The central government through a series of notifications has adopted certain recommendations made in the 25th GST Council meeting held at New Delhi on 18 January 2018. A summary indicating key clarifications made by the GST Council are as under:

Amendment in the Central Goods and Services Tax Rules, 2017

The government vide Notification No. 3/2018 – central tax has made following amendments in CGST Rules 2017:

- Extension in the time limit for submission of Form GST ITC-03 to 180 days (previously 90 days) from the date of composition levy.

- For registrants under composition levy, the rate of tax prescribed shall be applied to the State/Union territory turnover.

- Persons having registered voluntarily under GST would be eligible to make an application for cancellation of registration at any time. The previous time limit of one year has been removed.

- Extension in the time limit for cancellation of GST registration (vide Form REG-29) has been extended to 31 March 2018 (previously 31 December 2017) for those registrants who are not required to be registered under GST.

- Valuation rules in case of supply of lottery, betting, gambling and horse racing have been introduced vide Rule no. 31A under CGST Rules, 2017.

- Clarification on the manner of determination and reversal of input tax credit in respect of capital goods has been prescribed.

- Entities having the same PAN and registered in the same state as an input service distributor can issue invoice/credit note/debit note to transfer the credit of common input services.

- Transporters to carry a copy of tax invoice/bill of supply during transportation in case of non-applicability of e-Way Bill to such persons.

- About filing refund of integrated tax paid on exports-

- Shipping bill filed by an exporter shall be deemed to be an application for refund of integrated tax paid on the goods exported out of India. The same is applicable only to exporter of goods.

- Similarly, export invoices processed by customs shall pertain to export of goods.

- Commencement of generation of e-Way Bills for the movement of goods on consignment has been brought into effect from 1 February 2018.

Extension of Time Limit for submission of GSTR-6

- GSTR 6 is a monthly return that has to be filed by an Input Service Distributor. It contains details of ITC received by an Input Service Distributor and distribution of ITC.

- The due date for filing of GSTR 6 was 13th of next month.

- CBEC vide Notification No. 8/2018 – Central Tax has extended time limit for submission of GSTR-6 for the months of July 2017 to February 2018 till 31 March 2018

Website for e-Way Bill

CBEC vide Notification No. 9/2018 – Central Tax has notified electronic portal for furnishing electronic e-Way Bill - www.ewaybillgst.gov.in.

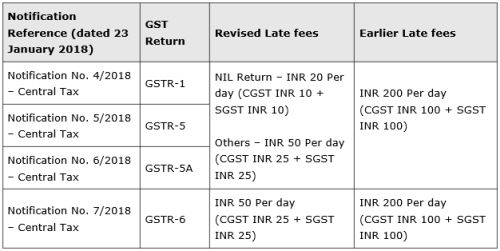

Relaxation in late fee

Per day penalty for delay in filing of returns has been reduced for following returns:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.