In a huge relief to the Birla Group, the Mumbai Bench of the Income-tax Appellate Tribunal (Tribunal) has recently set aside a capital gains addition of over INR 5,200 crores made by the revenue authorities in relation to the demerger of Aditya Birla Telecom Limited's telecom undertaking in the Bihar service area to Idea Cellular Limited (ICL).

Background

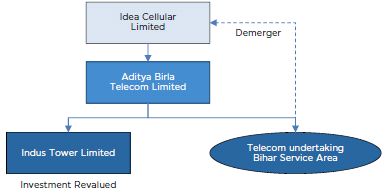

- Pursuant to a scheme of arrangement which was duly approved by the High Courts of Bombay and Gujarat in March 2010, Aditya Birla Telecom Limited (Company) demerged its telecom business in the Bihar service area for nil consideration to its parent, ICL. Under the scheme, the Company also revalued its existing investment held in Indus Towers Limited (Indus), an asset separate from the demerged telecom undertaking, at fair value. The difference between the fair value and book value of the investment was recorded as a "Business Restructuring Reserve" (BRR) in the books of the Company.

- The revenue department held the demerger to be a slump sale under Section 50B of the Income-tax Act, 1961 (IT Act) and thereby proceeded to compute short term capital gains in the hands of the Company by treating the amount credited in BRR on revaluation of assets as the full value of consideration for the transfer of the telecom undertaking.

Tribunal Ruling

- The Tribunal held that in the absence of any consideration received by the Company for the demerger of its telecom undertaking to ICL, no capital gains could be said to have accrued to it. Therefore, the addition made by the revenue department to the Company's income in relation to the demerger was liable to be deleted.

- Reliance was placed on the landmark decision of the Supreme Court in the case of B C Srinivasa Setty1 to hold that it was a cardinal principle of law that the charging and computation provisions together constituted an integrated code under the IT Act. Therefore, where computation provisions could not be applied at all, the implication was that such a case was not intended to fall within the scope of the charging provision. In other words, when the computation provision in the IT Act fails, the charging provision also fails.

- The Tribunal took note of a catena of cases which supported the proposition that no capital gains could be levied due to a failure of the computation mechanism, including inter alia, PNB Finance Limited v CIT2, In re: Amiantit International Holdings Limited3 and Avaya Global Connect Limited v ACIT4.

- The Tribunal noted that the revenue department had failed to understand that the BRR created in the books of the Company was merely an accounting entry recorded in its books on account of revaluation of its investment in Indus and that the amount representing an accounting entry could not possibly be deemed to be the value of consideration for the transfer of the telecom undertaking. The BRR merely represented a notional reserve created to bring the value of the investment held in Indus to its fair value.

- The Tribunal also relied on the decision of the Authority for Advance Rulings in the case of Dana Corporation5 to hold that profit or gain or the full value of the consideration cannot be arrived at on a notional or hypothetical basis. The profit or gain to the transferor must be a distinctly and clearly identifiable component of the transaction. The consideration for the transfer of a capital asset cannot be implied or assumed and gain cannot be inferred on a deeming or presumptive basis. What can be taxed in the hands of the transfer under the IT Act is real or actual gain that accrues / arises from the transfer of a capital asset and hence, in the absence of any sale consideration (and resultant profit from such transfer) no notional gain could be imputed and consequently taxed.

- The Tribunal observed that there were

only two other provisions in the IT Act, namely Sections 50C and

50D, which provided for imputation of consideration, both of which

were inapplicable in the instant case:

- Section 50C provides that where consideration received / accruing as a result of transfer of a capital asset, being land or building or both, is less than the value adopted for stamp duty purposes, then the stamp duty value shall be deemed to be the sale consideration for the purposes of computing capital gains.

- Section 50D of the IT Act provides for assumption of fair value of an asset as its sale consideration in cases where sale consideration accruing / received as a result of a transfer is indeterminate or not ascertainable. Since Section 50D of the Act has been inserted by the Finance Act, 2012, with effect from assessment year 2013 – 2014, the provision could not be applied as the assessment year under consideration was 2010 – 2011.

- Basis the foregoing, the Tribunal concluded that wherever considered appropriate, the legislature itself had inserted specific provisions for assumption of sale consideration for the transfer of assets in specified cases. It was therefore unjust and unwarranted to impute / assume consideration in cases which clearly did not fall within the ambit of such specified provisions.

- Further, the flow of consideration necessarily required at least two parties (i.e. the payer and the recipient) and since in the instant case, the BRR was created on account of a unilateral action by the Company, the same could not be treated as consideration received from ICL.

- Reliance was placed on the decision of the Gujarat High Court in the case of CIT v Vania Silk Mills Private Limited6 to hold that a sine qua non for the levy of capital gains tax is a "transfer" in terms of the IT Act. Further, there ought to be a causal nexus between the "transfer" of the capital asset and the profit or gain accruing to or received by the taxpayer. In the instant case, there was no nexus between the transfer of the telecom undertaking by the Company and the revaluation of the investment in Indus, except that both transactions independently arose from the same scheme of arrangement.

- The Tribunal therefore concluded that since no consideration was received by the Company on account of the demerger, no profit or gain arose which could be exigible to tax.

KCO Comments

For a demerger to qualify as tax neutral under the IT Act, certain conditions are required to be satisfied which inter alia include that shareholders holding not less than three-fourths in value of the shares in the demerged company (i.e. the Company in this case) other than shares already held therein by the resulting company (i.e. ICL in this case) must receive shares of the resulting company as consideration. While ICL held 100% of the equity shares of the Company, the Company also had some preference shareholders who had consented to the scheme of arrangement in its entirety and no shares were required to be issued to them. However, this aspect has not been dealt with in the case.

The Tribunal has only ruled on the computation and chargeability of capital gains tax in the absence of consideration and not on whether the demerger is otherwise tax neutral. This ruling is in line with the settled position that in absence of consideration, the same cannot be imputed (unless the specific provisions under which consideration can be imputed are attracted).

Footnotes

1. (1981) 128 ITR 294 (SC)

2. 307 ITR 75 (SC)

3. (2010) 322 ITR 678 (AAR)

4. 122 TTJ 300

5. 321 ITR 178 (AAR)

6. 107 ITR 300

The content of this document do not necessarily reflect the views/position of Khaitan & Co but remain solely those of the author(s). For any further queries or follow up please contact Khaitan & Co at legalalerts@khaitanco.com