Great expectations hung on the outcomes of the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) meetings in July. The two Boards met on 23 July 2009 to agree on a single measurement basis for the accounting of insurance contracts. However, two significant differences of opinion emerged and there is a risk now that convergence between IFRS and US GAAP could be more difficult.

Unless the two Boards reach an agreement on these differences of opinion in the next Joint Board Meeting on 26 – 28 October 2009, it is likely that each Board will publish an exposure draft containing its selected approach, asking respondents to indicate their preference.

Primary areas of agreement between the two Boards

The work of the IASB and the FASB has progressed substantially on several issues which would represent the foundation of any further convergence debate in the remaining few months of the work towards an exposure draft. Indeed both Boards support the use of a single model for all insurance contracts. They believe that the best model is one using the 'three building blocks' approach to the measurement of an insurance contract; the three building blocks being:

- the undiscounted probability-weighted estimate of future cash flows;

- the effect of the time value of money on a market consistent basis (a decision the FASB only reached at their 21 July meeting); and

- a margin or margins.

Both Boards agree on the fundamental principles informing blocks 1 and 2, including the requirement that they should be re-measured at every reporting date to include the most up to date information, avoiding the "locking-in" of assumptions set at inception. The Boards also agreed that, should the measurement of the liability on day one exceed the amount of premium paid (e.g. an onerous contract), the loss should be taken immediately through income.

Our appendix details all the current decisions highlighting the areas where the Boards share the same view and those where they have now agreed to disagree.

Areas of divergence between the two Boards

The Boards have a fundamentally different view on the objective of initial measurement of an insurance contract. This comes down to the role of acquisition costs in the initial calibration of an insurance contract liability against the price policyholders pay. Stemming from this difference, they are also divided over the nature and purpose of the margins, block 3 in the "three-building-blocks" approach.

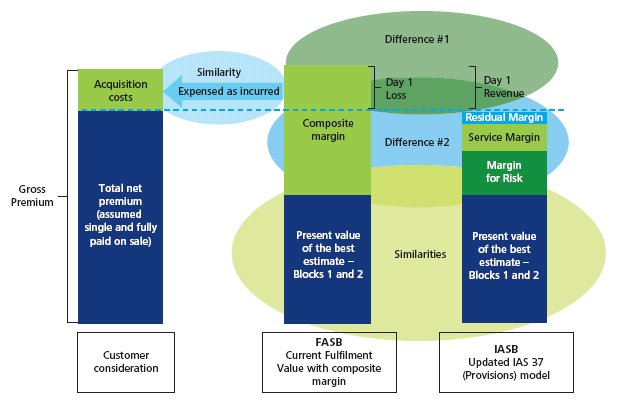

These two differences are considered in more detail in the following paragraphs and illustrated in the diagram below:

Difference 1 – the initial measurement objective and the role of acquisition costs

The first difference of opinion between the two Boards is the fundamental principle that an insurer should apply when first measuring the liability when a contract is sold. In practical terms, the different perspectives crystallise at the point of initial calibration of the insurance contract's liability, i.e. when it is sold and the premium is paid by the policyholder. Each Board see the roles attributed to an insurer's acquisition costs at that point in time differently, as explained below.

IASB's view

The IASB believes that contracts with the same risk should be accounted for at the same amount regardless of how the contract was sold. In arriving at this decision last April, the IASB considered the example of an insurer distributing identical contracts through two different channels with two different acquisition costs reflected in the premium. To arrive at equivalent measurement amounts for the same policy, the IASB requires that the initial liability be calculated by calibrating the three building blocks against the premium receivable after the deduction of incremental acquisition costs. Without such an adjustment, the same liability, sold via a more expensive distribution channel, is likely to produce a higher amount due to the presence of a portion in the premium that the policyholder purely pays to fund the cost of signing the policy with a particular high street broker.

This decision requires the recognition of what we called "new business revenue" (see IAN issue 3). This revenue is capped to the incremental acquisition costs incurred because the IASB (and the FASB) agreed that there should never be an accounting profit from selling insurance. In addition, to assist the objective of consistent application of this principle, the IASB decided that only acquisition costs which are incremental and directly attributable to the insurance contract being measured will be included in the calibration. All acquisition costs, whether incremental or not, must always be expensed through income as incurred, although a portion of those acquisition costs would normally be offset by the "new business revenue" on day one of the contract that we explained above.

The IASB has noted that its decision on incremental acquisition costs is consistent with the general IFRS literature on the subject, in particular with IAS 39, and it is a less arbitrary and complex basis than other definitions of acquisition costs; these characteristics should translate into consistent application of the principle across all IFRS preparers. However, several industry players have suggested that a definition of acquisition costs to include all costs directly related to the issue of the contract irrespective of their incremental nature, would more closely align the IASB principle to the underlying economics of insurance business.

FASB's view

The FASB emphasised the principle of revenue recognition in its analysis. They believe the contract liability should be measured as a function of the revenue that would be accounted for and thus, the initial calibration should be with the amount of the consideration paid since no service has been provided at that point in time.

Incurring acquisition costs has no part in the measurement of the revenue. When the FASB considered existing pricing practices among insurers, they argued that many insurers either charge the same amount for a given risk regardless of the method of distribution or, that any difference does not reflect solely the recovery of acquisition costs. Under the proposed revenue recognition standard, revenue can only be recognised once a service has been performed and, at the point of sale, the FASB argues that no service has been performed. Hence the insurance liability should follow that principle with no revenue recognised on day one of the contract.

However, the FASB agrees with the IASB that all acquisition costs should be expensed as incurred. While many industries have up-front acquisition costs, and there are several instances in US GAAP where deferral is permitted, the current FASB view does not support the deferral of any acquisition costs.

The tentative decisions of the Boards result in an IASB model with day one revenue capped by the amount of associated incremental acquisition costs and a FASB model with no day one revenue (i.e. larger day one loss, with more revenue earned in subsequent periods, all other things being equal) and a larger initial insurance contract liability.

The IASB decision to release day one revenue capped by incremental acquisition costs would mean that insurers' revenue recognition patterns will be determined by their decisions on whether to incur direct or incremental costs to sell their policies.

Difference 2 – nature and purpose of block 3 (margins)

The second difference of opinion between the two Boards is on the nature and purpose of the third block – margins. At the centre of this debate are the different views on the best approach to represent uncertainty of outcomes in financial reporting.

IASB's view

For quite some time now, the IASB has believed that estimation uncertainty should be accounted for on an explicit, current and unbiased basis. It believes that a margin for risk added to the probability weighted net present value of future cash flows is the most appropriate way to address this principle. Its work on accounting for uncertainty within the insurance project has informed the IASB project on all other liabilities where a new model based on the three building blocks will be the core of the updated IAS 37 liability measurement model. As we reported in our IAN issue 5, the IASB agreed in June to establish a clear parallel between the projects, revising general liability accounting and reporting of insurance contracts liabilities. At their pre-joint meeting discussion on 22 July, the IASB only agreed "directional" support of the plan to use the IAS 37 model for insurance accounting. The caveats will be removed only once the IASB Staff have satisfactorily resolved the issues raised so far, particularly on accounting for the margins.

The revised IAS 37 model that received the IASB support is based on the principle of the value to the entity of not having to fulfil an obligation. The measurement is based on entity specific estimates or, where there is a transfer market, the transfer value in the market. However, there are significant differences in the details of the IAS 37 approach when compared to the FASB fulfilment value model. In particular, the IAS 37 model, when adapted to the situation of selling insurance policies, includes explicit margins for risk, profit/service and, in certain situations, also a residual margin.

Under the IAS 37 model as would be applied to insurance contracts, the liability measurement would include a risk margin based on the recognition that an insurer would charge more for a high-risk probability weighted cash flow than for a low-risk probability weighted cash flow.

For example: Contract A has a 50% likely cash flow of CU90 and a 50% likely cash flow of CU10. Contract B has a 50% likely cash flow of CU51 and a 50% likely cash flow of CU 49. Both contracts have a probability weighted cash flow of CU 50; however there is significantly more risk in Contract A. Hence, based on the IAS 37 model, Contract A will have a higher liability due to the recognition of a larger risk margin than would result from considering the estimation uncertainty of the possible outcomes under Contract B.

The value to an entity of being relieved from an obligation would include the estimated costs of fulfilling the contract, a margin for risk (as discussed above) and an element of profit which should be estimated from an entity perspective if no reliable information from a "subcontractor" market exists. This principle in an insurance context would refer to the expected profit an insurer would make from providing any services other than acceptance of insurance risk, the latter being captured already in the margin for risk. Blocks 1 and 2 would include the probability weighted net present value of all the contractual cash flows including both expected claims (risk cash flows) and servicing costs (non-risk or non-contingent cash flows).

This model would apply to all general liabilities accounted for under IFRS. However, for insurance contracts, the IASB Staff proposed an additional step incorporating the previous decision the IASB reached on the initial calibration against the net premium to capture in the total insurance liability any positive amount not explained by the three-building-block valuation. Negative amounts would be taken immediately to the income statement as "day one losses".

At this point in time, the IASB has concluded that risk and service/profit margins should be remeasured at each reporting date. The fine details of this crucial principle and its impact on the resulting accounting profit pattern will be finalised after the IASB's August break.

FASB's view

Consistent with its revenue recognition focussed approach, the FASB believes that estimation uncertainty from the risks of the various cash flows is already accounted for through the use of a probability weighted cash flows estimate. The calibration to the gross premium paid would reflect (to the extent the price does that) the variability of the insured outcomes.

