Background

For many years, the Internal Revenue Code has provided various incentives aimed at encouraging economic development and investments in low-income and/or distressed communities by providing certain tax benefits to businesses located in such communities. One of those incentives includes new markets tax credits ("NMTC")1, which permit a taxpayer who makes a qualified equity investment into a community development entity, which further makes an investment in a qualified active low-income community business, to receive tax credits in the aggregate amount of 39% of the taxpayer's investment. The NMTCs are taken over a seven-year period with 5% in each of the first 3 years and 6% in the next 4 years, thus, establishing a 7 year compliance period. The NMTC program is administered by the Department of Treasury's Community Development Financial Institutions Fund (the "CDFI Fund").

The Tax Cuts and Jobs Act of 2017 (the "Tax Cuts Act")2, enacted December 22, 2017 and codified in new Code Section 1400Z, included a new incentive which requires investments in a qualified opportunity zone ("QO Zone"). Some of the framework language undergirding the new QO Zone program is similar to that found in the NMTC rules, but the approach is different for the two programs.3 The NMTC allocation authority of the Department of Treasury has to be reauthorized periodically by Congress. While NMTCs are tax credits, the QO Zone provisions allow a temporary deferral of inclusion in gross income for capital gains ("CG") reinvested in a qualified opportunity fund ("QO Fund"). The investments in QO Funds are intended to specifically encourage investments that will be used to start businesses, develop abandoned properties or provide low-income housing in low-income, economically distressed communities.4

A fact sheet published by the Economic Innovation Group made the following observations about the proposed QO Zone program that was originally introduced in early 2017 as the "Investing in Opportunity Act" (H.R. 828/S.293), and which laid the foundation for the final QO Zone provisions found in the Tax Cuts Act:

- U.S. investors currently hold an estimated $2.3 trillion in unrealized CG on stocks and mutual funds alone—a significant untapped resource for economic development. The QO Zone legislation allows investors to temporarily defer CG recognition from the sale of an appreciated asset, but only if they reinvest the gains into a QO Fund. This will help remove the disincentive for investors to roll assets into distressed communities, and preserve a larger amount of capital for investments in such areas.

- Many investors are willing to provide the capital, but lack the wherewithal to locate and follow through on opportunities in needy communities. The new QO Funds will democratize economic development by allowing a broad array of investors throughout the country to pool resources and mitigate risk, increasing the scale of investments going to underserved areas and thereby increasing the probability of neighborhood turnaround.

- The QO Fund legislation is designed to be low cost and low risk to the taxpayer. Investors bear the risk and are on the hook for all of their original CG, minus a modest reduction for long-term holdings, regardless of whether subsequent investments increase or decrease in value.

While this white paper is intended to be a reference covering the details of the QO Zone provisions, the basic concepts of the program are fairly simple and can be summarized as follows:

Step 1: A QO Fund is formed and certified by the Department of Treasury.

Step 2: An investor with a recently realized CG elects to invest this gain into the QO Fund, taking stock or a partnership interest in return. By so doing, the investor gets to defer including the CG in income.

Step 3: The QO Fund uses the investment to acquire "qualified opportunity zone property." This investment represents the QO Fund's interest in the underlying business in the low-income community.

Step 4: The investor holds the interest for as long as he desires or for some period of time as may be stipulated in the investment agreement with the QO Fund.

Step 5: If the investor sells or exchanges his QO Fund interest before Dec. 31, 2026, he will recognize the deferred CG. If the holding period is at least 5 years, the investor gets a basis allocation that will offset some of his CG (there is more basis allocation if the holding period is at least 7 years).

Step 6. In any event, the investor's CG deferral period ends on Dec. 31, 2026, and so if the investment is still outstanding, the deferred CG must be recognized then. The holding periods noted in Step 5 are taken into account at this point.

Step 7: If the investor holds his interest in the QO Fund for at least 10 years, he is entitled to a major fair market value ("FMV") basis step-up so that any appreciation in the value of his interest can be excluded from income.

Thus, the QO Zone provisions give incentive to potential investors into QO Funds by allowing for (a) temporary deferral of CG recognition, (b) a possible step-up in the basis of their investment, and (c) possible permanent exclusion of CG from the growth of the QO Fund investment if the holding period is at least 10 years.

What are Qualified Opportunity Funds?

QO Funds are the vehicles that taxpayers will use to invest their deferred CG in the QO Zones. Pursuant to the regulatory authority provided in the Tax Cuts Act, the Department of Treasury, most likely acting through the CDFI Fund, will have to provide more guidance and regulations outlining the process for certification of the QO Funds.5 It is anticipated that there will be a certification process by the CDFI Fund similar to the certification process for community development entities for NMTC purposes.

A QO Fund can be organized as a corporation or a partnership for the purpose of investing in "qualified opportunity zone property" (other than another QO Fund), that holds at least 90% of its assets in qualified opportunity zone property.6 Whether the QO Fund holds at least 90% of its assets in qualified opportunity zone property is determined by the percentage of qualified opportunity zone property held in the QO Fund measured (a) on the last day of the first six month period of the QO Fund's taxable year, and (b) on the last day of the QO Fund's taxable year.7

Qualified opportunity zone property

Qualified opportunity zone property includes qualified opportunity zone stock, qualified opportunity zone partnership interests, or qualified opportunity zone business property.

- Qualified opportunity zone stock is stock in a domestic corporation acquired by the QO Fund after December 31, 2017, at its original issue,8 solely in exchange for cash. When the stock is issued, the corporation must be a qualified opportunity zone business ("QOZB")9 and must remain a QOZB for substantially all of the QO Fund's holding period of such stock.10

- A qualified opportunity zone partnership interest is a domestic partnership interest acquired by the QO Fund after December 31, 2017, solely in exchange for cash. As with corporations, when the partnership interest is issued, the partnership must be a QOZB and remain one during substantially all of the QO Fund's holding period of such interest.11

- Lastly, qualified opportunity zone business property ("QOZBP") means tangible property used in a trade or business of a QO Fund if such property (i) was acquired by purchase12 after December 31, 2017, (ii) the original use of such property in the QO Zone commences with the QO Fund or the QO Fund substantially improves the property, and (iii) substantially all of the use of such property was in a QO Zone during substantially all of the QO Fund's holding period for the property.13 QOZBP will be treated as substantially improved by a QO Fund only if during the 30 month period beginning after the date of acquisition, the additions to the basis of such property in the hands of the QO Fund exceed the adjusted basis of such property at the beginning of the 30 month period.14

Definition of a Qualified Opportunity Zone Business

A QOZB is a trade of business in which substantially all of the tangible property owned and leased by the taxpayer is QOZBP.15 QOZBP means tangible property used in the trade or business of the QOZB if (i) acquired after December 31, 2017, (ii) the original use of the property in a QOZB commences with the QOZB or the QOZB substantially improves such property, and (iii) substantially all the use of such property was in a QO Zone and occurred during the QOZB's holding period for such property.16 Also, at least 50% of the total QOZB's gross income must be derived from the active conduct of such business and the average of the aggregate unadjusted bases of the QOZBP attributable to nonqualified financial property must be less than 5 percent.17

A QOZB cannot engage in any of the following "sin" businesses: any private or commercial golf course, country club, massage parlor, hot tub facility, suntan facility, racetrack or other facility used for gambling, or any store the principal business of which is the sale of alcoholic beverages for consumption off premises.18 The statutory language provides that if tangible property ceases to be QOZBP, it will continue to be treated as such for the earlier19 of: (i) 5 years after the date it ceases to be qualified, or (ii) the date on which it is no longer held by the QOZB.20 Thus, for example, if the QOZBP is no longer used in the trade or business on January 20, 2022 but has not been sold, then it will be deemed to QOZBP for 5 years after such date, January 20, 2027; however, if the QOZB sells the QOZBP on January 20, 2024, the property will no longer be QOZBP on the date of sale.

Penalty for failing to meet the 90% rule

As noted, the QO Fund must hold at least 90% of its assets in qualified opportunity zone property – i.e., qualified stock, partnership interests or QOZBP. This is to ensure that the QO Fund maintains a certain investment standard. If the QO Fund does not meet the 90% requirement, the QO Fund will pay a penalty for each month that it fails to do so. The amount of the penalty will be equal to the excess of 90% of the aggregate assets over the aggregate amount of qualified opportunity zone property held by the QO Fund, multiplied by the underpayment rate established in Section 6621(A)(2) for each month. If the QO Fund is a partnership, the penalty is to be taken into account proportionally as part of each partner's distributive share flowing from the partnership. There is a reasonable cause exception to this penalty.21

Assume for example that only 80% of the assets of a given QO Fund ("InvestFund") constitute qualified opportunity zone property measured on the last day of InvestFund's taxable year, resulting in InvestFund not meeting the 90% requirement. InvestFund must pay a penalty for each month that more than 10% of the total assets are not qualified opportunity zone property. Thus, if InvestFund has assets of $5,000,000, of which 80% are qualified opportunity zone property for the pertinent 6 month period, InvestFund will not meet the 90% requirement. Assuming the underpayment penalty rate is 2%, InvestFund must pay a penalty of $10,000 [$4,500,000 ($5,000,000 x 90%) – 4,000,000 ($5,000,000 x 80%) x 2%] for each month of the 6 month period).

What Are QO Zones?

Again, this new incentive program requires a QO Fund to make direct or indirect investments in a QO Zone. QO Zones are population census tracts that are low-income communities designated as qualified opportunity zones. The term "low-income communities" has the same meaning as provided in the NMTC provisions.22 The chief executive officer of each state or possession of the United States has 90 days from the date of enactment of the Tax Cuts Act, which will be March 22, 2018, to nominate census tracts for the designation as QO Zones by notifying the Department of Treasury in writing (a 30-day extension can also be requested). According to the Conference Report, the CEOs "are required to provide particular consideration to areas that: (1) are currently the focus of mutually reinforcing state, local, or private economic development initiatives to attract investment and foster startup activity; (2) have demonstrated success in geographically targeted development programs such as promise zones, the new markets tax credit, empowerment zones, and renewal communities; and (3) have recently experienced significant layoffs due to business closures or relocations".23

The Treasury Secretary has 30 days upon receipt of the CEO's nomination to determine whether the census tracts will qualify as a QO Zone. The Secretary will then certify those nominations that meet the statutory requirements and designate such tracts as QO Zones before the end of the "consideration period." The number of census tracts in a state designated as QO Zones may not exceed 25% of the number of low-income communities in the state. However, if the state has less than 100 low-income communities, then a total of 25 census tracts may be designated as QO Zones. The QO Zone designation remains in effect for 10 years following the designation.

In addition to the low-income community census tracts, the chief executive officers may also designate "population census tracts" that are not low-income community census tracts as QO Zones if (a) the tracts are contiguous with the low-income community that is designated as a QO Zone, and (b) the median family income of the population census tract does not exceed 125 percent of the median family income of the low-income community tract that is contiguous.24 No more than 5% of the designated QO Zones may be population census tracts.25

How Do QO Fund Investments Work?

Generally, an investment in a QO Fund will permit a taxpayer, who elects to do so, to defer a CG resulting from the sale or exchange to an unrelated third-party of any property held by the taxpayer, by investing such gain in a QO Fund. If the taxpayer's investment in the QO Fund includes amounts other than deferred CG, such investments will be treated as two separate investments – QO Fund investments and the other amounts. The investment must be made within 180 days from the date of the underlying sale or exchange.26 The deferment of recognition of the CG continues until the earlier of the date that such investment in the QO Fund is sold or exchanged, or December 31, 2026.27 The taxpayer will invest the CG that he intends to defer in a QO Fund. 28 On the applicable trigger date, the taxpayer will recognize a gain in the amount of the lesser of (a) the amount of deferred gain, or (b) the fair market value of the QO Fund investment over the taxpayer's basis in the QO Fund (which is initially considered to be zero). 29

Rollover and deferral of Capital Gains

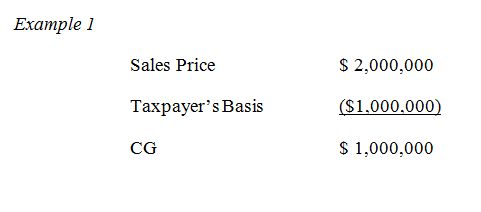

To illustrate, assume that on January 20, 2018, Taxpayer sells CG property with a basis of $1,000,000 to an unrelated third-party for $2,000,000, resulting in a CG of $1,000,000.

Taxpayer invests the $1,000,000 CG into InvestFund (a QO Fund) and elects to defer recognition of such gain until the earlier of the sale of his investment in InvestFund or December 31, 2026. Assume further that there are two additional Taxpayers who also invest $1,000,000 each of CG. These investments must have occurred after December 31, 2017 and must be made in InvestFund within 180 days of the sales or exchanges resulting in the CG. Taxpayers' initial basis in their respective investments is zero.30

InvestFund can use the proceeds of the investments to acquire either stock or a partnership interest of a QOZB, or QOZBP to be used by InvestFund. Assume InvestFund acquires stock or a partnership interest of a QOZB (the "SPE"), and the SPE uses these investments to acquire and improve a low-income housing development (the "Project"). Specifically, the SPE owns or leases and undertakes to develop and improve the Project. The SPE will have to "substantially improve" the Project to the extent that the Project property's adjusted basis at the end of the 30 month improvement period (commencing on the date of the acquisition of the Project) will exceed its adjusted basis on the date of the Project's acquisition.

Alternatively, rather than investing in the SPE's stock or partnership interest, InvestFund may invest directly in QOZBP by acquiring the Project itself and substantially improving it within the 30 month period following acquisition.

Recognition of deferred Capital Gains

If a taxpayer holds the investment in a QO Fund for at least 5 years, then the basis of such investment will be increased to 10% of the amount of gain deferred.31 Thus, if Taxpayer in Example 1 holds the investment in InvestFund for a period of at least 5 years, then his investment basis will be increased to $100,000 (10% x $1,000,000). If the investment is held by Taxpayer for at least 7 years, the basis is increased by an additional 5% of the amount of the deferred gain.32 Thus, in Example 1 above, after 7 years Taxpayer's basis would increase to $150,000 [(10% x $1,000,000)33 + (5% x $1,000,000)]. Now if that investment is held for a period of at least 10 years, the basis of the investment could be equal to the fair market value of the investment on the date it is sold or exchanged.34 However, as explained below, because the gain recognition date cannot be later than December 31, 2026, even if a QO Fund investment is held for more than 10 years, under the current Tax Cuts Act stipulations, a taxpayer will not be able to completely escape tax on more than 15% of the initial CG invested.35

Example 2

If Taxpayer decides to sell the investment in InvestFund prior to January 20, 2023,36 Taxpayer would have to recognize the entire deferred gain and any appreciation resulting from such investment. If Taxpayer sells his investment in InvestFund for $2,000,000, Taxpayer will recognize the $1,000,000 of deferred gain as well as the additional $1,000,000 in appreciation.

Example 3

If Taxpayer holds the investment in InvestFund until January 20, 2023 (i.e., at least 5 years) and sells it thereafter, but prior to January 20, 2025, Taxpayer's basis in the investment will be increased to $100,000, which is 10% of the $1,000,000 original deferral amount. If Taxpayer sells his investment in InvestFund for $2,000,000, Taxpayer will recognize a total gain of $1,900,000, which includes $900,000 of the deferred gain and $1,000,000 in appreciation.

Example 4

If Taxpayer sells his investment in InvestFund after January 20, 2025 (i.e., after 7 years) for $2,000,000, Taxpayer would have a basis of $150,000 in the investment and will recognize gain of $1,850,000, which includes $850,000 of the deferred CG invested in InvestFund and appreciation of $1,000,000.

Example 5

As previously noted, depending upon how long Taxpayer holds his investment in InvestFund, either a portion or all of the deferred CG must be included in gross income on December 31, 2026.38 This recognition trigger date applies regardless of whether the investment has been sold by that date, so Taxpayer could find himself being taxed on phantom gain if no sale has occurred. Taxpayer will recognize gain to the extent the amount of deferred gain previously excluded exceeds Taxpayer's basis in InvestFund39. Taxpayer's basis in InvestFund will be increased by the amount of the gain recognized.40 Thus, if Taxpayer holds the InvestFund interest on December 31, 2026, and has held such investment for less than 5 years, Taxpayer must recognize the full deferred gain on December 31, 2026.

Example 6

If Taxpayer holds the InvestFund investment on December 31, 2026 and has held such investment for at least 5 years but less than 7 years, he must recognize the deferred gain on December 31, 2026, while receiving a corresponding basis adjustment.

Taxpayer will include in his gross income gain in the amount of $900,000 and his basis in InvestFund will be increased by the same amount.

Example 7

If Taxpayer owns his InvestFund investment on December 31, 2026 and has held such investment for at least 7 years, Taxpayer must recognize the deferred gain on December 31, 2026.

Taxpayer will include in his gross income gain in the amount of $850,000 and Taxpayer's basis will be increased by the same amount.

The Tax Cuts Act specifically provides that if a QO Fund investment is held for at least 10 years and the taxpayer makes an election, the taxpayer will have a basis equal to the FMV of such investment on the date of sale of the investment.41 Thus, if a taxpayer holds the investment for 10 years, the taxpayer would not have to recognize any post-acquisition CG (i.e., appreciation) on the investment. If a taxpayer holds the QO Fund investment for 10 years, makes the FMV basis election and sells his interest, here is what will happen:

- If the investment is held for less than 5 years as of Dec. 31, 2026: All of the deferred gain is recognized as of 12/31/2026. If the investment is sold or exchanged after 12/31/2026 for FMV (after being held for at least 10 years) the taxpayer recognizes no additional gain, due to the FMV basis election, even if the investment has increased in value between 12/31/2026 and the date of disposition.

- If the investment is held for at least 5 years by Dec. 31, 2026: 10% basis adjustment applies; 90% of deferred gain is recognized as of 12/31/2026. If the investment is sold or exchanged after 12/31/2026 for FMV (after being held for at least 10 years) the taxpayer recognizes no additional gain, due to the FMV basis election, even if the investment has increased in value between 12/31/2026 and the date of disposition.

- If the investment is held for at least 7 years by Dec. 31, 2026: 15% basis adjustment applies; 85% of deferred gain is recognized as of 12/31/2026. If the investment is sold or exchanged after 12/31/2026 for FMV (after being held for at least 10 years) the taxpayer recognizes no additional gain, due to the FMV basis election, even if the investment has increased in value between 12/31/2026 and the date of disposition.

The section of the Conference Report that addresses the 10 year holding period and the FMV basis election states that "[t]axpayers can continue to recognize losses associated with investments in qualified opportunity zone funds as under current law."42 Therefore, in the three foregoing scenarios, if the investments were sold or exchanged in arm's length transactions for less than FMV, presumably the taxpayer could recognize a loss as a result of making the FMV basis election.

The Secretary of Treasury will prescribe regulations necessary or appropriate to carry out the purposes of the QO Zone provisions. The regulations will set forth the rules for certification of QO Funds, rules to ensure that the QO Funds have a reasonable period of time to reinvest the return of capital from the investments in the qualified opportunity stock and qualified opportunity zone partnership interests and to reinvest the proceeds received from the sale or disposition of the qualified opportunity zone property, and rules to prevent abuse.43

The new QO Zone provisions have the potential to unlock huge amounts of investment capital which can be directed into low-income communities that desperately need the infusion for business and community development and redevelopment. Since the performance of the underlying business activity under the QO Fund rubric will drive a potential investor's return on his investment in the fund (which introduces a different risk profile and analysis than the NMTC program), it remains to be seen if this program will take hold and push significant investment into low income communities.

(Updated February 14, 2018)

* All Rights Reserved.

**Mr. Castilla and Ms. Wicks are tax and business lawyers and members of Butler Snow's Business Services and Public Finance practice groups, resident in the firm's Ridgeland, Mississippi office.

Footnotes

1 I.R.C. §45D.

2 115th Congress (2017-2018) Enacted, To Provide the Reconciliation Pursuant to Titles II and V of the Concurrent Resolution on the Budget for Fiscal Year 2018 (Pub. L. 115-97), Tax Cuts and Jobs Act, as enacted December 22, 2017.

3 The NMTCs provisions are set to expire on December 31, 2019. No amounts of unused allocation limitation may be carried to any calendar year after 2024. See Tax Cuts and Job Act, Conf. Rep. to Accompany H.R. 1, H.R. Rep. No. 466, 115th Cong., 1st Sess. (2017), hereinafter referred to as the "Conference Report"). The House of Representatives' version of the Tax Cuts Act would have repealed the NMTC law; however, the Senate's version did not follow the House provisions. The Conference Report allowed the existing NMTCs law to stay in effect. In addition, the Senate's version of the Tax Cuts Act created the QO Zone program. Note that the QO Zone statute refers to "gain from the sale to, or exchange with an unrelated person of any property" and does not specifically state "capital gain" nor does it limit the types of property to capital assets as defined I.R.C. §1221(a), thus it seems to imply that any gain could be invested in a QO Fund. However, the Conference Report specifically refer to the deferral of capital gains.

4 Bloomberg Tax Complete Analysis of H.R. 1, Conference Agreement, as enacted (Dec. 22, 2017), hereinafter "Bloomberg Tax Analysis".

5 See I.R.C. §1400Z-2(e)(4).

6 See I.R.C. §1400Z-2(d)(1).

7 See I.R.C. §§1400Z-2(d)(1)(A) and (B).

8 Qualified opportunity zone stock can be acquired directly or through an underwriter.

9 If a new corporation, it must be organized for the purpose of being a QOZB, which is further defined below.

10 See I.R.C. §1400Z-2(d)(2)(B). Note that a redemption of such stock is subject to I.R.C. §1202(c)(3), meaning the qualified opportunity zone stock shall not be treated as qualified small business stock if at any time during the 4 year period beginning on the date two years before the issuance of the stock, the issuing corporation purchases any of such stock from the purchaser of the stock or a party related to the purchaser within the meaning of I.R.C. § § 267(b) or 707(b). The qualified small business stock would allow a taxpayer other than a corporation to exclude 50 % of the gain from the sale or exchange of such stock held for more than 5 years. See I.R.C. §1202(a)(1).

11 If a new partnership, it must be organized for the purpose of being a QOZB. See I.R.C. §1400Z-2(d)(2)(C).

12 Purchase shall have the meaning set forth in I.R.C. §179(d)(2). The reference in I.R.C. §1400Z-2(d)(2)(D)(iii) to I.R.C. §1400Z-2(d)(2)(A)(i) should have been to I.R.C. §1400Z-2(d)(2)(D)(i)(I).

13 See I.R.C. §1400Z-2(d)(2)(D)(i).

14 See I.R.C. §1400Z-2(d)(2)(D)(ii). Note that the reference in I.R.C. §1400Z-2(d)(2)(D)(ii) to I.R.C. §1400Z-2(d)(2)(A)(ii) should have probably been to I.R.C. §1400Z-2(d)(2)(D)(i)(II).

15 See I.R.C. §1400Z-2(d)(3)(A)(i).

16 See I.R.C. §1400Z-2(d)(3)(A) and I.R.C. §1400Z-2(d)(2)(D). .

17 See I.R.C. §1400Z-2(d)(3)(A)(ii). Similar restrictions are found in the requirements for a qualified active low-income community business in the NMTC provisions. See I.R.C. §§ 45D(d)(2)(A)(i) and 45D(d)(2)(A)(v).

18 See I.R.C. §1400Z-2(d)(3)(A)(iii). Note that this restriction is also found in the requirements for a qualified active low-income community business in the NMTC provisions. See I.R.C. § 45D(d)(2)(A)(i) and 45D(d)(2)(A)(v).

19 The Tax Cuts Act actually says the "lesser of" rather than "earlier of," but there should be a technical correction to clarify what Congress intended in this respect.

20 See I.R.C. §1400Z-2(d)(3)(B).

21 See I.R.C. §1400Z-3(f)(3).

22 See I.R.C. §1400Z-1(c).

23 The Conference Report at p. 538.

24 See I.R.C. §1400Z-1(e)(1). Note that I.R.C. §1400Z-2(e)(1) states "the low-income community that is designated as a qualified opportunity" seems to imply that the low-income community must be designated as QO Zone prior to the designation of contiguous tract; however, this may not have been the intent.

25 See I.R.C. §1400Z-1(e)(2).

26 See I.R.C. §1400Z-2(a)(1)(A).

27 See I.R.C. §1400Z-2(a)(2)

28 See I.R.C. §1400Z-2(a)(1)(A).

29See I.R.C. §1400Z-2(b)(2)(A).

30See I.R.C. §1400Z-2(b)(2)(B)(i).

31See I.R.C. §1400Z-2(b)(2)(iii).

32 See I.R.C. §1400Z-2(b)(2)(iv).

33 This is the increase in basis after 5 years.

34See I.R.C. §1400Z-2(c).

35 The Senate Amendment states that "[i]f the investment is held by the taxpayer until at least December 31, 2026, the basis in the investment increases by the remaining 85 percent of the deferred gain." However, this language, which is inconsistent with other pertinent basis provisions, does not appear in the final version of the Tax Cuts Act. See Conference Report at p. 539.

36 Taxpayer will have held the investment for less than 5 years, still assuming the facts of Example 1.

37 See I.R.C. §1400z-2(b)(2)(B)(iii).

38 See I.R.C. §1400z-2(b)(1)(B).

39 See I.R.C. §1400z-2(b)(2)(A).

40 See I.R.C. §1400z-2(b)(2)(B)(ii). Note that the reference in I.R.C. §1400z-2(b)(2)(B)(ii) to I.R.C. §1400z-2(a)(1)(B) is in error because there is no such subsection. The reference was apparently intended to be to §1400z-2(b)(1)(A).

41 See I.R.C. §1400z-2(c).

42 The Conference Report at 539.

43See I.R.C. §1400z-2(e)(4).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.