1. Executive summary

A week is a long time in politics but is a year a long time in corporate reporting? Does much really change from one year to the next? Experience suggests that there is more change than usual both in the year when a new rule is introduced, which is a statement of the obvious, and in the succeeding year as companies review initial practices and often revise their reporting to conform more to what is the emerging practice.

A year ago, Deloitte's survey "Down The wiRe" looked at how companies announced their first set of annual results under the Disclosure and Transparency Rules (DTR). At that stage, many companies appeared to be struggling to interpret the new rules, with only a small number, 11% to be precise, providing all the required information. So now, a year down the track, how are companies doing? The short answer is much better. But, in common with school report cards, the comment is that there is room for improvement.

This 2010 survey found that 33% of companies reporting on 2009 year ends (2008 – 11%) included all the information required by the DTR. 17% did so in a single announcement and 16% spread over more than one announcement.

Discussion of going concern matters increased, with 45% of companies referring to this in their first announcements, compared to 21% in the previous year. This change was not simply due to evolving practice. The FRC issued in October 2009 its revised guidance on this subject.

A company's first announcement of its annual results (be it in the form of a, now optional, preliminary announcement or some other form of reporting) should be about more than regulatory compliance. It is seen as the most important piece of regular communication with investors. Careful consideration is needed of questions such as:

- Is a preliminary announcement still necessary, or could a single announcement covering the results for the year and all the information required by the DTR do the job better?

- When is the best time to provide this information, towards the limit of the DTR's four month deadline, or earlier to coincide with accepted practice in a particular sector?

- How much information should be provided? Does a short, punchy announcement provide the clearest view of performance and position, or is a longer announcement needed to serve the needs of the company's investors?

- What information should be provided in the key 'financial highlights' introduction to the results? Do the statutory figures required by IFRSs best tell the story? Should non-GAAP measures be employed to show underlying business results?

The findings on practice are that:

- 86% (2008 – 93%) of companies continued to produce a preliminary announcement, usually basing these on audited results. In contrast, investment trusts have moved away from historic practice, with only 20% (2008 – 40%) producing a preliminary announcement;

- companies took on average 70 days (2008 – 70 days) to issue a first announcement, with all companies in the survey announcing within the DTR's four month deadline;

- the first announcement by companies averaged 22 pages, with 11 pages of narrative, three pages of primary statements and eight pages of notes to the financial statements; and

- 95% (2008 – 95%) of companies included financial highlights at the start of their first announcements, with 83% (2008 – 80%) of companies including both GAAP and non-GAAP highlights.

One potential battleground may be the IASB's project on the presentation of financial statements. Will the standard setters and regulators seek to reduce the use of non-GAAP measures? Will preparers retain the flexibility to communicate their results to reflect their businesses and requests from shareholders? In politics the word "fair" is often used. In corporate reporting, the future presentation rules should be fair for all and, more importantly, the resulting company reports should be fair for all.

The reporting of annual results is clearly developing, responding both to regulatory requirements and changing practice. Who knows what will happen further down the track?

2. Reporting requirements

The requirements governing the announcement of annual financial results became more complicated following the implementation of the Disclosure and Transparency Rules (DTR) for periods beginning on or after 20 January 2007. Listed companies must now comply with various parts of the DTR and other requirements in Listing Rules and company law. The Deloitte survey of the first annual report announcements under the DTR, "Down The wiRe", suggested that many companies initially struggled to interpret the new rules.

In short, preliminary announcements are now voluntary. Companies may issue either:

- a preliminary announcement followed by a dissemination announcement regarding the full annual report; or

- a single announcement containing some or all of their annual reports.

Recent regulatory changes

The dissemination requirements of the DTR discussed below have not changed since their implementation. However, there have been two recent developments in related areas.

- The Listing Regime in the United Kingdom was restructured with effect from 6 April 2010 into two segments, "standard" (requiring compliance with listing requirements imposed by EU legislation) and "premium" (requiring compliance with these requirements and additionally with the FSA's more onerous super-equivalent admission standards). This distinction has little impact on the issues discussed by this publication, as the dissemination requirements of the DTR apply equally to companies with premium and standard listed securities.1

- Listing Rule 9.8.6 was amended with effect from 31 December 2009 to require the going concern statement in an annual report to be prepared in accordance with guidance issued by the FRC in October 2009 (replacing a reference to guidance issued in 1994). Preliminary announcements and the annual reports of companies with standard listed securities are outside the scope of this rule but, as discussed under 'Going concern in preliminary announcements' on page 4, the FSA has recommended that directors consider including significant information on going concern in preliminary announcements.

The following overview deals with the common issues requiring consideration by companies and includes references to relevant regulations and explanatory guidance from the FSA.

Preliminary announcements

Preliminary announcements are now optional, but companies, with a premium listing of shares which choose to produce one, must comply with the requirements of Listing Rule 9.7A as explained below.2

Listing Rule 9.7A

If a listed company prepares a preliminary statement of annual results:

(1) the statement must be published as soon as possible after it has been approved by the board;

(2) the statement must be agreed with the company's auditors prior to publication;

(3) the statement must show the figures in the form of a table, including the items required for a halfyearly report, consistent with the presentation to be adopted in the annual accounts for that financial year;

(4) the statement must give details of the nature of any likely modification that may be contained in the auditors report required to be included with the annual financial report; and

(5) the statement must include any significant additional information necessary for the purpose of assessing the results being announced.

The FSA has clarified3 that the requirement for the preliminary announcement to include "the figures in the form of a table, including the items required for a half-yearly report" does not mean that the preliminary announcement should be prepared in accordance with IAS 34. The preliminary announcement should contain appropriate commentary "necessary for the purpose of assessing the results being announced", but not necessarily the full report.

Going concern in preliminary announcements

The FRC guidance on going concern and liquidity risk issued in October 20094 included a recommendation that directors of listed companies consider whether, in light of the LR 9.7A(5) requirement to include in a preliminary announcement "any significant additional information necessary for the purpose of assessing the results being announced", they need to make disclosures about going concern in their preliminary announcements.

Where the audit report on the annual report includes, or is likely to include, an emphasis of matter in respect of going concern, disclosure of that fact is clearly required by LR 9.7A(4).

The FRC guidance is consistent with guidance previously issued by the FSA.5

Where a preliminary announcement is not produced, similar considerations would be expected in respect of the dissemination announcement.

Basic dissemination requirements

DTR 4.1.3 requires a company's annual report to be made public within four months of the year-end.

In its updates to List! subscribers in June 2008 and March 2009, the FSA clarified that:

- issuing a preliminary announcement within four months of the year-end is not sufficient. The full annual report must be available on the company's website within that timescale; and

- annual report information (and, indeed, any other regulated information) required to be issued in plain text cannot be issued in pdf format or via a website link.

Information to be disseminated

DTR 4.1.5 requires that an annual report includes audited financial statements, a management report and responsibility statements. However, other laws and regulations require other items (for example, the corporate governance statement, directors' remuneration report and statutory directors' report information) to be included in annual reports.

The DTR require other periodic financial reports (half-yearly financial reports and interim management statements) to be communicated in unedited full text via an RIS.6 But, presumably because of the length of many annual reports, DTR 6.3.5 allows that only the information which is contained in the annual report and is "of a type that would be required to be disseminated in a half-yearly financial report" be communicated in unedited full text. The whole annual report is then published on the website accessible via a hyperlink included in the announcement. This is referred to as a "components only" dissemination announcement in this publication. Publishing the entire annual report in unedited full text is permitted by the DTR as an alternative to this "components only" approach.

DTR 6.3.5

(1) Regulated information, other than regulated information described in paragraph (2), must be communicated to the media in unedited full text.

(2) (a) An annual financial report that is required by DTR 4.1 to be made public is not required to be communicated to the media in unedited full text except for the information described in paragraph (b).

(b) If information is of a type that would be required to be disseminated in a half-yearly financial report then information of such a type that is contained in an annual financial report must be communicated to the media in unedited full text.

(3) The announcement relating to the publication of the following regulated information must include an indication of which website the relevant documents are available:

(a) an annual financial report that is required by DTR 4.1 to be made public;

(b) a half-yearly financial report that is required by DTR 4.2 to be made public; and

(c) an interim management statement that is required by DTR 4.3 to be made public or an equivalent quarterly financial report.

Auditor involvement and references to audited information

As was the case under the old Listing Rules, the auditors' consent continues to be required prior to publication of a preliminary announcement (whether described as audited or unaudited). By contrast, no such consent is required for the publication of a dissemination announcement, whether it be the full annual report in plain text or a "components only" announcement. This apparent discrepancy is logical as the auditors will always have signed their audit report by the time of a dissemination announcement.

Neither a preliminary announcement nor a "components only" dissemination announcement constitute a company's statutory accounts, as they do not include all of the information required by company law in a full set of accounts. Section 435 of Companies Act 20067 makes clear that an audit report should not be published with non-statutory accounts and that a statement should be included stating:

- that they are not the company's statutory accounts;

- whether statutory accounts dealing with any financial year with which the non-statutory accounts purport to deal have been delivered to the registrar; and

- whether an audit report has been made on the company's statutory accounts for any such financial year, and if so whether the report:

-

- was qualified or unqualified, or included a reference to any matters to which the auditor drew attention by way of emphasis without qualifying the report; or

- contained a statement under section 498(2) (accounting records or returns inadequate or accounts or directors' remuneration report not agreeing with records and returns), or section 498(3) (failure to obtain necessary information and explanations).

A statement for a preliminary announcement reporting on a year ending in December 2010 might read as follows:

"The financial information set out above does not constitute the Company's statutory accounts for the years ended 31 December 2010 or 2009 but is derived from those accounts. Statutory accounts for 2009 have been delivered to the Registrar of Companies and those for 2010 will be delivered in due course. The auditors' reports on those accounts were unqualified, did not draw attention to any matters by way of emphasis and did not contain a statement under section 498(2) or (3) of the Companies Act 2006."

The section 435 statement in a preliminary announcement may usefully be worded also to give the information required by LR 9.7A(4) on any likely modification that may be contained in the auditors' report on the annual financial report.

A dissemination announcement that includes the entire annual report, including the auditors' report, in full unedited text represents the company's statutory accounts and therefore a section 435 statement is not required.

A "components only" dissemination announcement should include at a minimum the following.

Responsibility statement in "components only" dissemination announcements

The annual report responsibility statement, required to be reproduced in the dissemination announcement, refers to the annual report as a whole and includes a statement that the financial statements give a true and fair view of the assets, liabilities, financial position and profit or loss of the company and group. The "components only" dissemination announcement would not typically include a full set of notes and is likely to contain little or no company only information. It is therefore advisable to include introductory words in the dissemination announcement, which explain that the responsibility statement has been prepared in connection with the full annual accounts and directors' report and that certain notes and parts of the directors' report are not included within the dissemination announcement. An example follows:

Responsibility statement of the directors on the annual report

The responsibility statement below has been prepared in connection with the company's full annual report for the year ending 31 December 2010. Certain parts thereof are not included within this announcement.

"We confirm to the best of our knowledge:

- the financial statements, prepared in accordance with IFRSs as adopted by the European Union, give a true and fair view of the assets, liabilities, financial position and profit or loss of the company and the undertakings included in the consolidation taken as a whole; and

- the management report, which is incorporated into the directors' report, includes a fair review of the development and performance of the business and the position of the company and the undertakings included in the consolidation taken as a whole, together with a description of the principal risks and uncertainties they face.

This responsibility statement was approved by the board of directors on [date] and is signed on its behalf by:

[name]

Chief Executive

[name]

Officer Chief Financial Officer"

Practical issues and sequencing of announcements In promulgating the DTR, it may have been considered that a preliminary announcement would rarely be necessary and that companies would simply release a dissemination announcement (being the full annual report or a "components only" announcement).

However, in practice delays arise. In considering how to address any such issues, companies are mindful of their obligations under DTR 2.2 (disclosure of price sensitive information) and Listing Rule 9.7A.2 (announcement of dividend and distribution decisions). Both rules require announcements to be made as soon as possible and frequently compel announcement of approved results or dividends before the full annual report can practically be made available.

Publishing both a preliminary announcement and a subsequent dissemination announcement could mean repetition of a large volume of information. The FSA10 issued in March 2009 some explanatory guidance in this area, stating that, if the minimum information required by DTR 6.3.5 is included in unedited full text in a preliminary announcement, it need not be repeated when the company later announces the release of its annual report. The FSA suggests that it may be useful to refer to the preliminary announcement, when making the later announcement, to make clear how the DTR dissemination requirements have been met.

The FSA guidance does not refer to the practice of issuing a preliminary announcement including only the information required by LR 9.7A (so not including, for example, information on principal risks and uncertainties) and then "topping up" the information with a later announcement including the website link and the additional items required under DTR 6.3 but not previously included in the preliminary announcement. This approach means that no single announcement contains all the information required by the DTR and hence companies may wish to consult their advisors before adopting such a practice.

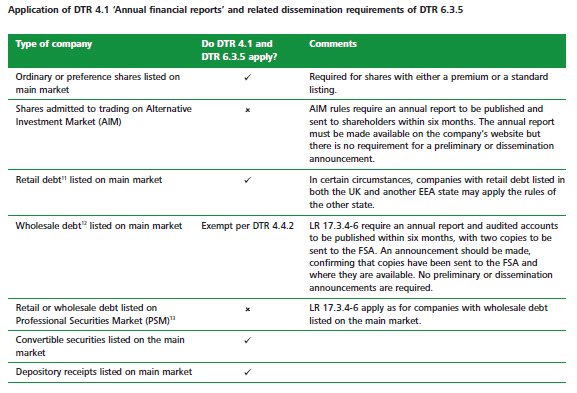

Application to different types of company

A summary of the application of DTR 4.1 on annual financial reports and DTR 6.3.5 on dissemination of those reports is provided in the table below.

3. The survey's objectives and basis

The objectives of this survey were to consider how practices in announcing full year results have developed following the implementation of the DTR and in particular:

- how promptly companies are announcing their full year results;

- what form the initial announcement of full year results takes and what information it includes;

- what subsequent announcements are made in respect of the annual report; and

- how companies are applying the dissemination rules of the DTR.

The survey was conducted by reviewing the announcements of the full year results of 130 companies with ordinary shares listed on the main market for financial years ending in 2009. The earliest period end sampled was a 52 week period to 25 January 2009 and the latest was a 52 week period ending 2 January 2010. The effective date of the DTR (being for periods beginning on or after 20 January 2007) meant that these were the second annual results reported under these rules.

For clarity, in this report, the first announcement of full year results issued by a company to the Stock Exchange means a Listing Rules 'preliminary announcement' or an 'annual results announcement' under the DTR or any other form of reporting, whichever appears first. Any later announcements concerning the full year results have been termed 'subsequent announcements'.

The sample comprised 30 investment trusts (companies classified by the London Stock Exchange as being in the industries of equity or non-equity investment instruments) and 100 other companies, split equally across the top 350 by market capitalisation at 26 February 2010, those in the smallest 350 by market capitalisation and the 312 that fall between those categories (the 'middle' group at 26 February 2010).

The sample is, as far as possible, consistent with that used in the recent Deloitte survey of half-yearly financial reports, "Measuring by halves". As a result of takeovers, delistings and movements between the market capitalisation strata over the recent months the sample could not be identical. One replacement investment trust and four replacement other companies were selected at random from the appropriate populations.

As in other recent Deloitte surveys, information for investment trusts is presented separately, in section 6.

To provide meaningful comparisons over time, where comparative information is given, it is for the 2008 full year announcements of the same companies in this sample.

4. Survey results – First announcements*

- 86% (2008 – 93%) of companies continued to produce a preliminary announcement, the majority of which were based on audited information.

- 83% (2008 – 80%) of first announcements included financial highlights reporting on both GAAP and non-GAAP performance measures.

- 39% (2008 – 22%) of companies included full detail on principal risks and uncertainties in their first announcements.

- 45% of first announcements made specific reference to going concern, compared to 21% in the previous year.

This section analyses the first announcements of annual results made by the 100 companies surveyed, covering the form of the announcement, the narrative content and the financial information provided.

Mechanics of reporting

Form of first announcement

The majority of companies continued to produce a preliminary announcement, with most of these made subsequent to the auditors' report on the company's annual report. As shown in figure 1 above, a number of companies opted for a more comprehensive first announcement. 8% of companies produced an annual report announcement (i.e. an announcement titled 'Annual Financial Report' or similar and clearly intended to provide all of the information required by the DTR in a single announcement), whilst 5% chose to disseminate their entire annual report in plain text. One company, in the smallest 350 group, provided only a link to a pdf of their annual report, with no further information in plain text.

Of the 75 companies announcing audited results, 65 stated that the auditors' report was unqualified, five stated that the report included an emphasis of matter and five stated that the results were audited but gave no indication of whether the report was qualified or modified in any way.

The five emphases of matter consisted of:

- four relating to going concern, one of which stated that the financial statements were prepared on a basis other than going concern; and

- one in respect of multiple uncertainties relating to going concern and the valuation of assets.

Of the 25 companies producing unaudited preliminary announcements:

- 19 stated that the auditors had yet to report, but gave no indication of whether a qualification or modification was expected;

- one stated that the company was not aware of any likely modification;

- three stated that a modified audit report was anticipated (two in respect of going concern and one a limitation of scope in respect of the net realisable value of inventory); and

- two made no reference to the status of the current year audit and thus did not comply with this aspect of section 435 of the Companies Act 2006.

Time to report

As shown by figure 2, most companies appeared to release their annual results in accordance with a settled timetable and the average time to produce a first announcement was steady year on year at 70 days. The time to report ranged from 35 to 120 days, with all companies producing a first announcement within the four month deadline.

Length of first announcement

The average length of the first announcements increased from 21 pages in the previous year to 22 pages in the current year. This was influenced by two companies in the smallest 350 group which chose to disseminate the full text of their annual reports for the first time and by two financial institutions in the top 350 group which continued to produce preliminary announcements but greatly increased the length of these in the current year.

As shown in figure 3, the larger companies tended to produce longer first announcements. The longest first announcements tended to be produced by banking and insurance companies. There were four such companies in the top 350 group, with first announcements ranging from 42 to 176 pages in length. The longest first announcement produced by any other company ran to 59 pages, being an audited preliminary announcement by a company in the top 350 group whilst the shortest first announcement was by the company in the smallest 350 group which provided only a link to a pdf of its annual report.

Figure 4 shows the split of the average 22 pages of a first announcement between narrative, primary financial statements and notes to the financial statements.

References to statutory financial information

93 of the 100 companies in the survey attempted to give a statement on the status of the statutory information included in the first announcement, as required by section 435 of Companies Act 2006 (and previously by section 240 of Companies Act 1985). Of the seven companies giving no such statement:

- five companies provided the full text of the annual report, including the auditors' report, in the first announcement and accordingly had no need for such a statement;

- one company was registered in Guernsey and therefore was not subject to this UK law requirement; and

- one company included the auditors' report from their annual report in a "components only" announcement.

The section 435 statements of 46 companies included all of the information required by Companies Act 2006. 38 companies stated that their last audit report was unqualified but did not make clear whether it included reference to any matters by way of emphasis and nine companies omitted other information.

An example of a statement meeting the requirements of Companies Act 2006 is included below.

The financial information set out above does not constitute the Company's statutory accounts for the years ended 31 December 2009 or 2008 but is derived from those accounts. Statutory accounts for 2008 have been delivered to the registrar of companies, and those for 2009 will be delivered in due course. The auditors have reported on those accounts; their reports were (i) unqualified, (ii) did not include a reference to any matters to which the auditors drew attention by way of emphasis without qualifying their report and (iii) did not contain a statement under section 237 (2) or (3) of the Companies Act 1985 in respect of the accounts for 2008 nor a statement under section 498 (2) or (3) of the Companies Act 2006 in respect of the accounts for 2009.

Rexam PLC – Final Results

Narrative content

The level of narrative reporting in first announcements ranged from a brief summary of the results for the year to, in two cases, over 100 pages of analysis.

The following elements of narrative reporting in first announcements have been analysed:

- which financial and non-financial highlights were included at the start of the first announcement;

- what information was given on key performance indicators (KPIs);

- whether the first announcement included detail on principal risks and uncertainties; and

- what level of disclosure was included on going concern and liquidity risk.

Financial and non-financial highlights

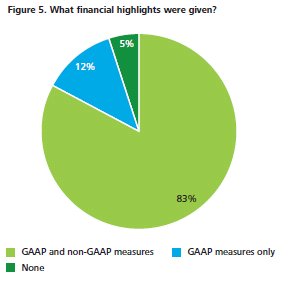

As shown by figure 5 below, nearly all of the companies in the survey included financial highlights in their first announcements, with most including both GAAP and non-GAAP measures.

This practice was consistent with the previous year, when 80% of companies presented both GAAP and non-GAAP financial highlights, 15% only GAAP highlights and 5% of companies presented no financial highlights.

In addition to these items, 38% of companies included non-financial highlights such as unit sales or number of retail outlets at the start of their first announcements.

As far back as 2006, the UKLA made recommendations14 in respect of the use of non-GAAP measures (referred to as Alternative Performance Measures (APMs) by the UKLA) in financial reports. These included that:

- non-GAAP measures should be clearly defined, including identification of the basis of calculation adopted;

- where possible, non-GAAP measures should be presented in combination with GAAP measures; and

- comparatives should be provided for any non-GAAP measures.

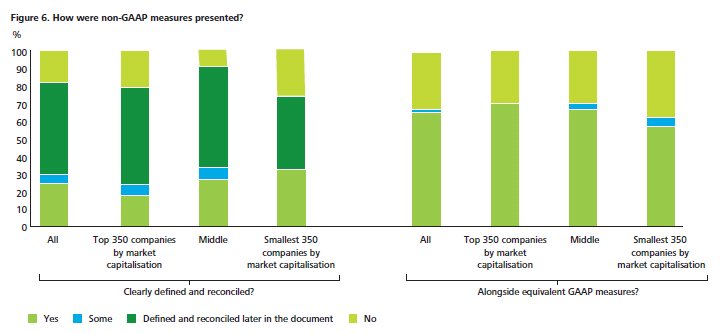

As shown by figure 6 above, the majority of companies attempted to comply with these recommendations.

Of the companies including non-GAAP measures in their financial highlights:

- 25% reconciled these measures to their GAAP equivalents in the financial highlights section, 14% cross-referred to a reconciliation later in the document and 38% explained the non-GAAP measure and reconciled to a GAAP equivalent later in the document but did not cross-refer to this reconciliation in the highlights section (the remaining 23% did not appear to meet this UKLA recommendation);

- 65% presented the non-GAAP measures alongside their GAAP equivalents; and

- 93% provided comparatives for the non-GAAP measures, with the remaining 7% providing year on year movements in percentage terms.

An example of highlights presented in accordance with the UKLA's recommendations follows.

Key points – Financial

- Revenue from continuing operations decreased by 42% to £55.0m (2008: £94.6m), mainly reflecting substantial reductions in both units sold and average selling price.

- Excluding exceptionals, the pre-tax loss was £8.3m (2008: £3.4m).

- Exceptional charges totalled £46.0m (2008: £17.4m), of which £44.6m (2008: £12.3m) was non-cash and related to downward asset revaluations.

- The loss before tax from continuing operations was £54.3m (2008: £20.8m), equating to a loss per share of 109.3p (2008: 39.9p).

- Year end total shareholders' equity decreased by 35% to £103.4m (2008: £159.2m), representing net assets per share of 197p (2008: 304p), also down 35%.

- Year end net cash totalled £10.9m, which compares with £7.1m at 31 December 2008 and £21.9m at 30 June 2008. Since the year end, net cash has risen to £16.0m.

Key points – Commercial

- Gleeson Regeneration & Homes and Gleeson Strategic Land made an operating loss of £43.7m (2008: £16.3m) on revenue of £34.2m (2008: £64.0m); excluding exceptionals, the loss was £6.3m (2008: £1.2m).

- Gleeson Regeneration & Homes sold 317 (2008: 436) units, down 27%, at an average selling price of £102,000 (2008: £149,000), down 32%, reflecting a higher proportion of sales to registered social landlords.

- Gleeson Strategic Land made no land sales, but increased its portfolio of options to 3,755 (2008: 3,621) acres

- Powerminster Gleeson Services (social housing maintenance) traded well, making an operating profit of £1.0m (2008: £1.1m) on revenue of £18.7m (2008: £19.5m), and increased its already substantial order book to £169.5m (2008: £158.8m).

- Gleeson Commercial Property Development (in run-off) now has only three sites remaining.

- The central overhead reduced by 41% to £3.6m (2008: £6.1m), of which £0.6m (2008: £0.7m) was exceptional.

MJ Gleeson Group PLC – Preliminary Announcement

Key performance indicators (KPIs)

Company law and DTR 4.1.9 require a listed company's annual report to include both financial and non-financial KPIs to the extent that these are necessary for an understanding of the business' development, performance or position. There is, however, no requirement for these to be included in the information disseminated in plain text.

As discussed above, nearly all of the companies in the survey included financial highlights in their first announcements.

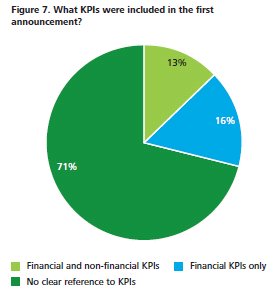

In addition to this, 29% of companies made explicit reference to KPIs (or a similar term such as "key performance measures") in their first announcements.

As shown in figure 7, all of these included financial KPIs whilst 13% of companies also provided non-financial KPIs in their first announcements.

This level of KPI reporting was consistent with the previous year, when 18% of companies provided both financial and non-financial KPIs and 11% only financial KPIs.

The number of KPIs presented varied:

- where companies provided financial KPIs, they numbered from two to ten with an average of five financial KPIs; and

- where companies provided non-financial KPIs, they numbered from one to ten with an average of four non-financial KPIs.

86% of companies providing KPI information sought to put those measures into context by providing comparative figures, with another 7% showing year on year movements in percentage terms. In addition, 17% of KPIs were compared to the company's targets.

An example of a KPI analysis showing both comparative figures and comparison to targets is shown right.

One company in the middle group and seven in the smallest 350 category included neither a financial highlights summary nor explicit reference to KPIs in their first announcements. One of these was the company noted above whose first announcement consisted only of a link to a pdf of the company's annual report, whilst the other seven companies provided some form of analysis of performance in the period in the narrative section.

Principal risks and uncertainties

As shown by figure 8 below, 39% of companies included the full description of principal risks and uncertainties in their first announcements, 4% gave only a summary and a cross-reference to the annual report and one company included a detailed description of financial risks but was silent on other risks and uncertainties. 56% of companies gave no information on principal risks and uncertainties in their first announcements.

Going concern and liquidity risk

Guidance issued by the FRC15 and by the FSA16 in 2009 recommended that the directors of listed companies consider including disclosures on going concern in preliminary announcements. These recommendations are discussed in more detail in section 2 of this publication.

As shown by figure 9 overleaf, this guidance had some effect, with a notable increase in the number of companies discussing either going concern or liquidity risk in the current year. In total, 45% of first announcements commented specifically on going concern, compared to 21% in the previous year.

A further 30% (2008 – 34%) made no explicit reference to going concern, but commented on liquidity risk. This shows a clear improvement in this area following the recent FRC and FSA guidance, although it is noted that 25% (2008 – 45%) of first announcements remained silent on both going concern and liquidity risk.

An example of disclosure on going concern from a preliminary announcement follows.

Going concern

A description of the Group's business activities, its financial position, cash flows, liquidity position, facilities and borrowings position, together with the factors likely to affect its future development, performance and position, are set out in this announcement. It will also be discussed and disclosed in the Business Review and Financial Review and in the notes to the financial statements, all of which will be included in the 2009 Annual Report that will be available on the Group's website, www.bat.com on 26 March 2010.

The Group has, at the date of this report, sufficient existing financing available for its estimated requirements for at least the next twelve months. This, together with the proven ability to generate cash from trading activities, the performance of the Group's Global Drive Brands, its leading market positions in a number of countries and its broad geographical spread, as well as numerous contracts with established customers and suppliers across different geographical areas and industries, provides the Directors with the confidence that the Group is well placed to manage its business risks successfully despite the current financial conditions and the uncertain outlook in the general global economy.

After reviewing the Group's annual budget, plans and financing arrangements, the Directors consider that the Group has adequate resources to continue operating for the foreseeable future. The financial statements have therefore been prepared on a going concern basis.

British American Tobacco PLC – Preliminary announcement year ended 31 December 2009

Financial content

Primary statements and dividend information

Other than the company noted above whose first announcement consisted only of a link to a pdf of the annual report, all companies in the survey included a full set of primary statements in their first announcements. All of the primary statements presented included comparative figures, other than for one company in the smallest 350 group which omitted comparative information from the statement of changes in equity.

45 companies in the sample reported on periods beginning on or after 1 January 2009 and were, therefore, subject to the revised version of IAS 1. This requires an additional balance sheet to be presented as at the beginning of the earliest comparative period (a "third balance sheet") when the company applies an accounting policy retrospectively, makes a retrospective restatement of items in its financial statements or reclassifies items in its financial statements.

Of these 45 companies:

- six presented a third balance sheet in their first announcement;

- one stated that its annual report would include a third balance sheet, but did not include this in the first announcement;

- 17 showed evidence of restatement of either primary statements or notes to the financial statements (including four companies with restated balance sheets) but gave no indication of presenting a third balance sheet; and

- 21 gave no indication of either restating any items in the financial statements or presenting a third balance sheet.

Listing Rule 9.7A requires a preliminary announcement to include "the figures in the form of a table, including the items required for a half-yearly report, consistent with the presentation to be adopted in the annual accounts for that financial year." This requirement is not entirely clear regarding the inclusion of a third balance sheet. Under the requirements of IAS 34, this would never be required for a half-yearly report.

However, to demonstrate clearly consistency with the presentation of the annual accounts, it would be advisable to include a third balance sheet in a preliminary announcement where one is included in those accounts.

Inclusion of a third balance sheet in a preliminary announcement would appear to necessitate reference to all three sets of statutory accounts in the company's section 435 statement, including reference to the Act under which each set of accounts was prepared. Accordingly, a section 435 statement for a December 2010 preliminary announcement incorporating three balance sheets might read as follows:

"The financial information set out above does not constitute the Company's statutory accounts for the years ended 31 December 2010, 2009 or 2008 but is derived from those accounts. Statutory accounts for 2008 and 2009 have been delivered to the Registrar of Companies and those for 2010 will be delivered in due course. The auditor's reports on the 2010, 2009 and 2008 accounts were unqualified, did not draw attention to any matters by way of emphasis and did not contain a statement under s498(2) or (3) of the Companies Act 2006 or equivalent preceding legislation."

57 companies included all of the information required by Listing Rule 9.7A.2 in respect of the proposed final dividend in their first announcements, whilst another 39 made clear in either the first announcement or annual report that no final dividend was proposed. The remaining four companies complied with this requirement by means of a separate dividend announcement on the same day as the first announcement. An example of a dividend announcement providing all information required by the Listing Rules follows.

Dividends

The Board is recommending a final dividend of 2.5p per ordinary share which, together with the interim dividend of 2.5p paid in October 2009, results in a total dividend of 5.0p per ordinary share in respect of 2009 (2008: 5.0p per ordinary share). The dividend will be paid on 14 May 2010 to shareholders registered at the close of business on 23 April 2010.

Molins PLC – 2009 Preliminary Announcement

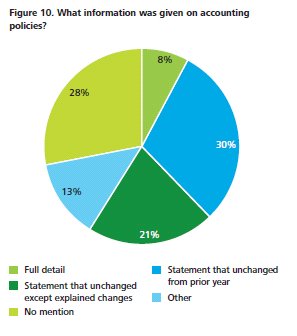

Accounting policies

As shown by figure 10 below, companies gave varied levels of information on their accounting policies in their first announcements, with 8% giving full detail of and 28% giving no meaningful information on their accounting policies.

The 13% of companies giving 'other' information on accounting policies consisted of:

- nine companies stating only that their financial statements were prepared in accordance with IFRSs;

- three companies giving details of specific changes in policies, but no statement that other policies were unchanged; and

- one company providing a statement that policies were unchanged along with detail of selected accounting policies.

Notes to the financial statements

Figure 11 shows the average number of notes included in the first announcement and the range. With the exception of the company in the smallest 350 group whose first announcement consisted only of a link to a pdf, all first announcements included at least one note to the financial statements. The largest number of notes was 41, in a full annual report disseminated by a company in the smallest 350 group. In total, seven companies included a full set of notes in their first announcements.

Figure 12 shows the type of notes most commonly included in first announcements. These are EPS, segmental analysis, exceptional items and tax. Other common notes gave details of dividends paid or proposed (63% of companies) and additional cash flow information (61%). The most common notes included in first announcements were all similar in that they gave information on the company's performance in the period (rather than additional balance sheet information).

20 of the 24 companies making reference to a business combination in their first announcement gave detailed information on those acquisitions in the notes to the financial statements, whilst 25 of the 63 companies with a defined benefits pension scheme balance gave detail on this in the notes.

To view this document in its entirety please click here.

* This section analyses the findings for all companies other than investment trusts

Footnotes

1 In March 2010, the FSA issued a summary of frequently asked questions on the changes to the Listing Regime, which is available at www.fsa.gov.uk/pages/Doing/UKLA/pdf/listing_regime_faqs.pdf

2 Companies with a standard listing are outside the scope of Listing Rule 9.7A. However, it would be advisable for such companies to treat this as persuasive guidance and to include the information required by Listing Rule 9.7A in any voluntary preliminary announcement.

3 List! Issue No. 18 – March 2008

4 Available at www.frc.org.uk/publications/pub2140

5 List! Issue No. 20 – January 2009

6 Regulated Information Service

7 The statement in respect of financial statements for which the comparative year's audit report was prepared under Companies Act 1985 (for example, a year ending 31 March 2010) will need to make reference to the requirements of that Act. The Deloitte publication "Down The wiRe", published in May 2009 and available at www.deloitte.co.uk/audit includes guidance on how this might be achieved.

8 List! Issue No. 18 – March 2008

9 List! Issue No. 18 – March 2008

10 Update to List! subscribers 30 March 2009

11 Debt with a denomination per unit of under €50,000 or equivalent

12 Debt with a denomination per unit of over €50,000 or equivalent

13 The PSM is a nonregulated market for listed debt of any denomination. It is listed for the purpose of the Listing Rules.

14 List! Issue No. 12 – February 2006

15 Going concern and liquidity risk: Guidance for directors of UK companies – available at www.frc.org.uk/publications/pub2140

16 List! Issue No.20 – January 2009

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.