Originally published July 2011

A sharp drop in the number of litigations and damages amounts awarded over misstatements has occurred, while broker-customer litigation has reached a record high.

Introduction

This report is an update for 2010 of Japanese trends in securities litigation, using statistics from 1998 through the end of 2010. Following the resolutions of large cases—including Livedoor and Seibu Railway—involving many individual and institutional investors, the number of judgments related to damages litigation over misstatements has decreased substantially to seven in 2010 from 14 in 2009. On the other hand, the number of regulatory actions by the Securities and Exchange Surveillance Commission (SESC) regarding monetary penalties for misstatement has increased to a record high of 12 in 2010 from nine in 2009. Although the resolutions of large cases resulted in a sharp drop in the amount of litigation in 2010, the potential for future misstatement cases is expected to continue to rise because the number of SESC decisions is considered to be an early indicator for litigation over misstatements in future.

Two examples of notable cases filed in 2010 include a lawsuit where shareholders claimed damages over misstatements against FOI Corporation, a manufacturer of production equipment of semiconductors listed on the Tokyo Stock Exchange (TSE)'s Mothers, and Futaba Industrial Co., Ltd., an automotive parts manufacturer listed on the First Section of the TSE. In the FOI case, the plaintiff's shareholders allege that the company misstated most of its sales since its listing on Mothers, and have filed complaints against the management, accountants, the underwriters, and the TSE, alleging that the examination for listing had been inappropriate.1 This is the first case in which the stock exchange has been questioned for its responsibility in listing examination.

The other recent set of notable filings involves a cross-border case where Toyota Motor's shareholders in the US have filed a class-action suit against Toyota alleging that insufficient disclosure of its recall risk is considered a misstatement according to Japan's Financial Instruments and Exchange Act (FIEA).2 Although it is unclear as to whether the filing for trial will be approved, the damages amount is likely to be substantial if it is approved.

In addition to litigations over misstatements, the number of litigations between financial institutions, including securities companies, and their customer investors ("broker-customer litigation") reached a record high of 44 in 2010. The securities markets remained sluggish in 2010, continuing a trend since the subprime crisis in mid-2007. As a result, there were an increased number of court judgments for broker-customer litigations over alleged violation of the principle of suitability, as well as over breach of obligation to provide explanation in soliciting transaction of bonds, investment trusts, and structured bonds.3 It is also notable that defendants in many of these cases are major financial institutions.

This report also includes an analysis of the recently increasing trend in Company Act cases regarding the petitions by shareholders for appraisal of stock purchase price in company reorganizations.4 While the number of cases has remained high and the reasonable method to derive the fair price has been considered in many cases, courts are on the way to reaching a consensus. In particular, the Tokyo High Court's decision for the Intelligence case in October 2010 is notable because the Court admitted the use of a market model5 in determining the fair price for the first time in Japan.

Trends in Securities Litigation by Type

To understand the statistical trend in securities litigation involving violations of the FIEA (former Securities and Exchange Law, SEL),6 the report authors collected court rulings in Japan from an external database, as well as newspaper and journal articles.7,8 A search for cases for 13 years, from 1998 to 2010, has resulted in 356 court decisions. A classification of the cases (both civil and criminal) by year and type9 is shown in Figure 1.

The total number of judgments in securities litigation has increased substantially to 56 in 2010, the highest in history, from 39 in 2009. Of the total 56 cases in 2010, the number of litigation cases over misstatements decreased substantially from 2008 or 2009 to seven cases, two of which were Seibu Railway cases and three of which were Urban Corporation cases. Over the past six years, multiple litigations against Seibu Railway and Livedoor had been undertaken by groups of plaintiffs consisting of individual and institutional investors,10 and, as estimated in the previous report,11 the decreased amount of overall securities litigation can be attributable to the resolution of many of these large cases.

In addition to litigation over misstatements, broker-customer litigation constitutes an important portion of securities litigations in Japan. In terms of numbers, broker-customer litigation continued to be the largest component of the cases in 2010, at 44 cases. Of the 44 cases, 12 involved unlisted stock trading12 which at 27% was the most frequent allegation.

Affected by the sluggish securities markets, 2010 resulted in an increased number of judgments for broker-customer litigation over alleged violation of principle of suitability or breach of obligation to provide explanation in soliciting transaction of bonds, investment trusts, and structured bonds.

Another characteristic observed in the data is the increased number of litigations in which leading financial institutions are the defendants. According to the authors' research, the number of cases in which leading financial institutions were the defendants13 was just five in 2009 but increased to 18 in 2010.

Trends in Damages Amounts

While the number of court judgments in securities litigation in Japan in 2010 was the highest in history at 56, the total judged damage amount in yen terms was about 19 billion yen, significantly lower than 47.2 billion yen, the highest reached in 2009.

For cases related to misstatements, the total judged damage has decreased substantially in 2010 to 2.7 billion yen from 45.9 billion yen in 2009, when there were many rulings in the cases of Livedoor and Seibu Railway. On the other hand, the amount of damages in broker-customer cases increased significantly in 2010, to 16.3 billion yen from 1.3 billion yen in 2009. The large amounts related to broker-customer litigation are due to a case judged in 2010 where the All Japan Liquor Merchants Association filed against Credit Suisse, its former employee, and a financial broker alleging damages totaling 16.0 billion yen for the insufficient explanation of risk during solicitation of investment in structured bonds.14 The Tokyo District Court ordered 15.14 billion yen to be paid by the financial broker only, and dismissed the claims against Credit Suisse and its former employee because "the plaintiff has decided to purchase the foreign bonds by the broker's solicitation, and Credit Suisse and its former employee were no more than a custody and were not involved in the soliciting process."15

Claimed Amount and Judged Amount

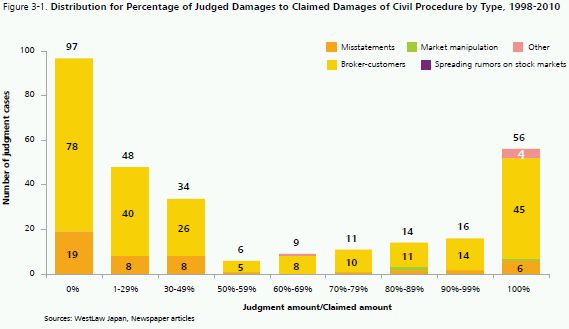

The statistical distribution of the ratio of damages award over claims indicates the trend degree of acceptance by the court of claimed damages amounts. Figures 3-1 and 3-2 show the distribution of the ratio of awards over claims in civil cases by type, from 1998 to 2010 and from 2007 to 2010.

As shown in Figure 3-1, although the distribution of percentage of awards over claims is U-shaped, the shape is asymmetrical. From 1998 to 2010, the percentage of cases in which less than half of the claimed amount was awarded—that is, cases where the ratio of judged amount to claimed amount is 50% or less—was 74% of total in cases over misstatements but 61% in broker/customers cases.

If only the most recent trend from 2007 to 2010 is examined (in Figure 3-2), this percentage stays nearly unchanged at 73% of misstatements but was 49% of broker-customer, making the U-shape closer to symmetrical. In 33% of broker-customer cases from 2007 to 2010 the plaintiffs' claims were dismissed, but in another 30% of broker/ customers cases, 100% of the plaintiffs' claims have been awarded.

Trends by Industry

Figure 4 shows the number of cases by industry of defendants in civil and criminal securities litigation cases.16 Since most of the defendants of broker-customer litigation cases are classified into the financial industry, it constitutes the majority of securities litigation at 70%, followed by the information, communications, and services industry at 10%, and the transport and logistics and the audit firms at 4%. Although the majority of the cases related to the information, communications, and services industry are linked to Livedoor, there are others cases in this category, including the cosmetic accounting cases of Medialynks and Associant Technology, and unlisted stock trading by consulting services firms.

