Across the globe, governments are increasingly expanding their powers to review foreign acquisitions over and above competition-based merger control.

In the United States, the Committee on Foreign Investment in the United States (CFIUS) regime has been significantly expanded. In Europe, many member states have adopted their own foreign direct investment (FDI) regime which allows governments to intervene typically on national security grounds in sensitive industries. These regimes sit alongside the applicable competition-based merger control review, but typically the review under FDI rules is conducted by government departments or ministries and not the relevant competition authority of the member state or the European Commission's Directorate-General for Competition. Jurisdiction in this area also lies with member states and not the European Commission. Section I below provides a high-level overview of the countries within the European Union that, to date, have adopted their own specific FDI rules.

In an effort to bring about a certain level of coordination while not undermining member states' jurisdiction, the European Commission has sought to agree on an overarching framework (EU Framework) that will lead to an increased exchange of information and coordination between European member states.

The EU Framework received political agreement by the EU institutions at the end of 2018.1 Formal approval by the European Parliament was granted on 14 February 20192 and a formal vote by the European Council is expected to follow in March 2019. Section II below provides an overview of the EU Framework in its current form.

I. European FDI Heatmap

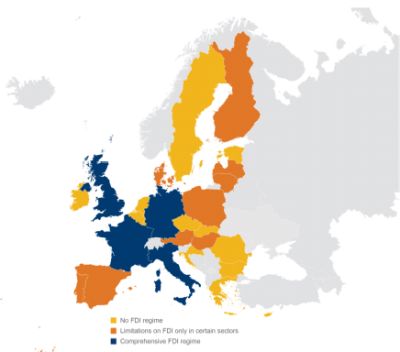

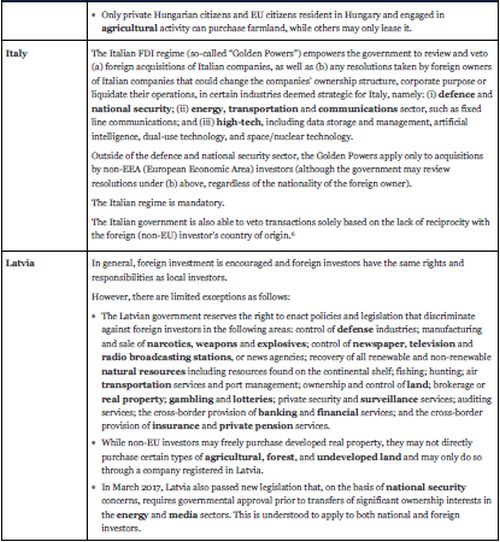

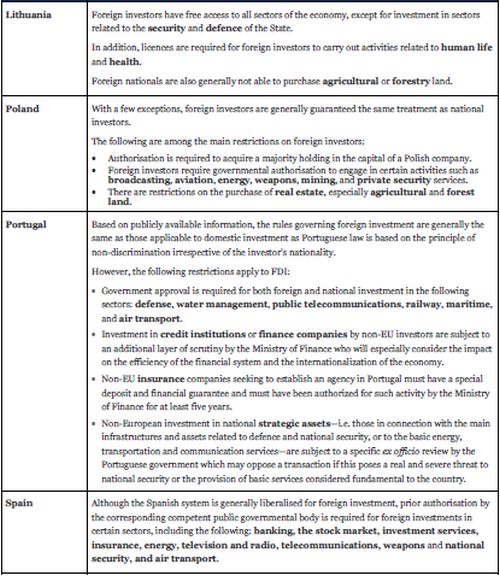

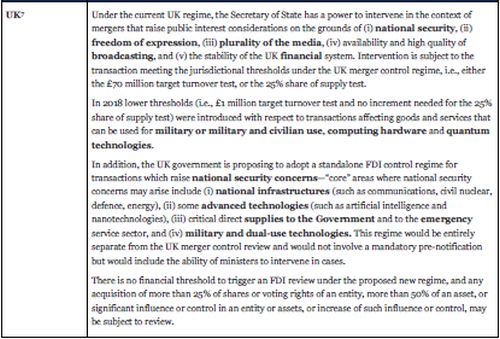

Below is a map of countries in Europe that have their own FDI regime. Some 13 out of the 28 current EU member states have some foreign investment screening mechanisms.Those differ significantly in design and scope, but common themes are a focus on sensitive industries, primarily computer and digital technology, defence, and some essential infrastructures.

The main focal point of likely reviews are investments particularly from China and Russia, although there is concern that this may be used more widely to revert to some form of public interest test. This chimes with moves led by Germany and France, following the Siemens/Ahlstom prohibition, to recast the European merger control process in a way that might bring in wider public interest tests also for clearing otherwise problematic mergers.

