A comprehensive new rule issued by the Department of Labor (the "DOL") on April 6 will make a much wider group of advisers subject to fiduciary standards under the Employee Retirement Income Security Act ("ERISA") beginning on April 10, 2017. Advisers subject to the new rules face potentially harsh penalties for non-compliance.

Recognizing the disruptive effect that the new rule would have on existing market practices and fee arrangements, the DOL also finalized a new exemption referred to as the Best Interest Contract Exemption (the "BIC Exemption"), which is designed to permit certain types of compensation that might create prohibited conflicts, if advisers and financial institutions meet specific requirements. After intense criticism from industry and certain lawmakers, the DOL relaxed many of the more onerous aspects of the proposed BIC Exemption.

Together, the new rule and the BIC Exemption, along with several other new and amended prohibited transaction exemptions, aim to reshape the marketplace for retirement investment advice.

This Alert and the accompanying chart summarize the final rule and the BIC Exemption and highlight key substantive changes between the proposed and final packages.

The Final Rule

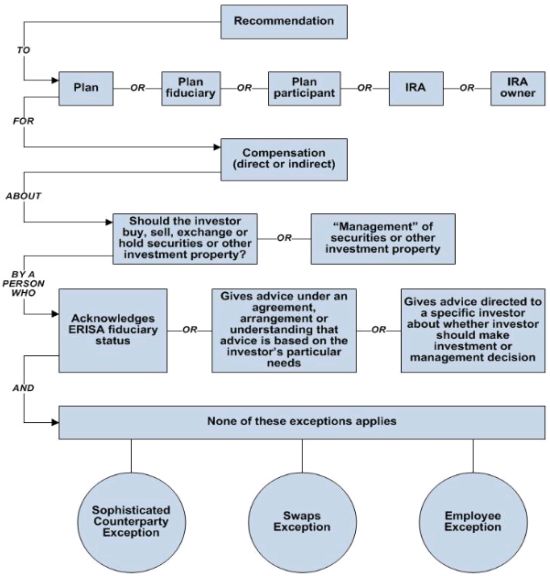

The new rule assigns fiduciary status based on whether the advising party makes a "recommendation" regarding an investment or investment management and receives direct or indirect fees as a result of dealing with a plan, plan participant or beneficiary, plan fiduciary, "IRA" (including certain other savings vehicles) or IRA owner.

What is a "Recommendation"?

The definition of "recommendation" is the lynchpin of the new rule. While there are a few bright line rules about what does and does not constitute a "recommendation," in general the determination is highly fact dependent.

To trigger fiduciary status, the "recommendation" must concern the buying, holding, managing, or selling of securities or other investment property by a plan or IRA. The rule expressly includes as "management" recommendations subject to the rule recommendations regarding account type (e.g., brokerage vs. advisory) and distributions (including the amount and form) from plans or IRAs (such as rollover decisions).

Like the proposed rule, the final rule defines "recommendation" as "a communication that, based on its content, context and presentation, would reasonably be viewed as a suggestion that the advice recipient engage in or refrain from taking a particular course of action." The DOL's framework for analyzing what constitutes a recommendation is summarized in the chart below.

| What is a "Recommendation"? | Principles For Evaluating Potential "Recommendations" |

|

|

| What is not a "Recommendation"? | |

|

As noted above, in the final rule the DOL confirmed that the following activities are not "recommendations":

- "Hire Me": In response to concerns raised during the comment period, the DOL confirmed that recommending oneself or an affiliate to serve as an investment adviser is not investment advice, as long as the communication does not include a recommendation otherwise covered by the rule. While the "hire me" exception may provide helpful reassurance, it likely does not provide relief where a pitch for an adviser's services is combined with a recommendation to buy a particular security (e.g., a pitch to invest in a managed fund).

- Platform Providers; Selection and Monitoring Assistance: A person who markets to an independent plan fiduciary a platform for making and monitoring plan investments is not making a recommendation, as long as the marketing is done without regard to the individualized needs of the plan. The "without regard to" language does not prevent marketing a platform based on objective criteria – such as plan size – as long as the marketing communication does not constitute investment advice. For example, marketing a platform designed for small plans is permissible, as long as the communication does not indicate the platform is appropriate for a specific plan. A person who identifies investment alternatives based on objective criteria (e.g., expense ratios, types of assets) specified by the plan fiduciary also does not make a recommendation as long as the person sets forth in writing certain disclosures to the fiduciary. A response to a "request for proposal" would not be a recommendation if the same requirements are met.

- General Communications: Mass communications including general circulation newsletters, public talk shows, remarks in widely attended speeches and conferences, general marketing materials, and prospectuses, are not recommendations as long as a reasonable person would not view the communication as such.

- Investment Education: Subject to certain limitations, general investment education, including plan information such as fees and expenses, general financial investment and retirement information, asset allocation models, and interactive investment materials are not recommendations under the rule. In providing investment education, parties are permitted to use specific investment alternatives in asset allocation models if the specific investment alternative is a designated investment alternative available under the plan and subject to oversight by an independent ERISA plan fiduciary.

Exceptions to the Definition of "Investment Advice"

The final rule exempts three specific types of communications, which may involve recommendations, from the definition of "investment advice": communications to financially sophisticated counterparties, advice by certain parties with respect to swaps and security-based swaps, and advice by employees or independent contractors of the plan sponsor (or certain other plan-related parties). An adviser or financial institution covered by the rule, who does not otherwise acknowledge fiduciary status, will not be considered an "investment-advice fiduciary" if the requirements for a specific exception are satisfied.

- Sophisticated Counterparty Exception: A counterparty transacting with an independent fiduciary of a plan or IRA in an arms-length transaction is exempt from the rule if the counterparty reasonably believes that the independent fiduciary is a qualified bank, insurance carrier or broker-dealer, or manages at least $50 million, and meets certain disclosure requirements. Unless the DOL clarifies that the exception covers IRA owners managing their own IRA accounts, it does not appear that advice to such individuals is exempted from the final rule. Absent such clarification, parties that do not or cannot rely on the BIC Exemption, such as sponsors of private funds, must avoid making "recommendations" directly to IRA owners about investing their IRAs.

- Swaps Exception: Communications from certain swap and securities-based swap parties interacting with ERISA plans are exempt from the rule if the swap or securities-based swap is covered under the Commodity Exchange Act or the Securities Exchange Act of 1934, the plan is represented by an independent fiduciary, and the retirement investor acknowledges that it is not relying on its counterparty for advice.

- Employee Exception: The rule exempts advice from human resources, payroll or other employees and independent contractors of a plan sponsor (or certain other plan-related parties, such as affiliates of the plan sponsor, the plan or an employee organization) to other employees (in their capacity as employees) or to the plan fiduciary as long as the individual communicating the information does not receive any type of special compensation in connection with the advice. The DOL broadened this exception in the final rule to clarify that employees who regularly create reports and recommendations for their employer's plan or other named fiduciaries of the plan are exempt from the rule to the extent they are operating within the scope of their employment.

The Best Interest Contract Exemption

As noted above, along with the final rule, the DOL issued and amended several prohibited transaction exemptions allowing fiduciaries to avoid falling into "prohibited transaction" rules of ERISA and Section 4975 of the Code. The most important of these is the BIC Exemption. The BIC Exemption gives investment advice fiduciaries an opportunity to continue giving advice that affects the adviser's compensation, which would otherwise be prohibited, as long as they meet a series of conditions aimed at ensuring that the advice they give will be in the retirement investor's "best interests."

When the BIC Exemption was first proposed, many financial service institutions and insurers balked at what were often viewed as onerous, possibly unworkable, requirements. The final BIC Exemption eliminates or simplifies some of the proposed exemption's more burdensome conditions. The final exemption also allows simplified compliance for advice given with respect to ERISA plans (e.g., advice to a 401(k) plan participant about how to invest the plan assets) and certain special advisory relationships.

Consistent with the final regulation's primary goal of protecting retail and other small investors, the most stringent requirements of the BIC Exemption apply when advice is given with respect to IRAs and non-ERISA plans, which lack the enhanced protections afforded by ERISA. The table below describes the various requirements of the BIC Exemption but, as noted above, in some cases these requirements are reduced or eliminated. The second table indicates which requirements apply in which situations.

| Condition | Description |

| Eligible Users of the BIC Exemption | The BIC Exemption can only be used by "financial institutions" and their employees, contractors, agents and representatives, affiliates and related entities. "Financial institutions" include only registered investment advisers, banks, insurance companies, broker/dealers and other entities with individual prohibited transaction exemptions issued by the DOL. |

| Eligible Counterparties |

The BIC Exemption is available with respect to advice rendered to

the following "retirement investors":

|

| Impartial Conduct Standards |

All financial institutions relying on the BIC Exemption must:

|

| Contract Requirement |

In certain cases, the BIC Exemption requires that investment advice

be given pursuant to an enforceable written contract, which must be

available through the financial institution's website. The

final BIC Exemption lowers the associated procedural hurdles that

had been proposed by:

|

| Required and Prohibited Contract Terms |

Where a "best interest contract" is required, the

financial institution bound by it must acknowledge its fiduciary

status in writing, commit to adhere to the "impartial conduct

standards" and give certain warranties regarding conflicts of

interest. A "best interest contract" may not limit the financial institution's liability for a violation of contract terms, force arbitration of individual claims in remote venues or in a manner that unreasonably limits enforcement of the contract, or limit the retirement investor's ability to bring class action claims in court. |

| Anti-Conflict Policies and Procedures | Financial institutions must adopt policies and procedures designed to prevent material conflicts of interest from causing the adviser violate the "impartial conduct standards" or use compensation, personnel or other actions that would incentivize advisers to make recommendations not in the best interests of retirement investors. |

| Required Disclosures | The BIC Exemption has a three-tiered disclosure regime requiring initial disclosures, transaction-based disclosures and more extensive disclosures through a website. Required disclosures include, among other things, the adviser's standard of care, services provided by the advisers, compensation arrangements (including from third parties), proprietary products and material conflicts of interest. |

| Notification to DOL | A financial institution generally must provide notice to the DOL of its reliance on the BIC Exemption. |

| Recordkeeping | A financial institution must maintain records sufficient to enable an examination of compliance with the requirements of the BIC Exemption for a period of six years. |

| Recommendations Involving Only Proprietary Products and Third Party Payments | The final BIC Exemption makes it clear that a financial institution may limit its investment recommendations to proprietary products or to investments that generate third party payments. The BIC Exemption deems the financial adviser to be acting in the best interests of the advisee if it meets certain heightened disclosure and documentation requirements, in addition to receiving no more than reasonable compensation, meeting the ERISA standard of care and otherwise taking prescribed steps to minimize conflicts of interest. |

| No Asset Limitations | The proposed rule would have made the BIC Exemption available only for recommendations with respect to certain asset classes, but the final exemption is available with respect to any asset type. |

Special Classes of Advisers

The BIC Exemption creates two special classes of advice – advice given by "level fee fiduciaries" and advice pursuant to a "bank networking arrangements" – that are subject to simplified compliance requirements as shown in the table below.

Level fee fiduciaries. Level fee fiduciaries are fiduciaries that are paid according at a fixed level (e.g., a percentage of assets) regardless of the advice rendered, provided that the fee is disclosed in advance to the retirement investor. To qualify for the simplified disclosure regime, the fiduciary must document the basis for a recommendation to roll over an account from an ERISA plan into an IRA or switch from a commission-based account to a level-fee account is in the retirement investor's best interest.

Bank networking arrangements. A recommendation of an unaffiliated qualifying investment adviser, insurance company or broker dealer made by a bank employee acting pursuant to an arrangement satisfying applicable regulations is subject to streamlined compliance rules under the BIC Exemption.

Applicability Date and Grandfathered Arrangements

Although the final regulation will generally become applicable on April 10, 2017, the BIC Exemption is subject to a slower phase-in, with full compliance with its requirements not needed until January 1, 2018, if the financial adviser complies with the impartial conduct standards, acknowledges fiduciary status in writing and meets certain other disclosure requirements.

The final BIC Exemption allows advisers and financial institutions to continue to receive fees in connection with a plan, participant or IRA's investment in securities or other investment property as a result of advice given prior to April 10, 2017, subject to certain conditions.

Summary of Applicable Requirements

As described above, the binding written contract requirement does not apply with respect ERISA plans and streamlined compliance requirements apply with respect to advice rendered by "level fee fiduciaries" and under "bank networking arrangements." Applicable requirements under each circumstance are described below.

| Requirement | Advice about Non-ERISA Plan/IRA | Advice about ERISA Plan | Advice by Level Fee Fiduciary* | Bank Networking Arrangements |

| Binding written contract | ✔ | |||

| Written fiduciary acknowledgement | ✔ | ✔ | ✔ | |

| Adherence to Impartial Conduct Standards | ✔ | ✔ | ✔ | ✔ |

| Adopt Policies Limiting Conflicts of Interest | ✔ | ✔ | ||

| Initial disclosures | ✔ | ✔ | ||

| Transaction-based disclosure | ✔ | ✔ | ||

|

Web disclosure |

✔ | ✔ | ||

| Notification to DOL | ✔ | ✔ | ||

|

Recordkeeping |

✔ | ✔ |

✔ means the requirement applies as of January 1, 2018

✔ means the requirement applies as of April 10, 2017 (along with transition period disclosure requirements)

* Additional requirements may apply for transactions involving proprietary products or investments that generate third-party payments.

Other Exemptions and Changes to Existing Exemptions

In conjunction with the BIC Exemption, the DOL finalized a new principal transaction exemption and amended a series of existing class prohibited transaction exemptions. The principal transaction exemption permits an investment advice fiduciary to engage in principal transactions where the buyer or seller is a plan, participant or beneficiary account, or IRA, as long as the transaction involves a permitted investment type (e.g., debt securities, CDs, interests in unit investment trusts and other DOL-approved securities) and satisfies certain other requirements. To comply with the principal transaction exemption, a fiduciary must comply with the BIC Exemption's "Impartial Conduct Standards," adopt anti-conflict policies and procedures, and comply with certain disclosure requirements.

Of the five amendments to various prohibited transaction exemptions, the exemption with the most notable change is PTE 84-24, covering certain transactions involving insurance agents and insurance companies. The final amended version of PTE 84-24 excludes indexed and variable annuities, which will be eligible for relief under the BIC Exemption. Amended PTE 84-24, and the remaining amended exemptions dealing with certain transactions involving employee benefit plans and broker-dealers and banks (PTE 75-1, PTE 86-128), the investment of plans in open-end mutual funds (PTE 77-4), securities transactions where the proceeds may be used to retire certain indebtedness (PTE 80-83), and the acquisition of interests in certain mortgage pools by plans (PTE 83-1) all condition relief on adherence to the best interest standard from the BIC Exemption.

* * * *

While the final rules and exemptions provide welcome relief from many of the most burdensome aspects of the proposed program, the new rules establish a complex new framework and for many will require changes to business practices to ensure compliance. Many important interpretative points remain and will require careful analysis in light of particular facts and circumstances.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.