Key findings:

- UK households income improved in the fourth quarter of 2012.

- Consumer sentiment is weak, despite consensus forecasts pointing to slower inflation.

- Spending holds up in the fourth quarter but consumers remain cautious.

- Economic growth is likely to be weak in 2013.

- Consumers are concerned about rising prices and plan to continue saving and rebuilding their finances.

Despite some improvement in their financial circumstances, consumers remain cautious and continue to focus on cutting debt.

Consumer and market inflation expectations are out of line as we enter 2013. While consensus forecasts point to further slowing of inflation in the coming year, consumers remain concerned about rising prices and continue to rebuild their finances.

In the year to the fourth quarter of 2012 inflation slowed dramatically, but consumer inflation expectations remain unchanged. Many people have become accustomed to higher levels of inflation and expect prices to continue rising in 2013, particularly for food, drink and utilities.

Inflation expectations are undermining confidence and dampening willingness to spend.

Consumers expect more bad economic news in 2013, perhaps reflecting the high number of negative headlines in the recent period.

HOUSEHOLD DISPOSABLE INCOME

UK household income improves in the fourth quarter of 2012.

- Some 13 per cent of UK households received a pay rise or bonus in the fourth quarter of 2012, a significant increase on the third quarter.

- Thirteen per cent of households saw a reduction in income, compared with 15 per cent in the first quarter of 2012.

- Other UK household circumstances influencing disposable income, such as employment, remained stable in the fourth quarter.

- Average earnings growth remain below inflation, but the gap is expected to close.

CONSUMER CONFIDENCE

Consumer sentiment remains weak, despite forecasts of further declines in the rate of inflation in 2013.

- Despite an improvement in household personal circumstances influencing spending, consumer sentiment in respect of disposable income remains flat.

- Overall, sentiment suffered a setback in the fourth quarter, with five of six measures deteriorating.

- Analysts say weak consumer confidence has become the new normal, with consumers highly cautious since 2009.

- The Deloitte Consumer Tracker is in line with the GfK NOP index, which fell to ‑29 in December from ‑22 in November, an 18‑month high.

- The UK population's sentiment about the economy over the next 12 months deteriorated to a level last seen in June, when the economy was in recession.

- UK inflation remained at 2.7 per cent for the third month in a row in December, with rising gas and electricity bills the main sources of price pressure.

- A rise in the price of food and drink contributed to inflation remaining above the 2 per cent target.

ECONOMIC OUTLOOK

UK growth is expected to remain weak in 2013.

- Economists have downgraded the UK's growth forecasts for 2012 and 2013.

- The UK economy is expected to have shrunk in 2012 and growth is expected to remain weak in 2013.

- The euro crisis seems to be on hold, with Spain, Greece and Portugal implementing austerity measures to tame deficits.

- The sharp fall in consumer price inflation and a revival in private‑sector job creation propped up UK consumer spending in 2012.

- Moreover UK unemployment rate fell to 7.7 per cent in the three months to November, down from 7.8 per cent in the previous quarter.

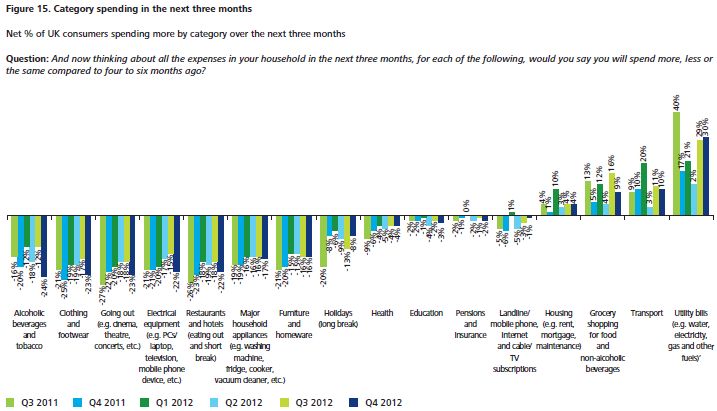

SPENDING BEHAVIOUR IN THE LAST QUARTER

Despite weak consumer sentiment, spending held up in the fourth quarter of 2012.

- Continued slowing of inflation and encouraging growth in earnings have led to an easing of pressures and spending is continuing to increase in discretionary categories.

- The data, however, also shows a net increase in spending on groceries (from 23 per cent to 32 per cent) and utilities (28 per cent to 44 per cent).

- There is still some doubt as to whether the positive signs seen over the past year represent the start of a sustained consumer recovery.

- In the year to the fourth quarter of 2012 inflation has slowed dramatically, but consumer expectations for inflation remain unchanged.

- Consumers are becoming more discerning, and defensive spending strategies saw a slight increase in the fourth quarter.

- Expansionary spending behaviours suffered a slight setback in the fourth quarter, except in the gift category, suggesting Christmas was reasonably positive for some retailers.

- Our data shows an encouraging increase in the number of people making repayments on their credit card accounts, but a slight decline in the number repaying loans.

- Despite a negative net balance in the total number of people saving, the number has nearly halved as consumers have been consistently increasing their savings.

- The fourth quarter of 2012 encouragingly sees a sharp increase in the number of people repaying their debts.

- In the past five years, consumers have focused on consolidating their debts. Continuing that trend, the personal saving ratio increased to 7.7 per cent in the third quarter of 2012, from 6.6 per cent in same period in 2011.

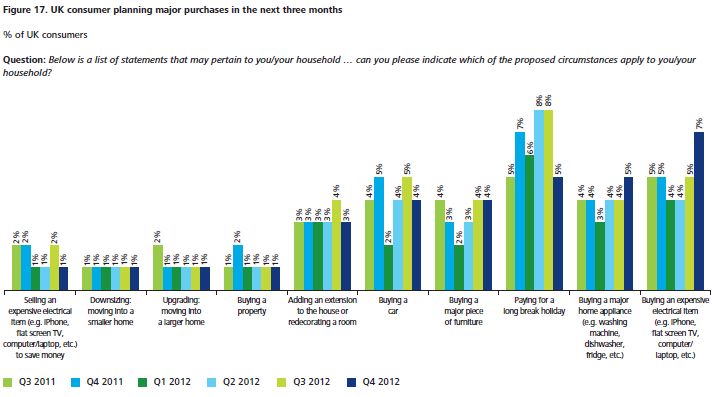

CONSUMER SPENDING OUTLOOK

Consumers remain concerned about rising prices and plan to continue saving and rebuilding their finances.

- Consumers seem to have become accustomed to high levels of inflation and expect prices to continue to rise in 2013, particularly utility prices.

- Consumers intend to continue to cut the number of credit cards and loans they hold in the next three months, confirming a consistent trend over the past year.

- More consumers expect to buy an expensive electrical item, a sign that discretionary spending could be picking up.

- One of the official measures of major purchases decreased one point in December 2012 to ‑27, but remains four points higher than in the same month the previous year.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.