Economic conditions over the past year have forced an increasing number of companies to file for reorganization under Chapter 11 of the U.S. Bankruptcy Code. Many of these companies will qualify for and benefit from fresh start accounting when they emerge from the bankruptcy reorganization process. Authors Michael Antonetti and John Grivetti explain how debtor companies can qualify for fresh start as well as some of the valuation, accounting, and tax implications related to this type of accounting.

Public and private entities that emerge from Chapter 11 bankruptcy are subject to Financial Accounting Standards Board Accounting Standards CodificationTM (FASB ASC) 852, the codification topic "Reorganizations." Fresh start accounting was previously covered under the American Institute of Certified Public Accountants Statement of Position 90-7, "Financial Reporting by Entities in Reorganization Under the Bankruptcy Code."

Under FASB ASC 852, certain emerging entities will adopt fresh start accounting, which calls for them to apply fair value concepts in determining their reorganization value and establishing a new basis for financial reporting. This type of accounting entails implications related to valuation, accounting, and taxes.

Does Fresh Start Accounting Apply?

Before the fresh start accounting approach can be used, these criteria must be met:

- Immediately prior to confirmation of the company's plan of reorganization, the company must be "balance sheet insolvent" – that is, the reorganization value of its assets is less than the sum of its post-petition liabilities and allowed claims; and

- The holders of the voting shares immediately before confirmation of the plan receive less than 50 percent of the voting shares of the emerging entity.

Under fresh start accounting, the emerging entity allocates its "reorganization value" to its assets based on their estimated fair value. Reorganization value is the value attributed to the reconstituted entity, as well as the expected net realizable value of those assets that will be disposed before reconstitution occurs. Essentially, reorganization value is understood as the price a willing buyer would pay for the new entity.

Preparing the Reorganization Plan for Fresh Start Accounting

The reorganization value, which serves as the foundation for the emerging entity's fresh start reporting process, is often based on pro forma cash-flow projections that become part of the reorganization plan. Those same projections will therefore generally provide the starting point for determining the cash flows that are used to value the assets of the emerging entity. While typically calculated by the debtor estate's financial adviser or hired professional services firm, the reorganization value is agreed upon by the relevant constituents through negotiations among the debtor, trustee, creditors, and holders of equity interests – or, at a minimum, agreed to by enough of the estate's voting classes to approve the reorganization plan. When adjusting the reorganization value, therefore, the entity must consider how those cash-flow numbers will affect the process of asset and liability valuation under fresh start accounting.

Note that, as a practical matter, changes to the reorganization plan tend to occur at the end of negotiations between constituents, after the initial development of cash flow projections. Often, the cash flow projections are not updated. The numbers will need to be updated, however, prior to applying fresh start accounting.

Relevant Accounting Standards

For accounting purposes, an emerging entity is treated in a manner similar to the treatment of a new acquisition. Thus, when allocating the entity's reorganization value to its assets, the entity must comply with FASB ASC 805, "Business Combinations," which was previously covered in FASB Statement No. 141R, "Business Combinations." Applying fresh start accounting is likely to lead to basis differences between financial reporting and income tax reporting. These differences will affect both the balance sheet and the differences between book and taxable income.

Under fresh start accounting, an emerging entity must calculate the value of the identifiable intangible assets and determine if value should be assigned to "reorganization value in excess of identified assets"– that is, the residual of total reorganization value less the value of tangible and identifiable intangible assets. The value of identifiable assets is generally determined based on discounted cash flows, but volatility makes valuing intangible assets more difficult. Calculating values is complicated when the debtor company had been in distress and the new entity is left to contend with negative associations in the marketplace.

The determination of the assets' fair values also must comply with FASB ASC 820, "Fair Value Measurements and Disclosures." This topic was previously covered in FASB Statement No. 157 (FAS 157), "Fair Value Measurements," which changed the previous definition of fair value. Following are some of the more critical aspects of fair value that are likely to be relevant to the fresh start accounting process.

Entry price versus exit price. When an asset is acquired or a liability is assumed in an exchange transaction, the "transaction price" represents the price paid to acquire the asset or received to assume the liability – that is, the entry price. The fair value of an asset or liability, however, represents the price that would be received to sell the asset or paid to transfer the liability (the exit price). This distinction is noteworthy because entities do not necessarily sell assets at the prices they paid to acquire them or transfer liabilities at the prices received to assume them.

Assets: highest and best use. FAS 157 clarifies that a fair value measurement should assume the highest and best use of the asset by market participants, considering the use of the asset that is physically possible, legally permissible, and financially feasible. The highest and best use is determined based on market participants' use of the asset, even if that use is not the entity's intended use. For example, an acquired trademark that the purchaser does not intend to use previously would have been assigned a zero value. Under FAS 157, however, the assigned fair value would represent the highest and best use based on the value to market participants who would continue to use the trademark.

