The annual conference of the National Advertising Division of the Council of Better Business Bureaus (NAD), coming up next week, September 24 and 25, in New York, is one of the key events on the advertising-law professional calendar. A highlight of the event is always the review of the key NAD cases and emerging themes over the past year, as determined both by NAD attorneys and by participants and their counsel. This will be discussed in panels on various issues such as claim substantiation, customer review of products, industry standards and certifications, NAD evidentiary standards, and more.

I recently examined NAD's decisions for the twelve months between August 1, 2017, and July 31, 2018, with some specific questions in mind. I wanted to know: Which industry sectors are using NAD? How often are advertisers' claims being found substantiated, and how often is NAD recommending discontinuation or modification? How many matters never reach a full decision, and for what reasons? Are there any indications that the FTC's declining interest in investigating and prosecuting advertising violations by national advertisers is changing participants' approach to NAD, which relies on the FTC as its ultimate enforcement backup?

Which Industries Are Using NAD?

NAD issued 90 case reports between August 2017 and July 2018. They were unevenly distributed across industry sectors. Some sectors have historically relied on NAD to resolve their advertising differences, while others have not. The most numerous category of advertisers before NAD, however, doesn't exactly appear voluntarily. This is the dietary supplement sector, which accounted for 17 of the 90 cases, mostly brought by the Council for Responsible Nutrition, a public interest group that uses the NAD forum to police dietary supplement efficacy claims. The next largest category (12 cases) was personal care products and cosmetics. A further 11 cases involved appliances, with vacuum cleaners being repeat players, and 11 more cases involved telecommunication services, with both wireless telephone and home broadband suppliers active before the forum. Seven cases concerned over-the-counter drugs such as analgesics and allergy relief products. The remaining 32 cases were divided among a number of categories, including food, pet and baby products, televisions, cleaning products, toys and apparel.

Which Side Wins at NAD?

I reviewed each case and categorized them as to whether the challenged advertising claims were deemed substantiated by NAD. Several claims normally are challenged, so I divided the cases into ones in which NAD recommended all or most of the claims be modified or discontinued, NAD found all or most of the claims to be substantiated, or roughly half of the claims went each way. I found, as many frequent NAD participants will have expected, that the results strongly favor challengers. Of the 66 cases in which NAD evaluated the advertising and reached a reasoned decision, it recommended modifying or discontinuing most or all of the challenged claims in 46 of them (70%). In a further 16 (24%), NAD recommended modifying or discontinuing a substantial number of the claims. In only 4 cases (6%) NAD found all or almost all of the challenged claims substantiated. This doesn't necessarily indicate any bias at NAD. The results could be due to selection bias – i.e., challengers generally bring good cases, plus NAD presumably weeds out meritless challenges at the initial stage, when deciding whether to open a case. That's all I'll say on the subject for now!

Why Does NAD Close a Case Without a Full Decision?

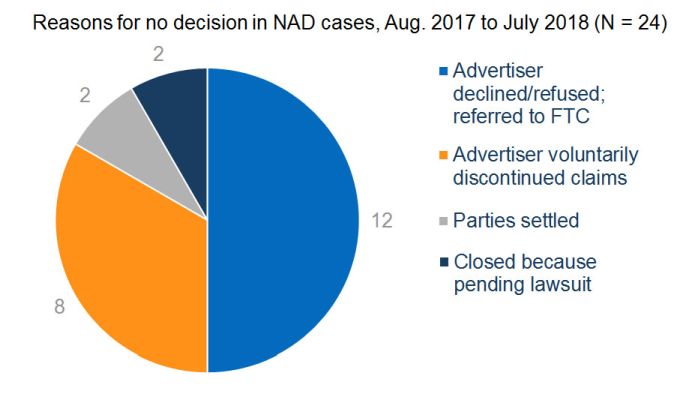

In some ways, though, the who-wins analysis may be burying the lead. What about those 24 of 90 opened cases that NAD never decided on the merits? That's a pretty high percentage. I examined the reasons why the cases were closed without a reasoned decision and found that they were closed for one of four reasons, shown below.

In half (12) of those cases, the advertiser declined to participate, causing NAD to refer the challenge to the FTC and/or other relevant agency. Some of these were small dietary supplement makers that were being busted by CRN for obviously unsubstantiated claims, but some were well-known national advertisers. It would be interesting to see whether more major advertisers are willing to have un-defended NAD challenges against their advertising land on the FTC's desk in recent years. In a further eight cases, the case was terminated because the advertiser voluntarily discontinued the claims. Even though the advertiser's reason might simply be that the advertising campaign has run its course, these might be interpreted as more wins for the challenger, especially because the NAD treats these cases, for compliance purposes, as though the claims had all been found unsubstantiated, and will later accept a compliance challenge and ultimately refer the matter to the FTC if the claims are not discontinued. The remaining four undecided cases were terminated either because the parties settled the matter before decision or because NAD became aware of pending litigation involving the claims.

In this post, my aim has been to supply the data on the last year of NAD cases, without too much interpretation or opinion. But they certainly could provide a basis for interesting discussion. If you want to have such a conversation, look for me or my colleagues Neil Austin, Dave Kluft and Natasha Reed from Foley Hoag at next week's NAD conference. There's still time to sign up here!

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.