1. Power Market in Turkey and Privatization

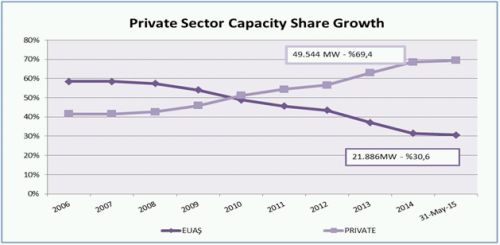

Turkey continues to transfer generation assets owned by state-owned generation company EÜAŞ to the private sector.

Thanks to the ongoing privatization process and the licensing of greenfield generation investments by the Energy Market Regulatory Authority (EMRA), the share of the private sector in power generation in Turkey has been steadily increasing.

The liberalization process in the Turkish power market is now more than ten years old and the level of competition is quite satisfactory. Day-ahead market, intra-day market and futures markets are available supplementary to the many bilateral contracts between buyers and sellers.

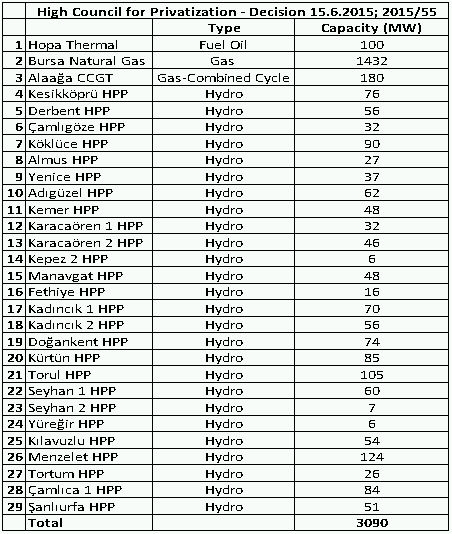

Most recently, the High Council for Privatization announced a new package of privatization and the process has been initiated. The power plants owned by EÜAŞ shown in the below table have been transferred to Privatization Authority (PA) to proceed with the privatization process.

26 out of the 29 power plants to be privatized in this round are hydropower plants. However, they are not qualified for the renewables support mechanism since based on the legislation, canal or river type hydro power plants as well as plants with less than fifteen square kilometers reservoir area that came online after 18 May 2005 are eligible for YEKDEM.

2. Renewables Support Mechanism in Turkey (YEKDEM)

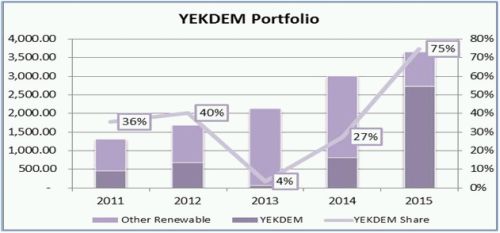

Turkey adjusted its renewables support mechanism in 2010 into a more incentivizing scheme and, amongst other aspects, a feed-in-tariff (FIT) mechanism denominated in US cents and on differentiated sources has been put in place. Since then, wind, solar, hydro and other renewables have attracted great interest from both domestic and international investors.

Renewable power plants commissioned after 18 May 2005 are qualified for feed-in tariffs. The guaranteed prices are applicable for ten years after commissioning.

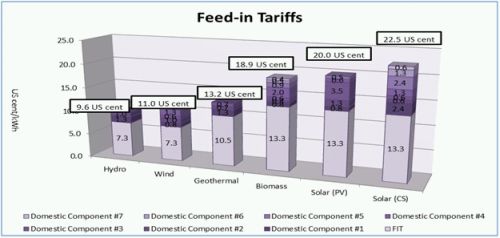

The applicable FIT for different types of renewables-based power generation varies. There is also a domestic component applicable to the existing tariff, and higher tariffs may be achieved based on the number of domestic components. The duration for domestic component addition is five years after commissioning. The legislation authorized the Council of Ministers to determine the scope of the tariff mechanism after 31 December 2015. For qualification, the Council of Ministers extended the time for commissioning to 31 December 2020 without changing other parameters such as duration or the level of the tariff. Below is a comparative chart depicting base FITs and Extra FITs.

3. Hydro Power in Turkey

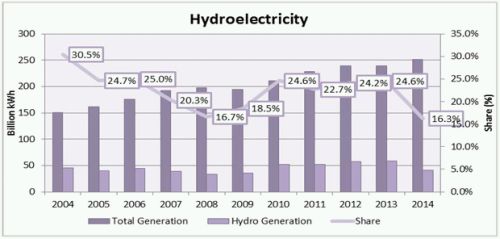

Turkey has traditionally utilized its hydro potential in electricity generation. 2014 marked a drop in hydro-based power generation due to a severe drought. Based on water and rain levels, hydro-based power generation exhibits a high degree of variation.

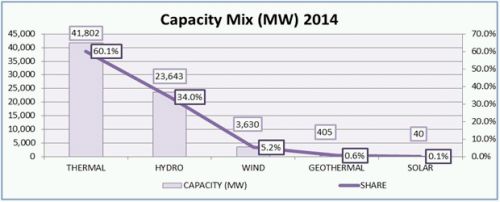

Thanks to the incentive mechanism, the installed capacity in hydro is stably increasing. As of the end of 2014, Turkey had 521 operational hydropower plants (the total number of operational power plants in Turkey is 1,126) with a total capacity of almost 24,000 MW (total capacity in Turkey is around 70,000 MW). This corresponds to 34 percent of total capacity. Within the first 5 months of 2015, 7 more hydropower plants came online with a capacity of around 1,000 MW. The share of hydro in power generation capacity went up by 1 percent during the first five months of the year reaching 35 percent from its previous 34 percent level in 2014.

The national transmission company TEİAŞ envisages that by 2018, the total capacity of hydropower plants will reach 29,635 MW corresponding to 36.9 percent of the total capacity (TEİAŞ, 2014). The target capacity of the Energy Ministry by 2019 is 32,000 MW (MENR, Strategic Plan 2014).

The FIT for qualified hydro power plants is 7.3 US cents. The domestic components include turbines (1.3 US cents) and generator and power electronics (1.0 US cents).

While the base FIT for small hydro is 73 USD per MWh the YoY average spot market price (7 July 2014-7 July 2015) in the day ahead market is 56 USD per MWh. As said, the tariff may be escalated for domestically manufactured equipment.

The FIT system provides the companies with constant and foreseeable cash flows that ultimately reduce the risks associated with the price, volume and domestic currency. Thus, project bankability is quite high.

The privatization process for state-owned hydropower plants is underway. Ten hydropower plants were transferred to the private sector in 2014, all to local bidders.

They received surprisingly high bids, USD 2.5m per MW on average, despite their small sizes. This once again underlined that acquisition of these operating assets is still more favorable than licensing of greenfield investments (PWC, 2015).

4. The Acquisition Regime

The acquisition regime in Turkey in terms of hydro power plants is relatively simple. It is stipulated by law that each power plant should get a separate license from EMRA and the accounts should be kept separately. Although licenses are non-transferable, usually the project company can be bought and sold or the specific power plant can be bought and sold. If the specific plant is sold to a third party, the third party should get a license from EMRA. If the shares of the project company are transferred a simple approval of EMRA is required. Certain transactions may require the approval of Competition Authority.

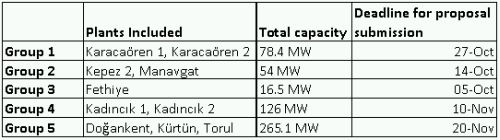

With respect to privatizations, the Privatization Authority (PA) is responsible for implementing the process. The process is depicted in the diagram at the end of this text. Soon after the announcement of the High Council for Privatization in June 2015, the Privatization Authority promptly announced the auction process of 10 out of 29 power plants.

Similar to the previous EÜAŞ privatizations, this round also adopts a portfolio approach, but this time on smaller scale. The portfolios of ten power plants have been announced in July 2015 as follows:

Bidders will not be able to bid separately for each power plant they have interest but bid instead for groups.

As the day-ahead market has been operational for almost 4 years, energy exchange EPİAŞ has been established, intraday market has been launched and power derivatives can be centrally bought and sold, the marginal costs for power plants have become increasingly important. With high marginal costs exacerbated by the foreign exchange rates, natural gas plants may struggle in the spot markets while zero marginal cost hydro-plants with purchase guarantees at dollar denominated prices covering the entire production may put hydro-dominated portfolios at an advantageous position.

To wrap-up, besides greenfield investments, acquisition of hydropower plants from the privatization portfolio provides good opportunity for the international and domestic investors alike. Given the market conditions, owning and operating hydro-power plants in Turkey continue to be quite attractive business.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.