PERSONAL TAX

Tax Rates:-

The Tax rate for individuals, HUF, AOP, BOI and AJP in the slab between Rs. 2.50 Lakhs and Rs. 5.0 Lakhs is reduced from 10% to 5%.

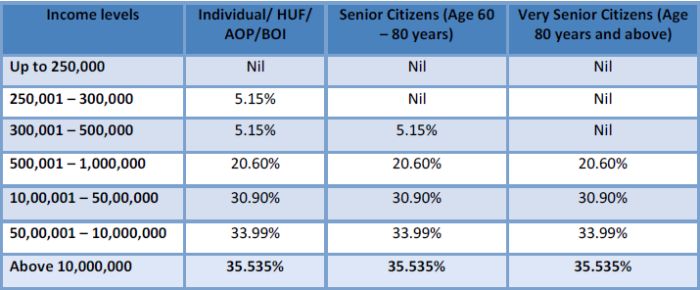

The new Tax Slab including Education Cess and Surcharge are as follows:

Note:

- A new Surcharge @10% will be applicable on income exceeding INR 50 Lacs but not exceeding Rs.1 Crore. For total income above INR 1 crore, surcharge @15% will continue.

- Education Cess @3% on Tax + Surcharge will also continue.

- Rebate u/s. 87A is reduced to maximum of INR 2,500 from the present limit of INR 5,000 and will be available only in case of income up to INR 3.5 lakhs instead of INR 5 lakhs.

- A simple one page tax return form is being introduced for individuals having taxable income (other than business income) up to INR 5 lakhs.

- Exemption on withdrawal from National Pension Scheme (NPS)

In case of partial withdrawal from the NPS, it has been proposed to exempt withdrawal up to 25% of the contribution made by the individual.

- Deduction for NPS contribution (Sec 80CCD)

It is proposed to increase the ceiling of deduction from 10% to 20% of the gross total income for a nonemployee contributing to NPS.

- Restriction on cash donation:

Under the existing provisions of section 80G, donation in excess of INR 10,000 made in cash is not allowed. The aforesaid limit is now proposed to be reduced from INR 10,000 to INR 2,000.

Download - Budget 2017 - Highlights

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.