Contents

- A Market Perspective Justin J. Perreault, General Partner, Commonwealth Capital Ventures

- Selected New England "Series B" and Later Round Transactions Commentary from David Pierson

- Terms of New England "Series B" and Later Rounds Commentary from Bruce Kinn

- The Activity Level Summary: New England "Series B" and Later Round Transactions by Industry

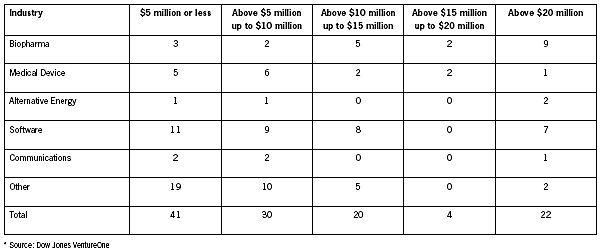

- Size of New England 2008 Year to Date "Series B" and Later Round Transactions by Industry Commentary from Amanda Vendig

This is the third edition of EEC Perspectives to focus on "Series B" and later round financings. This EEC Perspectives presents data and analysis on the number and size of transactions in the New England region and, with respect to numbers of transactions, nationally for the first nine months of 2008. It also reports and provides analysis on certain key terms of the New England transactions.

For this issue of EEC Perspectives, we have asked Justin J. Perreault of Commonwealth Capital Ventures to comment on later rounds. Justin points out, among other things, that in our current economic times an early stage company raising a Series B-round financing faces additional challenges. We plan to bring you other points of view in future issues of EEC Perspectives.

We hope you will find this information useful in your financing

efforts. In addition, we would like to hear from you if you have

transactions or comments that might be interesting to others. Do

not hesitate to send one of us at the EEC an email at

info@foleyhoag.com. Also, please visit our Web site

emergingenterprisecenter.com and plan on attending some of the many

networking and educational events we hold at the EEC. We hope you

will find the EEC a valuable resource as you start and grow your

company.

David Broadwin

A Market Perspective

Justin J. Perreault, General Partner, Commonwealth

Capital Ventures

We are currently experiencing the most unsettled economic times in recent memory. Against this backdrop, an early stage company raising a series B-round financing faces additional challenges. A B-round financing can be tricky even in normal times. Often a company at this stage has made substantial progress in product development, building its team, and understanding its target market. Yet at the same time, it is common for a B- round company to have modest or no revenue, so important questions of market acceptance and likely revenue ramp are still highly uncertain.

With this in mind, here are a few thoughts for entrepreneurs embarking on a B-round financing in the current environment:

It's only a financing round.

Often entrepreneurs regard B round pricing and terms as a grade for all the hard work and progress they've made. Naturally, based on these criteria many think they've earned an "A" in the form of a large valuation increase. Yet other criteria come into play in B-round pricing, many of which are completely exogenous to the startup. For example the economic backdrop, overall pricing environment for venture-backed companies, and VC's appetites to do B-rounds versus A or later-stage rounds all fluctuate. In most cases, the pricing offered for B-round financings by VCs is generally a reasonable measure of a company's value. If you want to raise a B-round, don't take the price personally. View it for what it is, the price of additional equity capital at a single moment in time.

Flat is the new up-round.

At the moment many VCs are more inwardly focused than usual, working with their existing portfolio companies to respond to the rapidly changing business environment. Many are simply not focused on making new investments. This will certainly change in short order as things settle down. There is definitely ample venture capital on the sidelines to fund exciting new ideas. But for the moment, you might consider doing an A-round extension with your existing VCs. It is quick, simple, and allows you to get back to building your business as fast as possible. Consider raising less money as an A-round extension and postpone investing the time and effort of a full-blown B-round process until the climate is more receptive.

The B-round is one step in a long journey.

Most venture-backed companies require several rounds of funding before reaching profitability and by that time the B-round terms and pricing will be irrelevant. What matters more is picking a VC firm that will work with you, your team, and other investors over the entire cycle of your company's development. You want to pick a partner that can help you to succeed and whose attitude is to ensure that along the way there is a fair distribution of rewards for everyone involved. Take the long term view and choose your partner wisely to maximize your long term outcome.

