On March 18, 2014, the Consumer Financial Protection Bureau (CFPB) continued its long march toward regulating general-purpose reloadable (GPR) prepaid cards by releasing test model disclosures for prepaid card packaging that are being considered by the CFPB in connection with an upcoming proposed rulemaking. The release comes shortly after the CFPB filed new interview and test materials related to GPR prepaid card disclosures with the Office of Management and Budget, and coincides with an announcement that the CFPB has been engaged in consumer testing of the forms in Maryland and California.

Blog Post on Model GPR Prepaid Card Disclosures

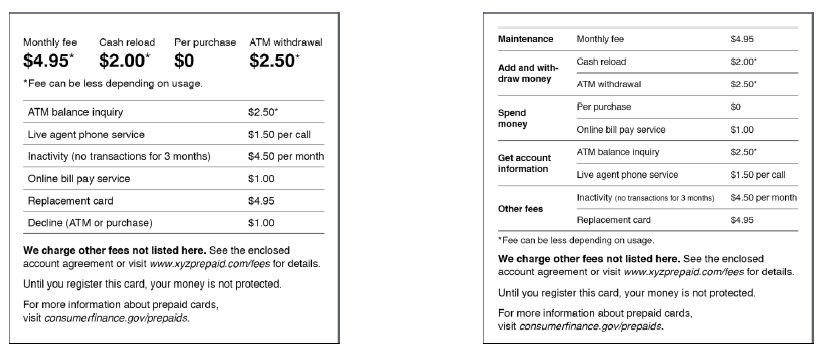

The CFPB's announcement occurred via a blog post containing four pictures of disclosures that appear to be from the back of GPR prepaid card packages. In the blog post, the CFPB juxtaposes those real-world disclosures with two model disclosures the CFPB states it "may propose to be used on the packaging of prepaid cards." While a rule has yet to be proposed, the blog's author indicates that the CFPB believes current GPR card packaging needs to be standardized, and that a lack of uniformity "could make it difficult" for consumers to find information that is important to them and to comparison shop across products. While the blog post does not contain further discussion on what types of fees the CFPB thinks are important, the model disclosures (reproduced below) suggest the CFPB is focused on various types of monthly and transaction fees.

Design of CFPB Screening and Interview Process

The website for the Office of Management and Budget provides additional documents about the CFPB's testing of GPR prepaid card disclosures. The documents include a telephone survey to pre-qualify candidates for in-person interviews, and a script for what appears to be qualitative, in-person testing of three different GPR prepaid card disclosures.

Telephone Survey: The telephone survey asks respondents to specify whether they have purchased a GPR prepaid card within the past 12 months. In addition to referencing types of GPR prepaid cards (Green Dot, NetSpend, RushCard and Bluebird) to help potential participants identify whether they have purchased such a card in the last 12 months, the telephone survey is designed to screen whether a participant has an unrestricted network-branded GPR prepaid card or a card that is limited in its use (e.g., a health savings account card). The survey materials indicate that the testing firm is attempting to identify a diverse response group, including persons who may be underbanked.

In-Person Interview Script: The scripted in-person interview materials contain 53 different questions, with some additional subquestions. The initial interview questions touch on issues other than disclosures, including:

- Reasons for choosing a GPR prepaid card to receive payroll benefits;

- How consumers choose between using GPR prepaid cards, credit cards, debit cards and checks;

- Consumer habits related to reviewing GPR prepaid card accounts, such as checking monthly statements, account balances and transaction history;

- Awareness and use of overdraft programs for GPR prepaid cards and debit cards; and

- Awareness and sufficiency of consumer protections such as FDIC insurance and network fraud protections.

Later interview questions test three model packaging disclosures. Interestingly, none of these model forms match the two model disclosures posted on the CFPB's blog. The interview questions appear to be designed to test whether consumers are aware that other fees may be disclosed in their card agreements, and how likely consumers would be to review their agreements to identify these other fees. The qualitative testing ends with interviewers asking consumers to use a list of GPR prepaid card terms to identify the most important fees to provide on model packaging disclosures.

* * *

Below please find links to the CFPB's blog post and testing materials.

CFPB Blog Post:

http://www.consumerfinance.gov/blog/prepaid-cards-help-design-a-new-disclosure /.

CFPB Testing Forms and Disclosures:

http://www.reginfo.gov/public/do/PRAViewIC?ref_nbr=201206-3170-002&icID=209918 .

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved