On April 23, 2019, the Board of Governors of the Federal Reserve System ("Federal Reserve") released a proposed rule ("Proposed Rule")1 to revise regulations related to the determination of "control" under the Bank Holding Company Act ("BHC Act") and the Home Owners' Loan Act.2 The Proposed Rule would "provide substantial additional transparency on the types of relationships that the Federal Reserve would view as supporting a determination that one company controls another company" by incorporating existing interpretations under the "controlling influence" prong of the control definition into Federal Reserve regulations and would make certain adjustments to historical Federal Reserve practice in this area. The Proposed Rule would also address other issues that commonly arise when analyzing controlling relationships. Comments on the Proposed Rule will be due 60 days after the date of its publication in the Federal Register.

Background

The concept of "control" is essential for the administration of the BHC Act. This is because the BHC Act applies to "bank holding companies," which are defined to include any company that has control over a bank.3 In addition, the restrictions and limitations contained in the BHC Act generally apply to any companies controlled by bank holding companies since the investments and activities of any company controlled by a bank holding company are generally attributed to the bank holding company itself.

For BHC Act purposes, a company is deemed to be "controlled" by another company if:

- The first company has direct or indirect ownership, control, or power to vote 25% or more of the outstanding shares of any class of the voting securities of the second company;

- The first company, directly or indirectly, controls the election of a majority of the second company's directors, trustees, general partners, or others with similar management responsibilities under the second company's organizing documents; or

- The first company otherwise has the direct or indirect power to exercise a "controlling influence" over the second company's management or policies.

The first and second prongs of the control definition create two fairly bright-line tests for when one company is deemed to control another company. The third prong of the control definition, however, requires a facts and circumstances analysis.

The BHC Act and current Federal Reserve regulations provide a number of presumptions upon which companies rely to avoid making controlling investments, including a presumption of non-control where a company holds less than 5% of any class of voting securities of another company. The Federal Reserve has also historically provided guidance regarding its controlling influence analysis through the issuance of various policy statements.4 For example, the Federal Reserve released a policy statement in 2008 that explains that the controlling influence analysis involves a review of certain "indicia of control." Pursuant to that policy statement, the indicia of control that the Federal Reserve will review to analyze whether a company may exercise a controlling influence over another company includes: total equity held (both voting and non-voting), board representation, business relationships, contractual covenants between the parties, proxy solicitations, and management interlocks, among other things. The Federal Reserve's controlling influence analysis is also described in various orders it has issued with regard to particular investments or transactions. And, historically, the Federal Reserve has required minority shareholders to enter into "passivity commitments" as a condition to obtaining its approval for certain transactions that present control issues.5

Despite the aforementioned presumptions and guidance, companies have found it difficult to discern with certainty when minority investments in other companies could result in a control determination for purposes of the BHC Act. The Proposed Rule is an attempt by the Federal Reserve to consolidate its guidance in this area into a single regulatory framework. In this way, the Federal Reserve seeks to provide greater transparency to investors and bank holding companies as to its approach under the controlling influence prong of the control definition.

Presumptions of Control and Non-Control

If implemented, the Proposed Rule would codify the Federal Reserve's historical practice and significantly augment the number of presumptions that would apply to potential control situations. 6 The preamble to the Proposed Rule states that the Federal Reserve "generally would not expect to find that a company controls another company where the first company is not presumed to control the second company under the Proposed Rule." Nevertheless, the Federal Reserve would retain its authority to determine control based on the specific facts and circumstances presented. In addition, the preamble to the Proposed Rule cautions that a proposed investment can still raise safety and soundness or other concerns that do not meet the expectations or requirements of the Federal Reserve even if the investment does not trigger a presumption of control or otherwise raise controlling influence concerns.

The presumptions in the Proposed Rule can be categorized into three main buckets: (1) presumptions that apply regardless of the voting securities held; (2) presumptions that apply according to the amount of voting securities held (with thresholds set at 5%, 10%, and 15% of any class of voting securities); and (3) presumptions of non-control.7

Generally Applicable Presumptions

The Proposed Rule would establish several new presumptions that would apply regardless of the level of investment in the securities of another company. These presumptions include:

- Management Contract or Similar Agreement. A company would be presumed to control another company under the Proposed Rule if the first company enters into any agreement enabling the first company to direct or exercise significant influence or discretion over the general management, overall operations, or core business or policy decisions of the second company. Circumstances where this presumption would likely apply include where the first company serves as managing member, trustee, or general partner of the other company. This presumption would not apply with respect to agreements to serve as an investment advisor to the other company.

- Total Equity. A company will be presumed to control another company if it controls one third or more of the total equity of the other company, regardless of the amount of voting securities held.

- Accounting Consolidation. A company that is consolidated by another company on its financial statements prepared under U.S. generally accepted accounting principles will be presumed to be controlled.

- Investment Funds. A company will be presumed to control an investment fund if it serves as an investment advisor to the investment fund and controls, directly or indirectly, or acting through one or more other persons: (a) 5% or more of any class of voting securities; or (b) 25% or more of the total equity of the investment fund. This presumption would not apply during a one-year seeding period for an investment fund organized and sponsored by the company.