The resulting model is a current fulfilment value (known as "candidate 4" in the list the IASB and the FASB considered at their first meetings in February – see our IAN issue 1) where the active measurement is done for the first two building blocks while the third is determined by the calibration process.

The FASB agrees that its view on the margin results in a third building block that includes all of the components of the IASB proposal, defined as a "composite" margin to reflect its multiple facets.

The FASB has criticised the IASB's approach as one that is not accounting for insurance contracts on a true fulfilment value approach. They argued that the explicit measure of margins for risk and service introduces concepts that are akin to the current exit price approach both Boards rejected as unsuitable for insurance reporting.

As they made their concluding remarks at the joint meeting, the FASB members noted that they have yet to discuss the subsequent accounting of the composite margin. Some of the IASB members observed that in their view, the production of reliable accounting values at dates subsequent to the sale of an insurance contract is the area where they felt the FASB model would fall short of the IASB proposals.

The FASB model would produce a lower liability for onerous contracts as the liability would never include risk or service margins. Where contracts are not onerous the IASB and FASB liabilities will depend, among other things, on the subsequent measurement and earning patterns the various margins would be required to follow.

The IASB has agreed that the risk and service margins would be remeasured at each reporting date; at this point in time, the IASB has not discussed how the residual margin would be earned. Similarly, the FASB has not yet discussed how the composite margin would be earned after its initial recognition.

In particular, both Boards wish to discuss in greater detail the interaction between their proposed margin approaches and the changes in the expected value (blocks 1 and 2) due to positive and negative deviations from the estimate.

The decisions still to be taken on the earning pattern for both the IASB and the FASB margin models as well as their approaches to dealing with subsequent deviations from initial estimates are likely to have significant effects on the overall profit signature from different types of insurance contact. Consequently, the final version of the IFRS for insurance contracts may have a significant effect on the relative pricing of different types of insurance contract.

Other decisions made by the IASB

At its meeting on 22 July 2009, the IASB also decided to require the use of the unearned premium method to account for the pre-claim liability for all contracts which meet all of the following conditions:

- cover 12 months or less;

- no embedded options or guarantees; and

- where the insurer is unlikely to become aware of events which could result in significant decreases in the expected cash outflows.

While the first two conditions are fairly standard for short term general insurance contracts, the third condition will result in significantly different accounting approach between high frequency, low variability risks (e.g. a large book of individual motor policies) and low frequency, high variability risks (e.g. catastrophe policies).

It is unclear whether this decision would result in different accounting profit patterns between insurers required to apply the unearned premium method and those which would not be required to use it. The unearned premium method would require all margins implicit in the initial liability to be earned over the period of cover. The post-claim liability would be accounted for as claims are incurred.

The discussion to date does not indicate whether the post-claim liability would require the recognition of the portion of the residual margin that would not be earned by the end of the cover period if the three building blocks approach had been used. It is also unclear whether the IASB will conclude that a service/profit margin should also be measured for the post-claim liability.

If the unearned premium method is refined so that a part of the residual margin (and service margin if any) is earned after the cover period, the profit pattern among insurers using the two different methods would be consistently reported. However in this case the main benefit of simplifying the accounting via the unearned premium would be substantially removed from the use of the three building block approach for claims incurred from the first year.

If such a refinement to the unearned premium approach is not part of the new IFRS there is a risk that the application of the three building blocks would produce, all other things being equal, significantly smaller accounting profits in the first twelve months of the life of an insurance contract with the opposite being true in subsequent financial periods.

The distinction between the pre-claim and post-claim approach has not posed a significant challenge to the debate to date. However we believe that the decision to require the unearned premium method for a subset of insurance contracts would call for even more careful attention on the consistency between the two resulting profit patterns as well as an assessment of the real benefits of requiring the simpler computation of preclaim liabilities.

The effect of the unearned premium method would potentially mean that residual margins be earned more quickly than under the IAS 37 model, unless the post-claim liability is required to include the portion of the residual and service margins not earned at the end of the cover period under the IAS 37 approach.

Next steps

The IASB Staff have a substantial amount of urgent work ahead of them before the September IASB meeting. They will need to prepare proposals on the accounting principles to be used for the release of margins to income, recommend an approach for the presentation of premiums and claims in the income statement, and finalise the development of the IAS 37 model being used as the base for the measurement of insurance contract liabilities.

The FASB does not take a break in August and it could take advantage of its meetings this month to further develop its own model and also to deal with all the other matters already tentatively decided by the IASB (e.g. renewal and cancellation options or the requirement to use the unearned premium method).

In addition, other important issues will also have to be considered before the publication of the exposure draft, for example:

- the criteria for the selection of an appropriate discount rate;

- how participating contracts will be accounted for;

- whether insurance liabilities should be measured by contract, by portfolio, or on some other wider basis; and

- the assessment of the results of the targeted field testing.

There is much still to do but the Boards are committed to delivering the exposure draft (or drafts) at the end of 2009.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.