Enforcement by the SESC

Continuing the observed trend of the number of actions17 by the SESC regarding the administrative monetary penalties, the number of actions in 2010 has reached a peak. Companies ordered to pay penalties due to misstatements have not been sued for damages in many cases, because most of them are emerging companies with small market capitalization. Without the class action system, filing for damages is costly to the plaintiff in Japan, where litigation costs are high, so plaintiffs may not have an incentive to bring cases against small market-capitalized companies. However, it has become possible in recent litigation for the plaintiffs to use the SESC documents, including inspection reports, for the purpose of proving misstatements.18 In this way, the enforcement by the SESC can be seen as a leading indicator in estimating the future trends in securities litigation.

Trends in Petitions for Appraisal for Stock Purchase Price

The Companies Act in Japan gives shareholders dissenting from the company reorganization the right to require that the reorganized company purchase back their shares at "fair price," and, if the discussion does not settle, the shareholders may file a petition to the court for determination of the price. Figure 6 shows the number of petitions for appraisal of stock purchase price cases from 2004 to 2010.

Because the petitions are non-contentious cases, publicly available information is either limited or only disclosed after a certain period of time. The counts of cases in 2008 and 2009 have been increased one and four cases, respectively, as information related to cases that had been undisclosed at the time of the previous report became public. While a number of determinations are handled by courts, this report covers cases available in the database or newspaper and journal articles, and thus may not be comprehensive. The number of cases in 2010 identified from searches in the database and newspaper articles is 14, which is as high as in 2009.

Figure 7 shows the trend of court decisions of petitions for appraisal of stock purchase price from 2004 to 2010, by type of company reorganization. Of the total 14 cases in 2010, 13 were related to the purchase price for listed companies, where the fair prices were determined based on market prices, including the average market price over a certain period before announcement of the company reorganization. Methods applicable to nonpublic companies, such as discounted cash flow, or DCF, models, were not adopted for listed companies.

Figure 8 shows the type of minority shareholders who petitioned for appraisal of stock purchase price. For each case, the number of petitioners was counted by type. About half of the petitioners were individuals, but investment funds and institutional investors constituted a significant portion as well.

A notable case in 2010 was the Tokyo High Court's determination of the fair price of Intelligence stock.21 Shareholders of Intelligence dissenting from Intelligence's merger to become a subsidiary of USEN filed a petition for appraisal. In previous cases, the fair value had been determined by taking the average stock price over a certain period prior to announcement of the reorganization plan. However, since the legal valuation date for appraisal of the fair price had been set to be a date several months after the announcement (in this case, the High Court selected the date when reorganization is legally effective), the average stock price prior to the announcement would not reflect the general market trend after the announcement. In particular, this is true because in the case of the USEN-Intelligence merger, the collapse of Lehman Brothers and the subsequent deepening of the credit crisis took place between the announcement date and the valuation date. The Tokyo High Court ruled that it is more reasonable to determine the fair price as the average stock price for the month prior to the effective date of the reorganization, adjusted for the general market impact on stock price, rather than just taking the average price. For the adjustment of the general market impact, the regression method, or a market model, was judged to be reasonable based on scientific grounds.

The methodology to derive the "fair price" in petition for appraisal for stock purchase price may still be on the way to reaching a consensus among the courts, but the above decision is the first case in financial and commercial litigation in Japan where the statistical regression method (the market model) was approved.22 The ruling has important implications regarding the possible expansion of the use of economic analysis, including estimation of damages by event studies, in resolving various legal issues in capital markets.

Footnotes

1 Nihon Securities Journal, 30 September 2010.

2 The Sankei Shinbun, 28 May 2011.

3 Litigation statistics are based on judged cases, not based on filing. Therefore, a timing difference occurs between the court judgments in 2010 and the economic background under which a lawsuit is filed against a broker.

4 The Companies Act in Japan admits that shareholders dissenting from the company reorganization have the right to require that the reorganized company purchase back their shares at "fair price." If such a discussion does not settle, the shareholders may file a petition to the court for determination of the price.

5 A regression model to predict the stock price return in question based on general market factors only, from correlation of the stock price return in question with the market index including TOPIX over a certain historical period.

6 Securities litigation has been defined as civil and criminal litigation cases seeking damages from illegal acts by violating the Financial Instruments and Exchange Act (FIEA) and the Securities and Exchange Law.

7 WestLaw Japan has been used for research on court rulings. The search has been conducted for the period from 1 January 1998 to 31 December 2010 using the keywords "Financial Instruments and Exchange Act" or "Securities and Exchange Law" and "violation." The database does not include settled cases. Of the cases found, the following three types have been excluded: (i) cases related to Patent Act, Copyright Act, Labor Standards Act, or Taxation; (ii) court decisions on M&A; and (iii) cases involving board members' violation of due care of a prudent manager. Note that even if cases do not stem from violations of the FIEA, they are included in the analysis as long as they have allegedly consequently led to misstatements. The number of cases is based on court rulings; the district court decision and the upper court decision of the same case are counted separately. Court decisions not included in the database but found in newspaper and journal articles have also been included, but the authors do not guarantee that the cases covered in this report are exhaustive.

8 Kyoko Ida, analyst in the NERA Tokyo office, has conducted the main part of the search.

9 For a description of classification of securities litigation by type, refer to the NERA report, "Trends of Securities Litigation in Japan: 1998-2008."

10 Since Japan has not adopted the class action system, different plaintiffs or group of plaintiffs can file separately against the same defendant.

11 Refer to the NERA report, "Trends in Securities Litigation in Japan: 2009 Update."

12 Litigation over unlisted stock is mostly related to solicitation of unlisted stocks by brokerage companies not registered with the Japan Securities Dealers Association (JSDA). Customers, after being told by these companies that the issuer would go public shortly and that the stock price would certainly rise, enter into a transaction contract but later find out that the issuer actually has no intention of going public. Most of the litigation consists of customers filing against the soliciting companies for damages related to such purchase of unlisted stock.

13 Leading financial institutions in this report are defined as listed financial institutions and the group members, or foreign financial institutions.

14 2006 (Wa) No.18333.

15 The Shikoku Shimbun morning edition, 1 December 2010.

16 The industry classification in Figure 4 is based on the TOPIX-17 series of the Tokyo Stock Exchange (TSE), which aggregates 33 industries established by the Securities Identification Code Committee into 17 industries. The "audit firm" industry has been added separately by the authors.

17 SESC makes recommendations to the Financial Services Agency (FSA) regarding the order of an administrative monetary penalty.

18 "Securities litigation case study-Legal responsibility for misstatements", edit by General Law Research Center, Research Group on Financial Instruments and Exchange Act of the Dai-ichi Tokyo Bar Association, Seibunsha (May, 2011), pp.5-6.

19 Press release of the SESC revised to calendar year basis.

20 WestLaw Japan has been used for research of the cases. The search has been conducted for non-contentious cases for the period from 1 January 2000 to 31 December 2010. After reading the summary of the cases, "petition for appraisal of stock purchase price" cases were identified. The number of cases is based on court determinations; district court determinations and upper court determinations of the same case are counted separately. Cases not included in the database but found in newspaper and journal articles have also been included, but the authors do not guarantee that the cases covered in this report are exhaustive.

21 Tokyo High Court, 19 October 2010.

22 In April 2011, the Supreme Court remanded the case to the High Court due to its legal definition of the valuation date (Supreme Court's decision on 19 April 2011). However, the Supreme Court has accepted the reasonableness of the statistical method used in the High Court.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.