FOREWORD

Some 18 months ago we launched our report "An appetite for change: Eat, drink and be ready" which provided a unique insight into changing consumer needs and preferences and examined the resulting challenges and opportunities facing the food and beverage industry. The key themes included carbon footprint and the environment, good nutrition and health, ethical sourcing and the continuing focus on food safety.

None of these have gone away, yet so much has also changed in the wider economy and within the industry. This, our latest report describes the rapidly shifting landscape and identifies the issues and choices facing businesses looking to successfully navigate the downturn and emerge as future industry leaders.

The Food and Beverage team at Deloitte hope you find this report insightful and useful and we look forward to having the opportunity to discuss its implications for your business.

EXECUTIVE SUMMARY

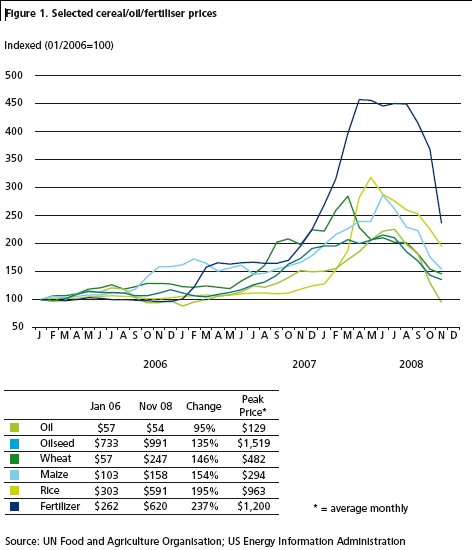

2008 was a tumultuous year for businesses in the food and beverage sector. In the first part of the year food commodity prices soared, driving food price inflation sharply upwards.

Demand had outstripped supply for a number of years driven by global population growth and increasing affluence in the developing world. The removal of price intervention in the US and EU had also made a major contribution to declining inventories of key commodities. 2008 saw a tipping point. The market did the rest, fuelled by fears over security of supply and active speculation in commodity futures.

By August 2008, food commodity prices had peaked and since then have been falling. A strong cereals harvest in 2008 boosted grain stocks and the global economic downturn helped soften demand for both oil and food. These falls are now flowing through into a dramatic reduction in food price inflation and the beginnings of real price reductions for the consumer, with the weakness of the pound limiting the extent of real price deflation for UK consumers.

Just as food price inflation began to ease, the credit crunch started to impact economies around the world with the UK in the front-line. This has presented businesses with a new set of challenges. Disposable incomes are being squeezed and consumer spending is in decline. Consumer confidence is at an all time low and even better off individuals are spending more cautiously. The number of companies failing is mounting and unemployment is rising rapidly.

The recession is not just impacting how much money consumers spend but also the way in which they spend it. Footfall in discount grocers is rising and many shoppers are trading down, for example from more expensive convenience foods to economy products and cheaper raw cooking ingredients.

The numbers of covers and average spend in restaurants are falling, but at the same time, sales of some premium products in supermarkets are rising as consumers treat themselves at home instead of going out. People are still spending money, but their priorities are changing, with price and value increasingly central to the choices they make about where to shop and what to buy.

In this more challenging environment, competition is tough and pressure on margins accentuated. Food and beverage businesses must think carefully about how they engage with consumers and shoppers to secure their share of available spend. Companies must consider the different ways in which people obtain and use the information that informs the choices they make. The influence of traditional 'push' media such as television advertising is diminishing. The power of 'pull' media such as the internet is growing fast and transforming the relationship between business and consumer.

Crucial to this process is ensuring a strong link between the stimuli consumers receive outside the store and what they are receptive to in store, particularly with promotions being an increasingly important part of the marketing mix in both retail and hospitality. Closer collaboration for example between retailers and manufacturers will be important. For manufacturers, the traditional barriers between marketing and sales need to be broken down quickly in a more shopper and point of consumption centric approach to demand stimulation and management.

Longer term challenges lie in wait

Although the recession has helped dampen commodity prices for now, businesses must prepare themselves for ongoing volatility in the markets. Food and oil prices will almost certainly rise again in the future as the global economy recovers and the world's population continues to grow. Food and beverage businesses need to give careful thought to their sourcing strategies and relationships with key suppliers.

Unsurprisingly, the combination of the recession and volatile commodity markets has resulted in a sombre mood among many of those operating in the food and beverage sector. Research we conducted at the end of 2008 demonstrates that the vast majority of companies believe consumer confidence is worse than a year ago. They also think the economy will deteriorate further over the coming 12 months.

In facing up to today's challenges, there is no "one size fits all" recipe for survival, prosperity and future market leadership for companies in the food and beverage industry. That said, there are a number of areas that businesses should think about when developing strategies appropriate to their particular situation.

The first is strengthening the balance sheet, which focuses on sources of funding and cash management to improve liquidity. The credit crunch means many banks are reluctant to provide new lending or even renew existing facilities. As the economy has slowed, more and more businesses are challenged in servicing their debts and ensuring adequate working capital. Tackling this may, for example, require debt restructuring, recapitalisation and new approaches to supply chain finance and trade credit insurance.

The second area is optimising trading performance, which focuses on 'how to win' in the current market – maintaining and growing market share with reduced resources. Priorities include improving the effectiveness of market spend; optimisation of pricing and promotions: a sharper focus on customer and product profitability; range simplification; and product value engineering. General housekeeping – such as back office costefficiency and managing the effective tax rate of the business – has a role to play, too.

The third area is about laying the foundations for future success in the medium term, for example in a 2012 timeframe. This is about being clear about both "where to play" and "how to win". Businesses will need to consider, among other things, re-evaluating strategies relating to channel, category and geography focus; integrating marketing and sales in more shopper centric approaches; focusing innovation on changing customer and consumer needs; and developing longer term sourcing strategies to secure supply.

Finally, building confidence among stakeholders is crucial. This includes motivating managers and staff during the downturn; managing shareholder interactions and expectations; and both reassuring and collaborating closely with suppliers and other business partners.

Ultimately, the companies and brands that do well in the future will be those which track and anticipate changing consumer needs and preferences and engineer the right value propositions for their customers and consumers. Most consumers will feel less well-off for the foreseeable future and falling commodity prices risk contributing to a deflationary dynamic in the economy. Success will depend on being more granular and agile in understanding how the market is changing and targeting different consumer groups accordingly.

Many businesses will use this market to their advantage, anticipating and responding to consumer needs, capturing share and being ready for the recovery fitter, leaner and with healthier margins. In the conclusions to this research report, we share the ingredients for such success.

SETTING THE SCENE

To call the past year turbulent would be an understatement. A combination of economic factors has conspired to make life tough for those who manufacture food and drink, those who sell it and those who consume it.

In the first half of 2008 the value of key food commodities rose sharply, impacting businesses and individuals alike. Factory gate prices increased, the cost of food and drink in stores and foodservice outlets followed suit, and consumers began to feel it in their pockets.

Later in the year commodity price pressures began to ease but by then the financial meltdown that resulted from years of irresponsible lending had hit the financial markets and was spreading to the real economy. Consumers were bombarded with messages of doom and gloom. The credit crunch increased the cost of borrowing dramatically, or rendered it virtually unavailable. House prices began to fall, adding to the general sense of economic woe. It all amounted to a "perfect storm" in which the cost of food and other products was rising, and consumer confidence and spending power were in sharp decline.

On a more positive note, inflationary pressures from commodity prices have now eased – the oil price has fallen and food price inflation has gone into reverse for now. However, the underlying factors which drove prices up in the first place have not gone away and a weaker pound, while good news for exporters, will impact the cost of imported foods. The price of key commodities, while much lower than the peaks seen previously, will most likely remain volatile and all against the backdrop of the economic downturn.

This has major implications for companies operating in the grocery and foodservice sectors, presenting both supply-side and demand-side challenges. It means businesses must respond to weakening consumer spending power and shifting consumption patterns while at the same time paying close attention to costs. It will inevitably translate into tough price competition between retailers and greater margin pressure on suppliers, creating a challenging environment for food and drink manufacturers.

Why has this happened?

The cost of basic food commodities rose sharply because demand growth had exceeded supply growth for a number of years and inventories of key commodities had fallen progressively. Global demographics were largely at the root of this.

Global population growth continues to increase demand for food generally, with a net increase of 70 million "new mouths" to feed added each year worldwide. Meanwhile, the rapid emergence of a relatively affluent middle class in key developing economies such as China, India and the Middle East has increased demand for high value foods traditionally popular in the West. Analysis by the World Bank indicates that an increase in daily food expenditure from £1 a day to just £5 a day in the developing world results in rapid growth in demand for basic agricultural commodities as people eat more meat and dairy products. Given that, for example, it takes 8kg of grain to produce 1kg of beef, it's easy to see how increasing affluence in the developing world can result in enormous pressure on global supplies of cereals.

Other socio-political factors have played a part, too. The removal of price intervention in the European Union and in North America has ended phenomena such as the so-called "butter mountain". This eradicated incentives to over-produce, but has also left inventories at record lows. Five years ago, there were 18 months of grain buffer stocks in storage; by early 2008 there were just a couple of months of stocks. The balance of power in the market switched suddenly from buyers to sellers and a vicious upward price cycle ensued as retailers, manufacturers and even governments scrambled for supply.

Furthermore, subsidies in some parts of the world designed to encourage bio-fuels production have diverted precious agricultural capacity away from food production. Climatic events have also adversely affected supply. Droughts in Australia, for example, have impacted grain production severely. Another aggravating factor was the spiralling cost of oil, something that impacts directly on all parts of the food supply chain from farm to fork, from the farmers heating their chicken sheds, and buying fertilisers to the distribution of food to the supermarket.

With all these factors combined, the increase in food manufacturer input costs through 2008 averaged around 20%. For food retailers, the equivalent figure was around 7%. Food price inflation for the UK consumer peaked at around 14% before it started to fall back.

The outlook for food prices

Commodity prices have fallen dramatically since their peaks in mid 2008. According to estimates from the Food and Agriculture Organisation (FAO), the world cereal harvest rose to record levels last year, up 5.7% on 2007, boosting supplies.

This was thanks to favourable weather conditions and higher prices, which encouraged increased planting. Softening demand for fuel and food during the global economic crisis, particularly in the developing world, also contributed to easing the demand/supply equation and puncturing the commodity price bubble that had been exacerbated by speculation in futures markets.

