It's the most frequent question I've been asking my Lloyd's and London market clients since the turn of the year.

The question itself is testimony to the extent of work that the market has undertaken to design, implement and embed conduct frameworks over the last few years, particularly in relation to delegated authority business. These relatively new frameworks have been working in practice for long enough for the conversation to move towards efficiency and evolution.

It is important that firms now think about how to advance their frameworks to do more of what mitigates actual conduct risk through providing value, insight and assurance, and do less activities that are time consuming and not adding value.

What needs to evolve within conduct frameworks?

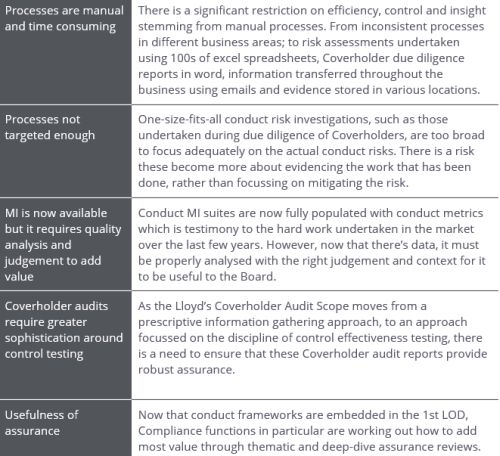

I set out below some of the challenges Lloyd's and London market insurers currently have that require a more value-add and efficient solution:

Overcoming these challenges is important for conduct frameworks to become fully embedded and add value to firms. This soft market only increases the need for these frameworks to be efficient, streamlined and targeted given the current focus on cost and margin.

Role of technology in driving efficiency

A straight forward solution to remove cost and increase efficiency in conduct risk, as well as delegated authority management more broadly, is through the use of technology.

We have created DART, our Delegated Authority Risk Tool which is an online technology solution for insurance companies to undertake the end to end delegated authority framework, including conduct risk. From underwriters undertaking risk assessments on their tablets at the box, to the automated generation of targeted due diligence scopes and the analysis of dynamic MI. This solution is being deployed in the market and the efficiency and cost gains are significant.

Another option is technology solutions that harness Artificial Intelligence, which can undertake a review of 100s of wordings within minutes.

While technology shouldn't be pursued for technology's sake, there are pinch points where technology can allow insurance companies to really advance – whether to become more efficient or gain competitive advantage, or both.

Going back to my opening question – when I ask my clients "Is your conduct framework adding enough value?"– I'm reassured to hear some great examples. Such as Coverholders where actual conduct risk was identified and mitigated, where products were changed to be fairer to customers, or commercial advantage gained due to the ability to manage high conduct risk business.

However, there are just as many examples of inefficiency which should now be addressed. Not least because it appears that financial crime frameworks are now being scrutinised in light of enhancements to conduct frameworks, and the question is quickly becoming "why aren't you doing financial crime risk assessments like your conduct risk assessments?"

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.