INTRODUCTION

Dillon Eustace is a leading law firm focusing on financial services, banking and capital markets, insurance regulation, corporate and M&A, insolvency, litigation and dispute resolution, real estate and taxation.

Headquartered in Dublin, Ireland, and the Cayman Islands, the firm practices Irish and Cayman Islands law. The firm's international focus and client base has seen it establish representative offices in Tokyo (2000), New York (2009) and Hong Kong (2011).

Dillon Eustace has developed a dynamic cross-disciplinary Aviation Finance Group made up of specialists operating in the firm's existing financial services, corporate, litigation, banking, regulatory and compliance areas.

AVIATION FINANCE – IRELAND AS A KEY LOCATION

Ireland has been one of the pre-eminent jurisdictions for aircraft finance and leasing for almost 40 years. The Irish industry traces its roots back to the foundation of Guinness Peat Aviation in Shannon, County Clare in 1975 and in the intervening period the aircraft leasing, trading and brokerage industry has proved to be one of Ireland's greatest success stories. As one of the world's major centres for aircraft lessors, a survey conducted by the Federation of Aerospace Enterprises in Ireland estimated that aviation leasing companies in Ireland manage assets worth in the region of €82.9 billion and provide approximately 1,000 high value jobs here.

IRELAND'S ATTRACTIONS

With the number of global aircraft leasing companies establishing a presence in Ireland exceeding 30 in recent years, Ireland and Dublin in particular has become recognised as a world leader in the aviation finance industry. Among the roster of industry leaders located here are GECAS, CIT, Orix, ILFC, AWAS, ICBC, Mitsubishi, SMBC Aviation Capital, Avolon and Lease Corporation International.

The principal reasons for selecting Ireland as a location for aviation finance and leasing are:

- Attractive tax treatment in an EU and OECD member state (and so an "on-shore" jurisdiction)

- Professional and knowledgeable service providers, with a track record of success

- Sophisticated legal system

- Simply owning or leasing an aircraft, aircraft engine or helicopter does not give rise to any requirement for licensing or authorisation in Ireland

- Complete familiarity with the Cape Town Convention

- Established reputation as a jurisdiction for the location of vehicles to access the capital markets

AVIATION FINANCE – UTILISING THE CAYMAN ISLANDS

With the establishment of our Cayman Islands office in 2012, Dillon Eustace became the first European Union legal firm to establish a fully serviced practice there. This move was in response to increased client demand for Cayman services and is a reflection of the attractiveness of Cayman as a place to do business.

The Cayman Islands offer a well-regulated and internationally respected, tax-neutral, offshore business environment and has been a leading offshore jurisdiction for international aircraft financing and operating lease transactions for more than thirty years. Use of special purpose vehicles ("SPVs") incorporated in the Cayman Islands has proven flexible for both financing and operating lease structures.

Cayman SPVs have a quick and easy incorporation procedure and are relatively inexpensive to establish. Although the system of company law in Cayman is based on English law, it provides greater flexibility and involves fewer administrative formalities than under the equivalent English legislation.

There are many factors that make it appealing to use a Cayman vehicle as part of an aircraft financing or operating lease transaction. With a Cayman exempted company, there is no requirement to appoint auditors, or to hold an annual general meeting, nor is there any statutory prohibition on the company giving financial assistance for the purchase of its own shares, so long as the directors are acting in the company's best interests. The corporate records of Cayman exempted companies are not publicly available and there is no requirement for directors or officers of the company to be resident in the Cayman Islands.

It is also possible for Cayman exempted companies to migrate out of Cayman into another jurisdiction (so long as that other jurisdiction allows inwards migration), and to merge with a company from any other jurisdiction that allows such merger.

The Cayman Islands is a safe and stable jurisdiction, and has a sophisticated legal system based on the English model, which can deal competently with any legal disputes which may arise. Moreover, the Cayman Islands' legal system facilitates the enforcement and realisation of security, allowing financiers to take comfort with the level of protection afforded to their interests in the jurisdiction.

Cayman incorporated - Irish tax resident SPV

It is possible to have a Cayman incorporated and Irish tax resident SPV, provided it can be established that central management and control of that Cayman incorporated SPV is in Ireland. Management and control relates to the high level strategic decisions of the SPV (i.e. where the "head and brains" of the company are) as opposed to the day-to-day administration of the SPV. In practice, the board of directors of the Cayman SPV should meet regularly in Ireland and ideally have a majority of Irish resident directors on the board in order to achieve Irish tax residence.

When set up in this way, an aircraft financing or operating lease structure can have the benefit of the Cayman Islands' flexible corporate law regime and of Ireland's aforementioned favourable tax regime, including its double tax treaty network (see Appendix I).

The combination of our Irish office together with our office in the Cayman Islands, places Dillon Eustace in an ideal position to provide clients with both legal and tax advice on how best to benefit from the establishment of such favourable corporate structures.

LEGAL & REGULATORY

Service provision capability

While market intelligence indicates that the favourable Irish tax regime has been a decisive factor for the vast majority of aviation finance and leasing companies, this influx has resulted in the development of a strong support services sector and professional expertise, particularly in the field of legal and tax advice.

As a centre for aviation finance and leasing since the mid-1970s, there is a strength and depth to Ireland's service providers in this area which equals, if not exceeds, that of any other jurisdiction.

Ireland and the Cape Town Convention

Ireland's importance in the aviation finance industry was underlined by its selection (ahead of stiff competition from a number of other countries) as the location of the International Registry of financial interests in aircraft established under the Cape Town Convention. The registry is operated by Aviareto in Shannon.

By introducing the concept of an electronic international registry of financial interests in airframes, aircraft engines and helicopters, the Convention addresses financiers' and creditors' concerns by providing for enforceable interests in those assets which are recognised by all Contracting States.

The Convention became part of Irish law on 9th July, 2005 with the enactment of the International Interests in Mobile Equipment (Cape Town Convention) Act, 2005. In addition, the Irish High Court was appointed as the international centre for the aircraft leasing disputes under the Convention.

The Irish Legal System

Ireland operates a "common law" system, along the same lines as both the USA and the UK. Much Irish legislation stems from either UK statutes or European Union directives or regulations.

As a successful location for international financial services over many years, Irish lawyers are well used to dealing with foreign law governed agreements, particularly where New York or English law is being applied, and with their counterparts in those jurisdictions.

The entry by Irish companies into arrangements governed by the laws of other jurisdictions does not usually raise any particular issues and those agreements are likely to be recognised and enforced by the Irish courts.

No requirement for an Irish Licence or Authorisation

Typically, Irish companies which own and/or lease aircraft, aircraft engines or helicopters are not required to be licenced or authorised by any Irish governmental entity in order to carry on their business.

So far as the registration of aircraft in Ireland in concerned, the Irish Aviation Authority ("IAA") is the State agency responsible for maintaining the register of civil aircraft.

While Ireland should not be considered in any way a "flag of convenience" jurisdiction, registering and deregistering an aircraft with the IAA is quite a straightforward process. In order for an aircraft to be registered on the Irish Aircraft Register and obtain an EI mark, the owner or lessor company must be incorporated in Ireland and at least two thirds of its directors must be Irish or EU citizens.

Irish registered aircraft may be operated and/or maintained in other jurisdictions provided certain requirements imposed by the IAA are met.

Accessing the Capital Markets from Ireland

Ireland has an established reputation as the jurisdiction of choice for the location of special purpose vehicles through which the capital markets may be accessed.

The first aircraft lease securitisation was originated by GPA in 1992 and since then Ireland remained at the forefront of this activity.

Aside from the various tax considerations which have made Ireland an attractive jurisdiction for these types of deals, the Irish Stock Exchange rules regarding the listing of specialist debt securities provide a relatively inexpensive and timely listing process and have proven popular with many arrangers (for both Irish and non-Irish domiciled vehicles).

TAXATION

As noted above the favourable taxation regime available in Ireland has been a significant factor in the development and growth of the aircraft leasing industry in Ireland. In this regard the Irish Government's continued commitment and support to the International Financial Services Industry (which includes the aircraft leasing industry) is extremely welcome. To this end the Minister for Finance announced in Budget 2013 that consideration is being given to the introduction of new funding sources for airlines, aircraft financing and aircraft leasing companies, with the intention of maintaining Ireland's position as the pre-eminent aircraft leasing jurisdiction.

The 2012 Finance Act contained a number of measures relevant to the aircraft leasing industry such as the Special Assignee Relief Programme which is designed to attract key executives to Ireland by essentially providing income tax breaks to these employees, subject to certain conditions being satisfied. Building on this the Finance Bill 2013 proposes the introduction of further measures designed to incentivise the growth of Ireland's aircraft leasing industry with the introduction of accelerated tax depreciation for the construction of hanger and other ancillary aviation facilities. Additionally provision is proposed to be made for exemption from stamp duty on the issue, transfer or redemption of an enhanced equipment trust certificate (which is a type of loan capital issued by a company in order to raise finance for the acquisition, development or leasing of aircraft).

Some of the key attractions of the Irish corporate taxation regime include:

- Availability of the 12.5% rate of tax

- Tax depreciation (Capital Allowances) for the cost of equipment and plant and machinery (which includes aircraft and aircraft engines) over 8 years and accelerated tax depreciation allowances for certain hanger and other ancillary aviation facilities as proposed by Finance Bill 2013

- An extensive range of exemptions provided from withholding tax on interest and dividend payments and no withholding taxes on lease rentals

- On-shore location (member of the EU and OECD)

- Availability of an extensive (and ever increasing) network of double taxation agreements (see list of current double tax treaty partners). Currently treaties are in place with 68 countries, of which 64 are currently in force and negotiations are taking place for another 4 in the future (See Appendix I)

- No stamp duty on instruments transferring aircraft or any interest, share or property of or in an aircraft in addition to an exemption with respect to enhanced equipment trust certificates as proposed by Finance Bill 2013

- Zero per cent VAT on international aircraft leasing

- Certainty offered by the Irish corporate taxation regime and on-going co-operation between key industry stakeholders

When considering leasing and asset finance transactions then generally speaking there are three options: (a) Trading Company, (b) Non-Trading Company and (c) a Qualifying Company.

Corporation Tax

a) Trading Company

The 12.5% rate of corporate tax is available in respect of trading activities and accordingly will be applicable to leasing activities which are sufficient to constitute a "trade" for Irish taxation purposes. There is no specific definition of the term "trade" for Irish taxation purposes and each case will be required to be examined in light of applicable guidance issued from the Irish Revenue Commissioners on the matter and relevant case law in order to determine whether a "trade" exists. In many cases there will be no doubt about whether a company's activities constitute trading but where there is some uncertainty it is possible to seek an opinion from the Revenue Commissioners.

Where the leasing activities are sufficient to constitute a trade then any trading profits will be taxable at the 12.5% rate of corporation tax with a deduction in general being allowed for expenses of a revenue nature which are incurred "wholly and exclusively" for the purpose of the trade. Interest payments made by a lessor should also generally be deductible for tax purposes where they are incurred "wholly and exclusively" for the purpose of the trade. Capital allowances (essentially tax depreciation) should also be available to a trading lessor at an annual rate of 12.5% (i.e. costs written off over 8 years) in respect of capital expenditure incurred on the acquisition of an aircraft for the leasing trade subject to certain conditions being satisfied (e.g. the burden of wear and tear remaining with the lessor).

b) Non-Trading Company

Where the activities of the lessor are not sufficient to constitute trading then the lessor will be subject to corporation tax at a rate of 25% with a deduction generally being available for most expenses. This is typically used in the context of lease in/lease out transactions where the head lease income is deducted from the sub-lease income in calculating the relevant profits and thus often the profits are negligible.

c) A Qualifying Company

Finance Act 2011 made amendments to Section 110 of the Taxes Consolidation Act 1997 (which provides for Ireland's favourable structured finance and securitisation regime) by extending the definition of "qualifying assets" which may be held by qualifying companies (commonly referred to as Section 110 companies) to include "plant and machinery" such as aircraft and aircraft parts.

Transactions involving a Section 110 company may be (and almost always are) structured to be tax neutral. While the Section 110 company tax rules provide that the company will be subject to Irish corporation tax at a rate of 25% on its taxable profits, such taxable profits can be eliminated with appropriate structuring.

As a result of the amendments introduced by Finance Act 2011 it is possible to structure aircraft leasing transactions using a Section 110 company. Additionally, Section 110 companies may be used with respect to securitisation of lease receivables.

There has been a swift uptake in usage of Irish Section 110 aircraft finance structures since they were introduced in 2011.

Withholding Taxes

Outbound Lease Payments - Lease rental payments are not subject to withholding tax in Ireland and accordingly out-bound lease payments may be made free of withholding tax. Inbound Lease Payments - With respect to in-bound lease payments unilateral credit relief is available for withholding tax suffered on lease rentals from countries with which Ireland does not have a double taxation agreement.

Dividend Payments - The general position is that dividend payments made by an Irish resident company are subject to dividend withholding tax ("DWT") at a rate of 20%. However, Irish tax law provides for numerous exemptions from DWT including where the payments are made to recipients in an EU Member Sate or recipients in a country with which Ireland has a double taxation agreement, subject to certain conditions and requirements being satisfied (e.g. a relevant non-resident declaration is required to be completed by the recipient). Ireland has also implemented into domestic tax law the provisions of the EU Parent/Subsidiary Directive which allow dividend payments to be made by a subsidiary company to its parent company free of DWT without the need for completion of a non-resident declaration.

Interest Payments - With respect to interest payments the general position is that interest withholding tax ("IWT") at a rate of 20% applies to payments of yearly interest. However, again, Irish tax law provides for numerous exemptions from this IWT requirement including where interest payments are made to recipients in an EU Member State or recipients in a country with which Ireland has a double taxation agreement subject to certain conditions.

Stamp Duty

Irish stamp duty is a tax which generally applies to instruments operating to transfer property as opposed to being a tax on transactions. However, Irish stamp duty law specifically provides that instruments for the sale, transfer, or other disposition, either absolutely or otherwise, of any aircraft, or any part, interest, share, or property in an aircraft are exempt from stamp duty. Additionally as noted above Finance Bill 2013 proposes an exemption from stamp duty on the issue, transfer or redemption of an enhanced equipment trust certificate.

Value Added Tax

Ireland in common with all other EU Member States operates a system of Value Added Tax ("VAT"). However, while VAT needs to be addressed on any leasing transaction, Irish VAT law provides that in the context of international aircraft leasing no VAT applies on lease rentals with full VAT recovery (input VAT recovery) being available on costs attributable to the leasing activities.

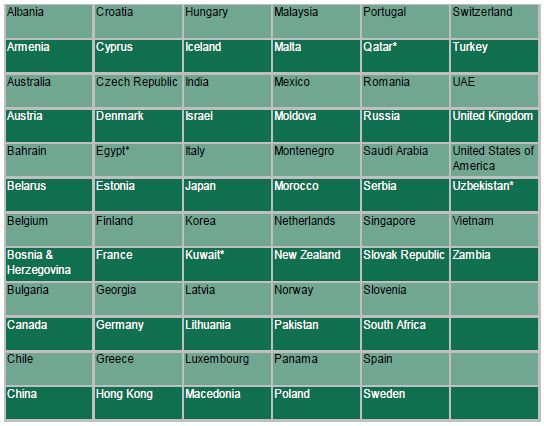

APPENDIX I

- Ireland has signed comprehensive double taxation agreements

with 68 countries, of which 64 are in effect.

*The Republic of Ireland has signed a double taxation agreement with these countries and although not yet in force has the force of law by virtue of section 826(1) TCA 97. Consequently Ireland will allow dividends, interest and patent royalties etc. to be paid in gross, free of withholding tax, to these countries. Ireland has completed the ratification procedures to bring the new agreement with Kuwait into force. When ratification procedures are also completed by Kuwait, the agreement will enter into force. - Negotiations for new agreements with Thailand and the Ukraine have been concluded and are expected to be signed shortly.

- Negotiations are in train for new agreements with Tunisia and Azerbaijan.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.