Going forward, the short to medium term outlook is for lower but volatile food prices. The intense competition between UK grocers will ensure that, as input costs for manufacturers fall, these are passed through to retailers and then on to the consumer. However, unlike the Eurozone countries, where commodity price falls will most likely translate into real food price deflation in 2009, UK food prices will probably be prevented from falling further because of the relative weakness of the pound and the importance of imports in the overall mix of what we consume. In a way this will prove to be an advantage to UK retailers over their continental European peers, who will need to manage the hugely challenging cycle of deflation, followed by a return to inflation and all that means in terms of coping with the resulting shopper mind-set change.

The respite provided by falling commodity prices will almost certainly be, at best, medium term. Firstly, the effect of governments pumping huge amounts of liquidity into the global financial system will inevitably be inflationary once the economy begins to show signs of recovery. Secondly, despite recent falls in the price of oil, the long term forecast is for the cost of energy to rise again, most likely with repeated cycles of price spikes fuelled by the futures markets. The International Energy Agency predicts global demand for energy to increase by 50% by 2030.

Thirdly, although the financial downturn is impacting economic growth now, and thereby weakening demand for commodities, there is no long term prospect of an end to the growth in the middle class and rising incomes in developing economies. Finally, in spite of last year's bigger harvest, future harvests will need to continue to improve dramatically to meet growing demand for cereals. The FAO estimates that world food production will need to rise by 50% by 2030 and double by 2050 to feed the world's population, which will surge from six billion people now to nine billion over the next four decades.

A growing global population doesn't just mean more people to feed. The ensuing greater demand for food, water and fuel will place added pressure on ecosystems, making it difficult to halt, or reverse global warming. The general consensus is that we are doing too little too late. This, will therefore result in the unpredictable weather patterns, from severe droughts to catastrophic flooding, which can devastate harvests. The problems created by human-influenced climate change are unlikely to be resolved, in spite of governments' best efforts, and this will put significant pressure on food supplies.

In addition, new challenges are emerging all the time. The decision by the European Parliament to ban 22 pesticides deemed harmful to health is one example. Politicians and farmers in the UK have warned this will make some crops more difficult and more expensive to grow.

The recent easing of pressures on commodity and food prices is therefore temporary, though potentially with us for the next two to three years. In the short term the UK will probably experience a stagnant or slightly deflationary food price environment depending on the strength of the pound. In the longer term, it is hard to avoid the conclusion that food price inflation will return.

In the short term the UK will probably experience a stagnant or slightly deflationary food price environment depending on the strength of the pound.

Impact of the economic downturn

For now though, food and fuel price inflation is over. Nevertheless, any relief consumers might be feeling as a result will be far outweighed by the impact of the current economic downturn on their personal financial circumstances.

The ending of a global debt boom has ushered in a new era of debt reduction and falling asset prices around the world. The industrialised world, including the UK, is in recession and growth is likely to contract in virtually all Western economies in 2009. Average forecasts are (at time of writing) for the UK economy to shrink by 2.1% over the course of the year, some predict as much as 3% contraction in the overall economy.

It is likely that the economy will continue to contract into 2010 and it is quite possible that this recession will be more severe than those of the 90s, 80s or 70s. Given the deeply disrupted state of the financial sector a return to historical levels of average output growth is unlikely until 2011 or later.

The economic chill has left consumers suffering a nasty bout of financial flu. House prices, one of the key factors in the economic boom of recent years, have been in freefall, the market frozen up by the reluctance of banks to lend to potential buyers.

Personal debt levels are high, with household debt in the UK having risen from 20% of GDP in 1978 to 60% in 1998 and almost 90% today. Consumers' access to new credit has been diminished, and many struggle even to pay off existing loans. The savings ratio, at less than 1%, is at exceptionally low levels.

Like the banks, UK households need to rebuild their balance sheets. That means reducing debts and increasing savings. But doing so in an environment of declining real incomes, reduced credit availability, falling house prices and raising unemployment will be challenging and the process of rebalancing will take some time. Consumer spending is likely to take much of the strain. 'Big ticket' spending, from home improvements to cars is coming under the greatest pressure.

Unemployment, meanwhile, has risen by over a quarter of a million from its trough and is likely to go substantially higher. Some forecasters assume it will double over the next two to three years, leaving millions hard up. All these factors, together, equate to an environment in which spending by already indebted UK consumers is being affected by dramatic falls in confidence. Unsurprisingly, people are trying to save money by eating out less, trading down in what they buy and spending less on the high street. The average forecaster currently expects that overall consumer spending will contract by 1.8% in 2009.

The Government and the Bank of England have not hesitated to intervene. Reductions in interest rates and the provision of capital to the banking system should moderate the severity and duration of the downturn. Policymakers are likely to be willing to throw everything – including printing money – into the battle to prevent a protracted period of deflation. But the adjustment in debt levels and asset prices which is already underway has further to run. In a world of scarcer credit and lower asset prices, consumers need to save more and spend less. This process of rebalancing will take time.

The main issue now concerns the scope and efficacy of monetary policy. Progressively more unorthodox monetary and fiscal measures should start to stabilise the financial system in 2009. The pace at which this happens will be key to determining the timing of the trough in this cycle. But for now, the UK economy is likely to remain weak well into 2010.

"Although the recession has helped dampen commodity prices for now, businesses must prepare themselves for ongoing volatility in the market." 7

CHANGES IN CONSUMER BEHAVIOUR

With consumers' disposable income squeezed by the reduced availability of cheap credit, and their desire to spend impacted by falling confidence, it is not surprising that shopping habits are changing.

This is manifested in different ways. Convenience, quality, health and nutrition, environmental and ethical concerns have not gone away. However, price and value are becoming increasingly central to the choices that shoppers make about where to shop and what to buy.

There is evidence that people are making fewer but more planned trips to the supermarket. More careful shoppers are also shopping around for commodities in one store, and luxuries in another. Sales of private label products are rising in several categories. Many are buying fewer added value pre-prepared products and cooking more from scratch instead – which may also encourage healthier eating.

Retail data illustrates how people are altering the way they buy food and drink to reflect the change in their financial situation and confidence in future income. TNS Worldpanel figures for the 12 weeks to 25 January 2009 showed Aldi's sales up 24.1% year-onyear and Lidl's rising by 11%. Freezer centres also did well, with Iceland's sales rising 14% and Farm Foods' 14.9%. Of the 'Big Four', only Morrisons and Asda enjoyed growth ahead of inflation, while premium player Waitrose saw sales fall 0.2%.

There are also signs shoppers are 'redefining need' when it comes to the kinds of products they buy. Asda has reported that while sales of flavoured water through its stores are up 10%, sales of plain still water – which is also available from the tap – are down 15%. There are also signs of consumers going back to basics to make grocery shopping more affordable. Retailers have found that their advertising of budget recipes for the whole family has resonated with shoppers and generated substantial increases in sales of those products.

Paradoxically, retailers are reporting big increases in sales of some luxury items – Champagne for example – giving weight to the traditional belief that in hard times, consumers stop going out to treat themselves and stay in instead, particularly towards the end of the week. This observation is reinforced by businesses in the upper and mid-casual dining sector, where the number of covers have fallen dramatically, in many locations, some citing a 30% reduction. Alongside this, many restaurant operators are seeing average spend per cover also falling.

Where consumers are eating out, there is evidence many are trading down, with operators at the lower end of the market reporting buoyant sales. Recently, McDonald's said record numbers of people were dining in its UK restaurants, partly as a result of consumers trading down from more expensive options to cheaper burgers and fries. Domino's Pizzas, meanwhile, recently reported sales up 8.6%. The average order placed with the takeaway chain is just £14.50. Circumstances are dictating that consumers must cut back, and they are. But they are doing so with care whilst ensuring they are still able to enjoy the food and drink they want. Against this background, we are seeing the emergence of a stronger competitive pricing dynamic in the hospitality sector that will see margins coming under greater pressure.

In this environment, it is also not surprising that we are seeing a decline in the relative priorities given by consumers to issues such as health, ethical sourcing and the environment, even though food still represents a relatively small percentage of the outgoings of better off individuals and families. We have seen a fall in sales of organic foods, for example, though sales of ethical brands such as 'Fairtrade' have held up better. However, these factors will not go away altogether. For one thing, pressure from the Government through both legislation and high profile voluntary programmes is unlikely to disappear just because of the economic crisis. Public health and the environment are key areas of government policy and will continue to shape the political agenda. Nor will public pressure on manufacturers and retailers to behave more responsibly in terms of, for example, animal welfare go away, driven by pressure groups, the media and celebrity chefs.

A PERSPECTIVE FROM INDUSTRY LEADERS

Most companies operating in the UK food and beverage sector are generally downbeat about the current business climate and about the challenges that 2009 holds in store, though some still see opportunity.

This view is revealed in a survey we conducted of senior executives from across the food and beverage industry. The findings are not surprising. Ninety six per cent of respondents said they thought consumer confidence was worse now than a year earlier. Not a single respondent believed it was better. Meanwhile, 94% said they thought the health of the UK economy would deteriorate over the coming 12 months. None held the view that things would improve. Nearly half (48%) said they thought the performance of their own sector would worsen during 2009, while 38% said it would stay they same.

Foodservice businesses had a particularly negative take on things, with all respondents in the sector stating they believed they would suffer in the coming year. Food and beverage manufacturers, however, were slightly more optimistic. While 38% of respondents from this group believed the prognosis was for their sector to deteriorate in 2009, 54% thought sector performance would stay the same and 8% even believed it would improve.

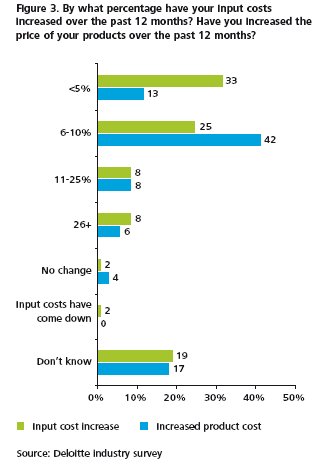

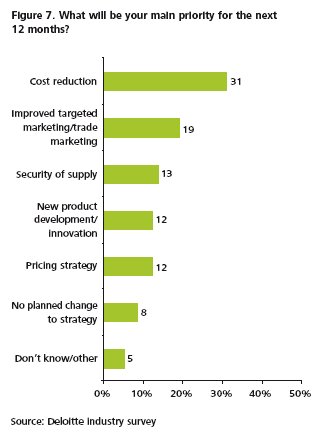

The survey responses indicated generally that most businesses will be focusing on cost and price related factors over the coming year as they face up to the challenges of the economic downturn and changing consumer purchase behaviour. Cost reduction will be the top priority for 31% of businesses in 2009, with another 12% identifying their pricing strategy as their number one area of focus to protect and improve trading performance.

