With oil hitting a 12-year low below $30 per barrel and with the

volatility and decline of worldwide equities markets during the

first weeks in January 2016, some are warning of a return to the

bleak days at the beginning of the Great Recession.1 In

our April 2014 Commentary "High Yield Debt: Credit

Bubble and Litigation Risks," we warned—perhaps

presciently—that a credit bubble may be forming in the high

yield debt ("HYD") market, including in the emerging

markets ("EMs").2 In particular, soaring debt

levels in emerging markets such as China, Indonesia, Malaysia,

Thailand, Turkey, and Brazil raised concerns about the risks

associated with debt issued from emerging markets.3 Over

the past 18 months, this trend has continued,4 and

concerns about a potential bubble have intensified. The events of

the last two weeks only add further credence to existing fears that

the increasingly volatile HYD market will trigger another global

financial crisis.5

In October 2015, the International Monetary Fund ("IMF")

released a detailed report warning that as "advanced economies

normalize monetary policy, emerging markets should prepare for an

increase in corporate failures."6 In the months

following the IMF's warning, Standard & Poor's

disclosed that global corporate default rates have reached their

highest levels since 2009, with emerging market issuers

representing approximately 20 percent of defaults in

2015.7 At the same time, analysts report that over the

course of the last four years, EM default rates have risen from .7

percent to 3.8 percent, while U.S. default rates have risen from

2.1 percent to 2.5 percent over the same period.8 Some

market participants anticipate that defaults will continue to rise

in 2016.9

This Commentary highlights the legal and economic

challenges that financial institutions—particularly in their

roles as underwriters and/or placement agents for EM debt

offerings—may face in connection with emerging market debt as

significant changes in the global economy continue to develop. This

Commentary also suggests some steps a prudent institution

may now undertake to prepare and protect itself against potential

litigation that experience has shown often follows in the wake of

the market downturns.

The Macroeconomic Environment Suggests a Bumpy Road

Ahead

Over the past six to eight years, issuers in several emerging

markets have taken advantage of the global search for yield to

issue high yield bonds, often denominated in U.S. dollars or euros.

Historically low global interest rates, a strong Chinese economy,

and a strong commodity cycle all aided the rush to HYD issuers in

the emerging markets. But now, a trifecta of macroeconomic

developments portends a significant risk of corporate defaults and

perhaps broader market disruptions as the U.S. raises interest

rates, the Chinese economy falters, and the commodity cycle

turns.

Rising Interest Rates. Rising interest rates will

present substantial challenges in the high yield space as

borrowing/refinancing becomes more expensive for speculative grade

companies throughout the emerging markets. The U.S. Federal Reserve

raised rates in December 2015, and further increases are

anticipated. Normally, expectations of increased rates lead to

higher bond yields, but yields on U.S. Treasury bonds have declined

in recent months.10

A sustained increase in interest rates by the U.S. Federal Reserve

would put downward pressure on high yield bond prices and undercut

interest in this asset class.11 A possible scenario

might see investors pulling money out of emerging markets and

driving up borrowing costs for local companies.12 Higher

interest rates in the U.S. may also prompt investors to shift their

investments, in a so-called "flight to quality," that

could hobble EM issuers looking to refinance.13 Here,

any sharp uptick in capital outflows could disrupt markets as a

result of limited liquidity as investors are unable to find buyers

for the bonds that they wish to sell.14

In Southeast Asia, the effects of an increase in interest rates

could be especially acute. Foreign investors have engaged in much

of the local currency lending, but those same investors are likely

to pull their investments when interest rates rise.15

Thailand, for example, already has high rates of indebtedness, and

further rate movements by the Federal Reserve could lead to a

higher speed of outflows.16 The effects of this

potential sell-off could be compounded by the large wave of

maturities in the coming years from emerging market issuers that

took advantage of cheap borrowing.17 Recent high-profile

defaults in the HYD market, including defaults by a high-profile

Chinese real estate developer that was unable to make interest

payments on its U.S. debt in April 2015, may contribute to growing

investor concern about this market.18

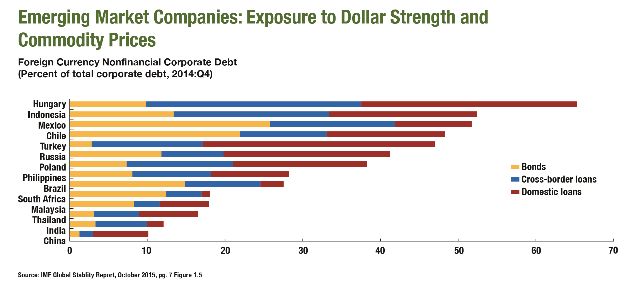

The Strengthening U.S. Dollar. One immediate

impact of these developments has been the relative strengthening of

the U.S. dollar, resulting in higher debt service costs for a

number of emerging market issuers. For example, high-profile

speculative grade issuers in emerging markets such as South Africa,

Turkey, India, China, the Philippines, and Indonesia have all sold

dollar-denominated bonds in recent months.19 Over the

same period, the dollar has gained approximately 7 percent when

compared with emerging market currencies over the last 12 months,

and it has gained even more against the currencies of Brazil and

Turkey.20

In Asia, issuers have tripled their foreign-currency debt from

US$700 billion to US$2.1 trillion during the years between 2008 and

2014.21 Risks from currency fluctuations are especially

noteworthy in China, where a small group of property developers

have, since 2011, accounted for US$41 billion of total outstanding

HYD or 30 percent of all HYD in Asia.22 In fact, these

homebuilders have become the single biggest source of

dollar-denominated HYD in Asia. With maturities and defaults

looming, investors are justified in expressing concern. But these

risks are further exacerbated in countries like Turkey and South

Africa, where high external debt persists amid a dearth of U.S.

dollar-denominated cash flow.23

Issuers that sell their services and products locally and whose

revenues are in local currencies will be most exposed to exchange

rate risks as a stronger dollar leads to more expensive interest

payments on their dollar-denominated debt.24 A

significant change in currency values could lead to bankruptcies

and defaults for companies that cannot manage this increased debt

burden.25

Protective Measures: Managing Litigation

Risks

The 2008 financial crisis has taught us that once the underlying

collateral suffers distress and investors suffer losses, financial

institutions will soon be facing lawsuits engineered by

plaintiffs' attorneys to recover their clients' lost

investments through litigation: asserting claims of fraud,

negligence, incomplete/inaccurate disclosure, breach of fiduciary

duties, and breach of contract.

As noted in our April 2014 Commentary, issuers,

underwriters, dealers, and other participants in the HYD and

emerging markets should review current practices and procedures,

enhance those practices and procedures, and potentially adopt new

practices and policies to protect against the consequences of a

bursting of the HYD bubble. Now more than ever, institutions should

ensure that proper safeguards and procedures are in place to

protect against the litigation risks posed by any potential

downturns in the market.

While participants in the emerging markets cannot fully insulate

themselves from all the detrimental effects of a market failure,

institutions that move early to install appropriate safeguards to

identify, analyze, and address legal risks can minimize litigation

exposure and maximize their ability to move forward toward full

recovery and continued growth.

Four Steps You Should Consider Taking Now

- Assess Potential Exposure. Underwriters and placement agents should begin now to investigate and assess potential exposure to claims asserted by investors in debt issued by emerging market companies. In light of the relevant statutes of limitations, the inquiry should target offerings over the course of the past six years. This assessment should focus not only on onshore transactions but also on offshore transactions that may result in litigation being filed in the U.S.

- Perform Due Diligence. Comprehensive due diligence by both issuers and underwriters can minimize the likelihood that the negative consequences of changes in the macro environment will be a surprise. Understanding the details of an issuer's business model or the complexities of a structured product and how they will be affected by the many risks that are on the horizon is a crucial step in minimizing potential litigation.

- Prepare for Potential Litigation. Institutions with clients around the world have to marshal an understanding of both U.S. law and the laws of multiple jurisdictions to prepare effectively for any potential litigation, particularly in the context of bankruptcy and insolvency proceedings in a wide variety of emerging market jurisdictions. In an accompanying Commentary, we discuss some of the issues presented. The risks highlighted above will affect global markets in different ways, requiring flexible responses and an understanding of multiple legal regimes.