Market participants. A fair value measurement should be determined based on the assumptions that market participants would make in pricing the asset or liability. FAS 157 clarifies that market participant assumptions include assumptions about risk, such as the risk inherent in a particular valuation technique used to measure fair value (like a pricing model) or the risk inherent in the inputs to the valuation technique. A fair value measurement should include an adjustment for risk if market participants would include one when pricing the related asset or liability, even if the adjustment is difficult to determine.

Principal market. Fair value measurement under FAS 157 assumes that the transaction occurs in the principal market – the most active market in which an entity would sell an asset or transfer a liability. The principal market is thus that market in which the entity normally conducts its business. In the absence of a single principal market, the most advantageous market should be identified.

Transaction costs. While transaction costs are used to determine the most advantageous market, the price used to measure the fair value of the asset or liability should not be adjusted for transaction costs. If the fair value of an asset is $26 and the transaction cost is $1, the amount recorded in the balance sheet should be $26, not $25. Transaction costs, though, are different from transportation costs, which include the costs incurred to transport the asset or liability to or from its most advantageous market. Transportation costs should be included in determining fair value.

Financial Reporting for the New Entity

Rather than a continuation of the reporting of the old entity, fresh start financial reporting reflects a new entity with no beginning retained earnings or deficit. In general, in addition to resetting the value of assets and liabilities on the balance sheet at fair value, the reporting calls for starting from zero on the income statement, statements of cash flow, statements of shareholder equity, and other financial statements.

The balance sheet must reflect changes in the debt and equity structure as a result of the reorganization. In addition, fresh start accounting requires certain disclosures, including:

- Adjustments to the historical carrying values of assets and liabilities;

- The amount of debt forgiveness; and

- Significant matters related to determining the reorganization value, such as the methods used and key valuation variables.

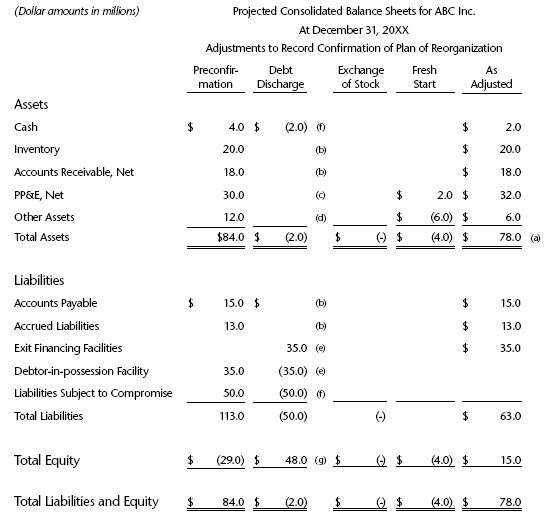

The following example illustrates the effect of fresh start accounting on the balance sheet of a qualifying entity emerging from Chapter 11 reorganization. It includes the balance sheet prior to confirmation of a reorganization plan, the adjustments related to the fresh start accounting process, and the as-adjusted balance sheet upon emergence from bankruptcy for a fictitious company, ABC Inc.

(a) Reorganization value immediately before the date of the bankruptcy plan confirmation, Dec. 31, 20XX, was estimated to be $80 million, based on the present value of discounted cash flows projected for the emerging entity and $2 million of cash in excess of normal operating requirements.

(b) The book values of these assets and liabilities were recorded at the fair value.

(c) The appraised value of the PP&E was $32 million.

(d) Goodwill of $6 million was eliminated and all other assets were recorded at fair value.

(e) The proceeds of the exit financing facilities were used to pay the providers of the debtor-in-possession loan.

(f) Liabilities subject to compromise received $2 million in cash and 100 percent of the common stock of the emerging entity.

(g) Equity represents the net effect of items in (c), (d), and (f).

Tax Considerations

Finally, the new entity needs to consider the tax issues related to the reorganization. The impact of the reorganization can be significant on the presentation and disclosure of current and deferred taxes, including:

- The tax effects of the temporary differences resulting from the fair value allocated in fresh start accounting and from the tax basis;

- The potential impact on carryforward tax attributes, such as net operating losses and any corresponding valuation allowances assigned to such attributes;

- The different ordering sequences for pre- and post-fresh start reporting periods for recognition of tax benefits;

- The effect of measurement of insolvency for tax purposes and the impact on discharge of indebtedness income; and

- Consideration of the effects on tax attributes at various levels of an organization, such as the parent company and subsidiary effects.

The company must understand the tax outcomes of the reorganization plan to account for them. The complexity of the tax laws in these specialized areas requires careful consideration to avoid accounting and tax issues in the future.

Laying the Groundwork for a Fresh Start

The emergence of a new entity under fresh start accounting is a multidimensional process that requires valuation, accounting, and tax expertise. The debtor entity should deploy this expertise, whether in-house or from a third party, as early as possible to ensure that the final reorganization plan facilitates the adoption of fresh start accounting.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.