It is not really surprising that so many are preoccupied with cutting costs when you consider that 73% of respondents said they had experienced substantial input cost rises during the previous 12 months. A quarter had faced increases of between 11% and 25%. Tellingly, only 8% of respondents said they had implemented price increases to match this rise, with 56% putting up their own prices by 10% or less.

This illustrates the gap that exists between the input cost increases companies have faced and the extent to which they have been able to recover these. In fact, just 37% of respondents were able to pass on all cost increases to their customers. With a range of input costs now falling, many suppliers and manufacturers are now seeing their retail and food service customers seek price reductions, though we are also seeing leading retailers becoming increasingly concerned about the stability of their supply base in the current environment.

Reducing administration and overhead costs was the most common single area of focus for companies looking to cut costs – cited by 37% of respondents. But product value engineering, cited by 21%, was also expected to be increasingly important over the coming year.

The increased emphasis on price and cost has resulted in a decline in the significance of other factors which have become commonplace features of the food and beverage landscape in recent years. Not one single executive said that corporate responsibility, ethical sourcing or reduction of carbon footprint would be their top priority in 2009.

Conversely, the recent price spike in commodities and associated availability issues have pushed sourcing strategies higher up the agenda. Commodity prices and security of supply were ranked equally as the single most important future issue that would affect the UK's food and beverage sector in the next five to ten years by 19% of respondents, or 38% combined. Security of sourcing is, currently the number one current priority for 2009 for just 13% of businesses that participated in our survey. But we can be fairly confident this figure will rise as we move into the next decade and supply again becomes constrained versus growth in demand.

In terms of relations with their suppliers, respondents indicated a return to core fundamentals with 68% of those polled stating that price, quality and availability – either one of these, two or all three – would be the most important aspects of their relationship with major suppliers in 2009.

With consumers feeling the pinch, many businesses are finding that purchasing behaviour is changing. Among those surveyed, 25% said the profile of their target consumer was changing, while the same proportion said their customers were trading down. It was also noted by 55% of respondents that promotional intensity in retail outlets was increasing.

Many businesses see refocusing their marketing strategies towards changing consumer and shopper needs as a key strategy to ride out the recession and emerge stronger. Improved targeting of marketing and trade marketing was considered the top priority for the coming year by 19% of respondents. And only 4% said they would reduce overall marketing spend to cut costs.

In addition, most of those asked (83%) also said they expected to change how they communicated their brand proposition to their target audience either by putting a greater emphasis on brand differentiation and value or by working more closely with retailers on communicating with the shopper in store, or a combination of the two.

Interestingly, innovation – other than product value engineering – was cited by no respondents as a priority for the coming year, suggesting companies will be focusing on getting the basics right in demand/supply management and cost-efficiency before investing in new product development.

As a report card on the state of the food and beverage industry, now and in the short to medium term, the survey findings do not make happy reading. Most companies are predicting tough times ahead or at least a period of no growth, against a backdrop of what nearly all respondents believe will be a deteriorating UK economy. The mood is sombre and the outlook, at best, mixed. However, there are still opportunities for those organisations that effectively track and foresee changing consumer needs to meet those needs with relevant brands, products and services.

IMPLICATIONS FOR BUSINESSES

On the whole, the food and beverage sector usually enjoys a degree of insulation during recessions since people continue to eat and drink, and this appears to be the case this time round.

The impact of the economic turmoil has been most keenly felt in the non-food retail sector with many having a torrid time and a number failing to survive the twin burdens of declining business and unsupportable levels of debt. The Christmas period, the most important trading event in the retail calendar, was disappointing for many retailers. In a year that will be remembered in particular for the collapse of Woolworths alongside many other famous names, consumers played a game of 'chicken', delaying their Christmas shopping in the hope retailers would flinch first and slash prices. Many did, and the deep discounting continued until long after Christmas.

However, the food and beverage sector is not completely immune from the impact of the downturn. TNS Worldpanel data put total UK grocery sector growth at 6.4% in the 12 weeks to 25 January 2009. This meant it was in much better health than the nongrocery sector. But over the same period food and drink price inflation was 8.3%, based on TNS's own survey of 75,000 products in-store, which meant grocery sales were still in decline in real terms.

As the inflation figures suggest, the grocers have been passing on a significant part of their cost increases to consumers. The impact of these increases on the consumer has been mitigated by the intense competition between the UK's leading grocery retailers, which has helped to dampen food price rises. This has had a major impact on suppliers, with retailers asking them to absorb at least some of the price increases. It has made life especially tough for many food and beverage manufacturers, particularly those marketing second and third tier brands, as well as some of those operating in the own label arena. As commodity prices have fallen from their peaks, leading retailers have also sought early price reductions from their suppliers to support competitive pricing for the consumer.

Foodservice companies have experienced the same input cost pressures as retailers. But they also face the added pressure that, with consumers eating out less in the economic downturn and price competition sharpening it is often harder for them to pass these price increases at point of sale. This has resulted in a sharp focus on outlet performance and changes in menu choice to reflect greater price sensitivity.

With the credit crunch exacerbating the impact of rising living costs on consumers, food and beverage businesses are having to be especially focused on how best to capture what money is still being spent. This means it has never been so important to track and understand changing consumer and shopper preferences and needs and to communicate effectively, both outside the point of purchase and consumption and in the outlet itself. However, never before has it been so difficult to do so.

In the grocery sector, perhaps the most significant decision consumers make is to visit a particular store at all. Previously this choice may have been made solely on the basis of convenience of location or habit. But value, price and, in particular, information about promotions are now becoming more important in many markets. Retailers are looking ever more carefully at how they reach their target market and entice the shoppers they want into their stores.

This is no longer simply a case of investing in conventional advertising. Consumers now use a variety of different sources, such as the internet, digital television, mobile phones, celebrities and their personal network to help them make choices about where to shop and what to buy. In particular there has been a decline in the influence of 'push' media, such as traditional television, radio and print, over whose content the public has little control. On the other hand, 'pull' media, such as the internet and on-demand cable and satellite channels and social networking sites have grown in stature as consumers take control over what they watch, when and how.

Even viewing of traditional television is being transformed by time-shifted recording such as Sky+, which allows viewers to fast forward through advertising breaks. Businesses must grapple with this changing dynamic to ensure they don't lose touch with their shoppers and consumers, especially with the economic downturn making those consumers even more price and value conscious than before.

The linkage between communication strategies outside the store with activation in the store is ever more crucial. In retail, research shows that shoppers, by and large, "sleepwalk" through a store paying little attention to information that could inform the product choices they make. New labelling schemes have sprung up in recent years providing details of products' nutritional composition, their provenance, carbon footprint, and more besides. However, in the modern grocery market, while consumers increasingly expect more and more information about products to be available, the reality is that outside of specific dietary and related needs timepressed shoppers make very limited use of written information to inform product selection, being strongly influenced by simple visual triggers.

It is vital therefore for brand owners, retailers and foodservice companies to implement effective strategies to connect with consumers and shoppers to differentiate their brands and create drivers for purchase in the face of changing consumer behaviour. Retailers are becoming increasingly aware of the need for integration of messaging outside the store and in the store. But in today's increasingly outlet and shopper-centric marketing environment, branded manufacturers also need to break down the barriers between marketing and sales, combining consumer and shopper insight to provide a strong integrated value proposition to the retailer, restaurant operator and individual. Collaboration with channel partners will be increasingly central to branded manufacturers' brand development and communication strategies.

Food safety, and its importance to brand reputation, should not be forgotten. In the past high food prices have provided a financial incentive for less ethical intermediaries to allow food not fit for human consumption to re-enter the food chain.

The big rises in the cost of commodities have taken food safety off the front pages for a while, but not off the agendas of senior executives in the industry who appreciate the risks only too well. In the 2008 CIES Top of Mind survey of food retailers and manufacturers, food safety rose from number eight to number two in a ranking of senior executives' priorities and has maintained that position in the newly released 2009 survey. With ever more global patterns of food supply, it remains critically important for businesses to ensure the end-to-end integrity of the supply chain in which they operate in the interest of protecting consumers and protecting the brands they trust. We should not be complacement. This issue deserves even greater focus within most food and beverage businesses.

Ultimately, the successful brands in the future will be those which track and anticipate changing consumer needs and preferences and engineer the right values into their proposition, recognising that not all consumers are alike. Success will depend on being more granular in understanding how the market is changing and in targeting different consumer groups accordingly. This will have to be done against a backdrop of significant challenges as most consumers will feel less well-off for the foreseeable future.

Health and wellness will continue to be important but will need to be affordable. Effective management of food safety risk is crucial. Environmental and ethical issues will be essential to brand relevance but price premiums versus alternative products will need to be well justified.

There will of course remain a significant minority of affluent consumers who can absorb the increases in their costs and who will continue to shop much as they did before, buying premium products, such as organic and Fairtrade. These shoppers should not be ignored as they offer higher margin opportunities for both manufacturers, retailers and foodservice operators. At the same time, however, it would be unwise to ignore how the centre of gravity of the market is shifting.

"Many businesses see refocusing their marketing strategies towards changing consumer and shopper needs as a key strategy to ride out the recession and emerge stronger."

KEY QUESTIONS FOR THE INDUSTRY

Success in today's more challenging market environment will depend on understanding and anticipating changing consumer needs and responding with relevant products and solutions at the right price points.

The key questions for food and beverage businesses include:

- How are shopper and consumer needs changing, both in the short and longer term?

- Are our historical market segmentation models still relevant or do we need to find different ways of looking at the market and the changing landscape of available revenue and value capture?

- What do we need to do to protect and enhance our brand's reputation and ensure its relevance to consumers whose mindsets are very different to a year ago and in which extravagance seems inappropriate, even to the better-off?

- What is the most effective way of communicating our brand value proposition given the fragmentation of media channels and the barrage of messaging that consumers and shoppers receive?

- How can we most effectively integrate messaging outside the store with that at the point of purchase?

- How can we keep our existing customers and consumers loyal, and win new ones?

- How can we stay ahead of the curve in anticipating their needs and accelerate innovation and time to market?

- How should we steer the focus of this innovation to respond to changing consumer needs for value and keen prices?

- What do we need to do to adapt our business model to establish the capabilities needed to compete effectively in today's market?

- Where do opportunities exist to improve operational efficiency and reduce costs, for example in marketing, sales, customer service, distribution or manufacturing, or the back office?

- How should we adapt our sourcing strategies for affordability, sustainability and security of supply?

- How can we most effectively manage and reduce food safety risks given the new issues in the changed economy and increasingly global supply chain?

INGREDIENTS FOR SUCCESS IN VOLATILE MARKETS

In answering these questions, to claim that there is a 'one size fits all' recipe for survival, prosperity and future market leadership for all businesses in the industry would be to over-simplify. Different businesses find themselves with differing priorities.

For many mid-sized and smaller suppliers, especially those carrying significant debt as do many private equity owned businesses, cash-flow and liquidity are the critical issues, alongside pressure on prices and margins and the need to reduce costs.

Larger, better capitalised businesses are often more focused on tracking and anticipating changes in the market by category, geography and channel and prioritising investment accordingly to meet changing consumer and shopper needs.

That said, we can identify a number of areas that all businesses should think about when developing strategies appropriate to their particular situation. These fall under the following broad headings of:

Strengthening the balance sheet: which focuses on sources of funding, working capital and cash management.

Optimising trading performance: which focuses on 'how to win' in the current market – maintaining/ growing market share with reduced resources. Priorities include reducing complexity in sales and marketing and improving the effectiveness of marketing spend; optimising pricing and promotions; understanding and improving customer and product profitability; SKU range simplification; product value engineering; short term sourcing optimisation; improving operational efficiency across the supply chain; providing outstanding customer service; and managing the effective tax rate of the business.

Winning in the medium term: which focuses on re-assessing strategy as to 'where to play' and 'how to win', for example in optimising the category and geography portfolio; integrating marketing and sales in more shopper-centric approaches; re-evaluating channel strategies; focusing product innovation on changing customer and consumer needs; developing longer term sourcing strategies to secure supply; and ensuring integrity in increasingly global supply chains. Building confidence among stakeholders: which focuses on leading and motivating people in a downturn; managing shareholder interactions and expectations; and collaborating with suppliers and other business partners.

Each of these is explained in more detail below.

Strengthening the balance sheet

Liquidity is the biggest problem facing many businesses today. Banks are reluctant to provide new lending or even renew existing facilities. Retailers are bolstering their own cash flow by insisting on extended payment terms from suppliers. Many suppliers carry high levels of long term debt, especially those in private equity ownership and those that have been engaged in substantial acquisition activity at or near the top of the market. As the economy has slowed, more and more businesses are challenged in servicing their debts and ensuring adequacy of working capital. Leading retailers and foodservice companies are increasingly concerned about the stability of their supply base.

Being more disciplined in managing receivables, payables and working capital tied up in inventory is good practice, but hardly sufficient to make much impact on the scale of the problem many face. More drastic action is required and businesses need to work with their lenders to develop workable solutions. New equity investment can reduce short term debt but can adversely impact existing investors. Selling off non-strategic business units may be necessary, though values realised in today's market may be low. New approaches to supply chain finance which see invoices settled on presentation at an affordable discount rate may be one of the most effective parts of the overall solution given that many businesses have 60 to 90 days of revenue tied in receivables.

Optimising trading performance

There are a number of levers that businesses can and, in many cases, are already pulling which can materially impact business performance in the short-term. Speed, focus and cutting complexity are key themes. It's often as much about deciding what to stop doing because it is not value adding as it is about what to do that is new or different.

Marketing spend effectiveness is a critical lever for any brand based business. Even before the current economic circumstances, changing media trends and consumer behaviours were already driving consumer goods companies to re-evaluate their marketing approach and media mix. Now, changing shopper behaviours and buying patterns are also challenging the allocation of marketing investment across brands and channels. It has never been more important for consumer goods companies to spend their marketing money wisely.

Pricing and promotions offers one of the most important areas of opportunity. Deloitte research shows clearly that getting price setting correct and instilling the right disciplines in pricing execution has the highest potential of any area of focus to positively impact both the top line and profitability. In spite of brutal price-led competition putting pressure on prices and margins across the industry, many businesses could do more in winning and sustaining the price increases they need.

Promotions are important and promotional intensity is set to increase in the current economic environment. What's clear is that while shoppers like every day low prices, they are even more influenced by promotions. The winners in maximising return on this investment will be those that go beyond promotions simply being a 'ticket to play'.

They will capture the learnings from each promotion and apply them to future investment activity in a way that adds value and reinforces the case for closer collaboration. Using shopper insight down to the level of the individual will become increasingly central to strategies to target promotional spend on the right consumers. The challenge for many will be how to reconcile the short term imperative to play to the consumer's appetite for promotions with the longer term need to protect brand values and avoid commoditisation.

In times of plenty many businesses could afford not to focus on the profitability of individual customers and products, especially very strong brand-led businesses. However, times have changed and understanding where value is created and value is destroyed has become critical to more and more businesses. Realistic customer cost-to-serve models are becoming an important business intelligence tool but are still only established in a minority of businesses. Those businesses that have them have an important commercial advantage, both in margin management and price negotiation.

Understanding product profitability provides a vital starting point for SKU range simplification and the elimination of business complexity that is a major driver of cost. It also focuses effort in product value engineering which is increasingly important in protecting margins. Short term sourcing optimisation, for example, capturing fully the benefits of recent commodity price falls, is an important part of this. Procured materials often represent two thirds of the cost of manufactured foods at the factory gate and therefore represent a key area of focus.

Improving operational efficiency across the supply chain is also important. If not already in place, this typically includes establishing an effective sales and operations planning process, optimising the supply network and establishing the right distribution partnerships. This is also an important foundation for providing outstanding customer service from supplier to retailer, increasingly central to the ability to access wider joint business development opportunities.

