Article by Matthew Friestedt and Jane Wang*

Under Item 402(t) of Regulation S-K, public companies are required to provide their shareholders with a non-binding vote to approve "golden parachute" compensation arrangements disclosed in their merger- and acquisition-related proxy or consent solicitations. Although the vote is advisory, it provides shareholders with an opportunity to signal whether they approve of executive compensation that is triggered or changed in the transaction context. This article provides an update1 on the discretionary enhancements that companies have made in connection with signing up merger agreements filed with the SEC from May 2013 through April 2014 (the third year since the say-on-golden-parachute vote rules went into effect) and Institutional Shareholder Services ("ISS") recommendations and shareholder voting results in response to such actions. It also provides an update on the size of reported golden parachute compensation relative to the target's equity value for certain transactions that were announced between May 2013 through April 2014.

Among the 169 companies that filed non-tender offer merger agreements from May 2013 through April 2014 and held a say-on-golden-parachute vote, 65 of the companies (or about 38%) adopted executive compensation enhancements in connection with the transaction.2 Relatively common enhancements which generally did not trigger a negative ISS recommendation included: (A) deal bonuses paid on closing (3 out of 17 companies, or 18%, received ISS recommendations against), (B) retention bonuses paid after closing (9 out of 27 companies, or 33%, received ISS recommendations against), (C) new severance entitlements (3 out of 13 companies, or 23%, received ISS recommendations against) and (D) new equity grants (4 out of 12 companies, or 33%, received ISS recommendations against). In comparison, the following enhancements were more likely to receive a negative ISS recommendation: (A) accelerated vesting or payment of performance-based equity or cash incentives without actual achievement of the relevant performance metrics (3 out of 6 companies, or 50%, received ISS recommendations against), (B) cash out of severance, or conversion of severance into a retention bonus or new equity grants, without an actual termination of employment (6 out of 12 companies, or 50%, received ISS recommendations against), (C) recently adopted excise tax gross-ups (2 out of 3 companies, or 67%, received ISS recommendations against) and (D) retroactive salary increases (1 out of 1 company, or 100%, received an ISS recommendation against).

ISS continues to look at a number of factors in determining its recommendation,3 including "recent actions (such as extraordinary equity grants) that make packages so attractive as to influence merger agreements that may not be in the best interests of shareholders" and placing more weight on recent amendments that incorporate problematic features. While certain enhancements are more likely to result in a negative recommendation, ISS appears to be taking a more nuanced view towards golden parachutes. For example, in Actavis, Inc.'s acquisition of Warner Chilcott plc, both the target and the acquiror accelerated the vesting of their executives' stock-based compensation to avoid triggering the 15% "inversion" excise tax under Section 4985 of the U.S. Tax Code as a result of the combined entity's reincorporation to Ireland. The acquiror received a positive ISS recommendation for the say-on-golden-parachute vote, with the ISS report explaining that the accelerated equity represented a small fraction of the total transaction value and that no other problematic features were identified. In contrast, the target received a negative ISS recommendation, with the ISS report stating that multiple problematic features were identified and that the accelerated equity taken together with an existing Section 280G excise tax gross-up raised significant concerns.4

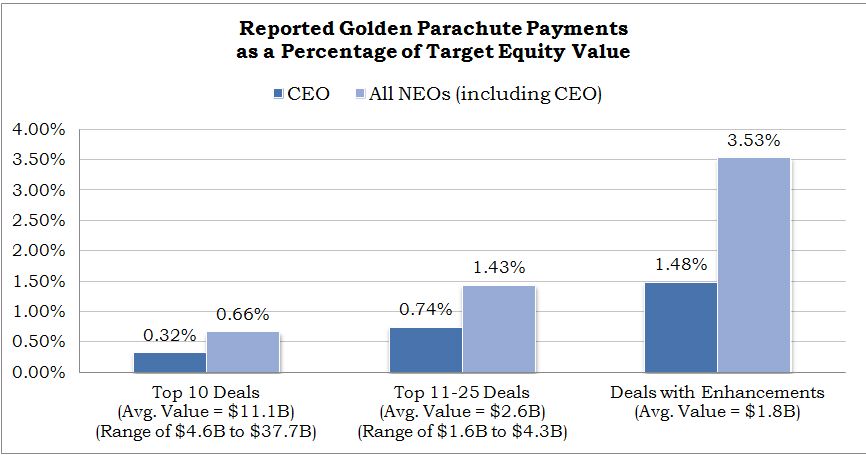

One of the other factors that ISS looks at is whether the golden parachute payments are excessive, either on an absolute basis or as a percentage of transaction equity value. The chart below shows the size of reported golden parachute payments as a percentage of the target's equity value for the 25 largest deals5 announced from May 2013 through April 2014 and the 65 companies that substantively enhanced executive compensation arrangements6:

Consistent with prior years, golden parachute amounts as a percentage of the target's equity value tend to increase as deals become smaller. For the largest 25 deals, only one of the companies reported golden parachute payments that were in excess of two times the applicable average. In contrast, for the 65 deals with enhancements, a meaningful number of companies reported golden parachute payments that were in excess of two times the average (11 companies or 17%, whether looking at the CEO only or at the NEOs as a group).

ISS's recommendations continue to be influential on shareholder voting. Other than the Atlantic Coast Financial Corp. acquisition by Florida Community Bank (where the failure was unrelated to executive compensation),7 each of the companies that received a positive ISS recommendation passed its say-on-golden-parachute vote. Excluding the Atlantic Coast deal, the 44 companies that made enhancements and received a positive ISS recommendation received strong support on the vote with an average pass rate of 87%. In comparison, 2 of the 20 companies that made enhancements and received a negative ISS recommendation failed the vote and the remaining 18 companies received weaker support with an average pass rate of 66%.

While the say-on-golden-parachute vote is an important avenue for shareholder concerns, at this time, shareholder support for the transaction itself continues to remain unaffected by the results of the say-on-golden-parachute vote. Shareholders approved each of the deals with executive compensation enhancements, other than the Atlantic Coast deal. However, the following year's say-on-pay vote could be impacted if the company does not respond accordingly. Of the four failed say-on-pay votes at the following annual meeting, Cynosure, Inc. received a negative recommendation from ISS because it awarded "excessive severance payments and excise tax gross-ups to the CEO of an acquired company [Palomar Medical Technologies] upon his resignation," citing a "lack of responsiveness to shareholder concerns" and "no disclosure detailing any shareholder engagement efforts."

To view the full article please click here.

* Matthew Friestedt is a partner and Jane Wang is an associate in the Executive Compensation and Benefits group of Sullivan & Cromwell LLP.

Footnotes

1 For an analysis of the discretionary enhancements that companies made in connection with signing up merger agreements from April 2011 through April 2013, see "Recent Discretionary Executive Compensation Enhancements and Their Impact On the Say-On-Golden-Parachute Advisory Vote" by Matthew Friestedt and Jane Wang, which was published in the November/December 2013 issue of The M&A Lawyer.

2 Although golden parachute arrangements must be disclosed in connection with acquisitions implemented through a tender offer, there is no related say-on-golden-parachute vote and, accordingly, tender offers were not included in our review of executive compensation enhancements. In addition, our review did not include arrangements where there was no say-on-golden parachute vote because the target was a foreign issuer or where ISS did not produce a recommendation report for the target (e.g., when none of ISS's institutional investor clients held the target's shares at the time of the transaction).

3 For more information on ISS's policy on say-on-golden parachute proposals, see the 2014 U.S. Proxy Voting Summary Guidelines at http://www.issgovernance.com/file/2014_Policies/ISSUSSummaryGuidelines2014March12.pdf

4 Similarly, Perrigo Company provided full gross-up payments for the 15% "inversion" excise tax imposed under Section 4985 in its acquisition of Elan Corporation. Perrigo initially received a negative ISS recommendation, but after discussions with Perrigo, ISS issued an updated positive recommendation on the basis that there was no accelerated equity vesting and the tax savings as a result of the merger "far outweigh[ed]" the costs of the gross-up.

5 In determining the largest 25 deals, we excluded any deals that were announced but for which the merger agreement had not been filed with the SEC as of the date of this publication or for which no golden parachute amounts were reported.

6 In calculating this percentage, we used the reported golden parachute amounts required by Item 402(t) of Regulation S-K and the target's equity value, measured by market capitalization, reported by MergerMetrics.com, ThomsonOne or Bloomberg, L.P.

7 Despite a positive recommendation from ISS, shareholders rejected both the deal itself and the say-on-golden parachute vote. Dissident board members, including the former chairman, sent letters to shareholders arguing that the deal price was too low.

Previously published by the M&A Lawyer in July/August 2015

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.