On June 29, 2015, the Commodity Futures Trading Commission ("CFTC") issued proposed rules ("Proposed Rules") regarding the cross-border application of its proposed uncleared swaps margin rules issued last October. The Proposed Rules are open for public comment until 60 days after publication in the Federal Register, which is forthcoming. The Proposed Rules are available here.

I. Background

In the October proposal, the CFTC included an Advance Notice of Proposed Rulemaking ("ANPR"), but did not propose rules, addressing the cross-border application of the uncleared swaps margin rules. The ANPR requested comment on three possible alternative approaches: (1) a transaction-level approach consistent with the CFTC's Cross-Border Guidance, (2) an approach that is consistent with the approach proposed by the Prudential Regulators1 in their uncleared swaps margin proposal from September 2014, and (3) an entity-level approach that would apply the margin rules at the entity level, without an exclusion.

Under the first alternative, the proposed margin rules would apply to CFTC registered swap dealers and major swap participants that do not have a Prudential Regulator ("Covered Swap Entities" or "CSEs") based in the U.S., other than foreign branches of U.S. banks that were CSEs, irrespective of whether the counterparty were a U.S. person. Substituted compliance, a possible determination by the CFTC that compliance with a foreign regulator's analogous margin rules suffices for CFTC purposes, would not generally be available. Substituted compliance would be available, however, for swaps involving foreign branches of a U.S. bank that is a CSE and non-U.S. CSEs, provided that their counterparties were not U.S. persons.

The second alternative would follow the approach proposed by the Prudential Regulators. The Prudential Regulators would exclude foreign uncleared swaps or security-based swaps of foreign CSEs that would otherwise be covered by their rules if neither the counterparty to the foreign CSE nor any guarantor of either counterparty's obligations is (1) organized in the U.S. or any State, (2) a branch or office of an entity organized in the U.S. or any State, or (3) a CSE controlled by a U.S.-organized entity. For these purposes, a foreign CSE is defined to mean any CSE that does not fall into any of categories (1) through (3) above. Under this definition, foreign uncleared swaps could include swaps with a foreign bank, as well as a foreign subsidiary of a U.S. bank or bank holding company, if the subsidiary is not a CSE. Substituted compliance would be available for CSEs with respect to uncleared swaps that are not guaranteed by a U.S. entity, if the CSE itself is a foreign CSE, a foreign bank, a U.S. branch or agency of a foreign bank or a foreign subsidiary of a depository institution, or an organization operating under section 25A of the Federal Reserve Act or having an agreement with the Board of Governors of the Federal Reserve System under section 25 of the Federal Reserve Act. Substituted compliance would not be available to U.S. CSEs under any circumstances.

Under the third alternative, an "entity-level" approach would be adopted under which the CFTC would apply cross-border margin rules based on the nature of the entity itself, irrespective of whether the counterparty is a U.S. person, but would consider allowing substituted compliance.

II. The Proposed Rules

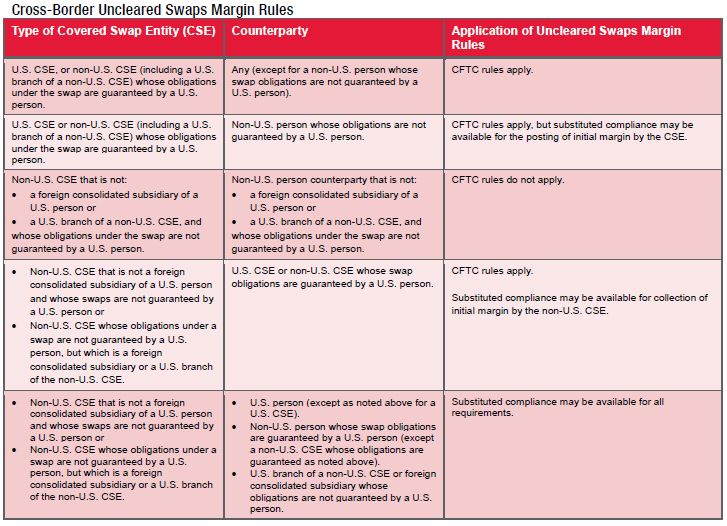

The Proposed Rules represent a hybrid of the entity- and transaction-level approaches and are closely aligned with the Prudential Regulators' approach. Specifically, the Proposed Rules would apply the uncleared swap margin rules at the entity level, meaning that they apply to CFTC registered swap dealers or major swap participants—as entities—that do not have a Prudential Regulator. However, as described below, certain uncleared swaps would be eligible for substituted compliance or excluded from the CFTC's margin rules entirely, based on the counterparties' relationship to the United States relative to other jurisdictions.

A. Application of the Margin Rules to U.S. CSEs

Under the Proposed Rules, the CFTC's margin rules would apply to all uncleared swaps of a U.S. CSE, without exclusion. Substituted compliance would be available in one circumstance only: with respect to initial margin posted by (but not collected from) any non-U.S. counterparty (including any non-U.S. CSE) whose obligations are not guaranteed by a U.S. person. The CFTC believes that, with regard to a non-U.S. counterparty whose swap obligations are not guaranteed by a U.S. person, that entity's local regulator may have an equal or greater interest in the collection of initial margin by the non-U.S. counterparty than the CFTC. The rules differ in this regard from the Cross-Border Guidance, as well as the Prudential Regulators' proposed rules, under which a U.S. CSE would not be eligible for substituted compliance under any circumstances.

B. Application of Margin Rules to Non-U.S. CSEs

The Proposed Rules would apply the CFTC's margin requirements to a non-U.S. CSE if (1) its swap obligations are guaranteed by a U.S. person or (2) its financial statements are consolidated with those of a U.S. "ultimate parent entity" in accordance with U.S. generally accepted accounting principles. The term "ultimate parent entity" means an entity that is not controlled by any other entity in the consolidated group.

Under the Proposed Rules:

- If the non-U.S. CSE's swap obligations are guaranteed by a U.S. person, the applicability of the CFTC's margin requirements would be the same as their applicability to a U.S. CSE.

- If the non-U.S. CSE's swap obligations are not guaranteed by a U.S. person, but its financial statements are included in those of a U.S. ultimate parent entity, (such a non-U.S. CSE, a "Foreign Consolidated Subsidiary"), the CFTC's margin rules would apply in the same way as a non-U.S. CSE that is not guaranteed by a U.S. person and whose financial statements are not consolidated with a U.S. parent entity, except that swaps with such a Foreign Consolidated Subsidiary would not be eligible for the exclusion from the margin rules (see section III below). The same treatment applies to swaps executed by a U.S. branch of a non-U.S. CSE.

- If the non-U.S. CSE's swap obligations are not guaranteed by a U.S. person and its financial statements are not consolidated with a U.S. parent entity, and its counterparty is not a U.S. CSE or a non-U.S. CSE whose obligations are guaranteed by a U.S. person, and the non-U.S. CSE's swaps are not eligible for the exclusion from the rules as described in section III below, such swaps are eligible for substituted compliance (see section IV below).

- If the non-U.S. CSE's swap obligations are not guaranteed by a U.S. person and its financial statements are not consolidated with a U.S. parent entity, and its counterparty is a U.S. CSE or a non-U.S. CSE whose obligations are guaranteed by a U.S. person, substituted compliance would be available only with respect to initial margin collected from the U.S. CSE or guaranteed non-U.S. CSE.

The concept of the Foreign Consolidated Subsidiary was created by the CFTC in response to reports which surfaced last year that U.S. banks were "de-guaranteeing" their overseas affiliates apparently at least in part in order to lessen the impact of the CFTC's regulations through its Cross-Border Guidance on their overseas affiliates' swaps business. It is likely that many such affiliates of CSEs will be impacted by this provision, so long as they are consolidated on the financial statements of their U.S. parent, and are therefore likely to find themselves subject to the CFTC's margin rules. Such affiliates may be eligible for substituted compliance, as described in section IV below.

Another interesting, and potentially controversial, aspect of the Proposed Rules is the treatment of U.S. branches of foreign CSEs, which are treated in the same way as Foreign Consolidated Subsidiaries. This treatment appears to be based on the jurisdictional outlook set forth in CFTC Advisory 13-69, which would apply transaction-level requirements to swaps between a non-U.S. swap dealer and a non-U.S. counterparty, if the transaction is arranged, negotiated or executed by personnel or agents of the non-U.S. swap dealer located in the U.S. Unlike the Advisory, however, substituted compliance may be available for U.S. branches of foreign CSEs with respect to the Proposed Rules.

