The US Commodity Futures Trading Commission ("CFTC") has adopted widely anticipated rules regarding the application of its commodity pool operator ("CPO") regulatory regime to CPOs of registered investment companies ("RICs").1 In what will be a relief to the mutual fund industry, the CFTC has largely deferred to established industry practies. Many observers feared that the agency, having in 2012 replaced a broad status-based exemption for RICs with a narrower exemption dependent on trading limitations, now might impose additional rules on RICs. Instead, the CFTC's final rules provide extensive relief from CPO compliance obligations under Part 4 of the CFTC rules and generally allow so-called "substituted compliance" with corresponding obligations imposed on RICs by the US Securities and Exchange Commission ("SEC"). In other words, for CPOs of RICs, the CFTC has determined to accept compliance with most SEC rules in lieu of the CFTC rules that otherwise might apply.

Highlights of the relief provided by the final rules are as follows:

- Substituted Compliance: Registered CPOs of RICs will be in compliance with CFTC Rules 4.21 (delivery and acceptance of disclosure documents), 4.22(a) and (b) (reporting to pool participants), 4.24 (general disclosures), 4.25 (performance disclosures) and 4.26 (use, amendment and filing of disclosure documents) if they satisfy the corresponding SEC rules applicable to RICs, subject to certain exceptions discussed below.

- Performance Disclosures: In an exception to the principle of substituted compliance, a RIC with less than three years' operating history will be required to disclose the performance of all accounts and pools that are managed by the RIC's CPO and that have investment objectives, policies and strategies "substantially similar" to those of the RIC.

- Third-Party Service Providers: All CPOs (not just those operating RICs) now are permitted to use third-party service providers to maintain their books and records.

I. Background

CFTC Rule 4.5 provides a conditional exclusion from regulated CPO status for the operators of RICs (and several other entities that are otherwise subject to extensive regulation). Effective December 31, 2012, an amendment to CFTC Rule 4.5 imposed significant additional conditions on the ability of the operators of RICs to claim the CPO relief under CFTC Rule 4.5.2Specifically, the amendment incorporated a de minimis commodity interest trading test3 – which is the essence of the registration exemption under CFTC Rule 4.13(a)(3) that is often relied upon by the operators of private funds – and a marketing restriction whereby the CPO may not market the RIC as a commodity pool or other means for gaining exposure to the commodity interest markets.

As a result of these rule changes, many investment advisers to RICs that previously claimed relief under CFTC Rule 4.5 were required to register as CPOs with the CFTC earlier this year. In doing so, however, they potentially could have been subject to duplicative and/or conflicting SEC and CFTC compliance regimes, including overlapping rules regarding disclosure, reporting and recordkeeping obligations. Recognizing that an interim solution was required, the CFTC had suspended the compliance requirements that would have been imposed on CPOs of RICs under Part 4 of the CFTC rules – at least pending the effectiveness of promised rulemaking that would "harmonize" the CPO requirements with the applicable requirements of the SEC4. The CFTC's newly adopted final rules now provide the requisite harmonization.

II. Claiming Substituted Compliance

To take advantage of the substituted compliance regime under the final rules, a CPO of a RIC must make the following additional filings:

- The CPO must file notice of its use of the substituted compliance regime with the US National Futures Association ("NFA");

- The CPO must file the financial statements with the NFA that it prepares pursuant to the RIC's obligations with respect to the SEC; and

- If the CPO of a RIC uses or intends to use third-party service providers for recordkeeping purposes, it will be required to file a notice with the NFA providing information about the third-party service provider and a statement from the service provider agreeing to maintain the pool's books and records. To the extent that a CPO of a RIC fails to comply with its obligations under the SEC administered compliance regime, the CPO also will be in violation of its obligation under Part 4 of the CFTC's rules. Therefore, it could be subject to enforcement action by either or both agencies in respect of a single violation.

III. Other Obligations

Notwithstanding the broad relief under the CFTC's substituted compliance regime, there are several affirmative obligations that CPOs of RICs will need to consider in order to discharge their obligations under the CFTC rules.

a. Performance Disclosure for RICs with Less than Three Years of Performance History

The CFTC will require that the CPO of a RIC with less than three years of performance history disclose the performance of all accounts and pools managed by the CPO that have investment objectives, policies and strategies "substantially similar" to those of the RIC in order to be compliant with CFTC Rule 4.25(c). Although there is no corresponding SEC requirement to prepare this information, the SEC staff has published a guidance update confirming that newly registered RICs may include performance information for substantially similar funds and accounts managed by the CPO in an SEC-regulated prospectus5.

While the disclosure requirement may introduce subjectivity regarding what are "substantially similar" objectives, policies and strategies, the CFTC indicated that disclosure of the performance information is expected to provide materially useful information for market participants about RICs lacking an established performance history. This requirement will come into force 30 days after the date the final rules are published in the Federal Register. CPOs of RICs must begin compliance with the disclosure requirement when the RIC files an initial registration statement with the SEC or when the RIC is required to update and file its prospectus with the SEC. CPOs of RICs with upcoming annual update deadlines must begin, almost immediately, to assess what new information will be required and how to present it.

b. Systemic Reporting

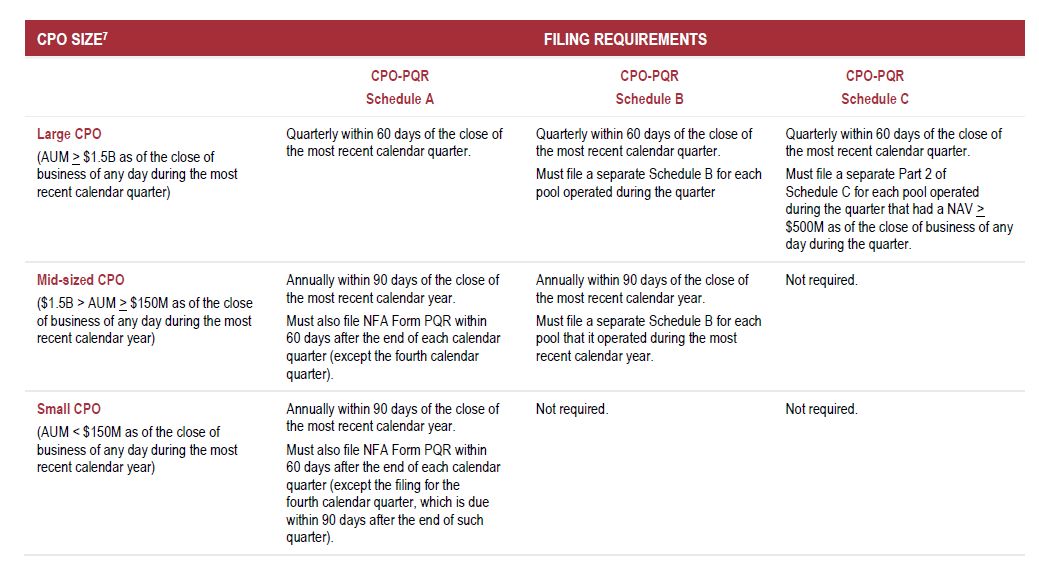

CPOs of RICs will be required to file one or more Schedules of CFTC Form CPO-PQR and, in some cases, NFA Form PQR, each of which requires detailed disclosures regarding the CPO and the commodity pools that it operates. The forms must be filed within the timeframes specified in the chart below:6

These filing obligations will come into force 60 days after the date the final rules are published in the Federal Register. As such, the first filing for many CPOs in respect of their RIC commodity pools will be in the first quarter of 2014. c. Cautionary Statements and General Disclosures While CPOs of RICs are largely relieved from specific disclosure requirements under CFTC Rules 4.24 and 4.25 (provided that they are otherwise in compliance with the disclosure requirements of the US Securities Act of 1933, as amended (the "Securities Act"), the US Investment Company Act of 1940, as amended, and the US Securities Exchange Act, as amended), the CFTC has indicated that the cautionary statement required by Rule 481 of the Securities Act, which alerts investors that the SEC has not approved or passed upon the adequacy of the prospectus, will need to be expanded to include reference to the CFTC as well.8The prospectus, however, need not include the standard risk disclosure statement under CFTC Rule 4.24(b), which includes a general discussion of liquidity, counterparty creditworthiness and limits on the ability to alter the terms of certain swap agreements, given that such risks may not reflect those associated with investments in a RIC. Again, compliance with the related regime administered by the SEC would be deemed sufficient to satisfy the compliance obligations of CPOs under CFTC Rule 4.24.

The new legend requirement will come into force 30 days after the date the final rules are published in the Federal Register. CPOs of RICs must begin compliance with the legending requirement when the RIC files an initial registration statement with the SEC or when the RIC is required to update and file its prospectus with the SEC. For CPOs of RICs with upcoming annual update deadlines this means the new legend must be incorporated almost immediately.

IV. Controlled Foreign Corporations

In its 2012 rulemaking release adopting the amendments to CFTC Rule 4.5, the CFTC declared that it would regard controlled foreign corporations held by RICs ("CFCs") as commodity pools to the extent that they trade commodity interests, and, hence, would subject the operators of CFCs to the CPO registration requirements under the US Commodity Exchange Act, as amended. In its harmonization rulemaking release, the CFTC has reaffirmed its position in respect of CFCs, but has also extended its harmonization efforts to CPOs of CFCs. Specifically, CPOs of CFCs will not be required to file separate disclosure documents under the Part 4 rules if the related RIC provides full disclosure of the CFC's activities under the SEC rules. Similarly, the CPO of a CFC will not be required to file separate financial statements to the extent that the CFC's financials are consolidated with those that the CPO of the RIC files with the NFA.

V. Rule Modifications Affecting All CPOs

In addition to providing relief specific to CPOs of RICs, the finals rules modify existing Part 4 rules applicable to all CFTC-registered CPOs.

a. Updating Disclosure Documents

Under the current rules, a registered CPO must update its pool disclosure documents every nine months. The CFTC amended this timeframe in the final rules and will permit all CPOs and commodity trading advisors to use a disclosure document for up to 12 months before it must be updated.9 Additionally, given that open-end RICs (typically referred to as "mutual funds") may update their registration statements yearly within four months of the fiscal year-end pursuant to Section 10(a)(3) of the Securities Act and SEC Rule 485, the CFTC has determined that the operators of open-end RICs may satisfy their obligation to annually update those RICs' disclosure documents by complying with the SEC's timeframe (i.e., 16 months).

b. Third-Party Maintenance of Books and Records

The Part 4 rules currently provide that a registered CPO must maintain its books and records at its principal place of business. Recognizing current market practices and advancements in technological capabilities, the CFTC has amended this requirement in the final rules such that all CPOs will now be permitted to use third-party service providers to maintain their books and records at an offsite location. In order to take advantage of this, however, the CPO must file a statement with the CFTC identifying the delegate recordkeeper and also must ensure that the CFTC will have timely access to its records.

c. Acknowledgments of Receipt

CFTC Rule 4.21 currently requires a registered CPO to deliver a disclosure document to each prospective pool participant, and to obtain from that prospective participant a signed acknowledgment of receipt before accepting funds from that participant. The CFTC has rescinded this requirement for all CPOs, citing the substituted compliance with similar SEC requirements for RICs and the sophistication of investors in non-RIC commodity pools.

VI. Conclusion

After months of uncertainty and the prospect of being subject to additional, often overlapping and even conflicting regulation, the CFTC's harmonization rules come as welcome relief to the RIC community. It bears noting, however, that the CFTC pointedly indicated throughout its rulemaking release that it reserves the right to evaluate any future SEC rules and guidance issued after the adoption of the final rules for consistency with its own regulatory interests. In other words, it appears that the CFTC will continue to monitor RIC regulation, and it may not have made an open-ended commitment to the principles of substituted compliance.

Footnotes

1. Harmonization of Compliance Obligations for Registered Investment Companies Required to Register as Commodity Pool Operators; CFTC final rule, available at: http://www.cftc.gov/ucm/groups/public/@newsroom/documents/file/federalregister081213.pdf .

2 Commodity Pool Operators and Commodity Trading Advisors: Compliance Obligations; 77 FR 11252 (Feb. 24, 2012), available at http://www.cftc.gov/ucm/groups/public/@lrfederalregister/documents/file/2012-3390a.pdf .

3 The de minimis commodity interest trading test under CFTC Rule 4.5 requires that, at the time that a commodity pool enters into any commodity interest transaction, either (1) less than five percent of the liquidation value of the pool has been allocated to establishing positions in commodity interests, or (2) the aggregate net notional value of the pool's commodity interest positions is equal to less than 100% of the liquidation value of the pool. Under CFTC Rule 4.5, commodity interest transactions that are entered into for bona fide hedging purposes may be disregarded in determining compliance with these tests.

4 The Part 4 compliance rules will apply to CPOs of RICs within 60 days following the effectiveness of these final rules.

5 Guidance Update on Disclosure and Compliance Matters for Investment Company Registrants That Invest in Commodity Interests, available at http://www.sec.gov/divisions/investment/guidance/im-guidance-2013-05.pdf ("Guidance Update").

6 For more information regarding these forms, please see our client alert entitled "Life After CPO Registration: Select CFTC and NFA Compliance Obligations that Lie Ahead" available at: http://www.shearman.com/life-after-cpo-registration--select-cftc-and-nfa-compliance-obligations-that-lie-ahead- 03-11-2013 /.

7 The instructions to Form CPO-PQR include several rules for determining a CPO's assets under management ("AUM") and a pool's net asset value ("NAV"), which are not included in this chart. CPOs should consult the Form's instructions for guidance.

8 The SEC staff specifically stated in its Guidance Update that it would not object to such a legend.

9 Notwithstanding this extension, to the extent that a CPO becomes aware of a material defect in the disclosure document, it must amend and distribute a revised disclosure document to pool participants within 21 days after becoming aware of the defect.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.