There are also housekeeping matters that, if not already addressed, should at least be considered as a part of optimising overall business performance. Many organisations have already addressed cost-efficiency in the back office through consolidation and outsourcing. Most commercial organisations have a duty to release the potential value to their shareholders that this affords. However, clear business partnering models and service level management frameworks need to be in place to assure quality and value for money from such arrangements. Managing the effective tax rate of the business also presents opportunities to protect cash and increase the capacity to invest.

Winning in the medium term

In parallel with pulling the levers that can help protect margins and deliver strong business performance in the short term, the businesses that are going to be the leaders in 2012 need to be laying the foundations for future success now. This is about being clear about both 'where to play' and 'how to win'.

With economic confidence declining and individual consumption patterns rapidly changing the market landscape, traditional market segmentation and value quantification models risk irrelevance. At the same time, the resources available for investment by businesses are increasingly constrained.

To make the difficult decisions and trade-offs that will lay the foundations for future success, management require solid quantitative evidence of value creation potential. Deciding 'where to play' and gaining stakeholder commitment therefore requires robust insights into how available market revenue and value pools are evolving. These insights require high quality, timely analysis of past, current and anticipated market trends to inform where the business should focus – on which consumer segments, in which geographies and channels, in which types of outlet, and with what products. They also require both an 'outside-in' view of the opportunities based on the changing market landscape and an 'inside-out' view that informs the ability to exploit those market opportunities profitability. The result is both a clear view of 'where to play' and an agenda for the changes in the business required to play successfully and profitably. Longer term, businesses should make granularity of analysis a core discipline to underpin strategic thinking and embed revenue and profit pool landscape tracking in routine management processes.

Based on clear priorities about 'where to play', many businesses will choose to make changes in their category and geography portfolio. Non-core businesses may be divested. Attractively valued assets that fit the strategy may be acquired, benefiting from the challenges that many other businesses face in today's market. Many businesses will find that brand architectures and strategies will need to be refreshed to ensure relevance and resonance in each priority market.

We will see major changes in the way in which businesses reach the consumer and shopper. With fragmenting media, where individuals actively choose to pull content rather than being passively broadcast to, and the growing power and marketing capabilities of the retailer, traditional brand and product marketing approaches are fast being abandoned in favour of more shopper centric approaches. Success in reaching the future consumer and visitor will depend on integrating much more tightly activity outside the store with that inside the store. This in turn will mean breaking down the traditional barriers between marketing and sales and, for example, integrating current and actionable shopper and consumer insight to inform brand, channel and communication strategies. Effective execution then requires a strong marketing mix model; an effective digital media strategy; good management information on the allocation of marketing resources; excellent marketing sourcing processes; and real management commitment to the alignment of marketing and sales activities. In the 2009 CIES Top of Mind survey of food retailers and manufacturers, consumer marketing has risen three places to number eight in a ranking of senior executives' priorities showing that this is becoming more important, even to smaller businesses.

Focusing product innovation and portfolio management on changing customer and consumer needs will be also be crucial to longer term success in the industry. In spite of economic challenge, the key trends we saw 18 months ago such as convenience, good nutrition and health, packaging reduction, interest in provenance, environmental impact and ethical sourcing have not gone away. At the same time affordability, perceived value and price will be relatively more important drivers of consumer and shopper choice for the foreseeable future than has been the case historically. Those businesses that succeed in bringing new products to market that reconcile these different needs, and at the same time make a good margin, will win market share and capture value.

Moving to the supply side, the commodity price spike we experienced in 2008 was a wake up call for many businesses, highlighting what occurs when demand and supply come into finer balance. While we are now in a more benign period of commodity pricing from a buyer's perspective, underlying trends such as population growth, development of the middle class in major developing economies and climate change are unlikely to go away. As the global economy eventually moves out of recession and demand for commodities and resources accelerates, we will again see supply side challenges emerge.

The coming year will therefore be a good time for many businesses to revisit longer term sourcing strategies to secure supply at the right quality and cost. We expect more and more businesses to identify needs for greater vertical integration to secure supply and to assess potential partners and suppliers according to criteria such as sustainability of supply; risk profile and climatic exposure; and long term capacity. We also expect strategies for water and energy use to become increasingly central to supplier choice.

Building confidence among stakeholders

Perhaps one of the most important things for businesses to do in the current downturn is to build and keep the confidence of their various stakeholders – their shareholders, their customers, their suppliers, their employees and others. Management need to focus on leading and motivating the people in the business through the downturn – setting a clear direction, managing expectations and communicating regularly. The requirements are very similar to those needed to deal with shareholders; explaining strategy, managing expectations and avoiding surprises. It's equally important to keep the confidence of both suppliers and customers – ensuring they see the business as a stable and reliable business partner, able and willing to work with them in navigating a changing and challenging market. This sounds obvious – and it is to most – but with so many demands on the time of business leaders it is worth a reminder.

In conclusion, we are entering a time of new challenge but also of new opportunity. The winners will be those businesses that tackle the issues of liquidity and current trading performance without delay. This will allow early focus on understanding and exploiting the longer term shifts in the market, enabling businesses to capture share while getting leaner and fitter as a platform for future leadership and value creation. For most businesses this means there is a huge amount to do and many will need expert support to make the numerous changes needed, as sure-footedly and quickly as business imperatives dictate.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.