes to airlines is an additional cost burden to international flights.

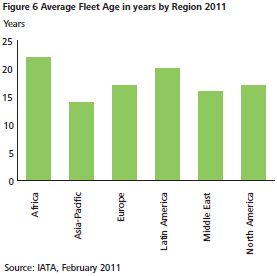

- Competitive pressures from increasing

globalisation: The increasing reach of airlines beyond

their domestic markets, particularly Middle East and Asian players

with newer and more efficient fleets, as well as financial strength

is placing competitive pressure on European and US airlines with

older fleets and higher cost bases (Figure 6).

- Competitive pressure from evolving business models: Traditional demarcations between the business models of low-cost and flag carriers are blurring as low-cost carriers ("LCCs") target business passengers and flag carriers offer no-frills services on key routes.

- Supply-demand balance: With the rates of deliveries reaching new highs, there is a continued prospect of excess capacity.

- Demanding stakeholders: After a period of low returns and with perceived higher risks in the industry, investors are demanding a greater return on investment.

- Demanding customers: Increasing pressure from customers for higher service at lower prices e.g. provision of modern cabin interiors as part of increased competition for business class passengers.

- Responsible business: Industry responding to calls to reduce the environmental impact of air transport.

New technology, new options

The range of next generation airframes and engines being introduced are expected to provide significantly improved fuel efficiency, increased flexibility especially from new mid-range aircraft, and customer comfort.

This increased range of options means that ranking and prioritisation of fleet choices is more important and more complex. Factors which need to be included on top of the traditional capex versus opex trade-off criteria include:

- Delivery timing: The availability of production slots and/or whether OEMs will be able to deliver new aircraft to schedule (as with the A380 and Dreamliner).

- Prospect of newer technology: Determining the optimal timing given expected future technological developments, including the range of options from potentially newer manufacturers, to ensure that the decision is as robust as possible and stands the test of time.

- Leasing constraints: Fulfilling obligations and timing restrictions on existing leased aircraft within the timeframe for commissioning of new aircraft.

- Evaluation of optionalities: Incorporating the additional value arising from the greater flexibilities offered by new aircraft in terms of their geographical reach or the split between passengers and freight they can carry.

- Availability of finance: Changes in the appetite of traditional finance providers may require access to alternative sources such as private equity and OEM customer finance.

- Brand strength: The comfort, quality and reliability of an airline's fleet is becoming more important to brand strength. The decision to maintain, upgrade or replace is far less driven by pure economics.

These factors provide a more challenging backdrop for long term capital investment decisions generating greater opportunity to deliver, and also greater potential to destroy, significant shareholder value.

THE OPPORTUNITY

The strategic direction, and hence value creation, of an airline is underpinned by a number of key considerations:

- The vision and positioning of the airline versus available business models.

- Securing growth and profitability in an increasingly competitive market, through network planning and demand capture.

- The actions taken to minimise cost base and maximise returns to shareholders whilst ensuring a sustainable business model.

Historically, the industry has been characterised by comparatively less uncertainty around its operating environment, less volatility around its key cost drivers, fewer options in respect of airframes and engines, and higher margins. Consequently the focus of decision- making has been on operational planning and cost efficiency with less emphasis and analysis required on fleet choices.

The increased strategic importance of the fleet decision, greater range of available options, and higher uncertainty demands a robust response which enables an airline to:

- Align decision-making more closely with the chosen strategic direction.

- Incorporate the risk and uncertainty around key decision drivers.

- Evaluate any embedded optionalities associated with fleeting choices.

- Understand the risk-return profile associated with alternative choices.

- Enable the application of an airline's risk appetite and balance sheet strength in its decision-making to optimise the trade-off between risk and return across a wide range of potential future scenarios.

- Implement an integrated approach from decision- making through to negotiation support.

Based on our discussions with industry executives, there is a strong belief that future winners and losers might be defined by the impact of their fleeting decisions on strategic positioning.

REALISING THE OPPORTUNITY

Maximising value from the fleeting decision requires consideration from three perspectives:

- Strategic alignment.

- Implementation considerations.

- Negotiation support.

Strategic alignment

From a strategic perspective, the airline's key considerations in respect of fleet planning include:

- What is the total fleet requirement, in terms of the number and type of aircraft?

