Despite substantial lobbying efforts, FASB, banking regulators and federal lawmakers are clearly indicating not to expect any delays in the implementation date for the new credit loss model known as CECL.

Federal Reserve Chair Jerome Powell has said he does not believe the accounting change will have a material effect on banks' lending.

"Don't wait any longer. Don't panic, but don't wait any longer," said Alison Clark, chief accountant at the National Credit Union Association, as reported by Bloomberg Tax during an April 11 regulator webinar about how financial institutions must follow FASB's CECL accounting standard.

FASB Assistant Director Shayne Kuhaneck urged banks not to expect any major changes in the standard or a change in the effective date of 2020 for public companies.

Robert Storch, FDIC chief accountant, said the standard will be an improvement over current accounting, which hid looming losses. "It's going to better align with how we supervise banks and how institutions manage credit risk," he said.

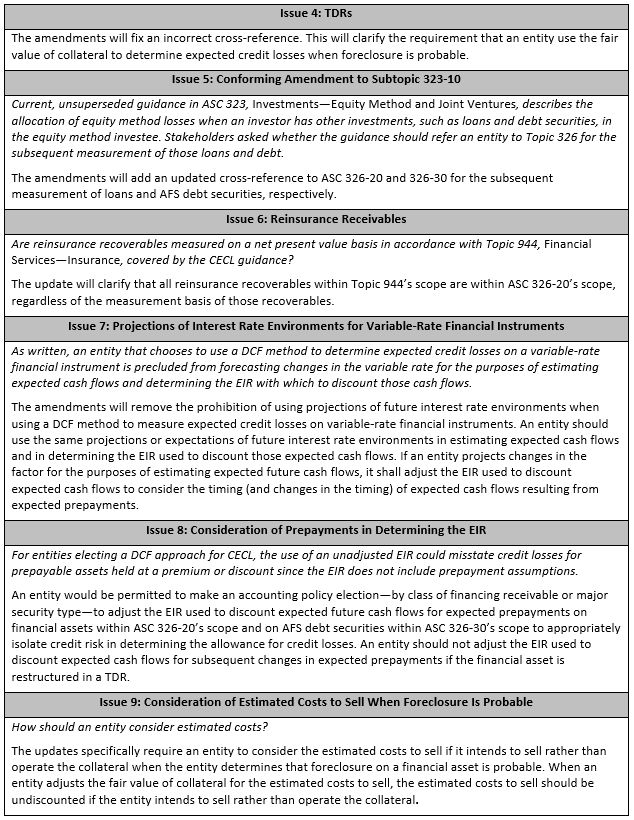

On April 25, 2019, FASB issued Accounting Standards Update (ASU) 2019-04, a set of technical corrections covering many CECL implementation and transition issues. See Appendix A for a full list of updates. FASB will have at least one more ASU, in addition to finalizing the exposure in the table below that will cover troubled debt restructuring (TDR) relief, and may include two other items pending required further research:

- Transition relief for TDRs. FASB had previously approved a transition election to use a prepaymentadjusted effective interest rate (EIR) in a discounted cash flow (DCF) approach to measure credit losses on TDRs that exist at the adoption date

- Extension of the use of negative allowances from amortized cost basis securities to also include availablefor-sale (AFS) debt securities

- Extension of the scope of transfers between classification and categories for loans and debt securities to also include trade and lease receivables

Recent FASB Activity Transition FVO In April 2019, FASB approved amendments for very narrow transition relief that would permit a one-time irrevocable election to apply the FVO to certain existing financial instruments that are both:

- Within the scope of Accounting Standards Codification (ASC) 326-20 and

- Eligible for the FVO in ASC 825-10, Financial Instruments—Overall

This election would be applied on an instrument-by-instrument basis for eligible financial assets. This FVO election will not be applicable to debt securities classified as AFS or held-to-maturity (HTM). Under current guidance, the FVO only can be elected for eligible instruments on specified election dates, i.e., when an entity first recognizes a financial asset. This relief would allow entities to elect the FVO for existing eligible instruments upon adoption of CECL and would help some companies avoid having two different accounting models for similar asset portfolios.

FASB rejected expanding scope to any other security types, permitting a reclass from HTM to AFS on CECL adoption and allowing companies to reverse previous FVO decisions.

A final ASU is expected in the second quarter of 2019.

Regional Banks Proposal

At an April 2019 meeting, FASB rejected a proposal developed by regional banks. The approach would retain the CECL methodology's intent of establishing a balance sheet allowance for lifetime credit losses, but the income statement provision would have been recognized in three parts. See BKD's article FASB Rejects Regional Bank CECL Proposal for further details.

Vintage Disclosure: Gross Write-Offs & Receivables

At the same April meeting, FASB also decided not to move forward with a proposal that would have required gross write-offs and recoveries to be part of vintage disclosure.

Preparers should follow the written guidance in the standard and will be in compliance with generally accepted accounting principles (GAAP) if they do not include the disclosure of gross write-offs and recoveries in the illustrative example. Entities can still choose to provide the additional detail. FASB will keep the project on its research agenda and may consider additional standard setting at a future point after CECL's effective date.

Other CECL Resources

FAQs – Regulators

Bank regulators—Office of the Comptroller of the Currency, Federal Reserve, FDIC and the National Credit Union Administration—released an update to the September 2017 frequently asked questions (FAQ) document. The update contains nine additional questions covering internal control considerations, consideration of stress-testing models, scenarios and forecasting periods for future economic conditions, borrower payment behaviors as a risk characteristic for credit card portfolios and expected future changes in collateral when using the collateraldependent practical expedient. See BKD's article 2019 Updates to Regulators' CECL FAQs for further details.

AICPA Resources

The American Institute of CPAs' (AICPA) Depository Institutions and Insurance Expert Panel will be addressing several CECL issues. ASU 2019-04 addresses many concerns, but many more are outstanding. The group has issued several discussion papers, and final conclusions will be in an audit and accounting guide expected to be released later this year. See a list of open issues in Appendix B.

The adoption of CECL will be complex and likely will require significant hours to implement correctly. BKD can help educate your team, provide implementation tools and assist with analysis and documentation. If you would like assistance complying with the CECL standard, contact your BKD trusted advisor. BKD has prepared a library of BKD Thoughtware® on this topic. Visit our website to learn more.

Transition

For entities that have not yet adopted ASU 2016-13, the effective dates and transition requirements for this ASU are the same as ASU 2016-13. The transition adjustment includes adjustments made as a result of an entity developing or amending its accounting policy upon adoption of ASU 2019-04 for determining when accrued interest receivables are deemed uncollectible and written off.

For entities that have adopted ASU 2016-13, these amendments are effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. These amendments should be applied on a modified retrospective basis by means of a cumulative-effect adjustment to the opening retained earnings balance in the statement of financial position as of the date an entity adopted ASU 2016-13. The transition adjustment includes adjustments made as a result of an entity developing or amending its accounting policy upon adoption of these amendments for determining when accrued interest receivables are deemed uncollectible and written off.

Early adoption is permitted in any interim period for entities that have already adopted ASU 2016-13.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.