Tiered Presumptions Based on Voting Securities

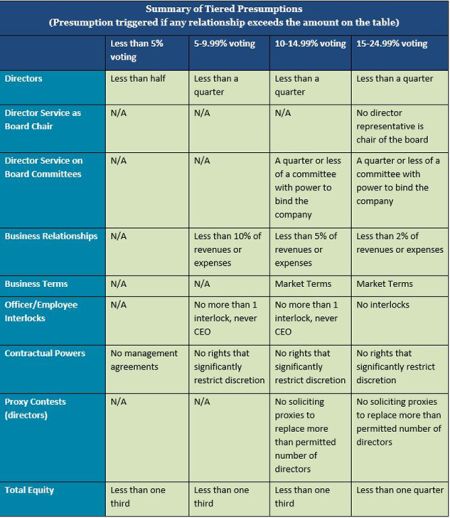

The Federal Reserve structured the tiered presumptions "so that, as an investor's ownership percentage in the target company increases, the additional relationships and other factors through which the investor could exercise control generally must decrease in order to avoid triggering the application of a presumption of control." In this regard, the tiered presumptions create three categories, namely, where a company controls: (1) 5% or more but less than 10% of any class of voting securities of another company; (2) 10% or more but less than 15% of any class of voting securities of another company; and (3) 15% or more but less than 25% of any class of voting securities of another company.8 These tiers are described below and explained in a helpful chart prepared by the Federal Reserve at the same time that the Proposed Rule was released, which is republished at the conclusion of this Client Alert.

5% or more. Under the Proposed Rule, investors controlling 5% or more of any class of voting securities of another company would be presumed to control the other company if at least one of the following factors is also present:

- Significant Director Representation. The investor, or any of its subsidiaries, has director representatives comprising 25% or more of the board of directors of the other company or any number of director representatives if such representatives are able to make or block the making of major operational or policy decisions.

- Management and Director Interlocks. Two or more employees or directors of the investor, or any of its subsidiaries, serves as senior management officials of the company or any of its subsidiaries or an employee or director of the investor, or any of its subsidiaries, serves as the chief executive officer (or in a similar position) of the company or any of its subsidiaries.

- Business Relationships. The investor or any of its subsidiaries has business relationships with the other company or any of its subsidiaries that generates 10% or more of the total annual revenues or expenses of the investor or other company.

- Contractual

Rights. Subject to an exception for certain

agreements to merge or make a controlling investment in the future,

a presumption of control arises if the investor or any of its

subsidiaries has a "limiting contractual right" with

respect to the other company or its subsidiaries.

- The Proposed Rule would define "limiting contractual right" to mean a contractual right that would allow a company "to restrict significantly, directly or indirectly, the discretion of another company, including its senior management officials and directors, over operational policy decisions..." The Proposed Rule provides a large number of examples of both what would, and would not, constitute a "limiting contractual right."

- Shares Held by Management. The investor and senior management officials and directors of the investor and its subsidiaries, together with their immediate family members, own, control, or have power to vote 25% or more of any class of voting securities of the other company. This presumption would not apply, however, where the investor and its subsidiaries control less than 15% of any class of voting securities of the other company and the senior management officials and directors of the investor and its subsidiaries, together with their immediate family members, own, control, or have power to vote a majority of each class of voting securities of the other company.

10% or more. In addition to the presumptions described above, investors controlling 10% or more of any class of voting securities of another company would be presumed to control the other company if at least one of the following factors is also present:

- Proxy Solicitation for Director Elections. The investor solicits proxies for a slate of directors in opposition to nominees by management or the board of directors of the other company, or any of its subsidiaries, and the total number directors the investor seeks to replace, combined with the number of the investor's director representatives, comprises 25% or more of the number of directors on the board.

- Representation on Board Committees. Director representatives of the investor, or any of its subsidiaries, comprise more than 25% of any committee of the board of directors of the other company, or any of its subsidiaries, where such committee can take actions to bind the other company or any of its subsidiaries.

- Business Relationships. The investor or any of its subsidiaries has business relationships with the other company or any of its subsidiaries that are either (1) not on market terms; or (2) generate 5% or more of the total annual revenues or expenses of the investor or the other company.

15% or more. Finally, in addition to the presumptions described above, investors controlling 15% or more of any class of voting securities of another company would be presumed to control the other company if at least one of the following factors is also present:

- Total Equity. The investor controls 25% or more of the total equity of the other company.

- Management and Director Interlocks. A director representative of the investor or any of its subsidiaries serves as chair of the board of directors of the other company or any of its subsidiaries or one or more employees of the investor or any of its subsidiaries serves as a senior management official of the other company or any of its subsidiaries.

- Business Relationships. The investor or any of its subsidiaries has business relationships that generate 2% or more of the total annual revenues or expenses of the investor or the other company.