In summary, the important thing to keep in mind is that the main objective of the B-round is to secure the capital and partners who can help you grow your business to the next level. While it's a challenging time now, this too shall pass, and the long term opportunity for entrepreneurs with innovative new ideas to build great new companies is as strong as ever.

Selected New England "Series B" and Later Round Transactions

Third Quarter 2008

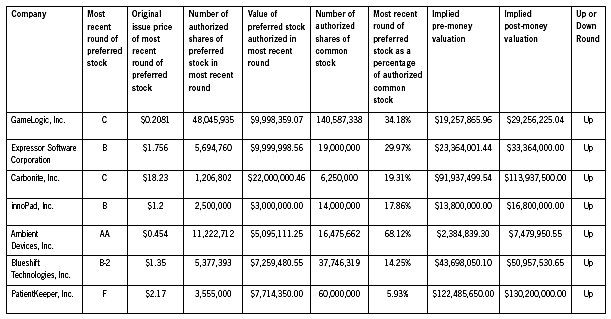

Implied Pre-Money and Post-Money Valuation

This analysis is inherently imprecise and is based on a number of general assumptions which may or may not be accurate. However, in a typical situation we believe it will yield an approximation of the valuation placed on the company at the time of financing, and therefore may be of interest to our readers

|

COMMENTARY: As was the case for the Q2 2008 later-stage deals featured in the December 2008 issue of EEC Perspectives, the Q3 2008 later-stage deals in the table above present a mixed picture. Significantly, the level of financing activity in Q3 2008 was down materially compared to Q2 2008 (7 reported transactions in Q3 versus 15 reported transactions in Q2). As was the case in Q2, the size of the reported transactions varied widely, as did the percentage of the financed companies sold and the implied pre- and post-money valuations, and once again some but not all of these differences can be accounted for by the stage of the financing round in question. Perhaps the most encouraging aspect of the reported Q3 data is that despite the worsening economic outlook, financing transactions continued to get done and all of the reported transactions were up-rounds. This tends to support the notion that even in these difficult economic times, promising companies should be able to find investors that are willing to fund their growth. Those that do best will be the ones that have trimmed their expenses and cash burn rates sufficiently to enable them to be patient in their search for new money and that have managements and existing investor syndicates that are willing to be flexible on terms for the next round. |

We can prepare a similar analysis across any group of transactions that our clients are interested in. For example, we could prepare an analysis for a group of competitive companies so you can see what the implied valuations of your competitors are. If you would like additional information on this service, please contact your lawyer at Foley Hoag or one of our Emerging Enterprise Center lawyers listed at the end of this publication.

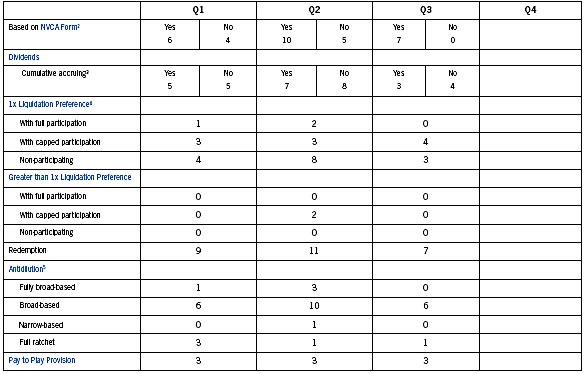

Terms of New England "Series B" and Later Rounds1

The tables above summarize publicly available information about the number and size of second round financings for companies headquartered in New England and nationally by industry. The data included in the tables is derived from Venture Source, a publication of Dow Jones Venture One. Venture Source categorizes transactions as "seed round" "first round," "second round" and so on. Upon examination of each transaction, it is not always clear why a particular transaction was put in a particular category, however, for the purposes of these tables we have used the categories as defined by VentureSource. Information included in the tables below is based on information made publicly available by participants in the relevant transactions and therefore is not comprehensive.