Figure 1.1 Map of FDI regimes in the European Union

The FDI screening mechanisms in France, Germany, Italy, and the UK (marked in blue) are the most comprehensive and stringent, meaning that a relatively higher number of transactions may be subject to review. Key themes in other countries with a more limited FDI review system (marked in orange) are public security and defence, public order and, in some countries (particularly in Eastern Europe), the purchase of land/real estate.

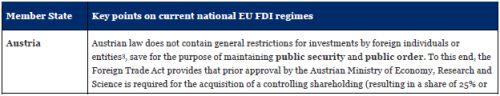

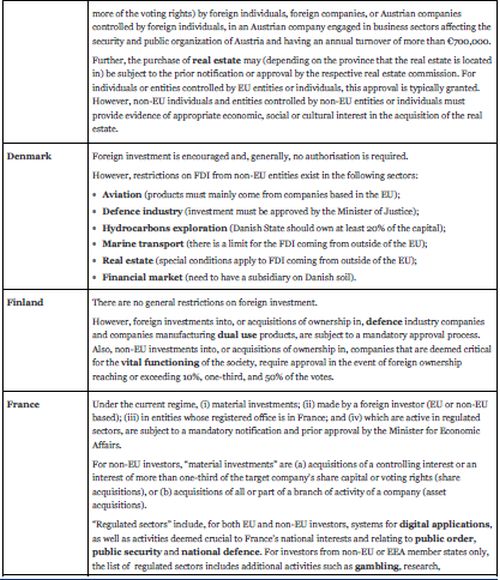

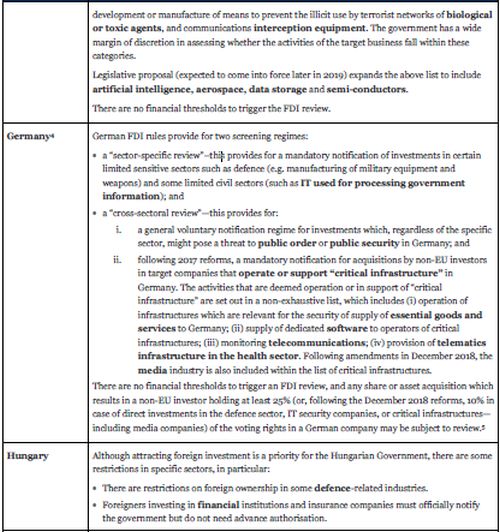

The table below seeks to set out the key points under the current regime in each of those jurisdictions.

II. The EU Framework: Coordinating member states

EU jurisdiction. The European Commission's role will be limited to a coordination and advisory one, and will therefore fall short of the competences of the CFIUS. Instead, each member state will retain its jurisdiction.

Process. Member states will be required to inform the European Commission and other member states of any direct foreign investment undergoing the national review process. The European Commission also will have an obligation, and not only a right, to screen deals with Community interest and will issue an opinion on the review; other member states will also have a right to comment on each review. Whilst neither the European Commission's opinion nor other member states' comments will be binding, member states will need to take the "utmost account" of these, and we expect the European Commission's opinion to have significant influence on the outcome of such reviews.

Scope. The EU Framework applies to investments that establish or maintain "lasting and direct links" between a foreign (non-EU) investor and the target enterprise. It is therefore wider than the competition law merger control process. The review is strictly limited to grounds of "public order and security."

The EU Framework contains the following non-exhaustive list of economic sectors affected:

- critical and strategic infrastructure, including networks, communications and media, data storage facilities, large-scale data analysis;

- critical and strategic technologies, such as information and communication technologies;

- access to sensitive information or to the personal data of EU citizens, and the ability to control large-scale data or sensitive information;

- the plurality and independence of media, and cultural services, including audio-visual services; and

- specific industries such as water, health, defence, media, biotechnology, and food supply.

Timing. We expect this process to lead to the need to plan for additional time in a transaction involving an FDI review. Under the current EU Framework, member states will have to inform the European Commission and other member states within five working days following initiation of the review process. Opinions and comments will need to be submitted within another 25 working days, which could be extended if, for example, additional information is needed.

Annual reporting. The EU Framework also introduces annual reporting obligations on member states with respect to their national security reviews in order to achieve greater transparency throughout the EU.

As mentioned above, the EU Framework still requires adoption by the European Council and we will separately report in more detail once this has taken place..

Footnotes

1 For more detail, see press release.

2 See press release.

3 Which we understand includes both EU and non-EU investors.

4 For more details on the German foreign investment regime and its recent reforms, see our Advisory.

5 For more details on the reforms adopted in December 2018, see Germany Extends its Power to Review and Block Foreign Direct Investments.

6 Under this rule, Italy can impose restrictions on a foreign investor to an Italian target if the investor's country of origin is likely to restrict the rights of an Italian national to invest in a similar target.

7 For more details on the UK foreign investment regime and its recent reforms, see our Advisory

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.