The Proposed Rules' treatment of non-U.S. CSEs differs from the Prudential Regulators' approach in a number of respects, including that the Prudential Regulators' approach does not include the Foreign Consolidated Subsidiary concept, and also would apply their rules where a counterparty to a swap or a guarantor is "controlled" by a U.S. entity, which is not a concept included under the Proposed Rules.

III. Exclusion from Margin Rules

The Proposed Rules provide for an exclusion from the CFTC's non-cleared swaps margin rules with respect to swaps entered into by a non-U.S. CSE with a non-U.S. person, provided that neither the non-U.S. CSE's nor the non-U.S. person's swap obligations are guaranteed by a U.S. person, and neither counterparty is a Foreign Consolidated Subsidiary nor a U.S. branch of a non-U.S. CSE.

IV. Substituted Compliance

The Proposed Rules would permit a U.S. CSE or a non-U.S. CSE in the circumstances described above that is eligible for substituted compliance to comply with the margin requirements of the relevant foreign jurisdiction in lieu of compliance with the CFTC's margin requirements, provided that the CFTC finds that such jurisdiction's margin requirements are comparable to the CFTC's margin requirements. The CFTC describes its comparability standard as "outcome-based" with a focus on whether margin requirements in the foreign jurisdiction achieve the same regulatory objectives as margin requirements under the Commodity Exchange Act without regard to whether the foreign jurisdiction has implemented specific rules that are identical to the CFTC's rules. The standard, however, after an initial determination that a foreign jurisdiction's margin rules are consistent with international standards, takes the form of an "element-by-element" determination involving 11 elements, where the CFTC would be free to find some elements comparable with its rules, but not others. It remains to be seen how the CFTC would apply its standard in a comparability determination.

V. Definition of U.S. Person

The definition of U.S. person for purposes of the Proposed Rules differs from the U.S. person definition in the CFTC's Cross-Border Guidance. While broadly similar in most respects, key differences include:

- Elimination of the "including, but not limited" language contained in the U.S. person definition in the Cross-Border Guidance. This change provides greater legal certainty for market participants as to who is (and who is not) a U.S. person.

- Elimination of the U.S. majority ownership prong that was included in the Cross-Border Guidance definition for funds or other collective investment vehicles. Market participants have commented that this requirement is burdensome and difficult to comply with.

- Elimination of the requirement that a legal entity owned by one or more U.S. person(s), for which such person(s) bear unlimited responsibility for its obligations and liabilities, be majority owned by one or more U.S. persons.

It is likely that the proposed definition of U.S. person will be welcomed by market participants, as it eliminates aspects of the Cross-Border Guidance definition that created legal uncertainty and were burdensome to implement.

VI. Definition of Guarantee

For purposes of the Proposed Rules, a guarantee is not as broadly defined as it is in the CFTC's Cross-Border Guidance. The rules would define the term "guarantee" in a similar manner to the definition contained in the Securities and Exchange Commission's cross-border rules as an arrangement, pursuant to which one party to a swap transaction with a non-U.S. counterparty has rights of recourse against a U.S. person guarantor (whether such guarantor is affiliated with the non-U.S. counterparty or is an unaffiliated third party) with respect to the non-U.S. counterparty's obligations under the swap. A party has rights of recourse against a U.S. guarantor if the party has a conditional or unconditional legally enforceable right, in whole or in part, to receive payments from, or otherwise collect from, the U.S. person in connection with the non-U.S. person's obligations under the swap. The terms of the guarantee need not be included with the swap documentation or reduced to writing so long as legally enforceable rights are created under the laws of the relevant jurisdiction. The Proposed Rules' definition is narrower than that in the Cross-Border Guidance because it does not include other types of financial arrangements, such as keepwells and liquidity puts, certain types of indemnity agreements, master trust agreements, liability or loss transfer or sharing agreements.

VII.Conclusion

The CFTC's Proposed Rules have a number of provisions that likely will be viewed favorably by market participants, including the greater legal certainty provided for in the U.S. person definition. Other aspects of the rules may be more controversial, including the concept of the Foreign Consolidated Subsidiary, treatment of U.S. branches of non-U.S. swap dealers, and the substituted compliance determination process, which, although labeled an "outcomes-based" approach, may not achieve that with its element-by-element determinations in practice.

Footnote

1 The Prudential Regulators are the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, the Farm Credit Administration and the Federal Housing Finance Authority.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved