On 21 July 2016, the Central Bank announced that holders of variable rate mortgages will be granted further protections from 1 February 2017.

The new protections will benefit personal consumers (i.e. individuals acting outside their trade, business or profession) in relation to variable rate mortgages (excluding tracker mortgages) ("relevant borrowers").

Regulated lenders (banks and retail credit firms) will be required to prepare a summary statement (the "Statement") of their policy on setting variable mortgage rates, provide additional information to relevant borrowers in their statements of account, and provide additional information to relevant borrowers when variable mortgage rates change.

BACKGROUND

In November 2015, the Central Bank began a consultation on increased protections for relevant borrowers in light of its concerns that the terms and conditions given to those borrowers were not sufficiently clear and transparent.

In its consultation, the Central Bank proposed that lenders be obliged to:

- publish a variable rate policy statement;

- give relevant borrowers information on alternative product options; and

- give relevant borrowers reasons for changes to variable rates.

The Central Bank also asked for views on whether a longer notice period should be given to relevant borrowers before a variable mortgage rate was increased. The Central Bank has decided not to increase the notice period beyond the current 30 day requirement for the time being.

HOW WILL THE PROTECTIONS TAKE EFFECT?

The protections are set out in an Addendum to the Consumer Protection Code.

WHEN WILL THE PROTECTIONS TAKE EFFECT?

The new protections will take effect from 1 February 2017.

DETAILS OF THE NEW PROTECTIONS

Summary statement

A lender must:

- draft and publish the Statement of its policy for setting each variable mortgage interest rate (excluding tracker rates) that it makes available to relevant borrowers;

- keep the Statement up-to-date;

- give the Statement to each potential relevant borrower when giving him/her the relevant loan offer (the Statement is a separate document from the loan offer); and

- publish the Statement on its website.

- The form and guidance as to the content of the Statement are set out in Appendix F to the Consumer Protection Code ("CPC"). The Statement must set out:

- factors that could cause a variable rate change (e.g. cost of funds, regulatory requirements, business strategy) and an explanation of those factors in "an informative and non-technical manner";

- details as to how those variable rates are set (e.g. what governance procedures are followed by the lender when changing those rates); and

- circumstances in which the lender applies different interest rates to different types of borrowers, and the reasons for this.

Changes to the Statement must be notified to relevant borrowers on paper or in another durable medium as soon as possible. The updated Statement must also be made available to them (for lenders with a website, relevant borrowers can be directed to the updated Statement on the website).

Statements/Notifications

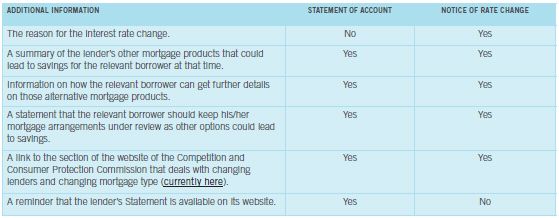

When:

- providing a relevant borrower with his/her statement of account (which, under the CPC, must be provided at least annually); or

- notifying a relevant borrower of an interest rate change under the CPC,

additional information must now be included. This is summarised below:

CONCLUSION

Each affected lender has until 1 February 2017 to prepare its Statement, and to make the necessary operational changes to ensure that account statements and notices of interest rate changes issued to relevant borrowers meet the new requirements going forward.

In its Feedback Statement, the Central Bank emphasised that as the prescribed form Statement contains instructions to lenders as to what should be included, rather than prescribing the exact content, lenders must:

- draft the content in "a clear and consumer friendly manner and in plain English"; and

- carry out consumer testing on the content before formally launching the Statement.

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.