Bakken crude oil increasingly heads south as low oil prices erode its competitive advantage in the U.S. East Coast market. The price of WTI crude oil—the benchmark price for most U.S. shale crudes—is moving toward parity with Brent, the international crude price benchmark for grades such as Nigerian Bonny Light that compete with Bakken in the U.S. East Coast market. This reduces the economic incentive for refiners to bring Bakken oil nearly 1,800 miles by rail when they can procure seaborne cargoes of light, sweet crude oil from Nigeria, Angola, and other niche suppliers such as Azerbaijan, which eagerly seek buyers because the U.S. shale revolution largely displaced them from the massive U.S. crude market. In essence, when WTI's discount to Brent falls below $5/bbl, East Coast refiners' incentive to bring in Bakken crude by rail declines because the economics come to favor imported crudes.

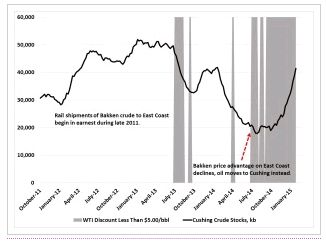

For the past five months, WTI's discount to Brent has been at or below $5/bbl. Accordingly, rail movements of crude from the Bakken to the East Coast appear to be slowing down. As early as November 2014, rail watchers in the Albany, NY area, a key hub for Bakken crude oil trains, noticed that traffic had dropped significantly.1. In January 2015, market intelligence firm Genscape recorded multiple crude oil trains arriving at the Cushing, OK, area for the first time in at least two months.2. While the precise movements of Bakken crude around the U.S. rail system are opaque, the Cushing storage area has seen its weekly crude inventories rise consistently for 13 weeks, beginning in late October 2014, which strongly suggests Bakken barrels are heading south to a much greater extent than before (Exhibit 1).

Exhibit 1: Cushing Stocks Rise as Bakken Crude Loses Competitiveness on East Coast

Source: EIA, Company Reports

Petroleum rail carload data support the thesis that crude volumes leaving the Bakken by rail may have declined slightly as pipelines such as Kinder Morgan's Double H project start up, but more important, rail volumes remain sizeable and are heading south rather than east. According to the American Association of Railroads, U.S. railways moved 15,503 carloads of petroleum and petroleum products in the last week of January 2015, a year-on-year increase of 17%. Yet railcar brokers now report a surplus of oil tank cars, and monthly lease rates have plummeted from $2,450 in January 2014 to only about $1,300 in January 2015—a nearly 50% decline.3.

The fact that more cars are moving but prices per car have fallen so rapidly suggests that the distance those cars are traveling is very likely substantially shorter than it was when wide price spreads between Bakken and imported crude oil justified the long and costly rail journey from North Dakota to the U.S. East Coast. To underline the lost railcar utilization caused by Bakken crude trains moving to Cushing instead of East Coast refineries, note that the distance from EOG Resources's rail loading terminal at Stanley, ND, to Cushing is approximately 1,100 miles, while Stanley to Philadelphia (a key East Coast Bakken crude demand point) is approximately 1,750 miles.4. Thus, the journey to Cushing requires approximately 37% less railcar usage compared to moving the same volume of crude from North Dakota into the Philadelphia area.

Ultimately, the market for crude by rail transportation is similar to that for crude oil itself. Relatively small changes in demand can spark outsized price movements. Unfortunately for Bakken crude producers at the moment, their geographic isolation and relative lack of access to pipelines compared to producers in the Eagle Ford, Niobrara, and Permian mean Bakken crude will continue to sell at a heavier discount. This was bearable when prices exceeded $100/bbl, but as long as prices stay below $60/bbl, Bakken's transportation-induced pricing disadvantage will likely accelerate rig count declines relative to those of other basins.

Footnotes1. Eric Anderson, "Bakken Crude shipments through Albany may be slowing," The Times Union, Nov. 7, 2014, .http://www.timesunion.com/business/article/Bakken-Crude-shipments-through-Albany-may-be-5879384.php

2. Bridget Hunsucker, "Crude train activity resumes at Stroud, OK, terminal as Cushing stocks build," World Oil, Jan. 14, 2015, http://www.worldoil.com/news/2015/1/14/crude-train-activity-resumes-at-stroud-ok-terminal-as-cushing-stocks-build.

3. Jarrett Renshaw, "US oil railcar market collapses as foreign crude makes comeback," Reuters, Feb. 2, 2015, http://www.reuters.com/article/2015/02/02/oil-railway-tankcars-idUSL1N0VB0FA20150202.

4. This is a simple Google Maps measurement. Due to curves and topography, the actual rail distance may be somewhat longer, but the fundamental difference between the Stanley-to-Cushing and Stanley-to-Philadelphia route distances endures.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.