This study was conducted in February 2009

One year on after the initial Managing Through The Downturn study the insights gained about how to address a downturn are still valid. To the contrary, they are even more valid as now is the right time to shape the corporate structure through a continued restructuring, preparing it for the next storm, when ever it may come.

Executive summary

Almost every day the media feature stories about the impact of the current financial crisis on the wider economy. But such stories are typically anecdotal and may not be representative of the overall trends currently being experienced by the majority of companies in Switzerland. This results in controversial discussions about whether there is a "credit crunch" or not.

With the goal of gaining a better picture of the real impact of the crisis PricewaterhouseCoopers has just completed a survey of Swiss based companies operating outside the financial services sector (the so-called "real economy"). Nearly a hundred Swiss companies responded to this survey. The results give an in-depth picture of what is currently happening in the "real economy".

Key insights:

- The survey shows clearly that many companies have already taken, or are in the process of taking, significant action to protect themselves from the effects of the impending recession.

- 70% of respondents have clearly taken the slogan "Cash is king" to heart and have changed their approach to capital expenditure as a direct result of the crisis.

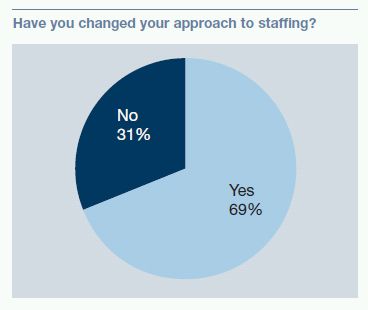

- 69% of respondents have changed their approach to staffing and the majority of these companies acknowledged implementing or investigating hiring freezes and redundancy programmes.

Only just over a third of respondents (38%) have so far experienced specific pressure from their banks as a result of the crisis.

Generally, the survey shows that the vast majority of respondents are taking certain action to respond to the crisis. However, we believe that the impact of the crisis is likely to be far-reaching and long-lasting. Many companies may be underestimating how deep the impact could be

Report statistics

The purpose of this survey was to assess the impact that the financial crisis is having on Swiss companies and the measures they are taking to survive the downturn. The 782 companies chosen to participate were all non financial services Swiss companies with an annual revenue in excess of CHF 25 m.

91 responses have been received representing 12% of the population. The research was carried out between 31 January 2009 and 28 February 2009. Please note that not all graphs add up to 100%. This is because some respondents left certain answers blank; these unanswered portions represent the shortfall

Of the 69% of all respondents who acknowledged changing their approach to staffing, 57% have implemented, or are investigating, a redundancy plan

- 69% of respondents noted that their staffing approach has changed as a result of the current downturn. This rises to 77% for larger businesses with an annual revenue greater than CHF 500 m.

- 57% of these businesses already have a redundancy programme in place or are currently investigating such a step.

- 73% have implemented hiring freezes.

- 27% are reviewing the use of early retirement programmes.

- 52% of respondents acknowledged reviewing the use of temps and contractors as a means of cutting costs.

PwC's view

The survey results highlight the deteriorating condition of the Swiss labour market. Businesses need to be inventive and redundancies should be considered a last resort. Many of the businesses surveyed commented that unpaid leave, wage cuts and shorter weeks were other alternatives being explored. It is important that businesses identify, retain and motivate key staff who will help them succeed through the downturn.

70% of those surveyed have changed their approach to capital expenditure as a result of the financial crisis

- 81% of respondents who changed their approach to capital expenditure have already delayed non-essential programmes with a further 11% of Swiss businesses investigating the possibility of doing so.

- Leasing is being considered as an alternative to purchasing by up to 40% of respondents who responded positively to this question.

- Vendor financing was not considered a viable option by most respondents.

- 77% of respondents with revenue in excess of CHF 500 m. have acknowledged changing their approach to capital expenditure as a result of the crisis.

PwC's view

Reducing and delaying capital expenditure further highlights the negative short-term outlook for the Swiss economy. These reductions, although necessary, will amplify the effects of the downturn throughout the economy.

Pressure from banks is being more acutely felt by larger Swiss businesses

- Only 38% of all businesses cited experiencing increased pressure from banks as a result of the crisis. This increases significantly to 54% among respondents with an annual revenue in excess of CHF 500 m.

- This pressure has forced 60% to establish or investigate the possibility of additional banking relationships.

- 40% have renegotiated, or are attempting to renegotiate, current loans and 31% have sold and leased back assets to relieve this pressure.

- Raising new equity was not considered possible by 49% of respondents.

- Only 3 of all respondents have covenant forecasting in place.

PwC's view

The credit problems currently being experienced by companies in other parts of the world do not yet seem to be as prevalent in Switzerland (also confirmed by the loan statistics of the Swiss National Bank). However, the percentage experiencing pressure from banks changes dramatically among companies with revenues in excess of CHF 500 m. with over 54% of respondents in this category having experienced pressure; this is likely due to the increased prevalence of international syndicated debt in larger companies

56% of all respondents have noticed differences in customer payment behaviour

- Customer payment behaviour Changed customer payment behaviour is being felt even more severely by larger businesses (revenue > CHF 500 m.), 69% of whom have acknowledged a change.

- 84% of all respondents have strengthened credit control procedures.

- 25% have put additional bank facilities in place and a further 29% are investigating this option.

- 41% of those who acknowledged the change are using or investigating credit insurance to mitigate against risk of default.

- Advanced payments and letters of guarantee were other methods cited by respondents to help reduce the risk of non payment.

PwC's view

Economic downturns invariably affect businesses' liquidity as customers attempt to delay payments for goods and services, resulting in businesses reacting by postponing payments to suppliers. This deterioration in the working capital cycle becomes even more pronounced during a credit crisis when the availability of finance is restricted. Companies should consider working capital management improvement projects just to protect their current position.

48% of all respondents indicated that supplier relationships had changed over the last year

- 75% of respondents who have observed changes acknowledged implementing or investigating more thorough procedures to assess the viability of suppliers.

- 77% are seeking alternative suppliers or already have new suppliers in place. Some companies surveyed mentioned that considerable price reductions could be attained and were renegotiating supplier contracts.

- Just in time purchasing has already been put in place by 45% of respondents.

- The effects of the downturn are once again being felt more dramatically by higher revenue businesses with over 62% of larger companies (revenue > CHF 500 m.) noting that they had changed their approach to suppliers.

PwC's view

Extension of credit by suppliers has been ruled out as a possibility by 43% of those businesses that acknowledged changing their approach to suppliers. The uncertainty surrounding the viability of suppliers is clearly apparent from the results; however, as Swiss companies seek to broaden their supply base this may represent an opportunity to achieve further cost savings.

78% of all respondents surveyed have altered their fixed cost base as a result of the downturn

- Procedures to consolidate the overhead function were already in place at 37% of respondents and a further 39% are currently investigating the possibility of doing this.

- A focus on core competencies is being investigated or is currently in place for 60% of respondents. 38% of respondents are investigating corporate simplification.

- 21% of respondents are pruning their product range and a further 30% are investigating the possibility of doing this.

- 70% of companies that acknowledged reducing complexity in their fixed cost base are focusing on sales areas to identify potential for reducing complexity and costs.

PwC's view

Focusing on those factors that contribute most to profit will help companies prevail through the downturn.

The crisis has forced companies to eliminate cost inefficiencies that they may have otherwise tolerated or ignored during previous more prosperous trading periods.

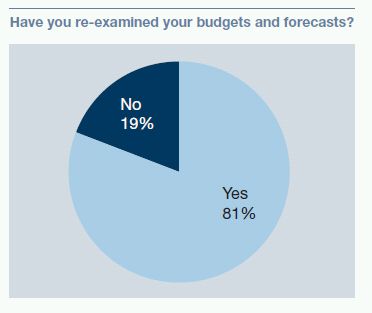

81% of respondents have re-examined their budgets and forecasts in response to the current crisis

- 78% of respondents have implemented scenario planning.

- 55% of respondents are stress testing their budgets and 49% have put contingency planning procedures in place.

- Measurement of the impact of goodwill has only been put in place by 27% of respondents.

PwC's view

Rapidly changing market conditions have made it extremely difficult for Swiss businesses to forecast future performance. 81% have re-examined their budgets, an action which highlights the uncertain trading environment. The use of the planning techniques outlined below will help businesses survive and thrive through a broad spectrum of possible eventualities.

52% of the Swiss businesses surveyed acknowledged changing their treasury management functions in response to the downturn

- 55% of those businesses which have changed their approach to treasury management have begun spreading their risk among various financial institutions, with a further 15% investigating the possibility of doing so.

- 64% of respondents are hedging their currency risk.

- 26% of companies responding positively have put in place interest rate hedging measures.

PwC's view

The uncertainty surrounding the viability of many Swiss financial institutions may be a factor in the large proportion of Swiss businesses spreading their investment risks.

The volatility in the currency markets over the last year and subsequent appreciation of the Swiss franc against major currencies poses a significant threat to the competitiveness of Swiss exports.

Low interest rates in Switzerland and throughout the euro zone may have reduced interest rate hedging as a priority for Swiss companies

Conclusion

The survey shows that the majority of Swiss companies are taking action to address the issues arising from the current financial crisis. But we believe there is much more to do and that there is no room for complacency. Greater focus on the cost base and curtailment of capital expenditure are frequent actions taken by companies as shown in the survey. Planned cost reductions must be carefully considered to avoid jeopardising the future recoverability and success of the business. Although only a minority of respondents admitted to being under pressure from banks, this percentage could change significantly as the crisis continues. Companies should be seeking to secure appropriate financing facilities which take account of the results of their prudent scenario planning. Implementing effective working capital management will help address cash flow issues arising from changes in customer payment behaviour, an issue faced by the majority of survey respondents.

PricewaterhouseCoopers has many years' experience in helping clients survive and prosper in difficult economic times. Now, more than ever, management teams must take bold action to address the impact of the crisis on their businesses. PwC can support them in developing the right strategies. There is no doubt the depth and severity of the crisis will inevitably result in some significant corporate "losers" in the coming months and years, but there is also an opportunity for significant "winners" to emerge. These will include those companies that most effectively address the crisis.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.