Welcome to the Summer edition of The Company Agenda.

This is a 'Company Agenda Special', in which we focus on the Draft Companies Bill.

The Minister for Jobs, Enterprise and Innovation, Mr Richard Bruton TD recently launched the draft Companies Bill which is published by his Department on its website. The proposed changes will revolutionise Irish company law and provide a state of the art company law code to the users of Irish company law. The heads of Bill were drafted by the Company Law Review Group (CLRG) and its innovations are based on its recommendations. Arthur Cox's Dr Tom Courtney, head of the firm's Company Compliance and Governance Group has been the chairperson of the CLRG and William Johnston, banking partner, has been a member of the CLRG, since its establishment in 2001. In this issue of 'The Company Agenda' Dr Tom Courtney outlines the architecture of the draft Bill and provides an overview of its main innovations. We will revisit particular parts of the Bill in more detail in future issues.

THE DRAFT COMPANIES BILL

The publication of the first of two volumes of the draft Companies Bill is a very significant step in the reform of Irish company law. This first volume is divided into 15 Parts, contains 952 sections of law and is focused solely on the private company limited by shares.

In publishing the first 15 Parts now, the Department of Jobs, Enterprise and Innovation continues to work with the Office of the Attorney General in finalising Volume 2 of the Bill, which will contain another ten Parts which will deal with all other types of company e.g. public companies, guarantee companies, special types of private company, unlimited companies etc. Only when these Parts are finalised will be the Bill be formally published in the Oireachtas.

The New Model Private Company

The new Bill both consolidates and reforms the law relating to Irish private companies. The private company has been the work-horse of commercial life in Ireland since it was first possible to register private companies in 1908, the year the Companies Act 1907 was commenced. Prior to then, it was only possible to form a public company which had to have seven members. In Ireland, the private company has become by far the most common type of corporate entity used by business. Of the 185,044 companies on the register as at 31 December 2009, 87% were private companies limited by shares; less than 1% were public companies, the balance being made up of guarantee companies and unlimited companies.

Ironically, the current Companies Acts view the private company as a peculiar variation of the public company, giving rise to a classic case of the tail wagging the dog. If there is one single recommendation of the CLRG which stands out, it is the very first recommendation of the First Report published on 31 December 2001, that "The private company limited by shares...should be the primary focus of simplification" (at paragraph 3.2.3).

That recommendation was accepted and is reflected in the draft Bill. Whereas there are currently 25 company law enactments (Acts and statutory instruments) applicable to various types of company, the first 15 Parts of the draft Bill will provide an almost exhaustive statement of the law applicable to the private company.

Part 1 – Preliminary and General

This Part is largely devoted to house-keeping and defines terms which are used throughout the Bill. Some of the more important terms which are defined include "subsidiary" and "holding company". One innovation here is the combination of the definition of "subsidiary company" which is defined in the Companies Act 1963 (s 155) for general purposes with the definition of "subsidiary undertaking" which is defined in the European Communities (Companies: Group Accounts) Regulations 1992 (reg 4) for the purposes of group accounts so that there will be a common definition. In this Part "wholly-owned subsidiary" is also defined.

Part 2 – Incorporation and Registration

Part 2 contains the law concerning the formation and registration of companies and it is here that some of the most fundamental changes to the law relating to private companies are to be found.

The new model private company will have a one-document constitution in place of the current memorandum and articles of association and will have "full and unlimited capacity" since it will not have an objects clause. If people wish to have a private company with a memorandum and articles of association and an objects clause they will have to use the alternative form of private company which will be provided for in Volume 2 - the DAC or designated activity company.

Private companies can authorise "registered persons" to bind the company to facilitate the conclusion of contracts. This does not mean that every employee with authority to bind a company (for example, a cashier in a supermarket) must be registered as certain people will have limited authority arising only in particular circumstances, but some officers and senior employees authorised to bind the company will have to be registered. There are many other changes which are also contained in this Part and these will be the subject of more detailed treatment in a forthcoming edition of The Company Agenda.