|

COMMENTARY: It is interesting that, at least within this sample, there was no major shift in price-related terms, such as full ratchets or greater liquidation preferences, when Q3 deals are compared to deals occurring earlier in the year. Although the number of deals and the prevalence of up-rounds in the Q3 sample suggest caution in drawing conclusions too broadly, this observation is consistent with our experience during the period, with investors more likely to address their pricing concerns through direct price negotiation than through other related terms. A second observation from the data is the uniform acceptance of redemption provisions, apparently in response to the persistent slowdown in IPOs and other exits last year. It is important to place the 2008 Q3 data that is presented here against a backdrop of public markets and a national economy that were at that time under stress but not yet in rout. We expect that the pricing and price-related terms for 2008 Q4 data, when available, will provide a more negative picture. |

We can prepare a similar analysis across any group of transactions that our clients are interested in. For example, we could prepare an analysis for a group of competitive companies so you can see what the implied valuations of your competitors are. If you would like additional information on this service, please contact your lawyer at Foley Hoag or one of our Emerging Enterprise Center lawyers listed at the end of this publication.

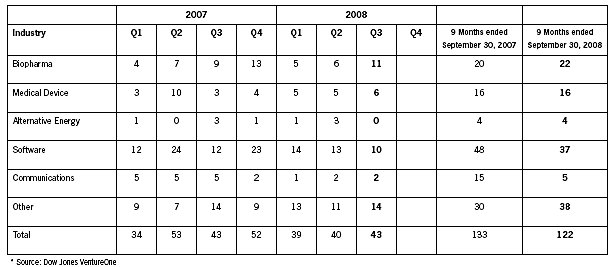

The Activity Level Summary

New England "Series B" and Later Round Transactions by Industry*

National "Series B" and Later Round Transactions by Industry*

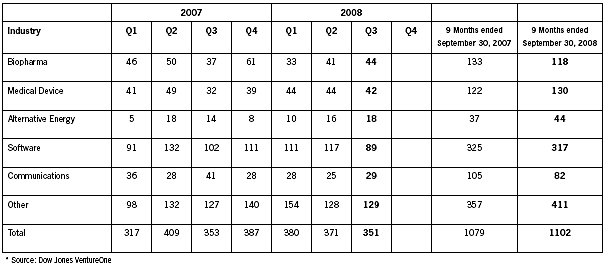

Size of New England 2008 Year to Date "Series B" and Later Round Transactions by Industry*

The Tables Above Summarize Publicly Available Information About The Number And Size Of Second Round Financings For Companies Headquartered In New England And Nationally By Industry. The Data Included In The Tables Is Derived From Venture Source, A Publication Of Dow Jones Venture One. Venture Source Categorizes Transactions As "Seed Round" "First Round," "Second Round" And So On. Upon Examination Of Each Transaction, It Is Not Always Clear Why A Particular Transaction Was Put In A Particular Category, However, For The Purposes Of These Tables We Have Used The Categories As Defined By Venturesource. Information Included In The Tables Below Is Based On Information Made Publicly Available By Participants In The Relevant Transactions And Therefore Is Not Comprehensive.

|

COMMENTARY: Both nationally and in New England the number of deals being done in the biopharma, medical device and alternative energy industries have remained consistent with their 2007 levels. Unfortunately the same cannot be said of deals being done in the software and communications industries which have seen drops of 20% or more in the number of deals as compared to this time last year. We have seen this same trend for Series A financings, where the biopharma, medical device and alternative energy sectors have held up well in the current economic downturn but the software and communications sectors have been hit much harder. |

Footnotes

1 Determined from a review of publicly available Certificate of Incorporation filings.

2 Certificate of Incorporation appears to have been based substantially on the NVCA form.

3 Dividend rates ranged from 6% to 8% during the third quarter of 2008.

4 Two of the transactions involved liquidation preferences which are not typical in these type of transactions and therefore were not included in the above chart.

5 "Fully broad-based", "broad-based" and "narrow-based" all refer to a weighted average conversion rate adjustment formula. "Narrow-based" means that the formula includes outstanding equity on an as-converted basis, but not options or warrants. "Broad-based" adds to the narrow-based formula outstanding options and warrants on an as-exercised basis, but does not include ungranted options. "Fully broad-based" adds to the broad-based formula options that may be issued in the future pursuant to a plan approved by the Board of Directors. "Full ratchet" means that the conversion rate adjusts to the lowest price at which the issuer sells or is deemed to sell (as in the case of a sale of convertible securities) any shares of common stock.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.