The pharmaceutical industry continues to face regulatory and reimbursement hurdles weighing on the research and development returns of pharmaceutical firms this year.

The seventh annual pharmaceutical innovation study by the Deloitte UK Centre for Health Solutions looks at the challenges the industry faces in generating returns from its R&D investments while highlighting the key strategies to help increase pipeline value while reduce R&D costs to generate sustainable R&D returns.

Explore our infographic

Key findings

After reviewing the estimated returns of 12 leading biopharma companies and comparing their performance with four mid- to large-cap companies, the study finds:

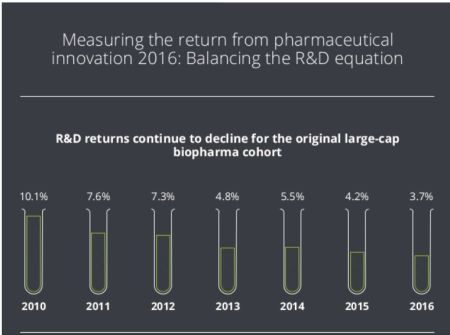

- Annual projected pharma R&D returns continue to decline to 3.7 percent

- Peak sales per asset fall 11.4 percent year-on-year since 2010

- Costs to bring a product to market stabilise, from $1,576 Million in 2015 to $1,539 Million in 2016

- Smaller pharma companies have seen a decline in overall performance, but on average they continue to outperform their larger counterparts, generating returns up to three times higher

Main factors influencing R&D returns

- Maintaining a consistent focus on a specific therapy area (disease): can deliver stronger returns. When a company focuses its attention on a particular therapy area in order to treat a disease or illness, this is linked to higher peak sales.

- End of the blockbuster: This has led to a situation with blockbuster costs without balancing blockbuster revenues, an equation which does not add up for long-term stakeholder value.

- Smaller companies remain more effective: There is a negative correlation between the size of the company and both predicted returns, and cost per product. Lessons can be learned from smaller companies—as they are able to achieve higher R&D productivity.

- Increase of M&A: Since 2013 there has been a steady decrease in the proportion of projected late-stage pipeline revenue derived from externally sourced products. This is a trend which has accelerated in 2016 as more of the products acquired as part of large-scale M&A in the late 2000s' leave the late-stage pipelines. The decrease in returns highlights how companies are struggling to replace pipeline value through self-originated products.

Balancing the R&D equation

The following key lessons can be applied to help increase commercial success and reduce the cost to launch.

Increasing commercial success

- Aim for therapy area focus

- Target populations where value can be maximised

- Adhere to robust target product profile

- Generate evidence to support all stakeholder needs

- Align end-to-end decision making across the organisation

Increasing R&D productivity

- Think small, win big decision making

- Strike the right balance of staff and resource

- Lift the burden of data complexity

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.