Deferred compensation

Restrictions are placed on "nonqualified deferred compensation plans" related to the timing of elections, distributions and funding. If the plan does not comply with the requirements, then amounts deferred are included in income when deferred, or, if later, when no longer subject to a substantial risk of forfeiture, and amounts could be subject to a 20% "penalty" tax. There are some exceptions, mainly:

- Short Term Deferrals – payments made within 2½ months after the end of the year in which the compensation vested.

- Stock Rights – certain grants of stock options and stock appreciation rights.

- Restricted Property – property transfers taxable under Internal Revenue Code Section 83.

- Separation Pay – certain types of separation pay plans.

- Foreign Plans – contributions or accruals exempt from US taxation under an applicable tax treaty.

Several factors are now influencing deferred compensation plans: (i) uncertainty regarding the financial health of companies; (ii) future tax rate increases; (iii) companies focusing on current deductions and (iv) the reduction in overall compensation levels. As a result, companies are looking to alternatives; potentially in the form of providing greater benefits through qualified plans which provide asset security or from the use of plans that would not be subject to the new rules.

Cost reduction

Companies are being forced to look at ways to increase their bottomline. This includes analyzing compensation plans and other employee benefits, including the cash funding requirements of pension plans. This could be achieved by funding plans with alternative assets which have depressed values but which have the potential for future appreciation.

United Kingdom

Tax features

Some headline features of the UK system include:

- Individual tax and social security rates combined at 41% rising to 51% for the highest earners (more than £150,000 per annum) from April 6, 2010.

- Corporate tax rates at 28%.

- General symmetry between the timing of corporate tax relief and the incidence of personal tax charges.

- Favorable capital gains tax rates (18%) with no requirement for long term holding of assets.

- Ongoing tax protections for individuals not domiciled in the UK for tax purposes.

- An increasing focus on counteracting tax avoidance.

Likely trends

While future developments will be driven in part by the changes in the commercial design of compensation packages, it is possible to anticipate some of the tax responses.

Government ownership

The UK has seen a systematic move by HMRC to counter aggressive tax avoidance. This was demonstrated by the announcement in December 2005 of power to use retrospective legislation to counter novel planning structures allied to the anti-avoidance tax disclosure rules introduced at the same time.

As a result, tax planning viewed as "unacceptable" has diminished, which is a trend which is likely to continue in organizations which have traditionally offered high compensation packages where the government has a significant level of ownership. The new high income tax rate may, however, increase the appetite for such planning in other companies.

Corporate tax losses

There is a strong link between allowing corporate tax relief and the recognition of income tax and social security charges.

Many organizations have suffered substantial commercial and therefore tax losses which will insulate them from paying corporate tax in the UK for many years. This offers more scope to deliver compensation in a form which delivers tax protection in the form of the deferral of tax payments or a capital gains tax (at 18%) rather than income tax treatment.

Long term deferral

There are several factors likely to result in executive compensation being delivered over longer term deferral periods. These include:

- For government owned organizations, pressure to defer participation in substantial remuneration until ownership has been reduced.

- Pressure to link executive returns with long term shareholder value creation.

- A resolution to delay paying remuneration until such time as any related risks have been exhausted and to claw back any related losses.

This will have implications for tax structuring. In particular:

- Where changes in tax rates are likely there will need to be detailed consideration of whether deferring tax will be optimal.

- Longer term deferral will give greater opportunities to offer capital gains tax treatment as the essence of the plans will often be to encourage the correlation of executive reward with value growth rather than current value.

- There will also be scope to deliver this remuneration within long term, tax protected deferral vehicles such as pension plans.

Risk capital

There will potential pressure for executives to "put some skin in the game" and invest their own money either through further deferral of compensation or the investment of post tax money.

Where this happens, there will be a focus on:

- Allowing the investment out of pre-tax money.

- Ensuring that relief is given for the costs of borrowing to fund the investment where this is feasible.

- Making returns subject to capital gains tax treatment.

Pension provision

The tax treatment of pension provision changed fundamentally in the UK following "A day" (6th April 2006). As a result, there is greater flexibility in pension provision but also more restrictions, including new limits on tax relief for high earners with effect from April 6, 2010.

This will lead to an examination of increasing (to the extent it remains tax efficient) the pension component of overall compensation, reflecting:

- Reductions in pension values due to falls in global asset values.

- The focus on long term value creation and delivery.

In turn, the scope for allowing self-investment in pensions will be developed. Given that limitations on funding remain a feature of tax preferred UK pension plans, the ability to combine the provision of qualifying pensions with non-qualifying plans to maximize the use of the tax reliefs while linking with the wider commercial and financial objectives of the employer and the executive will increase.

Cost reduction

Focusing tax directors on cost reduction will have greater priority in corporate planning. In the UK, this usually takes one of two broad forms:

- Initiating greater disclosure and co-operation with HMRC to achieve a "low risk" HMRC rating. This has two benefits. First, the level of ongoing scrutiny by HMRC (and the related costs of management time) should be reduced. Second, where errors do occur the imposition of penalties may be less likely.

- Structuring reward to reduce employer tax costs in a manner acceptable to HMRC. An example is structuring pension provision with a direct cost borne by the employer (with no social security charges) rather than through employee funding.

Looking ahead

Executive compensation tax planning is changing in line with more fundamental shifts in global economic patterns and the approach of government, regulators and shareholders to remuneration. These changes are impacting the global economy and are resulting in a response with some degree of consistency between jurisdictions.

This will result in unpredictable changes which will evolve over time. The only certainty is that the future is uncertain. It will be critical for everyone working to stay fully abreast of developments and thinking in what will continue to be challenging times.

FINANCE TRANSFORMATION TYING TAX INTO FINANCIAL REORGANIZATION

As global financial institutions embark on major Finance Transformation projects, tax departments are increasingly participating in these projects with the aim of contributing cost savings, mitigating tax risk and future proofing their systems. Tax processes must be embedded into these new systems in order to realize their full potential.

The features of Finance Transformation include implementations or upgrades of an Enterprise Resource Planning (ERP) system, the creation of shared service centers, post-acquisition integration, centralization and cost center rationalization. These create tax opportunities that can range from changing the business' operating model to the automation of the monthly VAT return process.

In the past, identifying and taking advantage of these opportunities has been difficult as they fell outside of the familiar tax department and accounting systems roles. Tax departments lacked the skills and experience to get deeply involved in Finance Transformation whilst the finance and systems teams generally had a poor understanding of tax and its importance.

Tax's recent higher profile means that companies are waking up to the benefit of extracting tax value from Finance Transformation.

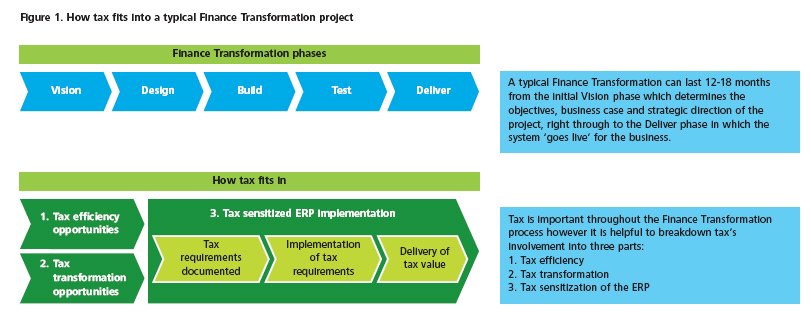

Early consideration of the tax issues and engagement of the tax team will help ensure that the tax value is maximized within a Finance Transformation. Figure 1 illustrates how tax fits into the phases of a Finance Transformation project. Tax impacts the whole Finance Transformation and managing this can be made easier by focusing tax's involvement on three parts: 'tax efficiency opportunities', 'tax transformation opportunities' and 'tax sensitization of the ERP system'.

Tax efficiency opportunities

A Finance Transformation brings with it the opportunity to reconsider whether the current organizational model strikes the right balance between the demands of the business and the global/local tax requirements.

Using the opportunity for organizational change to generate value is perhaps the most familiar area of tax consideration but this has been brought into fresh focus by the challenges faced by the global financial services industry.

Traditionally the location of a shared service center, the structure for cross charging for VAT and corporate tax as well as ensuring the level of analysis in the systems effectively support the tax requirements were the points of consideration. Now, other points of issue are vying for attention:

- The structure of tax reporting on a global basis.

- The measure of profits used in performance management i.e. should bonuses be measured on a pre or post tax profits basis?

- The increasing importance of tax forecasting and the need to reconcile differences between forecasts, actual results and tax return submissions.

These issues cover a wide spectrum of interests, from finance to human resources and will have impacts throughout the business' locations.

Tax transformation opportunities

Transforming tax activity should be an important component of the overall Finance Transformation, as it is an invaluable opportunity to review and redefine the current model. This is the best chance to not only contribute the tax compliance and reporting requirements into the project but also to exploit the wider Finance Transformation's push towards automation and centralization. As a business generates strategies for reducing costs and changing the shape of the finance function, leadership should make sure that tax activities are seriously considered within this agenda.

This approach is well illustrated by the example of financial Shared Service Center's (SSCs). Leading companies now see the set up or expansion of an SSC as an opportunity to include their tax processes as this opens up the opportunity to standardize and automate the activities. Their aim is to reduce the costs and increase the process controls within their tax departments.

An SSC is no longer just the domain of the routine or basic finance activities. Increasingly sophisticated tax calculation tools that interact directly with ERP solutions have facilitated a shift of both the indirect tax and Corporate Income tax return preparation work into SSC environments. There are no compelling arguments against a business considering moving at least some of their tax activities into a SSC.

A company recently successfully moved the VAT compliance for 12 countries into its SSC and so reduced the time spent on compliance and eliminated a costly outsource contract. They accelerated the VAT compliance process (from closing the books to filing the VAT return) by over 30% and generated 50% year on year savings compared to the cost of outsourcing the compliance.

In the above example, the benefits of adopting a specific indirect tax compliance solution extend beyond cost reduction alone. Compared to using spreadsheets, their solution mitigates the risk of exposure to material tax errors and penalties. It also provides full audit trails, cross referencing to the source ERP data, VAT to General Ledger reconciliations, detailed partial exemption calculations and even supports electronic filing of the tax return to the relevant authorities.

Another area of increasing interest within Finance Transformation is how to manage corporate income tax reporting. This is not only to ensure that the current process is supported, but so that the implemented solution reduces the cost of integrating between Tax and Financial reporting.

Global tax accounting solutions are now becoming the choice of many companies in the global financial services industry: especially those with a wide reach or complex organizational structure. As their cost saving benefits become clear, they will become as prevalent globally as they are currently in the US.

A company implementing a global tax accounting solution recently reduced the group tax effort at year end from 200 man days to 60 man days. They are expecting to cut that reduced time by a further 50% once the accounting structures in the ERP and tax accounting system are fully aligned.

Tax sensitization of the ERP system

It is the tax department's responsibility to ensure that the business' tax compliance and reporting obligations are met after a Finance Transformation project is completed. All too often, the complexity of each country's tax requirements is underestimated by the implementers of ERP solutions and this results in a less than perfect solution being rolled out.

Underestimating the importance of tax within the system will lead to process inefficiencies, inadequate reporting and errors in the data. This all pushes up costs and sorting it out entails a difficult post-implementation 'remediation' project to configure the ERP solution more appropriately for tax.

A better approach is to consider the business' tax requirements properly during the process of implementing or upgrading the ERP solution.

A recent example of best practice was a multi-national company aiming to deliver a world-class financial information solution to its businesses in Europe, North and South America and Asia Pacific.

They were motivated to ensure that tax was dealt with correctly because of consistently losing millions of US dollars globally through not being able to defend their positions robustly during tax audits. As such, tax was a key value driver for the project overall.

To deliver maximum value within each region's implementation, tax was managed as its own work stream alongside key teams such as general ledger, accounts payable, accounts receivable, asset management, controls and change management. This ensured that not only were all the tax requirements captured and documented during the project's early stages, but that they were then closely managed through to fruition.

The result is the company now has assurance that the tax requirements are completely addressed in the ERP solution and more importantly, that they have fully realized the tax value held within the business' systems.

Future proofing

The pace of change within Finance is ever increasing and a business' systems need to be set up in the right way to enable them to flexibly adapt to future tax challenges.

Finance Transformations are an excellent time to anticipate and prepare for the future statutory and business needs of the tax department such as:

- The convergence of Accounting Standards globally.

- Common Consolidated Corporate Tax Base (CCCTB) in Europe.

- Wider adoption of electronic filing globally.

An obvious example of this which is occupying companies currently is the new Business to Business (B2B) 'Place of Supply' rules which come in across the European Union on 1 January 2010. These will bring changes to the way VAT is paid for the financial services industry.

The EU is implementing changes designed to ensure that VAT accrues to the member state where the services are used. This will require VAT to be charged on B2B supplies of services at the place where the customer is situated. Suppliers will be required to include the services supplied to business customers in other member states on their European Community Sales Lists (ESL) while customers will need to ensure they've correctly accounted for VAT on the reverse charge.

Affected businesses who are currently involved in Finance Transformations should be using this as their opportunity to make the necessary changes to their billing systems, accounting systems and current ESL reporting.

The things to remember

In conclusion, there are significant benefits to be gained from a timely intervention by tax in the Finance Transformation process. If your business is about to embark on a Finance Transformation then there are five things that you should always remember to ensure that the transformation is a positive experience and the business' tax requirements are fully accommodated at the end.

1. Don't wait to be asked: Early engagement in a Finance Transformation is essential to avoid real problems further down the line.

2. You're an asset to the business: Tax can contribute real value to a Finance Transformation project – whether it's through process efficiencies, the mitigation of tax risk or the implementation of tax efficiencies. It is a mistake to view tax as burden on a Finance Transformation.

3. Stay ahead of the curve: Tax efficiency and transformation opportunities need to be thought about and discussed before design and build of phases of a program get underway.

4. Now's your chance: Finance Transformation brings the opportunity to enhance tax systems, processes and controls, and save costs within a central project budget.

5. Keep engaged: Decisions that directly affect tax will be made throughout life of a Finance Transformation. It is vital that tax's interests are represented at every stage and tax leadership should be looking to provide dedicated resource to the project.

UPDATING TRANSFER PRICING MODELS INCREASING THE FOCUS ON INTELLECTUAL PROPERTY

From increased documentation to attribution of profits, transfer pricing continues to be top of mind at global financial institutions. All forms of intra-group transactions need to be considered from a transfer pricing perspective, but one significant area that has traditionally been given less attention in the financial services industry is intellectual property. However the pressure to update transfer pricing models to the new environment provides an opportunity to fix that.

Transfer pricing is an issue with which most CFOs will be familiar. All forms of intra-group transaction need to be considered from a transfer pricing perspective, but one significant area that has traditionally been given less attention in the financial services industry is intellectual property. The IP used within the financial services industry generally falls under (but is not limited to) the categories of software/IT platforms and brand.

There are many reasons which might explain the relative lack of focus on IP transactions. For one, the sine qua non of financial services companies is the provision of potentially high value services to customers and the assumption of risk. While brand may have value and software may have an important – though ancillary – function, the view of many within this industry is that it is people functions and capital that are the primary value drivers for the industry. Accordingly, the transfer pricing of transactions involving services and capital have gotten the lion's share of attention and focus.

A second reason is that the tax authorities in the major financial centers have, in general not yet paid as much attention to the transfer pricing of IP in the financial services sector as they have in other industries. However, with the recent release of the OECD draft report on business restructurings, and the new US transfer pricing regulations on cost sharing (i.e., the transfer pricing of jointly developed intangibles) tax authorities around the world appear to have sent a signal that IP will be an increasing area of focus.

Increasing compliance focus

From what has been observed outside the financial services sector in recent years, IP transactions have arguably become the single largest area of transfer pricing challenge globally. Given the increasing awareness tax authorities have of such transactions in the wider economy and the increasing pressure to generate tax revenues in the current economic environment, there would seem to be a distinct possibility that going forward, tax authorities will seek to focus greater attention on IP transactions in the financial services industry. Indeed, we have already observed a greater number of instances of the IRS, HMRC and other tax authorities enquiring into financial services IP transfer pricing issues.

For example, it has been noticed that the IRS is increasingly challenged the pricing of software and platform development within the industry. For the most part, financial institutions have tended to recharge software development costs under either a cost allocation arrangement or a cost-plus pricing methodology. In the context of the new US cost-sharing regulations, the IRS is providing itself with more tools to assert that US entities have developed valuable IP for which they should be rewarded with a greater share of the operating profits generated by the businesses in which this technology is deployed. Such a charge might for example, take the form of a sales-based royalty. The technical arguments in this area are complicated and the risk of such a challenge will vary significantly depending upon the facts and circumstances of the technology and the use to which it is being put.

However, this emerging trend quite clearly points towards an increasing need for taxpayers to consider whether their IP transfer pricing transactions are arm's length. As with many transfer pricing issues, there is a first mover advantage. It is better to set the narrative yourself than to allow tax authorities wide latitude to interpret your facts with the benefit of hindsight.

Does your company have significant IP? How can you assess this? Beyond a qualitative assessment of your company's marketing materials – which may over emphasize the value of your IP in an effort to impress customers or investors – it may be useful to consider quantitative indicators of IP. As an example, consider the table below, which shows the level of annual R&D expenditure by software companies, averaged over the last three years. While cost is not necessarily an indicator of intangible value, the table below might help you assess whether your software spend is sufficiently large that a closer investigation of your IP transfer pricing is warranted.

The importance of branding within the financial services industry should not be overlooked either. Branding is a tricky issue for financial services firms. Does use of a brand name help a company to earn higher profits or to operate at lower costs? Does a brand's value in one tax jurisdiction translate to similar (or any) value in a different tax jurisdiction? How quickly does a brand's value deteriorate? In short, determining whether an unrelated party would pay for the use of a company's brand and if so, the amount that they would pay, is very sensitive to the facts and circumstances under which a company operates. As with software, it is probably prudent for taxpayers to investigate and address the transfer pricing of brand and similar intangibles before tax authorities start asking questions about these types of related party transactions.

Running in parallel to the trend of increasing tax authority scrutiny, are the obligations arising from FIN 48. In assessing whether the benefit taken in the accounts is appropriate, auditors will generally expect to see some form of documentary support for the transfer pricing policies adopted. This will often apply even if the policy is that no charge for the use of IP is appropriate and the support exists merely to demonstrate that such a policy is appropriate. Taken together with the increased focus of the tax authorities in this area, it would appear that the transfer pricing of IP should get more attention than it has in the past.

Strategic opportunities

Consideration of transfer pricing should not of course be restricted simply to compliance and documentation. As traditional tax planning opportunities are restricted, principles-based transfer pricing is an increasingly important tool for legitimately increasing tax efficiency within multi-national groups. This is of particular relevance within the financial services sector given the significant tax losses generated in recent times.

As companies reconsider (or perhaps consider) the transfer pricing of their IP transactions, the changing rules and increased levels of guidance on the pricing of intellectual property may provide taxpayers with the opportunity to make a virtue of necessity. Some companies may find that they should charge their affiliates more for IP in the future than they have in the past. To the extent that IP owners are also residual risk takers, this may provide taxpayers with the ability to use transfer pricing principles to bring income into entities that have net operating losses, while simultaneously increasing compliance with the most recent transfer pricing guidance regarding IP.

There is a range of issues and approaches that companies may want to consider in their IP transfer pricing. At the more basic end of the spectrum, careful thought should be given to ensuring that any new IP is developed and owned from a tax-optimal location. A more complex variant on this option might involve shifting the functionality associated with developing and maintaining IP, such that the location of ownership is gradually migrated over time with no exit charge being triggered.

At the more complex end of the spectrum, companies may want to consider an immediate migration of IP to an entity in a different tax jurisdiction (perhaps because the existing IP owner is not the entity with significant trading losses available for utilization or maybe because the desire is to quickly get the IP into a lower tax jurisdiction). The current environment may make this an attractive option, particularly given that asset values are currently relatively low and there may be the possibility of sheltering any gains against capital losses. However, it should be recognized that any such migration would need to be accompanied by real and significant transfers of functionality, along with detailed consideration of the implications of the recent OECD business restructuring draft and US cost-sharing rules.

A point worth emphasizing is that whilst indirect tax considerations are of critical importance in the context of charging for the use of IP, the added complications which arise are by no means insurmountable. By working closely with indirect tax experts to define intra-group pricing policies, it is often possible to devise arrangements which are efficient from both a transfer pricing and indirect tax perspective.

Conclusion

The transfer pricing of IP is an area which has not traditionally been the focus of either the tax departments of financial institutions or tax authorities. However, Deloitte member firm experience in the marketplace indicates that this is starting to change. Coupled with the need to comply with FIN 48, there is an increasing need for companies to consider whether they are adequately addressing their IP transfer pricing policies.

The compliance obligation to address the transfer pricing of IP may also coincide with opportunities to align the company's transfer pricing policies with its strategic tax objectives. In short, there may be opportunities to do well by doing good. There may be a number of alternative options available with varying degrees of complexity, but these opportunities should not be missed.

Footnotes

1 "Expecting the housing market to crash soon" CEBR, March 16, 2009

2 "International tax review", January 27, 2009

3 thedeal.com, December 15, 2009

4 In order to minimize any accounting volatility it is expected that the guarantee fee will be structured as a guarantee fee (recognized on an accruals basis to match underlying loan assets held on an accruals basis) and a derivative (which is fair valued for accounting purposes to match the underlying assets which are also fair valued for accounting purposes).

5 'Transfer Pricing Architect was used to analyze financial statement information for this set of 20 companies with sales in excess of $1 billion and which sell/license software to third parties. While these types of companies might reasonably be expected to own software or other information technology products with intangible value, Deloitte Tax has not separately evaluated any intangible property which these companies may own. Moreover inclusion in/exclusion from the set of companies is not intended to imply that Deloitte Tax has a definitive view on the value of intangible property owned by these or other companies.'

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.