Over there?

Executives in large companies today are taking a fresh look at global finance operations. As well they should. Some companies that have not moved any of their finance activities offshore probably should. Others may be better served by steering clear.

Meanwhile, early adopters of finance offshoring are pushing to expand their finance globalisation efforts as they look for every efficiency they can find. These finance organisations are shifting more and more activities offshore to countries ranging from India to China and Poland and Chile, and are establishing consistent and integrated systems and processes across the global enterprise.

Which raises these questions: How much is enough? What's the smart move in today's uncertain environment? If you're already operating a global finance function, should you stay where you are, expand, or pull back? And if you're not, is this the time to start?

To identify the different sides of the issue, we talked with CFOs and finance leaders in 51 organisations in 15 countries. Taken together, they represent 10 percent of Fortune 500 revenues. This briefing summarises the results of those interviews.

In brief

Given the drumbeat for offshoring among analysts and advisors, you'd think companies would be feverishly planning to globalise their finance operations.

That's not happening.

Yes, some companies are pushing globalisation for all the value they can get. However, these are the exceptions—only about 20 percent of those we interviewed.

Most companies are approaching finance globalisation without clear plans or timetables. They have moved some transactional functions offshore—and are satisfied with the modest benefits they've received. But that's as far as they've gone.

Bottom line? The transformation to a global operating model for finance is still in its infancy—and it lacks momentum. Although 80 percent of our respondents believe finance globalisation is important for superior performance, most are still in the earliest stages of the process.

CFOs do it better

Globalisation projects led by CFOs themselves deliver more savings than those led by CEOs, COOs or anyone else. That's probably because CFOled programmes tend to come with a roadmap for future improvement. CFOs also appear to focus on more types of shared services and outsourcing opportunities. And they put them together into a more tightly integrated programme.

So, if your company is looking at adopting deep globalisation for its finance operations, the most important thing to keep in mind is simple: CFOs should run the show.

What is more important than where

In the past, many finance organisations focused on a handful of proven locations for offshoring— such as Manila, Krakow and Budapest. However, as the practice has grown in popularity, these high-profile locations have become crowded and less economical.

Finance today has more location options than ever. Almost all of those options are meeting or exceeding CFO expectations. Which means you're free to think about capabilities and risks, not physical location.

Opportunities for action

Transactional

- Accounts payable

- Accounts receivable

- Travel & entertainment

- Payroll

Reporting

Management reporting

External reporting

Accounting

Fixed assets

General accounting

Cost accounting

The great divide

Most companies we interviewed focus on globalising individual processes rather than sets of related processes. For example, many have globalised activities such as purchase-to-pay, order-to-cash, and fixed-asset accounting. As a result, they're capturing savings generated by streamlined, end-toend transaction processes.

But when these processes aren't completed in other parts of the account-to-report work stream such as general ledger accounting, cost accounting, management reporting or external reporting, companies are leaving a lot on the table. This misses opportunities for further improvements in terms of quick, efficient reporting and higher control effectiveness.

This piecemeal approach can result in less than optimal performance while companies with deeper, more integrated globalisation programmes achieve significantly better results:

- The leading performers in our study are able to close their books in as little as four working days, compared with more than 25 days for the lagging organisations.

- Operating costs for the most efficient finance organisations are one-half percent of revenue, compared with 3.5 percent for the least efficient organisations.

- On average, companies that match the efficiency of our leaders could save approximately $5 million in finance costs for every $1 billion in revenue. Companies engaged in deep globalisation have invested in figuring out how to efficiently integrate finance functions across geographical boundaries. They report significantly higher satisfaction with their investments than those who have cherry-picked one or two offshoring opportunities.

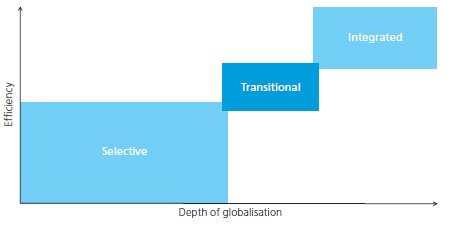

That said, 60 percent of those we interviewed are still in the earliest stages of globalisation, focusing on a handful of targeted operational activities. We call this the selective stage. But the holy grail is the integrated stage, in which outsourced processes dovetail with activities throughout the account-to-report workstream. Outsourcing service providers and continuous improvement initiatives can be a crucial link for companies looking to make this transition.

Talent isn't the driver

Finance organisations that do global sourcing tend to view offshore talent as a low-value commodity. That's not likely to change anytime soon. The crush of the downturn has made talent a buyer's market— even when it comes to highly capable professionals.

That said, globalised finance organisations tend to focus more time and resources on activities such as decision support, management reporting and in-depth analysis— activities that help businesses create value. That takes a special kind of talent—and it's available all around the world.

Among our study participants, leading organisations have more than 70 percent of their full-time equivalents engaged in these valueadding activities, compared with only 8 percent for more traditional finance organisations.

Final thought: Given the importance of international experience in career development for finance professionals today, companies should pay special attention to opportunities to develop, deploy and connect their people in collaboration with outsourcing suppliers.

The road ahead

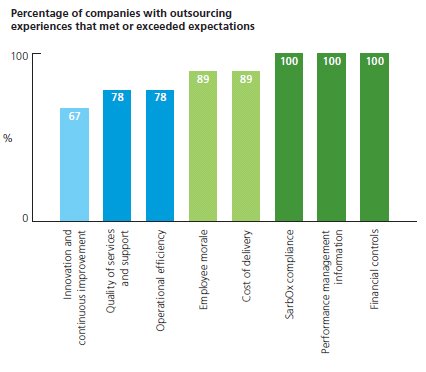

CFOs are uniformly cautious about outsourcing. They worry about reduced service quality, cost overruns, vendor risks and employee morale.

But among companies with practical experience, most fears weren't realised. Their experiences generally met or exceeded their expectations.

Efforts in the areas of innovation and continuous improvement are frequently disappointing, perhaps because outsourcing providers typically have little incentive to invest once a contract is signed. The lesson? What you start with is what you get—so make sure it's right from the beginning.

If you're going to do it, do it right

Globalising finance can significantly reduce operating costs. It also enables finance resources to focus more time and attention on activities that create greater value for the business, such as strategy, decision support, analysis and management reporting.

Companies that have effectively globalised finance have four common elements in their programmes:

- Global processes and systems. They improve and standardise their global processes through redesign and automation, usually supported by global IT platforms.

- Global talent. They tap into the global talent pool, both for commodity services as well as for leadership and management.

- Global operating model. They use a global finance delivery model that provides an optimal mix of services based on cost, location, in-house staffing and outsourcing.

- CFO leadership. Programmes led by CFOs deliver significantly more value than those led by others. Most executives we interviewed said globalisation is part of the future of their finance operations. In fact, 80 percent said that transforming finance into a global function is important to improving performance.

But the same percentage seem to be taking their time through the early stages. The vast majority of companies we interviewed have moved less than half of their finance activities to outsourcing or offshoring. And most are in no hurry to do more.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.