There are many Companies, other than a company in which public are substantially interested ("herein after referred to as Company") that issue equity shares at a Premium which is more than the Face Value per share of the Company. This is largely due to the fact that over a period of time, the company has established their goodwill, reputation, brands or other intangible benefits that are not reflected in the financials of the Company. These companies, that issues fresh equity shares at a premium, are exposed to the risk of getting the premium amount considered as income of the company and may have to end up paying tax on such premium.

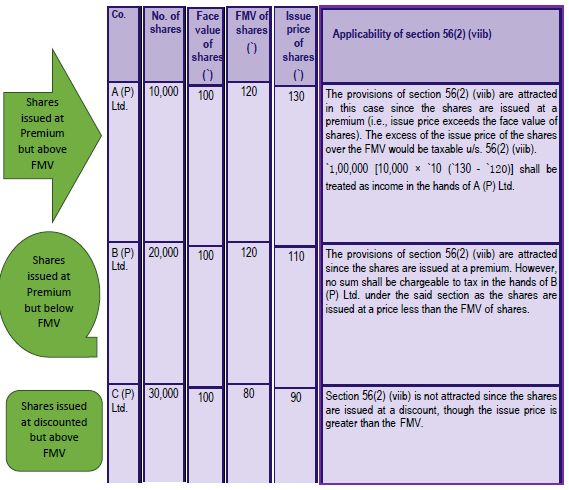

Section 56(2) (viib) of The Indian Income Tax Act actually brings to tax the consideration received by a company from any resident person, which is in excess of the Fair Market Value (FMV) of shares. Such excess is treated as income of the company liable to be taxed under the head "Income from Other Sources".

For the purpose of computation of FMV, the value of assets would include the value of intangible assets being goodwill, know-how, patents, copyrights, trademarks, licences, franchises or any other business or commercial rights of similar nature and the valuation is specifically defined under Rule 11UA of The Income Tax Rules.

As defined under Rule 11UA, the fair market value of unquoted equity shares shall be the value, on the valuation date, of such unquoted equity shares as determined in the following manner under (a) or (b), at the option of the Company, namely; -

Option (a):

The fair market value of unquoted equity shares shall be calculated simply by ascertaining "Book value of Assets (Less) Book value of Liabilities."

- For ascertaining the book value of

assets, following amounts shall be excluded:

- Advance Tax, Tax deduction or collection at source or any amount of tax paid as reduced by refund claimed under the Income Tax Act.

- any unamortized amount of deferred expenditure which does not represent the value of any asset.

- For ascertaining the book value of

liabilities, following amounts shall be excluded:

- the paid-up capital in respect of equity shares;

- the amount set apart for payment of dividends on preference or equity shares

- reserves and surplus, by whatever name called, even if the resulting figure is negative, other than those set apart towards depreciation;

- any amount representing provision for taxation, other than amount of tax paid as reduced by the amount of tax claimed as refund

- any amount representing provisions made for meeting liabilities, other than ascertained liabilities;

- any amount representing contingent liabilities other than arrears of dividends payable in respect of cumulative preference shares.

Option (b):

The fair market value of the unquoted equity shares as determined by a Merchant Banker as per Discounted Free Cash Flow Method. Earlier, a Chartered Accountant was also permitted to determine the FMV of such equity shares. However, with effect from 24th May 2018, this right of Chartered Accountant is done away with and therefore only Merchant Banker is authorised to determine the FMV of such equity shares.

Exclusion:

The above provisions on valuation of shares would not apply in case consideration for issue of shares is received:

- by a Venture Capital Undertaking (VCU) from a Venture Capital Fund (VCF) or Venture Capital Company (VCC); or

- by a company from a class or classes of persons as notified by the Central Government for this purpose.

This would mean that in above two cases, the Company can issue equity shares at a price which is higher than the Ne Asset value of the company and excess consideration received will not be regarded as income of the company.

Examples in case where the shares are issued by the company: -

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.