Presumption of Non-Control

The Proposed Rule would expand the current presumption of non-control to include any investment of less than 10% of any class of voting securities. The presumption of non-control would apply only if none of the presumptions of control described above are triggered.

Divestiture of Control

Historically, the Federal Reserve has considered a company that controls another company for a significant period of time to retain a controlling influence over that company even after a substantial divestiture. In order to divest control, parent companies have generally been required by the Federal Reserve to reduce their shareholding to below 10% (and in many cases below 5%) of any class of voting securities of the other company and to maintain only minimal business relationships.

The Proposed Rule would continue to treat divestiture situations differently than initial investments. However, the approach to divestiture situations would be relaxed in certain respects. Specifically, under the Proposed Rule, a company that controls another company under the first or second prong of the BHC Act definition of control could divest its interest to 15% or more but less than 25% of any class of voting securities of the other company and would be presumed to control the other company only for the two-year period following the divestiture. After the two-year period, the presumption of control would no longer apply (assuming no other control presumptions are triggered). As described in the preamble, this feature of the Proposed Rule implies that a company may divest control immediately by reducing its investment in any class of voting securities of another company to less than 15% (assuming no other control presumptions are triggered).9

Other Issues Addressed in the Proposed Rule

The Proposed Rule addresses a number of other issues that often arise when analyzing control, as briefly summarized below:

- The Proposed Rule would consolidate Federal Reserve guidance regarding the treatment of financial instruments that are convertible into, exercisable for, exchangeable for, or otherwise may become voting securities or nonvoting securities. Essentially, subject to certain exceptions, the Proposed Rule would deem a company to control the maximum number of voting securities or non-voting securities into which the financial instrument may convert at the option of the holder.

- If a company has entered into an agreement with the holder of securities that restricts the rights of the holder with respect to such securities, the company is deemed to control those securities. The Proposed Rule would import certain exceptions to this general rule into the Federal Reserve's regulations.

- Under the Proposed Rule, a company that holds 5% or more of the voting securities of another company will be deemed to control any shares held in the other company by its own senior management officials, directors, or controlling shareholders.

- Limited partnership interests or membership interests in limited liability companies would not be considered voting securities under the Proposed Rule if the voting rights are limited solely to voting for the removal and/or replacement of a general partner or managing member (or similar persons) for cause or due to incapacitation or to continue or dissolve the company after the removal of the general partner or managing member (or similar persons).

- The Proposed Rule provides standards for calculating the voting percentage and total equity held in a company.

- The Proposed Rule defines a number of terms that are important for the controlling influence analysis, including "director representative," "investment advisor," and "senior management official," among others.

Conclusion

The Proposed Rule is a long expected effort by the Federal Reserve to provide greater transparency into its analysis of potential control relationships. While modestly relaxing restrictions, the Proposed Rule would not represent a significant deviation from current Federal Reserve policy. Nevertheless, if adopted as proposed, the Proposed Rule would provide much needed clarity to bank holding companies with respect to their investment activities and to other companies interested in making non-controlling bank investments. The below chart as published by the Federal Reserve is available here.

Footnotes

1 The Proposed Rule, a chart summarizing the proposed tiered presumptions, and the opening statements of two members of the Federal Reserve Board are available here.

2 The concept of "control" is largely consistent between the BHC Act and the Home Owners' Loan Act, with certain distinctions. The Proposed Rule would generally take the same approach with respect to control under both statutes, accounting for those distinctions. In this Client Alert, we limit our discussion of the Proposed Rule as applied to the concept of "control" under the BHC Act and its implementing regulations.

3 12 U.S.C. § 1841(a)(1). Note, pursuant to Section 8 of the International Banking Act of 1978, foreign banks with a branch, agency, or commercial lending company subsidiary in the United States are treated as bank holding companies for purposes of the BHC Act. As a result, the concept of control is also essential with regard to the U.S. regulatory framework as applied to foreign banks.

4 See 12 C.F.R. §§ 225.143; 225.144; 225.138; 225.139.

5 Notably, the Proposed Rule does not discuss in what circumstances the Federal Reserve might require a minority shareholder to enter into passivity commitments to avoid control.

6 Technically, a company may not be deemed to control another company pursuant to the controlling influence prong of the control definition unless the Federal Reserve has determined, after notice and an opportunity for a hearing, that the company directly or indirectly exercises a controlling influence over the management or policies of the other company. The presumptions described in the Proposed Rule and in this section would apply for purposes of such proceedings and the presumptions would be rebuttable.

7 Note, the presumptions of control would not apply with respect to shares held in a fiduciary capacity and certain relationships with registered investment companies.

8 Investments of less than 5% of any class of voting securities of another company are presumed to be non-controlling investments pursuant to the BHC Act, assuming none of the generally applicable presumptions are triggered. Investments of 25% or more of any class of voting securities of another company are deemed to be controlling investments pursuant to the first prong of the control definition.

9 To the extent the company's investment rises above 15% of any class of voting securities of the other company during the two-year period, the company would be presumed to continue to control the other company.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved