With the change in the new Government, we can see the changing laws. The Finance [No. 2] Bill, 2014 as presented in the Parliament on 10.07.2014 along with various notifications have proposed innumerous changes in the Service Tax Law, Customs, Central Excise and the Income Tax wherein some of them are coming in force with immediate act, there are many others which shall have an impact with a future date.

Herein below is an assemblage of few important changes which shall be having influential effects, however only the time will tell how beneficial the same shall be to the Indian economy:

1. Pre-deposit has been made mandatory for Central Excise, Customs & Service Tax:At present Section 35F of the Customs and Excise Act, 1944 mandated that the person desirous of filing an Appeal against the decision or order, deposit with the adjudicating authority, the duty demanded or the penalty levied. However when the appeal was filed, it was the discretion of the appellate authorities to dispense with such pre-deposit subject to such conditions as it may deem fit to impose as so to safeguard the interest of the revenue. However the said section has been substituted with a new section to prescribe a mandatory fixed pre-deposit of 7.5 of the duty demanded or penalty imposed or both for filing an appeal with the Commissioner [Appeals] or Tribunal at the first stage and another 10% of the duty demanded or penalty imposed or both for filing second stage appeal before the Tribunal. Here, it shall be pertinent to mention that the said amount of pre-deposit shall be subject to a ceiling of Rs. 10 Crores. These provisions shall come into effect from the date of the Bill receiving the assent.

2. Time Limit to avail the CENVAT Credit:The CENVAT credit Rules, 2004 have been amended as an insertion of proviso to Rule 4(1) and fifth provision to Rule 4(7), wherein a manufacturer or a service provider shall take credit on inputs and input services only within a period of 6 months from the date of invoice, bill or challan with effect from September 1st, 2014. Additionally, while credit can be availed on receipt of the invoice pertaining to the input service, payment will have to be effected within 3 months from the date if the invoice, failing which the credit would be reversed. This rule shall be effective from 01.09.2014.

Presently there was no such time limit prescribed for the availment of the CENVAT Credit and it was well established by the courts that in the absence of the time limit prescribed under law, credit could be availed even at a later stage.

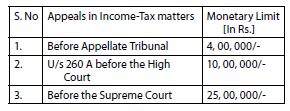

3. Revision of monetary limits for filing Appeals before the ITAT, High Courts and the Supreme Court:Vide the instruction No. 5/2014 dated 10.07.2014 issued U/s 268 A(1) of the Act, the CBDT has decided that departmental appeal shall be filed on merits before the Appellate Tribunals, High Courts and the Supreme Court keeping in view the monetary limits and certain specified conditions.

Henceforth appeals shall not be filed in cases where the tax effect does not exceed the monetary limits given hereunder:

It has also been clarified that an appeal should not be filed merely because the tax effect in a case exceeds the monetary limits stated above. Filing of appeal in such cases is to be decided in merits of the case.

For the purposes of the above, "tax effect" means the difference between the tax on the total income assessed and the tax that would have been chargeable has such total income been reduced by the amount of income in respect of the issues against which appeal is intended to be filed. However the tax will not include any interest thereon, except where the chargeability of interest itself is in dispute. In case chargeability of interest is the issue under dispute, the amount of interest shall be the tax effect. In cases where returned income is reduced or assesses as income, he tax effect would include notional tax on disputed additions, in case of penalty orders, the tax effect will mean quantum of penalty deleted or reduced in the order to be appealed against.

At this juncture, it shall be worth mentioning that the limits prescribed above, shall not apply to writ matters and direct tax matters other than income tax. These instructions will apply to appeals filed after 10th July, 2014. However, the cases where the appeals have been filed before the said date shall be governed by the instructions on this subject, operative when such appeal was filed.

4. Only 30 % of expenditure to be disallowed U/s 40(a) (ia):Where, everything seems to be against the assesses, one reform which is providing relief to the assesses caught in the tax litigations involving failure to deduct and pay tax on specified payments to residents before the prescribed due date. In the present situation, the departments disallow deduction of 100% of such payments, which result in majority of tax disputed causing undeserved hardship to the tax payers, especially when the rate of tax was only between 1% to 10% of the payment.

Now, instead of 100%, deduction U/s 40(1) (ia) shall be restricted to 30%. This applies to any payment made by way of interest, commission or brokerage, rent, royalty, fees for professional services or feed for technical services payable to a resident on which tax is deductable under Chapter XVII-B, including payments to a resident contractor or a sub-contractor for carrying out any work including that of supply of labor. The amendment is effective from April 1, 2015 and will apply in relation to the A>Y 2015-16 and subsequently.

5. Service tax exemption to technical testing on human participants, withdrawn:The service tax exemption for services by way of technical testing or analysis of newly developed drugs, including vaccines and herbal remedies, on human participants by a clinical research organization approved to conduct clinical trials by the Drug Controller General of India has been withdrawn vide Notification No. 6/2014-ST dated 11.07.2014, effective from the said date.

6. The Education Sector and Service Tax:Major changes being noted in this sector, the exemption under Notification U/s 25/2012 has been amended as below: "9 Services provided,-

(a) By an educational institution to its students, faculty and staff;

(b) To an educational institution, by way of,

- Transportation of students, faculty and staff;

- Catering, including any mid-day meals scheme sponsored by the Government;

- Security or cleaning or house-keeping services performed in such educational institution;

- Services relating to admission to, or conduct of examination by, such institution"

Meaning thereby, the exemptions in respect of other "auxiliary education services: and renting if immoveable property services provided to an educational service as was available up to 10.07.2014 shall not be available.

To be more precise, apart from all the services provided by the educational institution to persons other than students, faculty and staff shall be liable to service tax. Further, all the services provided to an educational institution except the four listed above, shall also be liable to tax. Here, it shall also be pertinent to mention that the for the purpose of this exemption, "educational institution" has been defined as an institution providing services specified in clause (I) of Section 66D of the Finance Act, 1994.

7. Services by way of renting of commercial places for residential or lodging purposes:The services by way of renting of a hotel, inn, guest house, club, campsite or other commercial places meant for residential or lodging purposes, having declared tariff of a unit of accommodation below Rs. 1000 per day or equivalent will continue to be exempt. However the reference to the words "other commercial places" being omitted vide Notification No. 06/20- ST w.e.f 11.07.204, where the amount charged per day or equivalent is Rs. 1000 or more, even dharamshalas, ashram or any such entity which offer accommodation would be liable to pay service tax.

However, on the other side, the fate of the two most vital future legislations i.e Goods and Service Tax [GST] and Direct Tax Code Bill [DTC] are still left without any definite timeline of their implementation, leaving the industry and stakeholders disappointed on this front.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.