Advance Pricing Agreement (APA):

Transfer pricing remains the most widely talked international taxation issue. Indian transfer pricing regulations came into effect on 1 April 2001 and have been one of the critical tax issues for Multinational Enterprises (MNEs) operating in India. India was in focus due to colossal transfer pricing adjustments made in past few years in the case of international transactions entered into by MNEs. Due to this, the international business fraternity had felt that taxation policies of India are not business friendly.

In response to the issue given above and to align the Indian transfer pricing regulations with global best practices, Advance Pricing Agreement (APA) scheme was introduced by the government in late 2012 followed by the 'Rollback' provisions in 2014. The APA scheme is a major initiative of the government towards fostering a non-adversarial tax regime which provides alternate dispute resolution mechanism to taxpayers in respect of transfer pricing issues. The scheme endeavours to provide certainty to taxpayers in the domain of transfer pricing by specifying the methods of pricing and setting the prices of international transactions in advance.

The APA scheme has received tremendous response from taxpayers. This is evident from the fact that since its inception, more than 800 applications (both unilateral and bilateral) have been filed in a span of five years.

Recently, the Central Board of Direct Taxes (CBDT) released the first Annual Report on APA scheme in India. The report provides crucial insights and statistics of the APA scheme during the period of five years. These insights and statistics are discussed and analysed in the forthcoming paragraphs.

Administration:

The APA applications are processed and analysed by a dedicated APA cell. Each APA team is headed by a Commissioner of Income Tax. Presently, there are two APA teams and the APA offices are situated in Delhi, Mumbai and Bengaluru. The CBDT has recently created two new posts of APA Commissioners at Mumbai and Bengaluru which will assist in fast track processing of the pending APA applications.

APA statistics and analysis:

As mentioned above, the APA scheme has received an overwhelming response from taxpayers. In total, 815 APA applications (unilateral and bilateral) have been filed till 31 March 2017.

It is evident from the data given in the table above that unilateral APAs are preferred by the taxpayers over bilateral APAs. This is mainly due to the fact that the US Competent Authority has opened up bilateral APA programme from February 2016 and therefore, the Indian subsidiaries of US-based companies (present in large numbers in India) had no choice but to opt for unilateral APAs. Furthermore, out of the total unilateral APA applications filed, 19 applications have been converted to bilateral APA applications at the request of the taxpayers. As against this, only one bilateral application has been converted into a unilateral application.

As the APA scheme has attained maturity, the number of agreements signed has gone up significantly. In FY 2016-17, 88 APA applications were concluded, which is probably the highest number of APAs entered into by any jurisdiction worldwide during this period.

It is interesting to note that India has concluded 152 APAs in four years as against 113 APAs signed by China in 10 years.

By entering into 152 APAs so far, the CBDT has managed to provide cumulative tax certainty of 1010 years. It includes 277 years covered under the rollback period of the concluded APAs.

India has been very proactive in concluding the APAs. India has managed to conclude unilateral APAs in 29 months on an average, as against the US timeline of 34 months. Bilateral APAs have been concluded by India in 39 months on an average vis-à-vis on an average 51 months taken by the USA.

Economic activity wise distribution of agreements:

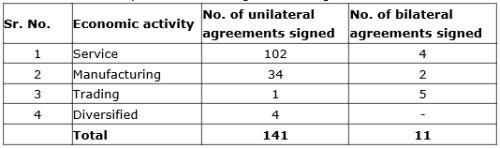

The economic activity wise details of agreements signed are:

As can be observed from the above data, the service sector has been overwhelmingly covered under unilateral APAs. This is mainly due to the service sector being the largest contributor to India's Gross Domestic Product (GDP) and there are many transfer pricing issues revolving around service transactions. In bilateral APAs, trading activities have found marginally more coverage than the service sector.

Almost 50% of the total unilateral agreements entered into are with the information technology and banking/finance industries. It is critical to note that APAs are not restricted to a few industries; there are 20 different industries that have availed the Indian APA scheme.

Transactions covered:

In all, there are 29 types of international transactions that have been covered in unilateral APAs. A total of 292 international transactions have been covered under these 141 APAs signed so far. Top transactions covered under unilateral APAs are:

- Provision of software development services

- Provision of information technology enabled services

- Intra-group payments

- Sale of goods

- Purchase of goods

- Provision of investment advisory services

The 141 unilateral APAs entered into so far have left their footprints on 118 countries where the Associate Enterprises (AEs) of the Indian applicant company are located. The USA is on top of the list and finds its entities in 93 APAs followed by the United Kingdom and Singapore.

There are 7 types of international transactions covered in the bilateral APAs. A total of 22 international transactions have been covered under 11 bilateral APAs. Top transactions covered under bilateral APAs are:

- Availing of intra-group services

- Purchase and sale of goods

- Provision of marketing/sales support services

It is interesting to note that unlike unilateral APAs, the provision of software development services does not reflect at all as a covered transaction in the bilateral APAs concluded by the CBDT.

Out of the 11 bilateral APAs signed, six pertains to the United Kingdom and five to Japan. The first bilateral APA between India and USA was resolved but the same is not concluded by 31 March 2017 due to technical issues.

Transfer pricing methods used:

Transfer pricing methods used more frequently in the unilateral APAs concluded till date are:

SKP's comments

The Indian APA scheme has matured over a period of five years which is reflected in the number of agreements signed. Transfer pricing issues which were prone to lengthy litigation process are resolved through APAs. While the taxpayers have managed to get certainty over transfer pricing issues for five or nine years (depending on the opting for rollback provisions), the government has been able to divert resources from the audit and litigation processes to more productive work.

The Indian APA scheme is moving ahead quicker than it was moving last year. The government is committed to creating a conducive environment for MNEs to do business in India.

The success of the APA scheme strengthens the government's resolve of fostering a non-adversarial tax regime. The Indian APA scheme has been appreciated nationally and internationally for being able to address complex transfer pricing issues in a fair and transparent manner.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.