UK: Stamp duty land tax anti-avoidance legislation

Perceived abuse of the special stamp duty land tax (SDLT) computational charging rules for property transactions involving partnerships resulted in targeted antiavoidance legislation earlier this year (enacted as section 55 of the Finance Act 2010).

The change stops tax avoidance schemes taking advantage of the special charging rules for partnership transactions (in Part 3 of Schedule 15 to the Finance Act 2003) by extending the general SDLT anti-avoidance provision (section 75A of the Finance Act 2003) so that it takes precedence over those rules. The special charging rules apply to transactions in UK property between partnerships and their partners or persons connected with the partners.

Whilst targeted at tax avoidance schemes, the effect of the change in law on commercial transactions is uncertain. Read literally, the general anti-avoidance provision (as amended) abolishes the special charging rules regardless of whether the particular transaction is motivated by tax avoidance or a genuine business purpose. The better view, in our opinion, is that the amendment made by this year's Finance Act 2010 must be read in a manner that is consistent with its purpose of stopping tax avoidance schemes that had exploited a carve-out from the general anti-avoidance provision and which involved arrangements that were contrived to ensure that the transaction would fall inside the special charging rules. Applying such a construction, the general anti-avoidance provision does not disapply the special charging rules in all cases and only applies to arrangements that have as one of their main purposes avoidance of liability to SDLT.

Her Majesty's Revenue & Customs have stated an intention to produce further guidance on the general anti-avoidance provision. It is unlikely, however, that the uncertainty regarding the application of the general anti-avoidance provision will be resolved by legislative correction.

Before entering into a land transaction that falls inside the special charging rules, taxpayers are strongly recommended to seek specialist advice.

UK: Stamp duty land tax rate increase for residential property transactions

The top rate of stamp duty land tax for residential-property transactions will increase by 1% (from 4% to 5%) for transactions over £1 million with effect from April next year. The last Government planned to use the extra revenue from the (permanent) increase to fund a two-year suspension of the 1% rate on homes bought by first-time buyers. Buyers of £1 million-plus homes will pay at least £10,000 more in tax from next year with an estimated 10,000 to 15,000 buyers being affected. The tax rise, which has been preserved by the Coalition Government, is expected to result in a spike in sales of £1 million-plus homes in the run-up to April 2011.

France: New French transfer pricing documentation requirements

Since 1 January 2010, new transfer pricing documentation requirements are applicable in France to French companies or branches of international groups meeting the following criteria:

- having a gross annual turnover or gross assets equal to or exceeding €400 million, or

- being directly or indirectly more than 50% owned by French or foreign entities meeting the €400 million criteria, or

- directly or indirectly owning at least 50% of one or more companies meeting the 400 million Euros criteria, or

- being worldwide consolidated or tax consolidated, with at least one tax consolidated entity meeting the €400 million criteria.

Entities within the scope of the new legislation must be able to provide the FTA, upon the first day of a tax audit, with TP documentation substantiating the TP method chosen and its arm's length nature. In case of failure to provide the information or if the information provided is not sufficient, a penalty amounting to 5% of the TP reassessment basis will apply, per audited year, with a minimum penalty of €10,000.

The main requirement is for the documentation to be contemporaneous, therefore requiring an annual review and update. A dynamic approach is also required to explain major changes or special circumstances, occurring either during the audited period or between audited and non audited periods. Specific additional documentation should be provided in case of transactions performed with related parties located in "non-cooperative tax havens".

Entities without current TP documentation must comply with these new requirements without delay and entities which already have TP documentation in compliance with the OECD model should update their existing documentation to ensure this meets the new legal requirements in France. Documentation and the chosen benchmark will need to be updated annually.

France: Real estate VAT reform

With effect from March 2010, the French VAT regulations governing the treatment of real estate underwent a major change.

The regulations covering this area prior to this date resulted mostly from a Law dating back to 15 March 1963. These regulations were not in compliance with VAT regulations under the 6th Directive of the EU. EU legislation generally applies the sameVAT principles to transactions in movable and immovable property whilst the French rules provided for a number of exceptions to the treatment of immovable property transactions, some of which were incompatible with general VAT principles.

The main features of the new rules are broadly as follows:

- The criteria for qualification as "land to be built on" ("terrain à bâtir") is modified and defined objectively according to the principles set out by French Construction Law, instead of being based solely on the purchaser's intention to build on the land.

- Buildings to be demolished are no longer assimilated to development land for VAT purposes but subject to the standard rules governing the supply of buildings.

- The supply of buildings completed for less than five years is subject to VAT automatically on the total transaction price. Unlike the former regime, this will apply regardless of whether a first transfer has already occurred in this period. Registration tax would in addition apply at the rate of 0.715% as was previously the case (unless certain commitments are taken by the purchaser, in which case duties could be reduced to €125).

- The supply of buildings more than five years old should be exempt from VAT and within the scope of registration duties at a rate of 5.09%, as was previously the case. However, a major change introduced in these new rules is that taxable persons would have the possibility to elect for VAT which would then apply on top of registration duties. This election would reduce the issues raised by the former regime, particularly when the building did not constitute a fixed asset for VAT purposes. Indeed, it was not possible in that case to transfer the right to deduct input VAT to the new acquirer. The amount of input VAT required to be repaid by the seller resulted in a final net VAT liability on such transactions.

France: Guidance from French tax authorities on the conditions under which foreign real estate funds can claim exemption from French 3% tax

Foreign real estate funds, just like any other entities owning, directly or indirectly, French real estate property, are liable to a French 3% tax based on the open market value of the assets held as at January 1st of any given year.

There are a number of exemptions from the French 3% tax. In particular, French SPPICAVS benefit from an exemption without any filing requirements to the extent they are retail funds (i.e. vehicles open to the wider public). SPPICAVs are the main form of French OPCIs which is a form of non-listed French real estate vehicle benefiting from a tax regime similar to the one applicable to French REITs (or "SIICs").

French 3% tax rules further provide that foreign vehicles that are subject to "similar regulations" to SPPICAVs/OPCIs in their country of establishment are also exempt from the tax without any filling requirements.

This requirement has raised many practical difficulties because of the diversity of regulations applicable to such real estate vehicles in the countries where they are established. In particular, the question of whether German open-ended funds were subject to sufficiently "similar regulations" was referred to the FTA, which published their opinion in December 2009.

Extending this opinion, the FTA have published on 14 September 2010 a ruling providing further details on the conditions under which foreign open-ended funds would benefit from a 3% tax exemption in the same manner as French retail SPPICAVs, in particular if they meet (regardless of local rules), the liquidity and asset ratios required from SPPICAVs.

Finally, for funds that are unable to meet these criteria and in particular for non-retail funds, the ruling further reiterates the conditions under which these funds will be able to benefit from exemption subject to filing requirements, and notably the disclosure of investors owning an interest of over 1%.

Interestingly, the ruling adds a documentation requirement which is that the fund's prospectus and annual reports must indicate expressly that any shareholder owning directly or indirectly an interest over 1% should disclose themselves to the fund in order to allow the latter to meet its information obligations towards the FTA.

France: New capital gains taxes on real estate: The "Grand Paris" and "Grenelle II" taxes

Several laws have recently been enacted in France introducing new taxes on gains arising in real estate assets located close to certain new public transport infrastructure yet to be constructed.

In particular, the law of 3 June 2010 provides for the introduction of a Grand Paris Tax arising on capital gains realized upon a number of transactions on assets located within 1,200 meters from the new passenger stations which will be constructed as part of the Grand Paris project. The Grand Paris project is an urban regeneration initiative that includes the construction of a new public transport network linking the center of Paris with the main centres of the wider conglomeration. The new tax will finance the construction of the transport network, the principle being to tax the increase in value arising as a result of the proximity of these assets, to the new stations to be constructed.

Similar capital gains taxes may also be introduced by local authorities in the rest of the Ile-de-France region around Paris as well as in other parts of the French territory (legislation of 12 July 2010 introducing the "Grenelle II taxes") and therefore the rest of France may also be affected by the introduction of this legislation.

The Grand Paris tax will apply in addition to existing taxes, to capital gains arising from the disposal of any real estate property including buildings, land, real estate rights as well as shares in real estate companies. Corporate taxpayers currently subject to corporate income tax at the standard rate of 34.43% on their real estate capital gains will also be liable to this tax if the conditions of application are fulfilled.

All transactions for consideration occurring within 15 years from the date of publication of the declaration of the new public utility or the display of the construction project declaration will be taxable. This therefore includes not only sales but also contributionsin- kind, even if they benefit from a rollover regime for corporate income tax purposes. This measure may be particularly detrimental to tax neutral intra-group restructuring operations, especially where such internal transactions do not realise any cash.

The tax will apply to individuals, legal entities regardless of their tax regime, and both to residents and nonresidents to the extent they are taxable in France. The tax is therefore due to apply even to transactions realized by entities that would otherwise be exempt from capital gains taxation under either individual taxation rules (e.g. individuals selling their home or selling another property if held for more than 15 years) or under corporate income tax rules (e.g. SIICs and OPCIs which would otherwise be fully exempt from capital gains taxation).

The tax rate is set at 15% for assets located within 800 metres of a new passenger station and 7.5% for assets located between 800 and 1,200 metres. It is still unclear how assets only partly located in one of these zones will be treated or how shares in property-rich companies owning several assets would qualify. Administrative guidelines yet to be published should provide further guidance in this respect.

In any case, the tax will be based on 80% of the capital gain, being defined for these purposes as the difference between the present value of the acquisition cost of the asset concerned and its sale price. This definition of capital gains is itself likely to be quite penalizing for SIICs, OPCIs or other entities which have already undergone a taxable revaluation of their assets, since these entities have already been taxed on the difference between their original acquisition cost and the steppedup value of their asset. Further administrative guidelines commenting on the new legislation are expected to comment on these potential double taxation issues.

There are a few exemptions available. The main exemption is for real estate developers. It should be noted that only the first sale after the opening of the transport network will be taxable, subsequent sales being outside the scope of the tax as the capital gains realised upon subsequent sales would not be deemed to be gains resulting from the opening of the transport network.

As mentioned above, several measures allow equivalent taxes to be introduced by local authorities in addition to the Grand Paris tax. In particular, the regional council of Ile-de-France may vote an additional tax at the same rates (i.e. 15% and 7.5%) that would apply to assets located in the perimeter of the public transport infrastructure to be constructed within the Ile-de-France region.

The "Grenelle II" taxes will apply to territories located outside Ile-de-France. There are two components to this tax: the first part is paid to the organizing authorities of urban public transport, and the second part is paid to the State or the regions in charge of the organization of regional public transport.

These taxes have the same tax base as the Grand Paris tax. The tax rate in respect of the portion paid to the organizing authorities of urban public transport is set at 15% for assets located within 800 metres of a new passenger station or 7.5% for assets located between 800 and 1,200 metres. The tax rate in relation to the portion paid to the State or the regions for regional public transports is set at 5% or 2.5% depending on whether the asset is located within 800 metres of a new passenger station or between 800 and 1,200 metres.

In total, these taxes would be capped at a maximum of 5% of the sales price of the asset but, as mentioned above, will be due in addition to capital gains taxation rules otherwise applicable (e.g. 34.43% for corporate taxpayers). The tax will be due by the seller at the time the deed of sale is registered. In practice, because the application of both the Grand Paris tax and Grenelle II tax requires a number of steps, which include State decrees and publications in various official journals, the implementation is not expected before 2011 at the earliest.

Germany: Depreciation of buildings not constucted on own land

According to a decision of the German Federal Fiscal Court dated 25 February 2010 (IV R 2/07), construction costs incurred by a taxpayer must be depreciated according to the general depreciation rules even if the building is not constructed on the taxpayer's own land. This rule applies independently from the terms of any agreement relating to the use of the land. The determination of the depreciation period, therefore, must be made regardless of the period under the lease agreement for the land. Buildings generally are depreciated over a period of 33.33 or 50 years.

Germany: VAT treatment of lease guarantee in connection with property acquisition

The VAT treatment of lease guarantee payments made in connection with a property acquisition has been subject to several inconsistent lower court decisions, with the courts ruling that the payments are either non- VATable indemnities or VATable lease payments, depending on the facts and circumstances of each case. The German Federal Tax Court has now ruled for the first time on the treatment of a lease guarantee in connection with a property acquisition. In its decision dated 11 February 2010 (V R 2/09), the Court held that where the amount guaranteed under a lease guarantee is not fully covered by lease payments arising from an existing lease agreement, the amount paid under the lease guarantee is to be treated as a reduction in the purchase price of the property, which therefore reduces the purchase price for purposes of VAT.

According to the Court, an adjustment of the purchase price for VAT purposes requires an immediate reduction of the purchase price of the VATable service, in this case (the delivery of the property). This requirement is only met if the compensation under the lease guarantee is higher than the actual lease payment. The agreement relating to the lease guarantee only serves as a legal measure to protect the buyer from a decrease in the value of the acquired property.

Germany: Real estate transfer tax increase in several federal states

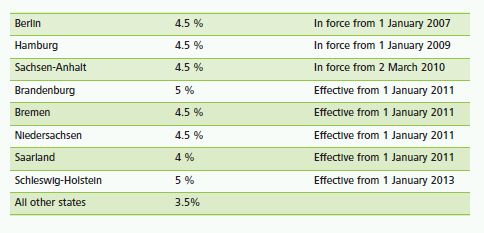

The federal states of Bremen, Brandenburg, Niedersachsen and Saarland have decided to increase the real estate transfer tax (RETT) rate applicable in these states, effective from 1 January 2011 and from 1 January 2013, for Schleswig-Holstein. The RETT increase affects real estate situated in these states that is transferred by way of a sale or reorganisation of the real estate itself, or the shares in a company that holds real estate (e.g. unification of shares or transfer of partnership interest).

Until 2006, a uniform RETT rate of 3.5% was applied throughout Germany. An amendment to the constitution gave the federal states the power to set the RETT applicable to each state and, as such, the rate can vary from one federal state to another. The federal states of Berlin, Hamburg and Sachsen-Anhalt have already increased the RETT rate to 4.5%. The table above illustrates the RETT rates in each state as a result of the recent increases.

The Netherlands: Competent authority agreement on transparent Dutch closed mutual funds

The competent authorities of the United Kingdom and the Netherlands have reached a mutual agreement regarding the application of the UK-Netherlands Double Tax Treaty to investors in closed fonds voor gemene rekening (a closed mutual fund or closed 'FGR') established in the Netherlands.

Generally an FGR is closed if the alienation or transfer of a participation in the FGR needs approval of one or more of the participants in the FGR. In that case the FGR is transparent for Dutch corporate income tax purposes.

This agreement applies to closed FGR formed in conformity with Dutch civil and taxation laws that act as a pooling investment vehicle for the assets of pension funds and other investors. The closed FGR invests these assets on behalf of investors.

The competent authorities of the United Kingdom and the Netherlands agreed that a closed FGR is not the beneficial owner of the income derived by the fund and that the income derived by the fund belongs to its investors in proportion to their respective participations in the fund. As such, a closed FGR is not entitled to benefits under the UK-Netherlands Double Tax Convention in respect of income derived on behalf of its investors.

Umbrella funds consisting of several closed FGRs are also not entitled to benefits under the Convention in respect of income derived on behalf of their investors.

Claim for application of the benefits on behalf of investors

A closed FGR which is established in the Netherlands and which receives income arising in the United Kingdom may itself, on behalf of the investors in the closed FGR and represented by its fund manager or its depository, claim the benefits, by way of a refund request, of a Convention for the Avoidance of Double Taxation to which the United Kingdom is a party and which is applicable to those investors.

Such refund claims are subject to enquiry and, where requested, a fund manager or depository shall provide relevant information which may include a schedule of investors (names, addresses and, where requested, a statement by the investor confirming they are the beneficial owner of the income and resident in a country that has a Convention with the United Kingdom) and the allocated income relevant to the claim.

A closed FGR may not make a claim for benefits on behalf of an investor in a closed FGR if the investor has itself made a claim for benefits in respect of the same income. If a closed FGR intends to make a claim for benefits on behalf of an investor, the fund manager or its depository should clearly communicate this to the investor to avoid duplicate claims in respect of the same income.

Importance in practice

By bundling their international investments in a vehicle such as a FGR, investors can reduce the cost of asset management and diversify their portfolio. This has led to a growing use of the closed FGR by institutional investors (similar to the growth of Luxembourg FCPs and Irish CCFs as pooling vehicles).

There are a number of reasons for these investors to choose a closed FGR as an asset pooling vehicle such as flexibility and (international) tax neutrality when compared to a direct investment. Given these developments the Dutch Ministry of Finance has expressed its commitment to consult with tax treaty partners in order to solve possible interpretational issues which may arise when applying tax treaties to income of the closed FGR.

Furthermore, as described above with the UK and recently also with Canada, the Dutch Ministry of Finance is increasingly trying to reach mutual agreements with other countries to provide a practical framework with regard to the treaty application on the closed FGR.

The combination of Dutch participation exemption, the extensive Dutch treaty network and the cooperation of the Dutch Ministry of Finance offers an attractive environment for asset pooling through the Dutch closed FGR.

Italy: Amendments to the investment funds tax provisions in Italy

A new Italian law was enacted on 31 May 2010 that introduced amendments to the investment funds provisions. This law introduced the following provisions:

New definition of investment funds

This new definition will replace the current, more wide-ranging definition of investment fund with a more restricted definition. Any vehicles which had previously benefitted from the investment fund tax regime but that do not meet the new definition will be required to make the necessary changes to meet the new definition. If any amendments are required to meet the new definition then a non-recurring 5% substitutive tax will be levied on the fund. The substitutive tax will be calculated on the net value of the fund as at 31 December 2009. The payments will be due in three installments – 40% by 31 March 2011, 30% by 31 March 2012 and 30% by 31 March 2013.

If the fund does not meet the new definition and does not make the necessary changes to meet the new definition, then the fund will be forced to go into liquidation, in which case a substitutive tax is levied at a rate of 7%, calculated on the fund net value as at 31 December 2009, payable in installments, as described above.

The liquidation process must be concluded within 5 years and an additional 7% substitutive tax (which substitutes the corporate income tax and local taxes) will be levied on the relevant annual results registered during this liquidation period. This 7% substitutive tax will be payable on or before 16 February of each year. In order to avoid double taxation, proceeds that are distributed during to the liquidation process (and therefore already subject to the substitutive tax) will not be subject to the 20% withholding tax on proceeds distributed to foreign beneficial owners.

The disposals of real estate during the liquidation process will be subject to the "reverse charge" VAT system (subject to EU approval) and to sundry taxes totaling €504. However, the contribution of multiple real estate assets to a single company (made during the mentioned liquidation process) is out of the scope of VAT but sundry taxes will apply.

Restrictions to the exemption from 20% withholding tax

Previously proceeds distributed by investment funds to foreign beneficial owners who are tax resident in a "white list" country were exempt from withholding tax levied at 20%. The exemption has now been restricted to foreign beneficial owners who are tax resident in a "white list" country and are a specific type of investor (such as a pension fund or central bank). For foreign beneficial owners who now do not meet the criteria for the exemption, a reduced withholding tax may be applied according to the relevant double tax treaty, if treaty protection is available.

However, as a transitory rule, distributions made after 31 May 2010 that relate of profits that arose in the period to 31 December 2009 are subject to the former exemption criteria (i.e. being tax resident in a "white list" country only).

Amendments to the taxation of "real estate funds with restricted holding basis"

Real estate funds with restricted holding basis are no longer subject to net worth tax at 1%. Furthermore, withholding tax on the capital gain arising from the sale of units in the fund has been reduced from a rate of 20% to 12.5%.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.