- Should we maintain or replace our existing fleet?

- Which aircraft frame(s) and engine(s) should we be considering?

Airlines are seeking to ensure that fleeting decisions reflect economic evaluation on whole-of-life costs, including the expected residual value of aircraft disposals, and provide a level of flexibility to adapt to changing circumstances. In addition, the uncertainty around key input parameters needs to be explicitly considered to ensure greater transparency around the risk-return profiles for all evaluation metrics.

Implementation considerations

Implementation considerations are also important as they impact value and risk significantly and in some cases may even alter the strategic choices above:

- Optimising the phasing of the introduction of new aircraft.

- Minimising implementation costs.

- Financing the fleet.

Airlines are increasingly recognising that alternative contract structures might, due to their financial and operational implications, impact the ranking of preferred airframe, engine and MRO concepts.

Negotiation support

It is also clear that significant value can be derived in the negotiation process by being able to:

- Compare between different manufacturer packages on a common basis.

- Isolate and evaluate the value of individual negotiation points relative to their cost.

Airlines who achieve premium value in negotiations display a number of characteristics:

- Comprehensive analysis of available packages/ options.

- Clear negotiation strategy.

- Costing/pricing of key negotiation points e.g. maintenance contract options.

- Ongoing evaluation of strategic alignment and implementation implications during the negotiations.

Analysis to support the decision-making

It is widely recognised that new capabilities are required to support fleeting decisions. The key improvement required is that the analysis needs to better incorporate the uncertainty in a dynamic rather than static way. This will enable the uncertainty to be incorporated into the traditional whole of life evaluation of the upfront capital cost versus the net present value of the benefit of reduced ongoing operating costs, including retraining and reconfiguration costs, and the inclusion of the aircraft disposal value (if owned).

Dynamic analysis will include features such as

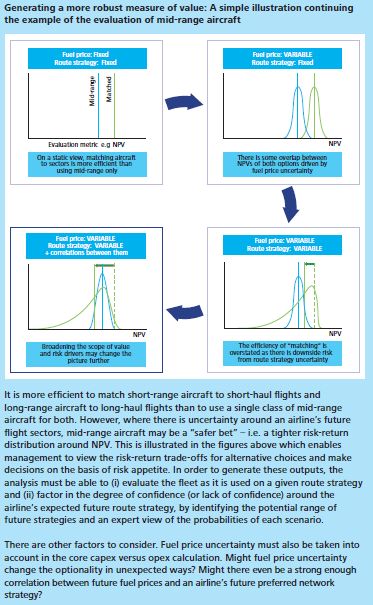

- Generating a more robust measure of value

– Using a risk-return approach which integrates

value and risk to enable better informed decision-making and

enhanced value creation, where:

- Key input assumptions such as fuel price are modelled using a range of fuel prices with associated probabilities.

- Being explicit about potential optionalities and the

uncertainty around these. For example, the greater the uncertainty

around an airline's future network strategy, the greater the

option value of using mid-range aircraft that can serve multiple

sectors rather than tailoring short/long-haul aircraft to

short/long haul flights. This is illustrated in the example

below.

- Optimising the strategic and implementation

considerations – An iterative approach helps to

optimise the strategic and implementation considerations, and

enable a coherent and integrated approach from fleet planning

through to closing the deal.

- There may be instances where implementation considerations are sufficiently important as to refine or even change the initial view on strategic direction, for example the value of the MRO contract accompanying a particular aircraft or particular size of order. An integrated framework recognises the complexity; an iterative approach cuts through it.

- Finally, the conclusions from both the strategic alignment and implementation considerations are only tentative until confirmed during negotiations.

CONCLUSIONS

Fleet choices are among the most significant decisions airlines make. The greater choice of airframe and engine options means there is a greater value opportunity. At the same time the challenges facing the industry also means there is greater risk and a greater impact of not reaching the best possible deal. In order to protect and enhance value, airlines are seeking to adopt a more robust and integrated approach to decision-making that better aligns fleeting decisions with their long-term strategic direction.

Identifying and incorporating the long-term complexities and uncertainties within the evaluation provides enhanced understanding of the risk-reward trade-offs, which in turn enables better financial and operational outcomes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.