- Engage Counsel Early. Institutions should involve counsel during the earliest stages of any downturn in the market to analyze exposure, evaluate potential claims, and advise on sensitive internal and external communications. The speed with which modern markets move necessitates the creation of a dynamic strategy to deal with legal challenges long before they arise.

Footnotes

1 Timothy Puko and Georgi Kantchev, The Wall Street

Journal, "Oil Prices Tumble Below $30 a Barrel,"

Jan. 15, 2016.

2 Jones Day Commentary, "High Yield Debt: Credit Bubble and Litigation

Risks" at 2 (April 2014).

3 Tom Wright, The Wall Street Journal, "Mounting Debt Bridles Asia," Apr. 22,

2015.

4 See Richard Barley, The Wall Street Journal,

"Yield Hunters' New Tune Echoes Financial

Engineering's Past," Aug. 10, 2014.

5 Matt Egan, CNN Money, "Junk bonds: The next financial crisis?,"

Apr. 20, 2015; Treasury Borrowing Advisory Committee, Presentation to the Treasury: Charge 1, at 12

(released Aug. 6, 2014).

6 Global Financial Stability Report:

Vulnerabilities, Legacies, and Policy Challenges, Risks Rotating to

Emerging Markets, International Monetary Fund Report, October

2015, at 83.

7 Dan McCrumb, Financial Times, "Global defaults climb to 6-year peak of

$95bn," Nov. 30, 2015.

8 Anjani Trivedi, The Wall Street Journal, "Emerging-Market Defaults Rise After Asia's

Debt Pileup," Nov. 30, 2015.

9 Dan McCrumb, Financial Times, "Global defaults climb to 6-year peak of

$95bn," Nov. 30, 2015.

10 Matt Wirz, The Wall Street Journal, "Junk Bonds Find Buyers After Crude's Trip

Down," Mar. 31, 2015.

11 Vivianne Rodrigues, Financial Times, "High-Yield Debt Market Defies Sceptics,"

Mar. 18, 2015.

12 Tom Wright, The Wall Street Journal, "Mounting Debt Bridles Asia," Apr. 22,

2015.

13 Fiona Law, The Wall Street Journal, "Jitters Stifle Asia's Junk-Bond

Market," Jan. 15, 2015.

14 Katy Burne, The Wall Street Journal, "Junk-Debt Liquidity Concerns Bring

Sales," Aug. 3, 2014.

15 Tom Wright, The Wall Street Journal, "Debt Piles Up in Asia, Threatening

Growth," Apr. 21, 2015.

16 James Kynge, Financial Times, "Thailand's credit binge: now for the

hangover," Apr. 20, 2015.

17 Chien Mi Wong, FinanceAsia, "Asia High-Yield to Plough Through Head

Winds," Dec. 10, 2014.

18 Chris Bourke, Vinicy Chan, and Cordell Eddings,

BloombergBusiness, "Major Chinese Developer Says It Can't Pay

Dollar Debts," Apr. 20, 2015.

19 Fiona Law, The Wall Street Journal, "Jitters Stifle Asia's Junk-Bond

Market," Jan. 15, 2015; Chien Mi Wong,

FinanceAsia, "Asian Bond Rush Ahead of Lunar Holidays,"

Feb. 1, 2015.

20 Ian Talley and Anjani Trivedi, The Wall Street Journal,

"Dollar's Surge Pummels Companies in Emerging

Markets," Dec. 30, 2014.

21 The Economist, "Feeling Green," Mar. 21,

2015.

22 Christopher Langner and Lianting Tu, BloombergBusiness,

"We're Just Learning the True Cost of

China's Debt," Apr. 22, 2015.

23 The Economist, "Feeling Green," Mar. 21,

2015.

24 Ye Xie, BloombergBusiness, "As Emerging-Market Debt Crisis Talk Grows, Some

Investors Scoff," Apr. 1, 2015.

25 Neil Irwin, The New York Times, "How a Rising Dollar Is Creating Trouble for

Emerging Economies," Mar. 16, 2015.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.