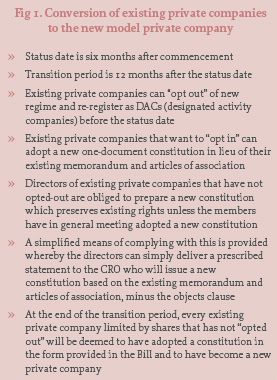

Initially, one of the most important set of provisions will be those dealing with the conversion of existing private companies (see Fig. 1). This will become hugely important for existing private companies after the enactment of the Bill. Arthur Cox will be contacting clients for whom we provide company secretarial services well in advance of all deadlines to assist them with cost-effective and streamlined compliance with the new regime.

Part 3 – Share Capital, Shares and Certain Other Instruments

One of the most striking things about Part 3 is that for the first time since 1983, all of the law relating to shares and share capital is contained in one place as opposed to being spread across several different enactments (see Fig. 2).

Perhaps the most important distinguishing feature between the new model private company and existing private companies is that the new private company may not offer any securities, whether shares (equity) or bonds (debt) to the public in any circumstances. Since December 2006 private companies have been permitted to list debt securities and many have done so. Under the draft Bill, existing private companies will still be able to do this but they will have to reregister as DACs – designated activity companies – which have an objects clause. By making this distinction, the model company can be the subject of a less complicated regime since if it cannot make public offerings of any kind, the law applicable to it can be simplified.

One of the central concepts in the new Bill is that where a private company's constitution is silent, it defaults to what is provided for in the Bill. This will reduce the need for companies to have detailed provisions in their constitutions. Provisions relating to calls on shares, lien, forfeiture, etc, are all now contained in the Bill and expressed to apply "save to the extent that the company's constitution provides otherwise".

Other significant changes to the law relating to shares include: reform of the law relating to the giving of financial assistance in line with CLRG's recommendations; reducing share capital by following the Summary Approval Procedure (see Fig. 3) without the need for a court order and the modernisation of the law relating to own-share acquisition. A form of merger relief is also provided for enabling distributions to members of amounts that would otherwise stand to the credit or share premium created following an acquisition.

Part 4 – Corporate Governance

This Part sets out in one place the law relating to the appointment and proceedings (including meetings) of officers (directors and secretaries) and members. In addition, the new Summary Approval Procedure whereby restricted activities can be carried out when validated is contained in Chapter 7 of Part 4 (see Fig. 3). Many of the provisions which are to be found here are currently contained in companies' articles of association. The approach taken is to include what might be seen as standard provisions, in that they are adopted by most companies, and to provide that these shall apply "save to the extent that the company's constitution provides otherwise". One of the clearest examples of this is in Chapter 4 – proceedings of directors – where what is now model Regulation 80 of Part I of Table A, and the cornerstone of corporate governance, is set out as the default position. So, section 156 provides that the business of the company shall be managed by its directors subject to certain carve-outs.

One of the more obvious changes which the Bill proposes to introduce is to permit private companies to have only one director. Far from relaxing corporate governance, it is thought that this will enhance accountability of the sole director. It is a fact that in many small private companies the 'second' director is a nominee, appointed only to meet a numeric statutory requirement.

The area of members' meetings is also the subject of reform under the Bill. One of the innovations proposed is that majority written ordinary and special resolutions will be permitted; at present, only unanimous written resolutions are allowed.

Part 5 – Duties of Directors and Other Officers

The proposed new regime on directors' duties is set out in six chapters comprising 53 sections of law. The general rule will be that duties and requirements of directors will apply to all directors, whether they have been formally appointed as such or whether they fall to be classified as de facto or shadow directors.

The Bill will confirm that it is the duty of directors to ensure compliance with the Companies Act; the obligation on secretaries to do this has been removed since secretaries have little or no statutory power to procure compliance, their role being no more or no less than that set by the board of directors. Directors of private companies that meet certain thresholds will be required to prepare directors' compliance statements (see Fig. 4). One of the very significant innovations is the codification of directors' duties. These fiduciary duties will be owed to the company and are based largely on common law and equitable principles (see Fig. 5).

The enforcement of duties has also been revised and updated and provision made for directors to be liable to account to the company for unlawful gains made by directors and to indemnify the company for losses resulting from breach of any duty in Part 5.

The restrictions on loans, quasi-loans, credit transactions (and certain guarantees and security) has been retained broadly in line with what is now Part III of the Companies Act 1990 as have the exceptions to those restrictions, which now include the Summary Approval Procedure. New provisions seek to encourage loans (whether to directors by their companies or by directors to their companies) to be put in writing. Where a loan is made to a director which is not in writing, there will be a statutory presumption that it is repayable on demand and bears interest. Where loans are alleged to have been made to companies by directors (as sometimes happens in a winding up, where the effect is to make the director a creditor of the company entitled to share its assets with other creditors) there will be a presumption that any amount advanced is not a loan and therefore not repayable.

A very welcome reform relates to the disclosure of interests in shares so that de minimis interests of less than 1% are not required to be notified.

Part 6 – Financial Statements, Annual Return and Audit

This Part sets out in one place the statutory provisions regarding the keeping of accounting records, and the preparation, audit and filing of financial statements, by companies, which until now have been spread over a number of pieces of legislation, and substantially amended over the years, often resulting in a lack of clarity as to what requirements apply to Companies Act and IFRS, and to individual and group, accounts. The Part states clearly the requirements for each such set of financial statements, and where there are provisions common to all financial statements, sets them out as such, avoiding duplication. Some key terms amended or clarified by this Part are set out in Fig 6.

Part 6 gives greater prominence to important terms such as "realised profits" and "true and fair view", to the requirements that the financial statements be audited and that the company make an annual return. It also resolves the anomaly whereby amendments had frustrated the original intention that penalties for failing to keep proper books of account would be more severe where the failure caused particular problems in the context of a winding up, than where the company continued trading normally. Other new provisions include:

- Provisions regarding the signing of financial statements and the directors' report respectively allow for the possibility of a single-director company.

- The obligation to deliver an annual return is removed while a company is being wound up, or being voluntarily struck off (unless it is then restored to the register).

- Thresholds for a company to qualify as small or medium-sized have been raised, reflecting inflation, and the increase in the EU limits, since the last amendment in 1993 (see Fig. 7).

Finally, to date, where a set of statutory financial statements have been filed and a deficiency in them becomes apparent, there is no statutory procedure to allow their revision. Chapter 16 will allow the directors prepare revised financial statements or a revised directors' report, or in certain circumstances will allow revision by supplementary note. It provides for the approval by the directors of the revised financial statements which shall have effect from the date of approval, in place of the original financial statements. The Chapter also provides for the audit of the revised financial statements, their laying before a general meeting of the company, and their delivery to the Registrar.

Part 7 – Charges and Debentures

The law relating to security created by companies is proposed to be consolidated and reformed in Part 7. One of the first changes relates to the definition of "charge" itself. While the general rule will be that all charges must be registered in order to avoid being void, a charge over cash in say a bank account will not have to be registered.

A significant proposed change to the law relating to the registration of charges is that there will be two separate procedures for registration: the one-stage procedure and the two-stage procedure (see Fig. 8).

Another significant change in law is that where the priority of charges is not governed by some other regime (e.g. priority in respect of charges over land will be governed by a separate regime) the priority of charges created by a company will be determined by reference to the date of receipt by the Registrar of the prescribed particulars.

Part 8 – Receivers

The law relating to receivers will also be consolidated and reformed. One of the proposed changes to the law is that the powers of receivers of the property of a company will be enumerated in a non-exhaustive list of receivers' powers, which will be without prejudice to the powers which may be granted by a debenture.

Part 9 – Reorganisations, Acquisitions, Mergers and Divisions

In this Part, existing means for reorganising companies, such as Court sanctioned schemes of arrangement and compulsory purchase of minority interests, sit alongside two new means for effecting reorganisations: mergers and divisions. For the first time in Irish law, a statutory mechanism is provided whereby two Irish companies can merge so that the assets and liabilities (and corporate identity) of one are transferred by operation of law to the other, before the former is dissolved. Moreover, it will be possible for an Irish company to be "divided" so that its undertaking is split between two other Irish companies.

Cross-border mergers and divisions involving Irish public limited companies have been possible since 1987 and those involving Irish private companies since 2008. Importantly, however, a cross-border element was required so that whilst there have been a number of very successful mergers of Irish companies, these have all involved mergers of companies from two different EU Member States.

Not only is it proposed to allow two Irish companies to merge but it is proposed that merger may be effected without the necessity for a High Court order. So, where a merger meets the requirements of the legislation, it is proposed that the Summary Approval Procedure can be utilised to effect the merger, and will result in a significant saving of time and money.

Part 10 – Examinerships

The current recession has brought a renewed reliance upon the process of examinership by which a company may be placed under the protection of the court in order to give time to an examiner to attempt its rescue through restructuring. The law on examinerships contained in Part 10 follows closely the current regime and reform of the existing law is relatively modest.

Part 11 – Winding Up

Part 11 of the draft Bill consolidates and modernises much of the law relating to the winding up of companies. In the first place, the law relating to winding up has been reordered in a more logically coherent way (see Fig. 9)

The draft Bill also seeks to introduce greater consistency between the three different methods of winding up (members' voluntary, creditors' voluntary and official). One of the objectives is to align Court-initiated liquidations with creditors' voluntary windings up so as to reduce the Court's supervisory involvement.

Some of the many other proposed reforms include: that the Director of Corporate Enforcement will have the right to petition to have a company wound up on the grounds that such is in the public interest; the minimum amount of indebtedness to entitle a creditor to serve a statutory demand will be increased to €10,000; for the first time liquidators will be required to be qualified (member of prescribed accountancy body, practising solicitor, other professional body recognised by IAASA or persons with suitable experience (grandfather provision)); a provisional liquidator will only have such powers as are provided for by the court order appointing him or her etc.

Part 12 – Strike Off and Restoration

The law relating to strike off and restoration of companies that have been struck off will be radically overhauled. In the first place, it will be brought together – at present it is scattered across a number of different Companies Acts. Secondly, for the first time there will be a statutory distinction drawn between voluntary and involuntary strike off.

Whereas the Registrar will initiate involuntary strike offs (see Fig. 10), the new voluntary strike off mechanism will formalise the ability of companies to apply to be struck off where certain conditions have been met (see Fig. 11).

No significant changes are proposed in relation to restoration – the Court will continue to have jurisdiction to restore a company where it has been struck off within the preceding 20 years and the Registrar will continue to be able to effect an administrative restoration within 12 months of the company having been dissolved.

Part 13 – Investigations

The Bill proposes to substantially re-enact without significant amendment the law relating to the appointment of inspectors to companies.

Part 14 – Compliance and Enforcement

In keeping with the stricter approach to the enforcement of company law, this Part gathers together provisions relating to compliance and enforcement, a change which will provide greater transparency.

Chapters 1 and 2 of this Part facilitate the making of orders – under Chapter 1, the Court can order that a company or an officer must comply with a provision of the Act, and can order directors not to reduce their assets or remove them from the State as relief to persons with certain claims against directors; under Chapter 2 the Court can make a disclosure order to facilitate the discovery of the beneficial ownership of shares.

Chapters 3 and 4 set out the law relating to the restriction and disqualification of directors, respectively. One significant proposed change to the restriction of directors is that it will no longer simply be enough to have acted "honestly and responsibly": in order to avoid the Court making an order it will also be necessary to satisfy the Court that the director has, when requested to do so by the liquidator, cooperated as far as could reasonably be expected in relation to the conduct of the winding up of the insolvent company. Chapter 5 facilitates the giving and acceptance of restriction and disqualification undertakings from directors, measures which will facilitate the saving of both cost and Court time.

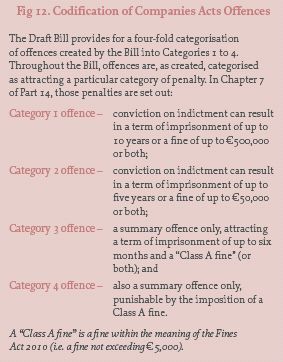

One of the most far-reaching reforms provided for in the draft Bill concerns the streamlining of the criminal offences that will be created (see Fig. 12).

Part 15 – Functions of Registrar and of Regulatory and Advisory Bodies

Provisions relating to the Registrar of Companies, the Irish Auditing and Accounting Supervisory Authority, the Director of Corporate Enforcement and the Company Law Review Group are contained in Part 15.

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.